Concrete Contractor Market Size 2024-2028

The concrete contractor market size is forecast to increase by USD 536 billion at a CAGR of 0.7% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. Firstly, the increasing urbanization and industrial development in various regions are driving the demand for concrete structures. Secondly, the focus on eco-friendly buildings and construction is leading to the adoption of sustainable concrete solutions. Lastly, automation and digitization of production processes are improving efficiency and reducing costs for concrete contractors. These trends are expected to continue shaping the market In the coming years. Additionally, the use of advanced technologies such as Building Information Modeling (BIM) and 3D printing in concrete construction is gaining popularity and is expected to revolutionize the industry.

- Overall, these factors are contributing to the growth and innovation In the market.

What will be the Size of the Concrete Contractor Market During the Forecast Period?

- The market In the United States is experiencing significant growth due to increased infrastructural developments and modern building techniques. Building contractors are increasingly utilizing civil engineering materials such as gelling materials, granular aggregates, and admixtures to enhance the compressive strength and durability of concrete structures. Modern construction methods, including modular constructions and offsite construction, are gaining popularity for their eco-friendly and sustainable development benefits. Advancements in technology are also driving market growth. Eco-friendly building practices, such as the use of recycled materials and low-carbon concrete, are becoming more prevalent. Innovations like 3D printing, drones, and prefabricated components are streamlining construction processes and reducing costs.

- Additionally, specialized concrete mixes, smart construction techniques, and forensic services are ensuring the longevity and safety of structures. The adoption of building information modeling and off-site construction further enhances efficiency and productivity In the market. Robotics and high-performance concrete are also gaining traction for their ability to produce structures with exceptional strength and precision. Overall, the market is experiencing a period of innovation and growth, driven by a focus on sustainability, efficiency, and advanced construction techniques.

How is this Concrete Contractor Industry segmented and which is the largest segment?

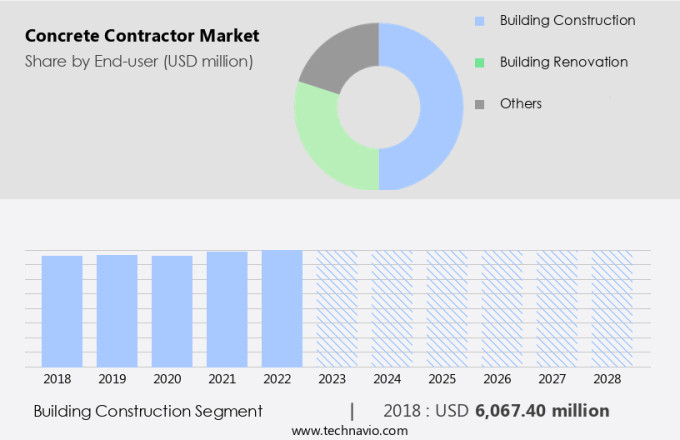

The concrete contractor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Building construction

- Building renovation

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

- The building construction segment is estimated to witness significant growth during the forecast period.

The market experiences significant demand due to concrete's widespread use in various infrastructure projects and real estate development. Concrete is the most commonly used man-made material, found in buildings, bridges, roadways, and other structures. In 2022, over 70% of the world's population resides in structures containing concrete. The US infrastructure package worth USD1 trillion passed in 2022 has further increased the demand for concrete contractors in road, bridge, and tunnel upgrades. Green building projects also contribute to the market's growth, utilizing low-cost raw materials like cement, aggregates, and concrete additives. Environmental issues drive the development of lightweight and heavyweight concrete types.

The concrete industry continues to evolve, with advancements in technology and sustainable practices.

Get a glance at the Concrete Contractor Industry report of share of various segments Request Free Sample

The Building construction segment was valued at USD 6.07 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

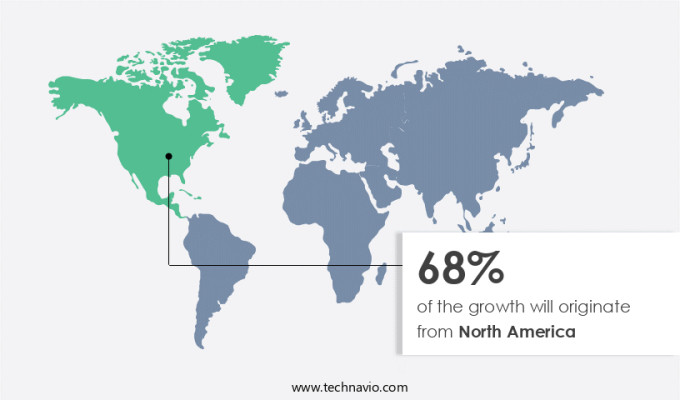

- North America is estimated to contribute 68% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America, with a significant focus on the United States, is experiencing growth due to increasing government initiatives towards energy efficiency in building construction. For instance, the Canadian government is working towards adopting net-zero energy-ready building codes by 2030, which will encourage energy efficiency improvements during renovations. This initiative will set new standards for heating equipment and other key technologies, supporting indigenous communities and governments in enhancing the energy efficiency of their buildings. The market includes segments such as self-compacting concrete, fiber-reinforced concrete, industrial construction, ready-mixed concrete, precast concrete, asphalt concrete, concrete pouring, concrete finishing, concrete repair, and concrete demolition.

Green building practices are becoming increasingly important, with a focus on reducing energy consumption and improving infrastructure investments.

Market Dynamics

Our concrete contractor market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Concrete Contractor Industry?

Increasing urbanization and industrial development is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for infrastructural developments and modern building techniques. Building contractors are increasingly turning to civil engineering materials such as gelling materials, granular aggregates, and admixtures to enhance the compressive strength and durability of their structures. Modern construction methods, including modular constructions and offsite construction, are reducing material wastage and promoting high-quality infrastructure. Green building projects are gaining popularity, with a focus on low-cost raw materials and sustainable practices. Eco-friendly building solutions, such as Lightweight Cellular Concrete and Heavyweight Concrete, are being used in residential and commercial construction, as well as affordable housing projects.

- Industrial construction also benefits from advanced technologies like 3D printing, drones, and prefabricated components. Forensic services are essential for concrete repair, demolition, and renovation projects. Decorative and structural concrete, as well as high-performance concrete and self-compacting concrete, are used for various applications. Fiber-reinforced concrete is increasingly being used for industrial construction, while ready-mixed concrete and precast concrete are popular choices for large-scale projects. Asphalt concrete is used extensively for road construction, while concrete pouring and finishing are crucial steps In the construction process. Green building practices and advanced technologies, such as recycled materials, low-carbon concrete, and Building Information Modeling, are promoting sustainable practices In the concrete industry.

- Off-site construction and ecofriendly concrete solutions are also gaining traction In the market. Waste management and concrete cutting are essential aspects of concrete construction projects, and small, medium, and large contractors are all contributing to the market's growth. Renovation, repair, and construction projects, as well as infrastructure projects, are driving the demand for concrete and related products and services. The market is expected to continue its growth trajectory, with a focus on innovation and sustainability.

What are the market trends shaping the Concrete Contractor Industry?

Eco-friendly buildings and construction is the upcoming market trend.

- The construction industry is witnessing significant advancements, driven by infrastructural developments and the shift towards modern building techniques. Civil engineering materials, including gelling materials, granular aggregates, cement, and concrete additives, play a crucial role In these developments. Buildings, whether residential or commercial, are being constructed using high-quality infrastructure, with a focus on eco-friendly and sustainable practices. Modern construction methods such as modular constructions, offsite construction, and 3D printing are gaining popularity due to their potential for reducing material wastage and enhancing efficiency. Concrete, a key component in construction, is being reinvented through the use of advanced technologies like self-compacting concrete, fiber-reinforced concrete, and high-performance concrete.

- Green building projects are at the forefront of this evolution, with a focus on using low-cost raw materials and addressing environmental issues. Lightweight Cellular Concrete and Heavyweight Concrete are examples of innovative concrete solutions that offer sustainability benefits. Industrial construction, renovation, and repair projects also benefit from the use of specialized concrete mixes and smart construction techniques. The construction industry is embracing recycled materials and low-carbon concrete as part of its commitment to sustainable development. Building Information Modeling, prefabricated components, and forensic services are some of the advanced technologies being used to streamline processes and improve overall efficiency.

- In conclusion, the construction market is undergoing a transformation, driven by the need for energy efficiency, sustainability, and cost savings. The industry is adopting modern building techniques, innovative materials, and advanced technologies to meet these demands, while also addressing the challenges of waste management and environmental concerns.

What challenges does Concrete Contractor Industry face during the growth?

Automation and digitization of production is a key challenge affecting the industry growth.

- Infrastructural developments continue to drive the demand for building contractors, who employ modern building techniques and civil engineering materials to construct high-quality infrastructure. Concrete, a key material in construction, is enhanced with gelling materials, granular aggregates, and concrete additives like admixtures, compressive strength enhancers, and fiber-reinforced concrete. These specialized concrete mixes enable the creation of modular constructions, offsite manufacturing, and eco-friendly building projects using recycled materials and low-carbon concrete. Modern construction methods, such as 3D printing, drones, and prefabricated components, minimize material wastage and streamline the construction process. Concrete contractors offer a range of services, including concrete pouring, finishing, repair, and demolition, while adhering to green building practices and advanced technologies like building information modeling and smart construction techniques.

- The construction industry is undergoing a digital transformation, with the adoption of robotics, automated processes, and specialized software for project management and design. However, the aging workforce poses a challenge to the industry's ability to adapt to these changes. To address this issue, training programs and educational initiatives are essential to equip the workforce with the necessary skills to work with these new technologies. The market for concrete contractors includes small, medium, and large contractors catering to residential, commercial, industrial, and renovation projects. The demand for affordable housing and sustainable development is increasing, driving the need for eco-friendly and cost-effective concrete solutions.

- The industry's future lies In the integration of technology, sustainability, and innovation to meet the demands of the modern construction landscape.

Exclusive Customer Landscape

The concrete contractor market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the concrete contractor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, concrete contractor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ARL Construction Inc. - Our company specializes in providing comprehensive concrete contractor services for various projects In the US market. These services encompass concrete patching, foundation work, and concrete paving, ensuring top-notch results for our clients. With a team of skilled professionals and state-of-the-art equipment, we guarantee efficient and long-lasting solutions for all your concrete needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARL Construction Inc.

- Base Construction Inc.

- Blue Wolf Performance Solutions LLC

- CEMEX SAB de CV

- CRH Plc

- CRM Construction Inc.

- First Davis Corp.

- Forterra Building Products Ltd.

- Four Square Industrial Constructors LLC.

- HeidelbergCement AG

- Holcim Ltd.

- Shay Murtagh Precast Ltd.

- Sika AG

- The Wells Companies

- Votorantim SA

- Weckenmann Anlagentechnik GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Evolution and Dynamics of the market: Trends and Developments the market is a critical segment of the construction industry, playing a pivotal role In the creation of high-quality infrastructure and buildings. This dynamic industry is driven by various factors, including infrastructural developments, modern building techniques, and the increasing demand for sustainable and eco-friendly construction solutions. Modern building techniques have significantly influenced the market. Civil engineering materials, such as gelling materials, granular aggregates, admixtures, and cement, have evolved to cater to the demands of modern construction. These materials have led to advancements in compressive strength, enabling the creation of structures that are more durable and resilient.

Moreover, the trend towards modular constructions and offsite manufacturing has gained momentum in recent years. These construction methods offer numerous benefits, including reduced material wastage, improved efficiency, and enhanced sustainability. Modular constructions and offsite manufacturing are increasingly being adopted for both residential and commercial projects, from affordable housing to large-scale developments. Environmental issues have become a significant concern In the market. Green building projects and sustainable development initiatives have led to the adoption of low-cost raw materials and eco-friendly building practices. Concrete contractors are increasingly using recycled materials and implementing advanced technologies, such as 3D printing and drones, to minimize environmental impact and improve efficiency.

Real estate development is another key driver of the market. From residential and commercial construction to industrial and civil projects, the demand for high-quality infrastructure remains strong. Concrete contractors are constantly innovating to meet the evolving needs of the industry, developing specialized concrete mixes and smart construction techniques to create structures that are durable, sustainable, and cost-effective. The market is diverse, with small, medium, and large contractors catering to various sectors and projects. Renovation, repair, and construction projects continue to provide ample opportunities for growth, as the demand for infrastructure improvements and upgrades remains high. In conclusion, the market is a dynamic and evolving industry, driven by various factors, including infrastructural developments, modern building techniques, and the increasing demand for sustainable and eco-friendly construction solutions.

Concrete contractors are constantly innovating to meet the evolving needs of the industry, adopting advanced technologies and materials to create high-quality infrastructure that is durable, sustainable, and cost-effective.

|

Concrete Contractor Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 0.7% |

|

Market growth 2024-2028 |

USD 536 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

0.7 |

|

Key countries |

US, China, Germany, UK, Japan, Canada, France, Brazil, India, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Concrete Contractor Market Research and Growth Report?

- CAGR of the Concrete Contractor industry during the forecast period

- Detailed information on factors that will drive the Concrete Contractor growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the concrete contractor market growth of industry companies

We can help! Our analysts can customize this concrete contractor market research report to meet your requirements.