Commercial Coffee Bean Grinders Market Size 2024-2028

The commercial coffee bean grinders market size is forecast to increase by USD 6.02 thousand at a CAGR of 2.15% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of energy-efficient models. These grinders not only reduce operational costs but also contribute to sustainability efforts, aligning with the global trend towards eco-friendly business practices. Furthermore, the market is witnessing an influx of commercial coffee bean grinders equipped with advanced features, such as programmable settings, easy maintenance, and consistent grind size. However, market expansion is not without challenges. Regulatory hurdles impact adoption, particularly in regions with stringent food safety and quality standards. Additionally, inconsistencies in the global coffee supply chain can temper growth potential, as unpredictable weather patterns and diseases affecting coffee plants can impact production volumes and quality.

- To capitalize on market opportunities and navigate these challenges effectively, companies must focus on innovation, regulatory compliance, and supply chain resilience. By offering energy-efficient, feature-rich, and reliable commercial coffee bean grinders, businesses can differentiate themselves and cater to the evolving needs of the industry.

What will be the Size of the Commercial Coffee Bean Grinders Market during the forecast period?

- In the dynamic US market for fresh coffee experiences, electronic coffee grinder machines have gained significant traction among coffee enthusiasts. These advanced appliances, which include automatic grinders and manual grinders, offer convenience and consistency in delivering perfectly ground coffee beans for various brewing methods such as moka pots or espresso machines. Automation features, including counter-rotating surfaces and LCD (liquid-crystal display) user interface panels, enhance the user experience. While manual grinders cater to those seeking a more traditional approach, automatic grinders' popularity lies in their ability to save time and ensure a consistent grind texture for various coffee beverages. The market for coffee bean grinders is diverse, catering to both residential and cafe applications, with a wide range of prices to accommodate various budgets.

- Electricity powers these machines, enabling the efficient grinding of coffee beans. However, some manual grinders operate without electricity, making them suitable for off-grid or emergency situations. Instant coffee, while convenient, cannot replicate the rich aroma and taste of freshly ground coffee. Automatic grinder combinations with milk frothers have further expanded the market, offering coffee lovers the opportunity to prepare their favorite beverages at home with ease. The trend towards automation and convenience continues to drive the growth of the coffee grinder market in the US.

How is this Commercial Coffee Bean Grinders Industry segmented?

The commercial coffee bean grinders industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Commercial electric burr coffee bean grinders

- Commercial electric blade coffee bean grinders

- Commercial manual coffee bean grinders

- End-user

- Coffee shops

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

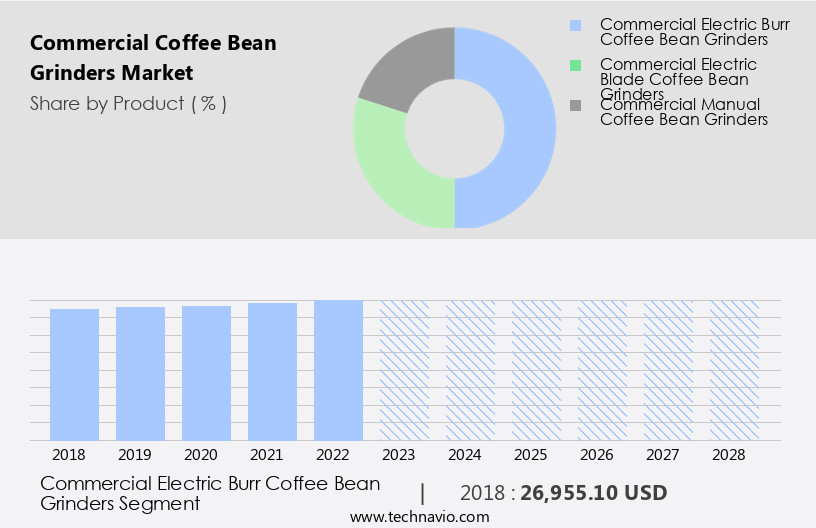

The commercial electric burr coffee bean grinders segment is estimated to witness significant growth during the forecast period.

Commercial electric coffee grinders, a crucial component in the preparation of freshly brewed coffee, employ counter-rotating surfaces to grind beans to a desired size. Operators can control the grind size by adjusting the distance between these surfaces. Commercial electric burr grinders come with either flat or conical burrs. Flat burr grinders allow fine grinding by adjusting the burr alignment. Conversely, conical burr grinders have burrs of different shapes that crush beans consistently, producing ground coffee. These grinders are compatible with various coffee brewers due to the adjustable distance between grinding discs. Stainless steel blades and non-rusting body materials ensure durability.

Customized products cater to diverse coffee shop and restaurant needs, with medium and high price points. Espresso coffee enthusiasts seek fresh coffee experiences, emphasizing the importance of aroma and texture. Automatic grinders are increasingly popular in cafes and restaurants, while manual grinders retain a niche following. Electric coffee grinders are available in semi-automatic, super automatic, and fully automatic machine types, catering to varying institutional coffee consumption levels. Online buying and electronic cooking appliances facilitate convenience. Coffee producers and roasters supply coffee beans to meet the demand for electric coffee grinder machines. Electric blade grinders are an alternative option, but electric burr grinders offer more consistent grinding and longer lifespan.

Commercial electric coffee grinders are integral to the coffee industry, evolving to meet the demands of diverse customer segments and brewing methods.

The Commercial electric burr coffee bean grinders segment was valued at USD 26955.10 thousand in 2018 and showed a gradual increase during the forecast period.

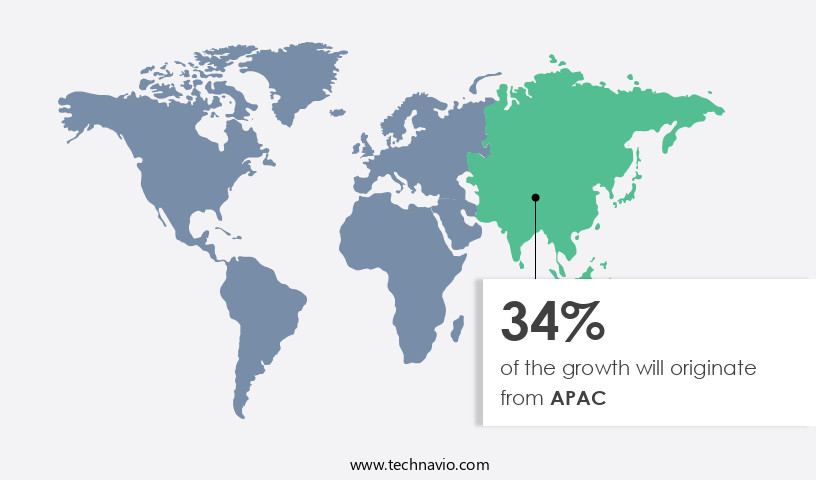

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing significant growth due to the increasing demand for freshly ground coffee in IT parks, cafes, restaurants, and hotels. Automation features, such as LCD displays and user interface panels, are driving the preference for electric coffee grinders over manual grinders. Semi-automatic and super automatic grinder combinations cater to the varying price points and coffee consumption patterns of low, medium, and high-end consumers. Espresso coffee and customized products continue to be popular among coffee enthusiasts, emphasizing the importance of aroma and texture. Roasting and electronic cooking appliances are also gaining popularity in the restaurant industry.

Online buying and electric coffee grinder machines are increasingly preferred for their convenience and ease of use. The market is expected to grow further with the increasing popularity of automatic grinders, milk frothers, and filter coffee. Institutional buyers, such as coffee shops and coffee producers, are also significant contributors to the market's growth. Companies are focusing on offering stainless steel blades and non-rusting body materials to ensure durability and longevity. The market is witnessing a shift towards fully automatic and coffeemaker machines, catering to the diverse needs of consumers and businesses in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Commercial Coffee Bean Grinders market drivers leading to the rise in the adoption of Industry?

- The increasing preference for energy-efficient commercial coffee bean grinders is the primary factor fueling market growth in this sector.

- Commercial coffee bean grinders, essential for high-volume production, are designed to minimize energy consumption, saving up to 35% compared to conventional models. This energy efficiency is increasingly preferred due to its associated benefits, including reduced utility costs and a lower carbon footprint. The primary objective of commercial coffee bean grinders is to efficiently grind coffee beans to the desired size in a short time, ensuring consistency and minimizing wastage.

- ENERGY STAR certified grinders offer significant advantages to end-users, making them a popular choice in the market. The demand for energy-efficient commercial coffee bean grinders continues to grow as businesses aim to reduce operational costs and promote sustainability.

What are the Commercial Coffee Bean Grinders market trends shaping the Industry?

- The market trend reflects the increasing supply of commercial coffee bean grinders, boasting enhanced features. This trend signifies a significant development in the coffee industry.

- Commercial coffee bean grinders in the marketplace are evolving with advanced automation features to enhance the user experience. These grinders come equipped with built-in timers, enabling operators to preset the grinding duration for consistently ground coffee beans without overheating and maintaining a desirable particle size. Furthermore, commercial coffee bean grinders are now available with multiple hoppers, allowing for the simultaneous grinding of various coffee bean quantities and textures, thereby increasing productivity. For instance, Bunn's commercial multi-hopper coffee bean grinders cater to this demand. The FPG-2 DBC, a double-hopper commercial coffee bean grinder, boasts digital controls, allowing operators to program batch information and boasts an overall capacity of 12 lbs.

- Electricity and water are essential requirements for these grinders, ensuring the freshly ground coffee maintains its optimal taste and aroma. While manual grinders still hold a place in the market, particularly in residential and cafe settings, automatic grinders cater to the growing demand for efficiency and consistency in commercial applications. Despite their higher price point, the benefits of automatic coffee grinders, including automation and increased productivity, make them a worthwhile investment for businesses.

How does Commercial Coffee Bean Grinders market faces challenges face during its growth?

- The coffee industry faces significant growth challenges due to the impact of weather conditions on coffee production.

- Coffee bean production is subject to various external challenges, primarily due to unpredictable weather conditions and disease outbreaks. Natural disasters such as droughts, floods, frost, and earthquakes pose significant risks to coffee plants, particularly in South America, the world's leading coffee-producing region. Seasonal wind shifts can lead to prolonged rainfall, causing landslides and mudflows in mountainous areas. Human intervention, including agriculture and animal husbandry, also puts pressure on coffee plant habitats. Untimely rainfall and frost can lead to the outbreak of coffee rust, a fungal disease that causes defoliation and disrupts the plant's fruit-bearing ability. These factors can negatively impact coffee production, leading to potential supply chain disruptions for industries relying on coffee beans, such as cafes, restaurants, hotels, and coffee shops.

- Electric burr grinders and electronic coffee grinders remain essential tools for these businesses, with user-friendly features like LCD displays and semi-automatic or super-automatic functions streamlining the beverage preparation process. Stainless steel blades ensure consistent grinding, while low-priced grinder combinations cater to budget-conscious businesses.

Exclusive Customer Landscape

The commercial coffee bean grinders market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial coffee bean grinders market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial coffee bean grinders market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ali Group S.r.l. - The Promac brand, a division of the company, specializes in the manufacturing and distribution of high-performance commercial coffee grinders.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ali Group S.r.l.

- Breville Group Ltd.

- Bunn O Matic Corp.

- Ceado Srl

- Compak Coffee Grinders SA

- Cunill

- Electrolux Professional AB

- Food Equipment Technologies Co.

- Hemro AG

- Kaapi Machines India Pvt. Ltd.

- Kanteen India Equipments Co.

- La Marzocco Srl

- La San Marco Spa

- Macap Srl

- MACQUINO INNOVATIONS LLP

- Mazzer Luigi Spa

- Sanremo Coffee Machines Srl

- SEB Developpement SA

- Smeg S.p.a.

- Unifrost

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Coffee Bean Grinders Market

- In February 2023, leading commercial coffee equipment manufacturer, Jura Elektronika AG, introduced the fully automatic A1 Plus Coffee Center, integrating a high-performance conical grinder and advanced milk frother system (Jura Elektronika AG press release). This innovation aims to cater to the growing demand for premium, barista-quality coffee in commercial settings.

- In October 2024, Starbucks Corporation announced a strategic partnership with BUNN, a prominent coffee equipment supplier, to expand its presence in the US foodservice market (Starbucks Corporation press release). The collaboration includes the adoption of BUNN's grind and brew coffee equipment, which will be used in Starbucks' cafes and licensed stores.

- In March 2025, Italian espresso machine manufacturer, La Cimbali, acquired a majority stake in the Turkish coffee grinder manufacturer, Tekel Makina Sanayi ve Ticaret A.? (La Cimbali press release). This strategic move aims to strengthen La Cimbali's position in the global coffee equipment market by expanding its product portfolio and enhancing its manufacturing capabilities.

- In July 2025, the European Union implemented new regulations on single-use coffee pods and filters, encouraging the use of reusable and biodegradable alternatives (European Commission press release). This policy change is expected to significantly impact the commercial coffee bean grinder market, as more businesses opt for sustainable grinding solutions.

Research Analyst Overview

Coffee bean grinders have become an essential component in both residential and commercial settings, as the demand for freshly ground coffee continues to rise. Automatic coffee grinders, a popular choice for cafes and restaurants, are integrating advanced automation features to enhance the coffee brewing experience. Electricity and water are two essential elements powering these electronic coffee grinders. The integration of LCD (liquid-crystal display) panels and user interface panels allows for customized coffee experiences, enabling users to select their preferred texture and quantity of ground coffee. Moka pots and espresso machines are common applications for these commercial-grade grinders. The low price point of manual grinders makes them an attractive option for archery clubs and cafes, while high-end models cater to coffee shops and hotels, offering medium to high price points.

Instant coffee and filter coffee have their place in the market, but the coffee enthusiast community continues to champion the fresh coffee experiences that come from freshly ground beans. Automatic grinders have become an integral part of the electronic cooking appliance landscape, offering convenience and consistency in coffee production. Online buying has made it easier for consumers to purchase coffee grinder machines, including electric burr grinders, electric blade grinders, and semi-automatic and super automatic grinder combinations. The non-rusting body material and stainless steel blades ensure durability and longevity, making them a worthwhile investment for coffee producers and coffee shops. The coffee industry is a dynamic and evolving market, with new technologies and trends emerging regularly.

Automatic grinders, with their ability to produce consistent, high-quality coffee, are a key player in this landscape. Milk frothing capabilities and grinder combinations are just a few of the features that set these machines apart from traditional coffee makers. Coffee consumption continues to grow, and with it, the demand for coffee grinders that can keep up with the increasing demand for freshly ground coffee. The market for coffee grinders is diverse, with offerings catering to various price points and applications, from residential use to institutional settings. The future of coffee grinders lies in continued innovation and the ability to provide fresh coffee experiences that meet the evolving needs of consumers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Coffee Bean Grinders Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.15% |

|

Market growth 2024-2028 |

USD 6.02 thousand |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.05 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Coffee Bean Grinders Market Research and Growth Report?

- CAGR of the Commercial Coffee Bean Grinders industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial coffee bean grinders market growth of industry companies

We can help! Our analysts can customize this commercial coffee bean grinders market research report to meet your requirements.