Commercial Espresso Machines Market Size 2024-2028

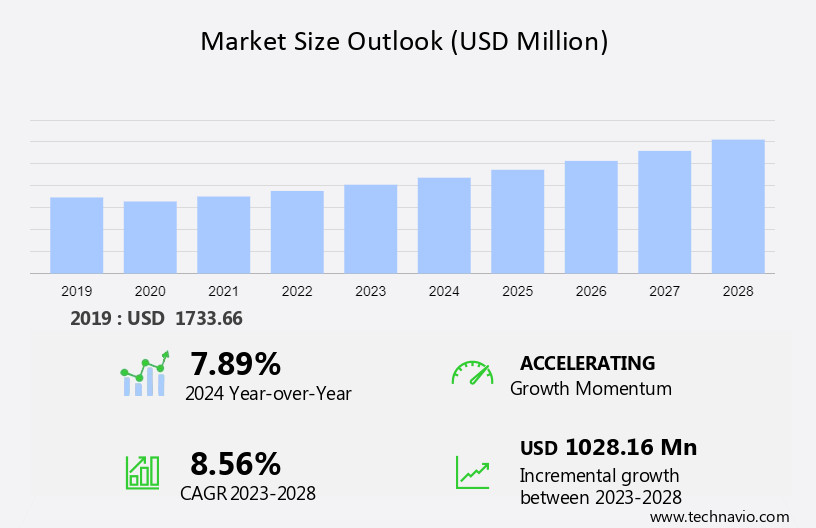

The commercial espresso machines market size is forecast to increase by USD 1.03 billion at a CAGR of 8.56% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for customizable espresso-based beverages. This trend is being driven by the changing consumer preferences towards specialty coffee and the convenience of having a wide range of beverage options at cafes and foodservice outlets. Technological advancements are also contributing to market growth, with innovations such as digital displays, programmable brewing parameters, and energy efficiency features. However, the market is facing challenges due to the environmental threats associated with commercial espresso machines, including high water and energy consumption and the generation of waste. To mitigate these challenges, manufacturers are focusing on developing eco-friendly solutions, such as energy recovery systems and water recycling technologies. Overall, the market is expected to continue growing, driven by consumer demand for high-quality espresso-based beverages and technological innovations.

What will be the Size of the Commercial Espresso Machines Market During the Forecast Period?

- The commercial espresso machine market encompasses a diverse range of brewing technologies catering to various coffee preferences and business needs. Innovation and energy efficiency are key trends driving market growth, with an emphasis on semi-automated and fully automated machines. Coffee quality and brewing techniques, including hacks for optimal taste, continue to captivate the industry. Accessories, such as grinders and milk frothers, expand machine capabilities. Energy-saving kitchen appliances and capsuless systems are gaining popularity for their sustainability.

- Moreover, market research reveals a thriving café culture, with soaring demand for coffee beverages, including cold brew and iced coffee. Small spaces and large families alike seek convenient, affordable options for coffee brewing. Maintenance and troubleshooting resources are readily available for machine owners, ensuring a smooth operation. Market insights indicate a growing interest in coffee brewing technology and price comparison websites to help buyers make informed decisions. Overall, the commercial espresso machine market is dynamic and vibrant, reflecting the enduring love for coffee and the relentless pursuit of innovation.

How is this Commercial Espresso Machines Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Manual and semi-automatic

- Fully-automatic

- End-user

- Cafes and restaurants

- Hotels

- Pubs and clubs

- Others

- Geography

- Europe

- Germany

- France

- Italy

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

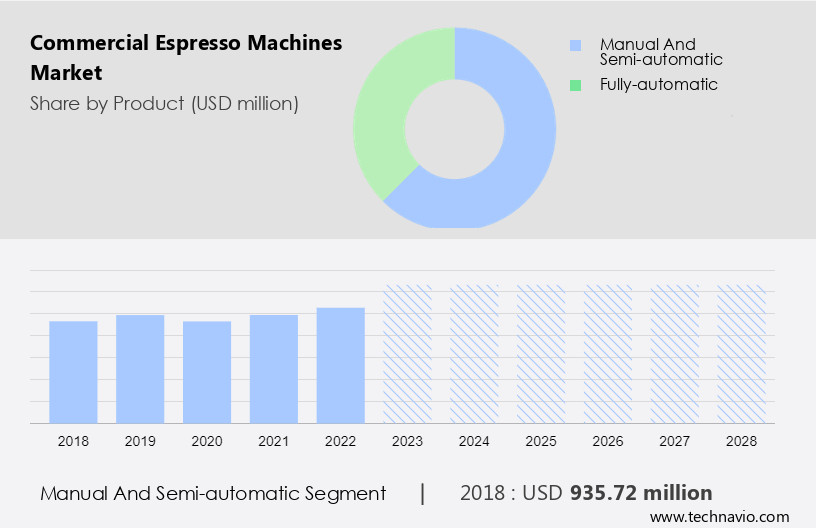

By Product Insights

- The manual and semi-automatic segment is estimated to witness significant growth during the forecast period.

Commercial espresso machines cater to various sectors, including kitchenettes, food stalls, and office cafeterias, offering automated and semi-automated models for refreshing beverages. Manual and semi-automatic machines serve diverse users, with manual machines, or lever machines, providing complete control over the brewing process for coffee shops and cafes. These machines allow baristas to customize extraction parameters, valued for their precision and craftsmanship. In contrast, semi-automatic machines streamline the process, combining automated functions with manual control for convenience and efficiency. Premiumization trends influence the market, with consumers seeking gourmet coffee experiences and health benefits.

Moreover, coffee dispensing appliances, such as vending machines and beverage vending machines, also contribute to the market's growth. Coffee consumption continues to rise, with convenience stores, coffeehouses, and coffee shops driving demand. Online purchasing and e-commerce platforms facilitate easy access to coffee pods, capsules, and coffee makers, including pod-based brewers. The market encompasses traditional espresso machines and energy-saving kitchen appliances, appealing to coffee enthusiasts and businesses alike.

Get a glance at the Industry report of share of various segments Request Free Sample

The manual and semi-automatic segment was valued at USD 935.72 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

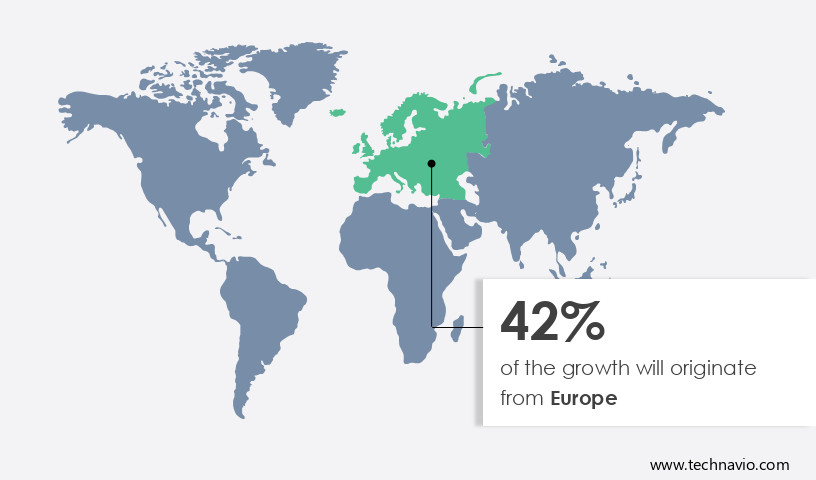

- Europe is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market is driven by a strong coffee culture and a tradition of technological innovation. With a diverse landscape of cafes, restaurants, and specialty coffee shops, Europe is a significant player In the global market. Italy and France, in particular, have a high demand that offer precision, performance, and a blend of tradition and modern technology. Coffee consumption is deeply ingrained in European social fabric, making these machines essential for businesses. Advanced features such as automated brewing, temperature control, and touchscreen interfaces are increasingly popular. Energy-saving kitchen appliances and health benefits are also key considerations.

Consequently, coffee dispensing appliances, including traditional espresso machines, and automated, semi-automated, and pod-based brewers, are in demand. Convenience stores, vending machines, and office cafeterias also utilize these machines to offer refreshing beverages to their customers. Coffeehouses and coffee shops continue to be major consumers, as coffee culture thrives. Online purchasing and e-commerce platforms have made it easier for coffee enthusiasts to access these machines. The market is expected to grow, driven by premiumization, convenience, and the health benefits associated with coffee consumption.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Commercial Espresso Machines Industry?

Rising demand for customizable espresso-based beverages is the key driver of the market.

- The market is witnessing significant growth due to the increasing popularity of automated coffee dispensing appliances in kitchenettes and food service establishments. Consumers are seeking refreshing beverages with customizable brewing styles, intensity, and quantity, leading businesses to invest in advanced espresso machines. These models offer features such as touchscreen interfaces, energy-saving capabilities, and compatibility with coffee pods and filters. The trend towards premiumization and gourmet coffee experiences is also driving demand for high-quality espresso machines. Convenience stores, office cafeterias, and coffeehouses are among the key adopters of these advanced coffee brewing appliances.

- Additionally, the health benefits associated with coffee consumption, including potential protection against type 2 diabetes and liver cancer, are contributing to the market's growth. The market is also witnessing the emergence of semi-automated and pod-based brewers, offering convenience and ease of use for businesses and coffee enthusiasts alike. Online purchasing platforms and e-commerce marketplaces are further expanding the reach of these coffee dispensing appliances. Overall, The market is poised for continued growth, driven by consumer preferences for customizable and convenient coffee experiences.

What are the market trends shaping the Commercial Espresso Machines Industry?

Technological advancements in commercial espresso machines are the upcoming market trends.

- Commercial espresso machines have experienced significant advancements, transforming the industry with automated features and enhanced brewing capabilities. These technological innovations cater to the growing demand for refreshing beverages and premium coffee experiences. Programmable settings and digital interfaces enable precise control over extraction parameters like water temperature and shot volume, allowing customization for various coffee beans and customer preferences. Automated models, including capsule-based and touchscreen-featured machines, offer convenience and energy savings in kitchenettes and office cafeterias. The integration of coffee dispensing appliances, such as vending machines and beverage vending machines, further expands accessibility.

- Furthermore, the health benefits and convenience of coffee consumption continue to fuel market growth, with coffee culture thriving online and in coffeehouses and shops. Drip coffee and traditional espresso machines coexist, but the trend toward automation and premiumization favors the former. Coffee pods, e-commerce platforms, and capsules have simplified purchasing and brewing processes for coffee enthusiasts. However, potential health concerns, such as type 2 diabetes and liver cancer, associated with excessive caffeine intake remain a consideration. Overall, the market continues to evolve, driven by technological advancements and consumer preferences.

What challenges does the Commercial Espresso Machines Industry face during its growth?

Environmental threats associated with commercial espresso machines are key challenges affecting the industry's growth.

- The market faces a significant challenge due to the environmental impact of these machines. The per-serving waste generated exceeds that of traditional coffee packaging, posing a challenge for waste management systems globally. Moreover, the manufacturing process involves materials like plastic and aluminum, contributing negatively to the environment. At a federal level In the US, the Environmental Protection Agency (EPA) regulates waste disposal, solid waste management, and recycling of waste under various acts, including the Resource Conservation and Recovery Act (RCRA), the Clean Air Act, the Clean Water Act, and the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA).

- Furthermore, despite this challenge, the market for coffee dispensing appliances, including commercial espresso machines, continues to grow due to the increasing coffee consumption In the working population and the demand for refreshing beverages. Automated models with features like touchscreens, energy-saving capabilities, and compatibility with coffee pods have gained popularity due to their convenience and premiumization of the coffee experience. Coffee culture, gourmet coffee, and online purchasing have also contributed to the growth of the market. However, the environmental concerns associated with commercial espresso machines remain a significant challenge that needs to be addressed to ensure sustainable growth In the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ali Group S.r.l. a Socio Unico

- Animo B.V.

- Bravilor Bonamat BV

- Breville Pty Ltd

- Bunn O Matic Corp.

- DeLonghi Group

- FRANKE Holding AG

- Glen Dimplex Europe Holdings Ltd.

- Groupe SEB WMF Retail GmbH

- Gruppo Cimbali S.p.A.

- Hamilton Beach Brands Holding Co.

- Illycaffe Spa

- JURA Elektroapparate AG

- Keurig Green Mountain Inc.

- Koninklijke Philips N.V.

- Melitta Professional Coffee Solutions GmbH and Co. KG

- Nestle SA

- Robert Bosch GmbH

- Simonelli Group Spa

- Smeg S.p.a.

- Panasonic Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The commercial espresso machines market encompasses a diverse range of brewing solutions designed to cater to the increasing demand for refreshing beverages in various industries. These coffee dispensing appliances have gained significant traction in recent years due to their ability to deliver high-quality espresso and other coffee-based beverages quickly and efficiently. Brewing style varies among the different models available In the market. Traditional espresso machines require a high level of skill and expertise to operate effectively. In contrast, automated and semi-automated machines offer greater convenience and consistency. Automated machines, also known as fully automatic or super automatic machines, feature built-in grinders, milk frothers, and programmable settings, allowing for minimal user intervention.

Furthermore, filters play a crucial role in ensuring the quality of the espresso produced by these machines. The choice between paper and metal filters depends on factors such as taste intensity and quantity desired. Some models offer the flexibility to use both types, providing greater versatility for coffee enthusiasts. Temperature control is another essential feature of commercial espresso machines. Precise temperature regulation is necessary to extract the optimal flavor profile from the coffee beans. Energy-saving kitchen equipment is also a growing trend, as businesses seek to reduce their environmental footprint and lower operating costs. The working population's growing appreciation for premium coffee beverages has led to a growth in demand for coffee dispensing appliances. This trend is evident in various sectors, from food stalls and vending machines to convenience stores and office cafeterias. The convenience offered by these machines, coupled with the health benefits associated with moderate coffee consumption, has made them an indispensable part of modern workplaces. Beverage vending machines, including those that specialize in coffee and espresso, have gained popularity due to their ability to offer a wide range of options and convenience.

Moreover, these machines often feature touchscreen interfaces, allowing users to customize their beverage preferences and make purchases quickly and easily. The coffee culture has evolved significantly in recent years, with gourmet coffee and specialty beverages becoming increasingly popular. Online purchasing platforms and e-commerce sites have made it easier than ever for businesses to source high-quality coffee beans and espresso machines. Pod-based brewers, such as capsule systems, have also gained popularity due to their ease of use and consistency. Despite the numerous benefits of commercial espresso machines, it is essential to consider the potential health risks associated with excessive caffeine consumption. Conditions such as type 2 diabetes and liver cancer have been linked to high caffeine intake. Therefore, it is crucial for businesses to promote responsible coffee consumption and offer alternative beverage options for those who prefer decaffeinated or herbal teas.

In summary, the commercial espresso machine market is a dynamic and evolving industry that caters to the growing demand for high-quality coffee beverages in various sectors. From traditional espresso machines to fully automated models, these appliances offer convenience, consistency, and versatility, making them an essential investment for businesses seeking to cater to the modern workforce's coffee preferences.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.56% |

|

Market growth 2024-2028 |

USD 1.03 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.89 |

|

Key countries |

US, China, Italy, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.