Commercial Vehicle Retarder Market Size 2024-2028

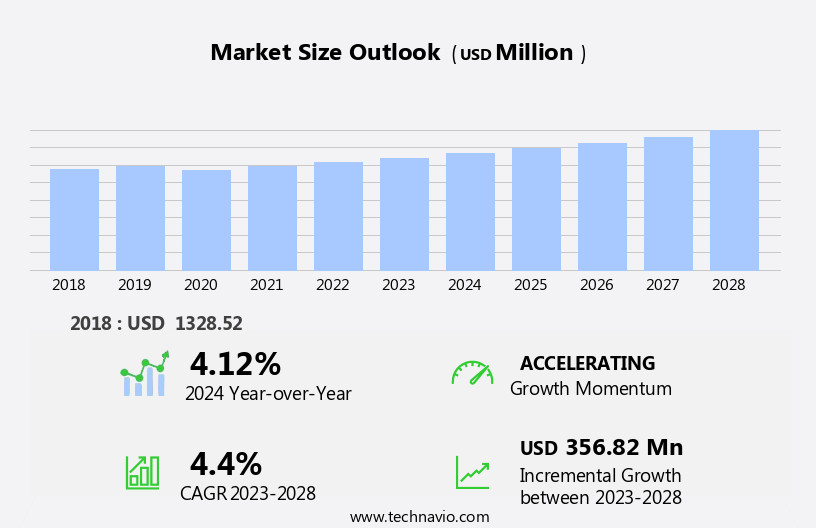

The commercial vehicle retarder market size is forecast to increase by USD 356.82 million, at a CAGR of 4.4% between 2023 and 2028.

- The market is experiencing significant growth, driven by the reduction in the overall cost of installing retarders. This trend is attributed to advancements in technology, enabling more cost-effective solutions for commercial vehicle operators. The industry is increasingly leveraging machine learning and artificial intelligence to optimize retarder performance, predict maintenance needs, and enhance overall vehicle safety and efficiency. Another key driver is the increasing adoption of self-charging electromagnetic retarders, which offer energy recovery during braking and reduce fuel consumption. However, challenges persist in this market, including the high energy consumption and overheating during retardation.

- Manufacturers must address these challenges by developing more energy-efficient and heat-resistant technologies to maintain competitiveness and meet evolving customer demands. Effective management of these dynamics will be crucial for companies seeking to capitalize on market opportunities and navigate challenges in the market.

What will be the Size of the Commercial Vehicle Retarder Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse needs of various sectors, including heavy-duty trucks, off-highway vehicles, and construction equipment. Retarders, such as electric, transmission, and hydraulic types, play a crucial role in heat dissipation, brake fade prevention, and improving fuel efficiency. Primary retarders, like engine brakes and exhaust brakes, are commonly used in heavy-duty vehicles for better speed control and driver comfort. However, secondary retarders, such as retarder actuators, offer additional benefits like torque capacity enhancement and extended service life. The agricultural machinery sector also leverages retarders to ensure optimal performance testing and reduce operating costs.

In the mining industry, retarders help manage the harsh operating conditions and minimize brake wear. Market dynamics are influenced by factors like driver training, wear rate, and fleet management. The ongoing focus on fuel efficiency and environmental impact further propels the adoption of retarders in commercial vehicles. Retarders' role in heat dissipation, performance testing, and life cycle analysis is essential in various applications. As technology advances, retarder control units and testing standards continue to evolve, ensuring continuous improvement and innovation in this dynamic market.

How is this Commercial Vehicle Retarder Industry segmented?

The commercial vehicle retarder industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Electromagnetic retarders

- Hydraulic retarders

- Type

- Buses

- Trucks

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

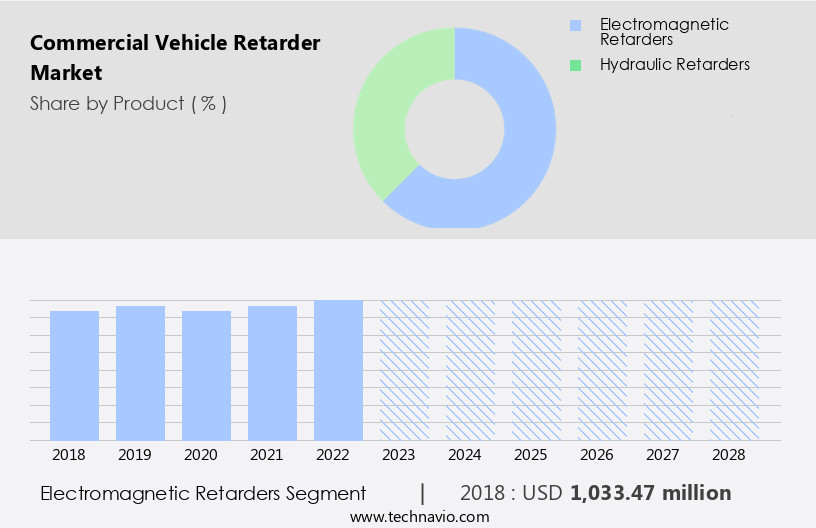

The electromagnetic retarders segment is estimated to witness significant growth during the forecast period.

The market encompasses various types of retarders, including electric and transmission retarders, which employ different mechanisms for generating retarding force. Electromagnetic retarders, a type of electric retarder, utilize the electromagnetic induction process. They can be integrated into the driveline or transmission unit, with a rotor attached to the former and a stator to the vehicle chassis. No contact surfaces or working fluids exist between the components. When a vehicle requires deceleration, power from the battery is supplied to the stator's electrical windings, generating a magnetic field. The rotor, in response, moves within this field, inducing eddy currents and creating an opposing magnetic field.

Heat dissipation is crucial in retarder systems to prevent brake fade and ensure efficient operation. In heavy-duty vehicles, such as commercial trucks, construction equipment, and agricultural machinery, retarders improve fuel efficiency by reducing the need for excessive engine or exhaust brake usage. Fleet management is essential in optimizing retarder usage and minimizing wear rates. Primary retarders provide immediate deceleration, while secondary retarders offer gradual deceleration, catering to various driving conditions. Driver training and comfort are essential factors in the market, as operators must effectively utilize retarders to maximize performance and minimize brake wear. Performance testing, operating costs, service life, and testing standards are critical aspects of the market, ensuring the reliability and efficiency of retarder systems.

The market comprises various players, including manufacturers of retarder actuators, hydraulic retarders, retarder control units, and other components. The market's evolution is driven by the need for improved fuel efficiency, environmental considerations, and the increasing demand for heavy-duty vehicles in various industries.

The Electromagnetic retarders segment was valued at USD 1033.47 million in 2018 and showed a gradual increase during the forecast period.

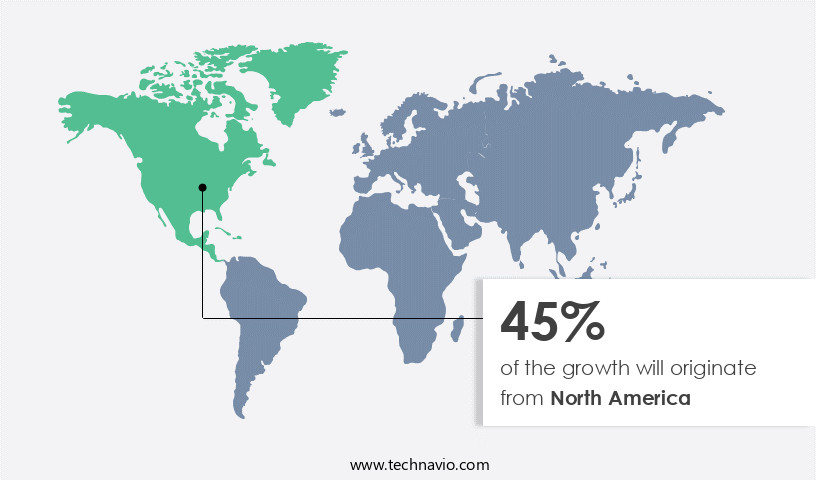

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American commercial vehicle market, safety systems, particularly commercial vehicle retarders, are gaining traction due to the increasing focus on cargo transportation. The US trucking industry's adoption of these systems is expected to rise, addressing concerns over the industry's escalating number of road accidents. In 2021, approximately 5,700 large trucks were involved in fatal crashes in the US, marking a 10% increase from the previous year. The aging driver population, with a median age of 49 years, is a significant contributing factor to these accidents. Commercial vehicle retarders, available in various forms such as electric and transmission types, help mitigate the effects of heavy braking on vehicles, reducing heat dissipation and brake fade.

Retarders also improve fleet management by optimizing speed control and driver comfort, ultimately reducing brake wear and enhancing fuel efficiency. These benefits are particularly crucial for heavy-duty vehicles, including those used in agriculture, construction, and mining industries. Retarder actuators, with their varying torque capacities, play a vital role in ensuring optimal performance and longevity. The integration of retarder control units and hydraulic retarders further enhances the system's efficiency and effectiveness. As the commercial vehicle market evolves, retarders are becoming essential components in the supply chain, addressing concerns over retarding force, environmental impact, and operating costs. Moreover, the importance of performance testing and adherence to testing standards is increasingly recognized in the industry.

The integration of retarders in commercial vehicles is a strategic move to ensure safety, improve efficiency, and extend the service life of these valuable assets. In conclusion, the adoption of commercial vehicle retarders is a significant trend in the North American market, addressing the challenges of an aging driver population, optimizing fleet management, and enhancing overall vehicle performance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market represents a significant segment in the transportation industry, focusing on technologies that enhance the braking performance of heavy-duty trucks and buses. These retarders, also known as engine retarders or Jake brakes, reduce the vehicle's speed during descents, minimizing the need for traditional friction brakes and extending their lifesphere. Retarders employ various mechanisms, such as engine compression brakes, hydraulic retarders, and electrical retarders, to generate resistance and decelerate the vehicle. The market is driven by factors like increasing freight transportation, stringent emission norms, and the growing preference for fuel efficiency and safety. Additionally, advancements in technology, such as regenerative braking systems and hybrid retarders, are expected to shape the market landscape.

What are the key market drivers leading to the rise in the adoption of Commercial Vehicle Retarder Industry?

- The significant decrease in the total installation cost for commercial vehicle retarders is the primary market motivator.

- Commercial vehicle retarders are essential components that enhance the braking system's efficiency and longevity. These devices help reduce the strain on the brakes by controlling the vehicle's descent, particularly during heavy loads or steep gradients. Retarders come in various forms, including electric and transmission types, which utilize oil cooling for heat dissipation. Heavy-duty commercial vehicles, such as off-highway machines, benefit significantly from retarders. They improve fleet management by reducing brake fade and increasing the active safety of the vehicles. By using retarders, the life of the brake lining can be extended by three to five times, leading to substantial cost savings over the vehicle's long lifespan.

- Retarders contribute to the overall efficiency of the commercial vehicle by relieving the service brake and ensuring the highest efficiency from the disc brake system. This results in the greatest stopping distance, which is crucial for safe and effective vehicle operation. The integration of secondary retarders further enhances the benefits by providing additional control and reducing the wear on the primary retarder.

What are the market trends shaping the Commercial Vehicle Retarder Industry?

- The integration of self-charging electromagnetic retarders is becoming increasingly prevalent in the market. This emerging trend signifies a significant shift towards advanced energy management solutions.

- The market encompasses the use of electromagnetic retarders, primarily in heavy-duty vehicles, including trucks and buses, as well as agricultural machinery. These retarders, which include a primary retarder, such as a self-charging type electromagnetic retarder, function by utilizing a stator yoke (core) and steel rotor. The stator yoke is placed between magnetic coils, forming multi-phase connections, while the steel rotor, which acts as a control device, is connected to the transmission unit. As the steel rotor rotates between the magnetic coils, it generates power continuously, which can be reused to charge auxiliary systems, such as batteries.

- This process enhances fuel efficiency and reduces the need for engine brakes, such as exhaust brakes, in heavy-duty vehicles. The retarder actuator plays a crucial role in controlling the velocity of the retarder, ensuring a harmonious interaction between the vehicle's powertrain and braking systems. The wear rate of the retarder components is a significant factor influencing the market's growth. Regular driver training and maintenance practices can help mitigate the impact of wear and tear, ensuring the longevity of the retarder system. The continuous development of advanced technologies, such as regenerative braking systems, is expected to further boost the market's growth.

What challenges does the Commercial Vehicle Retarder Industry face during its growth?

- One of the significant challenges impeding industry growth is the high energy consumption and resulting overheating during the retardation phase, which necessitates increased research and development efforts to mitigate these issues and improve overall efficiency.

- Commercial vehicle retarders are essential components in managing the braking system of heavy-duty vehicles, ensuring speed control and driver comfort. However, these systems can be subjected to excessive wear due to factors such as harsh driving habits, overloading, and poor road conditions. The resulting damage to the retarder system can lead to increased operating costs, including brake wear and potential performance issues. A recent study revealed that integrating retarders with regenerative braking technology can mitigate the overheating problem, harvesting up to 3 kW of kinetic energy during braking. This not only enhances the system's performance but also extends its service life.

- By focusing on the benefits of retarder systems, fleet operators can optimize their commercial vehicle operations, ensuring both driver comfort and cost efficiency. Retarders play a crucial role in maintaining the overall efficiency of commercial vehicles, especially in industries such as construction equipment and transportation. Regular performance testing and adherence to established testing standards are essential to ensure the longevity and effectiveness of these systems. By investing in well-maintained retarder systems, businesses can minimize downtime, reduce fuel consumption, and improve overall fleet productivity.

Exclusive Customer Landscape

The commercial vehicle retarder market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial vehicle retarder market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial vehicle retarder market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Brakes India Pvt. Ltd. - This company specializes in commercial vehicle brake systems, providing solutions such as hydraulic drum brakes and transmission park brakes, enhancing safety and efficiency for transportation fleets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Brakes India Pvt. Ltd.

- CAMA Luoyang Electromechanic CO. LTD

- Cummins Inc.

- Eaton Corp. Plc

- Frenos Electricos Unidos SA

- INDUSTRIAS ZELU SL

- KRISHNA CHEMICALS

- Nippon Steel Corp.

- Regal Rexnord Corp.

- Scania AB

- Shandong Heavy Industry Group Co. Ltd.

- SORL Auto Parts Inc.

- TBK Co. Ltd.

- Telma SAS

- Voith GmbH and Co. KGaA

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Vehicle Retarder Market

- In January 2024, Meritor, Inc., a leading global supplier of commercial vehicle components, announced the launch of its next-generation Blue Horizon⢠Series retarders, featuring advanced electronic controls and improved thermal management for enhanced fuel efficiency and reliability (Meritor press release).

- In March 2024, Wabco Holdings, a leading technology provider for the commercial vehicle industry, and Eaton, a power management company, entered into a strategic partnership to integrate Wabco's advanced braking and stability systems with Eaton's hydraulic retarders, offering customers a comprehensive braking and retarding solution (Wabco press release).

- In May 2024, BorgWarner, a global technology leader in clean and efficient transportation, announced the acquisition of Delphi Technologies' Power Electronics & Machining business, significantly expanding its electrification capabilities and enhancing its position in the market (BorgWarner press release).

- In April 2025, the European Union approved the new Euro VI emission standards, which include stricter regulations on commercial vehicle emissions, driving increased demand for retarders and other emissions reduction technologies (European Commission press release).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of corrosion-resistant materials and driver assistance systems. Advanced materials, such as electromagnetic retarders and fluid couplings, enhance braking systems and vehicle dynamics control, improving payload capacity and downhill speed control. Axle ratio and gear ratio are critical factors in optimizing payload and fuel efficiency. Heat management and thermal stress mitigation are essential for ensuring reliable operation in various climates. Passive safety systems, including hill start assist and vacuum retarders, are increasingly important for vehicle safety. Vehicle dynamics and active safety systems, like torque converters and engine management systems, contribute to improved performance and fuel economy.

- The integration of additive manufacturing in the production of retarder components offers cost savings and design flexibility. Fuel injection and manual transmission systems are also evolving to accommodate the demands of commercial vehicles. The market is witnessing a shift towards automatic transmissions for enhanced efficiency and ease of operation. The focus on material science and payload optimization continues to drive innovation in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Vehicle Retarder Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2024-2028 |

USD 356.82 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.12 |

|

Key countries |

US, China, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Vehicle Retarder Market Research and Growth Report?

- CAGR of the Commercial Vehicle Retarder industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial vehicle retarder market growth of industry companies

We can help! Our analysts can customize this commercial vehicle retarder market research report to meet your requirements.