What is the Size of UK Cold Chain Logistics Market?

The UK cold chain logistics market size is forecast to increase by USD 8.50 billion, at a CAGR of 9.9% between 2024 and 2029. The market is experiencing significant growth due to several key trends and challenges. One major trend driving market growth is the increasing use of RFID technology and IoT solutions in cold chain logistics to enhance supply chain visibility and improve efficiency. Another trend is the growing demand for technological advancements to address poor customer satisfaction and ensure the timely delivery of temperature-sensitive goods. However, the market also faces challenges such as high operational costs and the need for specialized infrastructure to maintain the required temperature conditions. To mitigate these challenges, market players are investing in advanced technologies and partnerships to improve their offerings and gain a competitive edge. Overall, the market is expected to witness strong growth in the coming years as businesses prioritize the secure and efficient transportation of temperature-sensitive goods.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2022 for the following segments.

- Application

- MFS

- Dairy and frozen desserts

- FVB

- Others

- Type

- Refrigerated warehouse

- Refrigerated transportation

- Geography

- UK

Which is the largest segment driving market growth?

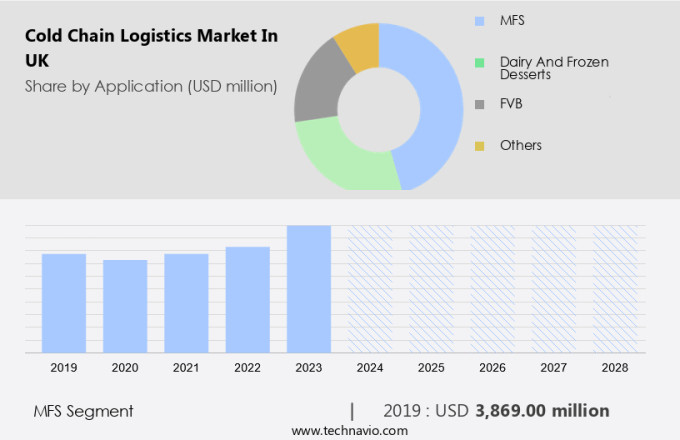

The MFS segment is estimated to witness significant growth during the forecast period. Cold chain logistics plays a crucial role in preserving the quality and nutritional value of perishable goods, including meat, fish, and seafood. These foods have specific temperature requirements for storage to maintain their freshness and prevent spoilage. For instance, fresh seafood must be kept at a temperature of 32 degrees F (0 degrees C), while frozen seafood requires storage at 0.40 degrees F (-18 degrees C) or below. These ogistics solutions ensure these temperature requirements are met, thereby preserving the quality of these goods. Online grocery delivery services have gained significant traction in the US market, driving the demand for this logistics. This trend is further fueled by the increasing popularity of e-commerce platforms for purchasing dairy products, fruits and vegetables, and vaccines and biologics.

Get a glance at the market share of various regions. Download the PDF Sample

The MFS segment was valued at USD 3.87 billion in 2019. Digitalization is transforming the cold chain logistics industry, enabling real-time temperature monitoring and automated tracking systems. Cold chain logistics is also essential for the successful implementation of vaccination campaigns. Vaccines and biologics require precise temperature control to maintain their efficacy, making this logistics a critical component of healthcare supply chains. The globalization of markets and the increasing demand for fresh produce and perishable goods have led to the expansion of these logistics networks. The use of advanced temperature monitoring devices and technologies, such as GPS and IoT, enables real-time monitoring and tracking of goods, ensuring their quality and safety. In conclusion, this logistics plays a vital role in preserving the quality and nutritional value of perishable goods, including meat, fish, and seafood, as well as vaccines and biologics. The increasing demand for online grocery delivery and the globalization of markets are driving the growth of this logistics industry. Digitalization and advanced temperature monitoring technologies are transforming the industry, enabling real-time monitoring and automated tracking systems.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AGRO Merchants Group - The company offers cold chain logistics equipped with conventional, mobile racking, automated storage, and retrieval systems.

Technavio provides the ranking index for the top 14 companies along with insights on the market positioning of:

- AP Moller Maersk AS

- Andrew Marr International Ltd

- Central Insulations Ltd

- Chiltern Cold Storage Group Ltd.

- Kerry Logistics Network Ltd.

- Lineage Logistics Holdings LLC

- Magnavale Ltd

- NewCold Cooperatief UA

- Posten Norge AS

- Reed Boardall Cold Storage Ltd.

- Seafast Logitics Ltd.

- Trade Distribution Ltd

- XPO Inc.

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Concentrated |

|

YoY growth 2024-2025 |

8.8 |

Market Dynamics

Cold chain logistics has emerged as a critical aspect of modern supply chain management, particularly in the healthcare and food industries. This essential function ensures the preservation of temperature-sensitive goods, maintaining their quality and efficacy throughout the entire supply chain. The healthcare sector relies heavily on cold chain logistics for the distribution of pharmaceuticals, vaccines, medical devices, and healthcare technology. Ensuring the proper handling and transportation of these goods is crucial for their effectiveness and patient safety. In the realm of drug development, cold chain logistics plays a vital role in the successful execution of clinical trials, contributing to the advancement of new treatments and therapies. Meanwhile, the food industry also heavily relies on cold chain logistics for the distribution of perishable goods, including fresh produce, dairy products, and meat. Maintaining the cold chain is essential for food safety, reducing food waste, and ensuring the availability of fresh products for consumers. Food traceability and temperature monitoring are critical components of cold chain logistics, allowing for efficient and effective supply chain management. Sustainability is a growing concern in cold chain logistics, with the need for more sustainable solutions to minimize the environmental impact of temperature-controlled supply chains.

Innovations in cold chain optimization, such as warehouse automation, digital health, and sustainable cold chain, are helping to reduce energy consumption and carbon emissions. Supply chain disruptions, whether due to natural disasters, geopolitical tensions, or other unforeseen circumstances, can significantly impact the cold chain. Ensuring supply chain resilience through effective inventory management, temperature-controlled warehousing, and logistics technology is essential for mitigating the risks of disruptions and maintaining the integrity of temperature-sensitive goods. The integration of e-commerce logistics into the cold chain landscape has further complicated supply chain management. Grocery delivery platforms and food delivery services must adhere to strict temperature requirements to ensure the quality and safety of their offerings. Cold chain innovation, such as refrigerated vehicles and advanced packaging solutions, are essential for meeting the demands of this rapidly growing sector. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

The use of RFID in cold chain logistics is notably driving the market growth. Cold chain logistics is a critical sector ensuring the transfer of temperature-sensitive products, including perishable food items such as fruits, vegetables, seafood, and dairy products, as well as medical supplies like vaccines, biologics, and protein-rich foods. These products require stringent temperature control to maintain their quality and integrity. The market encompasses various solutions, from automated warehouses and sustainable shipping products to advanced IT spending on cloud computing and digitalization. Logistics networks play a vital role in managing inventories of these temperature-sensitive goods. Cold chain logistics solutions include temperature monitoring devices, such as sensors and IoT systems, and packaging products that maintain chilled or frozen temperatures. These technologies enable real-time temperature data tracking and automated warehouse management, ensuring shipment integrity and product quality. The globalization of markets and e-commerce growth have increased the demand for cold chain logistics.

Online grocery delivery and convenience stores require efficient cold chain solutions to ensure the freshness and quality of perishable food products. Cold chain logistics is also essential for the distribution of vaccines and biologics, including cell therapies, during vaccination campaigns. The market is dynamic, with continuous innovation in temperature control technologies, such as RFID tags and sensors, and automation to minimize food waste and optimize supply chain efficiency. The market also faces challenges, including product recalls and the need for adherence to quality standards. However, the potential for reducing food waste and improving the availability of perishable food products to consumers drives the growth of the market. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

Increased use of IoT and technological solutions with cold chain is an emerging trend shaping the market growth. The Market is experiencing significant growth due to the increasing demand for temperature-sensitive products such as seafood, fruits and vegetables, dairy products, eggs, and vaccines. Online platforms, e-commerce, and globalization have fueled the need for efficient and reliable cold chain logistics solutions. Vendors in the market offer advanced technologies like automated warehouses, IoT sensors, RFID tags, and temperature monitoring devices to ensure product integrity and quality standards. These solutions help reduce food waste, maintain optimal temperatures, and ensure timely delivery of perishable food items and biological therapies like cell therapies and protein-rich foods. Logistics networks are investing in IT spending and cloud computing to optimize warehouse management, cold storage logistics, and shipment integrity. Digitalization and automation are essential components of cold chain logistics, with hardware components like temperature data recording systems and packaging products playing a crucial role in maintaining the chilled and frozen temperature of perishable food products.

The market is expanding to include delivery services, refrigerated transport, and convenience stores. Key players are focusing on sustainable shipping products and temperature control to meet the demands of dual income households and retail chains. The integration of online grocery delivery and hypermarkets is also driving growth in the market. Cold chain logistics plays a critical role in the distribution of vaccines and biologics for wellness and healthcare applications. Vaccination campaigns and the increasing popularity of online platforms for healthcare services are expected to further boost market growth. Overall, the market is poised for continued expansion, driven by technological innovations and the growing demand for temperature-sensitive products. Thus, such market trends will shape the growth of the market during the forecast period.

What are the major market challenges?

Poor customer satisfaction is a significant challenge hindering market growth. Cold chain logistics plays a crucial role in ensuring the quality and integrity of perishable food items, such as seafood, fruits and vegetables, dairy products, eggs, and protein-rich foods, during transportation and storage. Enterprises relying on cold chain solutions face challenges from vendors, including insufficient capacity and potential damage or product loss. Vendors with inadequate systems for product data collection may struggle to effectively manage inventory, leading to storage capacity issues and increased costs for enterprises. Additionally, some vendors may opt for low-cost cold chain carriers, resulting in mishandled products and spoilage, which can incur fines from regulatory agencies and negatively impact customer satisfaction. To mitigate these challenges, cold chain logistics networks are increasingly adopting digitalization through cloud computing, IT spending, and the implementation of temperature monitoring devices, such as sensors and IoT technology. Automated warehouses and warehouse management systems enable real-time inventory tracking and temperature control, ensuring optimal storage conditions and reducing the risk of spoilage. Cold chain logistics solutions also incorporate RFID tags and automated packaging products to streamline the supply chain and maintain product quality.

Online platforms, such as e-commerce and online grocery delivery services, have accelerated the demand for cold chain logistics, particularly in the context of the growing popularity of convenience and dual income households. The market for cold chain logistics is further driven by the increasing adoption of biologics, cell therapies, and vaccines, which require stringent temperature control for their efficacy. The globalization of food trade and the expansion of retail chains, such as hypermarkets and retail chains, also contribute to the growth of the market. Sustainable shipping products and temperature control technologies are becoming increasingly important in cold chain logistics, as enterprises seek to minimize food waste and improve product quality. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

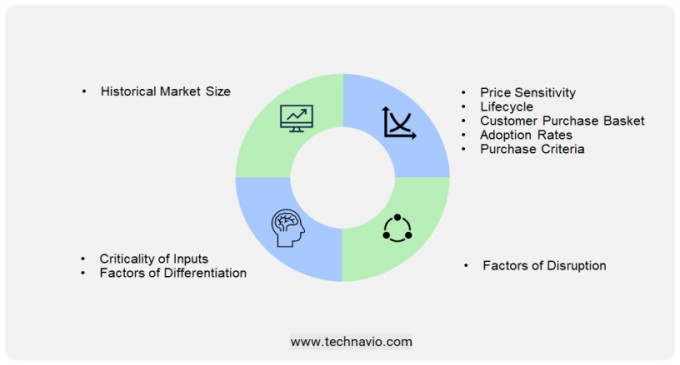

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The market is witnessing significant growth due to the increasing demand for perishable items such as seafood, fruits and vegetables, dairy products, and pharmaceuticals. This market is essential for maintaining the quality and integrity of temperature-sensitive goods, ensuring their timely delivery to consumers and end-users. Seafood, a major sector in the market, benefits from the growing popularity of online platforms. Consumers are increasingly opting for fresh seafood delivered to their doors, leading to an increased need for efficient cold chain logistics solutions. Another sector driving the growth of the market is the biotechnology industry. With the rise of cell therapies, proteins, and biological therapies, there is a pressing need for temperature-controlled storage and transportation to maintain the efficacy and safety of these sensitive products. Logistics networks play a crucial role in the cold chain supply chain. Cold storage logistics, warehouse management, and automated warehouses are essential components of these networks. Temperature monitoring devices, such as sensors, IoT, and RFID tags, are integral to maintaining the required temperature conditions for perishable items. The food industry, including fruits, vegetables, and protein-rich foods, also contributes significantly to the market. With the increasing trend of dual income households and the convenience offered by online grocery delivery services, there is a growing demand for perishable food items that require temperature-controlled storage and transportation. Quality standards and food safety are critical concerns in the market.

Temperature data, packaging, and storage solutions are essential to maintaining product quality and preventing food waste. Sustainable shipping products and IT spending on cloud computing further enhance the efficiency and effectiveness of these logistics. The pharmaceutical industry, particularly vaccines and biologics, relies heavily on these logistics for their distribution. Vaccination campaigns and the need for temperature-controlled storage and transportation are driving the growth of this sector. The market is also witnessing digitalization, with automation and shipment integrity becoming key focus areas. Hardware components, such as temperature sensors and automated packaging systems, are essential for ensuring product quality and reducing the risk of product recalls. The globalization of markets and the increasing popularity of e-commerce have led to an increased demand for these logistics solutions. Retail chains, hypermarkets, convenience stores, and delivery services all require temperature-controlled storage and transportation for their perishable offerings. The market encompasses a wide range of industries, including meat, pork, dairy, and agricultural products. Refrigerated transport and temperature control are essential for maintaining the quality and safety of these perishable items during transportation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

132 |

|

Base year |

2024 |

|

Historic period |

2019 - 2022 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market Growth 2025-2029 |

USD 8.50 billion |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AP Moller Maersk AS, AGRO Merchants Group, Andrew Marr International Ltd, Central Insulations Ltd, Chiltern Cold Storage Group Ltd., Kerry Logistics Network Ltd., Lineage Logistics Holdings LLC, Magnavale Ltd, NewCold Cooperatief UA, Posten Norge AS, Reed Boardall Cold Storage Ltd., Seafast Logitics Ltd., Trade Distribution Ltd, and XPO Inc. |

|

Market Segmentation |

Application (MFS, Dairy and frozen desserts, FVB, and Others), Type (Refrigerated warehouse and Refrigerated transportation), and Geography (Europe) |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across UK

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies