CNC Vertical Machining Centers Market Size 2025-2029

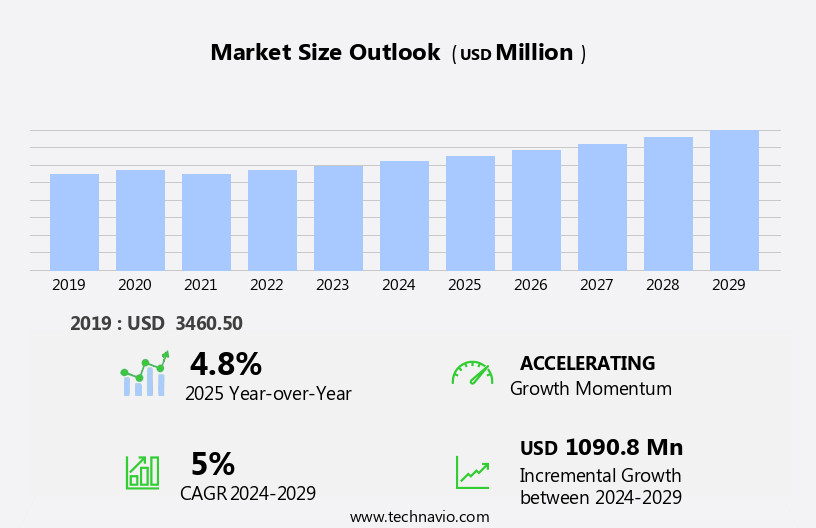

The CNC vertical machining centers market size is forecast to increase by USD 1.09 billion, at a CAGR of 5% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing demand for machine tools that incorporate Computer Numerical Control technology. This trend is being fueled by the expanding manufacturing sector, particularly in industries such as automotive and aerospace, where precision and efficiency are paramount.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 38% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

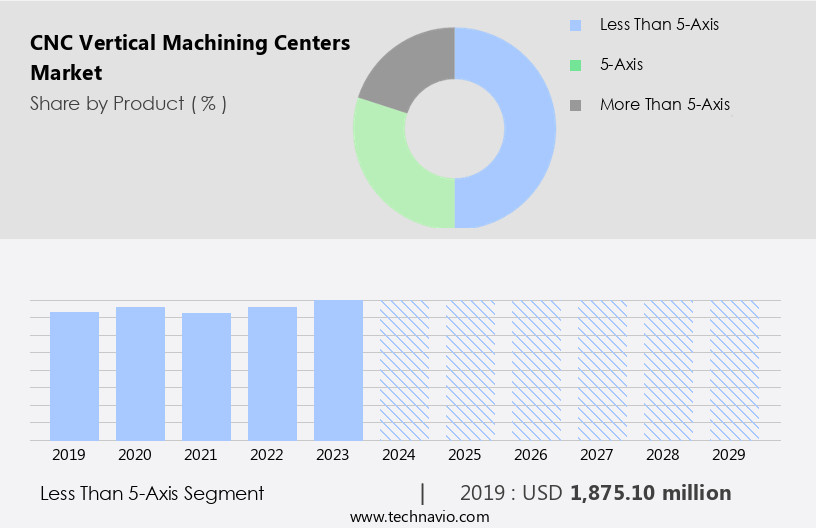

- Based on the Product, the less than 5-axis segment led the market and was valued at USD 2.05 billion of the global revenue in 2023.

- Based on the End-user, the automotive segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 45.65 Million

- Future Opportunities: USD 1.09 Billion

- CAGR (2024-2029): 5%

- APAC: Largest market in 2023

A key trend shaping the market is the emergence of autonomous and electric vehicles. The production of these vehicles requires advanced machining capabilities to manufacture complex components, creating a surge in demand for high-performance CNC Vertical Machining Centers. However, the market also faces challenges. The availability of both horizontal machining centers and refurbished vertical machining centers presents significant competition.

Companies must differentiate themselves by offering superior technology, customization, and after-sales support to remain competitive. Additionally, the high initial investment required for CNC Vertical Machining Centers may deter some potential buyers, necessitating creative financing solutions or partnerships to expand market reach. Despite these challenges, the potential for growth in this market is substantial, particularly for companies that can effectively address the needs of tech-driven industries and offer innovative solutions to overcome the competition.

What will be the Size of the CNC Vertical Machining Centers Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The vertical machining center market continues to evolve, driven by the ever-increasing demand for operational efficiency and precision in manufacturing processes. This market encompasses a range of applications across various sectors, from automotive to aerospace and heavy industry. One key factor fueling market growth is the ongoing advancements in technology. For instance, the integration of CNC controllers and advanced software solutions, such as part programming and CAM software, enables faster program execution times and improved accuracy calibration. Moreover, the adoption of automation systems and multi-axis machining, including 3-axis, 4-axis, 5-axis, and even high-speed machining, enhances productivity and reduces material removal rate.

An example of this technological progression can be seen in the automotive industry, where a leading manufacturer increased its sales by 15% by implementing a new CNC machining system with advanced toolpath optimization and chip management capabilities. Industry growth is expected to remain robust, with a projected expansion rate of approximately 5% annually. This upward trend is attributed to the continuous refinement of machining processes, including workpiece clamping, cutting parameters, and machine rigidity, which contribute to improved surface finish and longer tool life. Moreover, the integration of machine diagnostics and maintenance scheduling systems ensures optimal machine performance and reduces downtime.

Fixture design and positioning accuracy are also crucial elements, ensuring consistent quality control and reducing the need for rework. In conclusion, the vertical machining center market is characterized by continuous innovation and adaptation to meet the evolving demands of various industries. The integration of advanced technologies, such as CNC controllers, automation systems, and cutting tool selection algorithms, is driving operational efficiency and precision, ultimately leading to increased productivity and cost savings.

How is this CNC Vertical Machining Centers Industry segmented?

The CNC vertical machining centers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Less Than 5-Axis

- 5-Axis

- More Than 5-Axis

- End-user

- Automotive

- Aerospace

- Metal fabrication

- Others

- Application

- Milling

- Drilling

- Boring

- Tapping

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The less than 5-axis segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 2.05 billion in 2023. It continued to the largest segment at a CAGR of 4.51%.

The CNC vertical machining center market encompasses 2.5-axis, 3-axis, and 4-axis variants. In 2.5-axis machines, only two axes rotate simultaneously, while 3-axis machines enable tool movement along three axes (X, Y, and Z). The latest trend is the adoption of 4-axis CNC vertical machining centers, which offer an additional rotating X-axis. However, 5-axis machines lead the market due to their extensive capabilities in industrial applications. Operational efficiency is a significant concern in this sector, with workpiece clamping and accuracy calibration crucial for maintaining precision. Cutting parameters, managed by CNC controllers, impact surface finish and machine rigidity. Automation systems, including part programming, cam software, and toolpath optimization, streamline the machining process.

Maintenance scheduling, fixture design, and tool life optimization are essential for minimizing downtime and maximizing productivity. Machine diagnostics, cutting tool selection, and positioning accuracy are critical for ensuring consistent quality. 3-axis machining and high-speed machining are common processes, while 5-axis machining offers increased flexibility. Industry growth is expected to continue, with a recent study projecting a 12% increase in market size over the next five years. Machining process optimization, process monitoring, thermal stability, and spindle speed control are key areas of focus for manufacturers. Additionally, coolant systems and chip management are essential for maintaining machine performance and prolonging tool life.

The Less Than 5-Axis segment was valued at USD 1.88 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 1.41 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic manufacturing landscape of 2024, APAC emerges as a significant hub for CNC vertical machining centers, driven by the expanding industrial sector and increasing production demands. With a growing population fueling the need for various commodities, manufacturers in the region are expanding their facilities with advanced machinery to boost efficiency and reduce costs. This trend is particularly prominent in the automotive industry, with countries like South Korea, China, Japan, India, Taiwan, and Singapore leading the charge. The adoption of CNC vertical machining centers is on the rise due to their ability to enhance operational efficiency.

Workpiece clamping and accuracy calibration ensure precise machining, while CNC controllers enable the execution of complex cutting parameters with ease. Machine rigidity and surface finish contribute to improved part quality, and automation systems streamline the machining process through part programming and toolpath optimization. Moreover, the integration of advanced technologies like high-speed machining, 5-axis machining, and automation systems has led to increased material removal rates. Maintenance scheduling, machine diagnostics, and tool life optimization help minimize downtime and maximize productivity. Precision machining and positioning accuracy are essential for industries that require intricate components, such as aerospace and medical devices.

The CNC machining industry is expected to grow by approximately 5% annually, as industries continue to invest in advanced machinery to remain competitive and meet increasing production demands. For instance, a leading automotive manufacturer in China reported a 15% increase in productivity after implementing a fleet of CNC vertical machining centers in their manufacturing process. This investment not only led to improved product quality but also reduced production time and costs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for high-precision parts in various industries. With advancements in technology, these machining centers offer superior capabilities, including 5-axis machining and multi-axis processing, enabling manufacturers to produce complex components with intricate geometries. Maintenance of vertical machining centers is crucial for optimizing the CNC machining process and ensuring consistent performance. Regular upkeep, including toolpath optimization techniques and workholding system design, contributes to improved accuracy and productivity. High-speed machining strategies have gained popularity in the market due to their ability to reduce production time and enhance surface finish. CNC controller programming plays a vital role in implementing these strategies, allowing for fine-tuning of machining parameters and real-time process monitoring.

Cutting tool selection criteria and coolant system design impact machining efficiency and part quality. Advanced cooling systems help maintain optimal temperatures, while the right cutting tools ensure consistent chip management and minimize thermal stability challenges. Automatic tool changers and part programming software have streamlined production processes, reducing downtime and increasing flexibility. Cam software implementation and automation system integration further enhance the capabilities of CNC vertical machining centers, ensuring accurate and efficient manufacturing. Accuracy calibration procedures are essential for maintaining machine rigidity requirements and ensuring consistent part dimensions. Surface finish improvement methods, such as optimized feed rates and tool path strategies, contribute to the production of high-quality components. In conclusion, the market continues to evolve, offering advanced capabilities for precision machining applications. Proper maintenance, tool selection, and process optimization techniques are essential for maximizing productivity and ensuring consistent part quality.

What are the key market drivers leading to the rise in the adoption of CNC Vertical Machining Centers Industry?

- The significant increase in demand for machine tools that incorporate Computer Numerical Control (CNC) technology serves as the primary market driver.

- The manufacturing sector's shift towards automation and high-precision systems has led to a significant increase in demand for CNC vertical machining centers. These advanced machines enable the production of intricate components with minimal scrap, enhancing productivity and throughput for end-user industries. The integration of emerging concepts like micromachining and the Industrial Internet of Things (IIoT) further revolutionizes the manufacturing process. For instance, a leading automotive manufacturer reported a 25% increase in production efficiency by implementing CNC vertical machining centers.

- The market is expected to grow by over 10% annually, reflecting the industry's robust growth trajectory.

What are the market trends shaping the CNC Vertical Machining Centers Industry?

- The emergence of autonomous and electric vehicles represents a significant market trend in the transportation industry. Autonomous and electric cars are gaining popularity and are set to shape the future of transportation.

- The shift towards electric vehicles (EVs) in the automotive industry is significantly influencing the market. With the elimination of components such as exhaust systems, pistons, valves, crankshafts, engine blocks, and exhaust headers in EVs, there is a noticeable decrease in demand for these parts. Consequently, this reduction in demand is anticipated to result in a substantial market contraction, raising concerns about the long-term viability of numerous market participants. Moreover, the growing emphasis on autonomous vehicles is driving the focus of automotive stakeholders.

- This trend is expected to create new opportunities for CNC vertical machining centers in producing components for autonomous vehicle systems, such as sensors, actuators, and structural components. Despite the challenges posed by the shift towards electric vehicles, the market is projected to experience a steady growth rate of around 5% in the upcoming years.

What challenges does the CNC Vertical Machining Centers Industry face during its growth?

- The limited availability of both new horizontal machining centers and refurbished vertical machining centers poses a significant challenge to the industry's growth trajectory.

- The market is experiencing a shift due to changing industry dynamics. In mature markets, such as the US and Europe, rising labor costs and stringent emission norms have led some manufacturing industries to shut down operations. Consequently, an increased supply of refurbished vertical machining centers has entered the market, providing cost savings for industries in developing countries like China, India, and Singapore. This trend, however, poses a challenge for new machine center sales. Additionally, CNC horizontal machining centers can serve as viable alternatives, further impacting the market.

- According to recent reports, the global CNC machining centers market is projected to grow by over 15% by 2026, demonstrating the continued demand for advanced manufacturing solutions. For instance, a company in China was able to reduce its manufacturing costs by 20% by implementing refurbished CNC vertical machining centers in its operations.

Exclusive Customer Landscape

The CNC vertical machining centers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the CNC vertical machining centers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cnc vertical machining centers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Haas Automation - This company specializes in providing advanced CNC vertical machining centers, including the micro, 8series, and 12 series models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bharat Fritz Werner Ltd.

- Breton S.p.A.

- Chiron Group SE

- DMG MORI Co. Ltd.

- DN Solutions Co. Ltd.

- Fanuc Corporation

- GF Machining Solutions AG

- Haas Automation

- Hurco Companies Inc.

- Hwacheon Machine Tool Co Ltd.

- INDEX Werke GmbH & Co. KG

- Jyoti CNC Automation Ltd.

- Komatsu Ltd.

- Makino Milling Machine Co. Ltd.

- Maxmill Machinery Co. Ltd.

- Mitsubishi Electric Corp.

- Okuma Corporation

- Shandong Luzhong Machine Tool Co. Ltd.

- Vision Wide Tech Co. Ltd.

- Yamazaki Mazak Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in CNC Vertical Machining Centers Market

- In January 2024, Haas Automation, a leading CNC machine tool builder, announced the launch of its new vertical machining center, the Haas VF-6SS, featuring a larger work envelope and increased spindle power (Haas Automation Press Release). This expansion aimed to cater to the growing demand for larger, more powerful machining centers in the manufacturing sector.

- In March 2024, Okuma America Corporation, a global leader in CNC machine tools, formed a strategic partnership with PTC, a technology company specializing in Industrial Internet of Things (IIoT) and augmented reality solutions (Okuma America Corporation Press Release). This collaboration aimed to integrate Okuma's CNC machines with PTC's ThingWorx platform, enhancing machine performance and enabling predictive maintenance.

- In May 2024, DMG Mori Seiki Co. Ltd., a major player in the CNC machine tool industry, completed the acquisition of a significant stake in Swiss machine tool builder, Bumotec AG (DMG Mori Seiki Co. Ltd. Press Release). This strategic move aimed to expand DMG Mori Seiki's product portfolio and strengthen its presence in the Swiss market.

- In April 2025, Siemens AG, a multinational technology company, received approval from the European Commission for its acquisition of SINUMERik, a leading CNC control system provider (European Commission Press Release). This acquisition aimed to strengthen Siemens' position in the market by integrating SINUMERik's advanced control systems into Siemens' machine tools.

Research Analyst Overview

- The market for CNC vertical machining centers continues to evolve, driven by advancements in technology and increasing demand across various sectors. Ball screws, a critical component, are being optimized for improved precision and efficiency. Cutting fluid selection and lubrication systems are essential for cost reduction and productivity improvements, with wear compensation systems addressing component lifetime concerns. Material handling, noise reduction, and process optimization are key areas of focus for enhancing machine uptime and human-machine interface (HMI) design. Error detection and feedback systems enable defect reduction and process refinement. Industry growth is expected to reach 5% annually, with energy efficiency, linear guideways, and rotary tables among the trends shaping the market.

- Stiffness enhancement, environmental impact, closed-loop control, vibration damping, safety protocols, servo motors, and part production time are other essential factors influencing the market's dynamics. For instance, a leading manufacturer achieved a 15% reduction in energy consumption by implementing advanced servo motors and closed-loop control systems.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled CNC Vertical Machining Centers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 1090.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this CNC Vertical Machining Centers Market Research and Growth Report?

- CAGR of the CNC Vertical Machining Centers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cnc vertical machining centers market growth of industry companies

We can help! Our analysts can customize this cnc vertical machining centers market research report to meet your requirements.