Conductive Inks Market Size 2024-2028

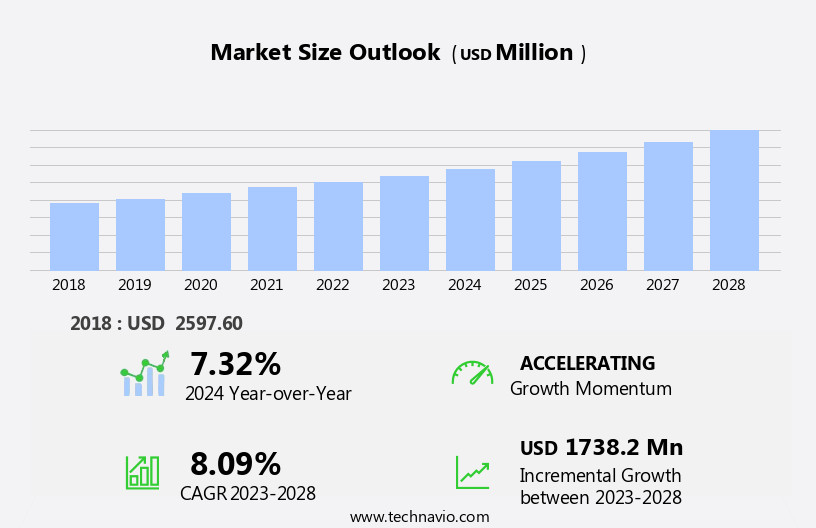

The conductive inks market size is forecast to increase by USD 1.74 billion at a CAGR of 8.09% between 2023 and 2028.

What will be the Size of the Conductive Inks Market During the Forecast Period?

How is this Conductive Inks Industry segmented and which is the largest segment?

The conductive inks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Silver ink

- Copper ink

- Others

- Application

- Photovoltaic

- Membrane switches

- Display and others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- France

- South America

- Middle East and Africa

- APAC

By Product Insights

The silver ink segment is estimated to witness significant growth during the forecast period. Conductive inks, primarily composed of silver, copper, polymers, graphene, aluminum, nanosilver, and carbon particles, have gained significant traction In the electronic industry. These inks are utilized in various applications, including photovoltaic applications, membrane switches, displays, bio sensors, PCBs, thermal heating, RFID chips, and RFI shielding. Conductive silver ink is extensively used in printed circuit boards, while conductive copper ink is employed for photonic curing and antenna applications. Furthermore, conductive polymers, carbon nanotube ink, and spin coatings are increasingly being used in printed electronics and flexible electronics. The demand for these inks is driven by the increasing electrical demand in various sectors, such as alternative energy solutions, consumer electronics, and medical devices.

Inkjet printing and slot die coatings are common techniques used for applying these inks. Key applications include photovoltaic cells, solar panels, batteries, and electromagnetic interference shielding.

Get a glance at the market report of various segments Request Free Sample

The Silver ink segment was valued at USD 1.33 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

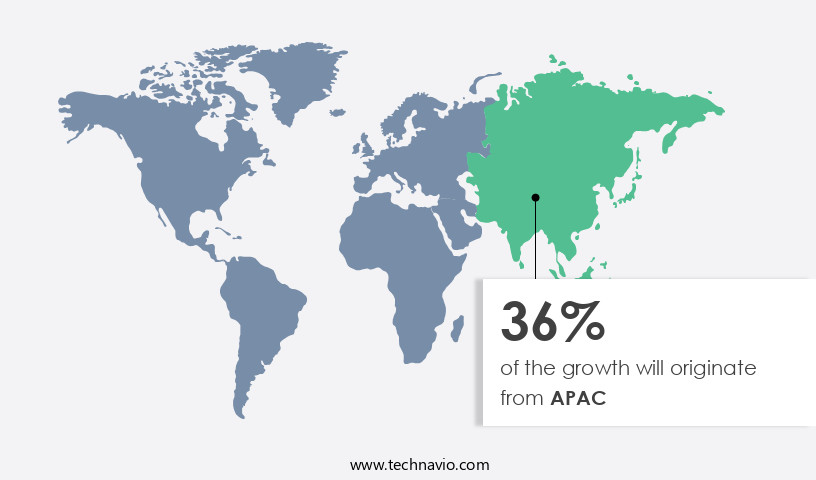

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia-Pacific region is a major growth market for conductive inks due to the expanding printed electronics industry. Key players in this market, such as China, Japan, and South Korea, are significant contributors to the global printed electronics market and are driving the demand for conductive inks. The region is home to the world's largest electronics manufacturers, including Samsung, LG, and Foxconn. With the continuous growth of the electronics industry in APAC, the need for conductive inks In the production of electronic devices is anticipated to increase. Conductive inks find applications in various industries, including photovoltaic applications, membrane switches, displays, bio sensors, PCB, thermal heating, RFID chips, and RFI shielding.

Materials used in conductive inks include conductive silver ink, carbon particles, copper, polymers, graphene, aluminum, nanosilver-based inks, and carbon nanotube ink. The market for conductive inks is expected to grow significantly due to the increasing demand for alternative energy solutions, flexible electronics, and nanomaterials in various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Conductive Inks Industry?

- Growing demand for printed and flexible electronic devices is the key driver of the market.The market for conductive inks is experiencing notable growth due to their increasing application In the electronic industry. These inks, which contain conductive materials such as carbon particles, silver, copper, polymers, graphene, aluminum, and nanosilver, enable the printing of electronic components directly onto various substrates. The demand for conductive inks is being driven by their use in various sectors, including healthcare, consumer electronics, and automotive. In healthcare, conductive inks are used In the production of flexible and wearable medical devices, such as biosensors and smart patches. In consumer electronics, these inks are used In the manufacturing of membrane switches, displays, RFID chips, and printed circuits.

In the automotive industry, conductive inks are used In thermal heating elements, antenna applications, and RFI shielding. The development of printed electronics, including flexible and stretchable circuits on polyimide, polycarbonate, glass, polyester, Teflon, silicone surfaces, and ITO coated surfaces, is further fueling the growth of the market. Additionally, conductive inks are being used in alternative energy solutions, such as batteries, fuel cells, photovoltaic cells, and solar panels, to address the increasing electrical demand and support the growth of solar energy installations. Conductive polymers, spin coatings, slot dies coatings, and carbon nanotube ink are also gaining popularity due to their unique properties and applications.

Inkjet printing and photovoltaic technology are the primary methods used for printing conductive inks. The market for conductive inks is expected to continue growing due to their increasing use in smart packaging, printed circuits, and various other applications.

What are the market trends shaping the Conductive Inks market?

- Developments in printing technologies is the upcoming market trend.The market is poised for growth due to the increasing demand for flexible and stretchable electronics. These inks, which can be printed onto various substrates including plastics and textiles, are essential for the production of printed electronics. The healthcare, consumer electronics, and automotive sectors are expected to drive the growth of the printed electronics market, consequently increasing the demand for conductive inks. Advanced printing technologies, such as inkjet and aerosol jet printing, are making it easier and more cost-effective to produce high-quality conductive inks. These innovations are expected to expand the adoption of conductive inks in various applications, including photovoltaic cells, solar panels, batteries, RFID chips, membrane touch switches, antenna applications, and printed circuits.

Additionally, conductive inks are used In thermal heating elements, fuel cells, and photonic curing applications. Nanomaterials, such as carbon particles, silver, copper, polymers, graphene, aluminum, nanosilver based inks, carbon nanotube ink, and dielectric inks, are commonly used In the production of conductive inks. The market for conductive inks is expected to grow significantly In the coming years due to the increasing demand for printed electronics in various industries.

What challenges does the Conductive Inks Industry face during its growth?

- High-cost and low quality is a key challenge affecting the industry growth.Conductive inks have gained significance In the electronic industry due to their ability to enable the production of flexible and large-area electronics. However, their higher cost compared to conventional circuitry fabrication techniques like wire bonding or etching can be a barrier in certain applications, particularly those with cost constraints. Additionally, conductive inks may not be as resilient as conventional techniques in extreme conditions, limiting their use in applications where heat, humidity, or other adverse circumstances are prevalent. Furthermore, not all substrates are compatible with conductive inks, restricting their application in specific areas. For instance, some metals or plastics may not take certain conductive inks well.

These factors might hinder the market growth for conductive inks in various sectors, including photovoltaic applications, membrane switches, displays, bio sensors, PCB, thermal heating, RFID chips, and more. Conductive inks are available in various forms, such as conductive silver ink, nanosilver-based inks, carbon particles, copper, polymers, graphene, aluminum, and carbon nanotube ink. Technologies like photonic curing, inkjet printing, spin coatings, and slot dies coatings are used for their application. Conductive inks find extensive use in various industries, such as consumer electronics, medical devices, alternative energy solutions, RFI shielding, and printed circuits. They are used in batteries, electromagnetic interference protection, fuel cells, photovoltaic cells, solar panels, steam, hot water, and solar energy installations.

Dielectric inks and carbon/graphene ink are also used in printed electronics and flexible electronics. The market for conductive inks is driven by the increasing demand for electrical components and the growing trend towards miniaturization and lightweight electronics. The use of conductive inks in nanomaterials, such as gold and platinum, further expands their applications. However, the market's expansion is also limited by the high cost and compatibility issues with certain substrates.

Exclusive Customer Landscape

The conductive inks market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the conductive inks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, conductive inks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AdNano Technologies Pvt. Ltd. - Conductive inks, a crucial component In the electronics industry, are gaining significant traction due to their versatility and functionality in various applications. The AgeNT VC102 offering from the company is a prime example of advanced conductive ink solutions. This ink delivers exceptional conductivity and adhesion properties, making it suitable for printable electronics, sensors, and wearable technology. Its ability to form conductive paths on diverse substrates, including plastics and textiles, broadens its application scope. The AgeNT VC102 ink's robustness and durability under extreme temperatures and humidity conditions further enhance its value proposition. As the demand for flexible and wearable electronics continues to surge, the market for conductive inks is poised for substantial growth. The AgeNT VC102 ink's unique features position the company at the forefront of this expanding market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AdNano Technologies Pvt. Ltd.

- CHASM Advanced Materials Inc.

- Creative Materials Inc.

- Daicel Corp.

- DuPont de Nemours Inc.

- Dycotec Materials Ltd.

- Encres DUBUIT

- Henkel AG and Co. KGaA

- Heraeus Holding GmbH

- Johnson Matthey Plc

- Methode Electronics Inc.

- Nano Dimension Ltd.

- Nano Magic Inc.

- Nippon Kayaku Co. Ltd.

- PPG Industries Inc.

- PV Nano Cell Ltd.

- Sun Chemical Corp.

- TAIYO HOLDINGS CO. LTD.

- Tanaka Holdings Co. Ltd.

- Vorbeck Materials Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a significant role In the electronic industry, offering innovative solutions for various applications. These inks, which are essentially suspensions or solutions of conductive materials, enable the creation of conductive paths on different substrates. The conductive materials include carbon particles, metals such as silver and copper, polymers, graphene, aluminum, and nanosilver-based inks. The demand for conductive inks is driven by their diverse applications in various sectors. In the photovoltaic application, these inks are utilized In the production of solar cells and solar panels. In membrane switches, they serve as the conductive layer, allowing for the creation of tactile buttons and switches.

Displays, bio sensors, and printed circuits are other areas where conductive inks find extensive use. Thermal heating applications, RFID chips, and rfi shielding are other significant markets for conductive inks. Conductive silver ink, for instance, is widely used In thermal heating elements due to its excellent thermal conductivity. In RFID chips, conductive inks are employed to create antennas and conductive traces. In rfi shielding, they are used to create conductive coatings that help reduce electromagnetic interference. Polyimide flexible circuits, tantalum capacitors, and various types of sensors are other applications where conductive inks are utilized. Inkjet printing, photonic curing, and spin coatings are some of the techniques used to apply these inks.

Carbon nanotube ink and carbon/graphene ink are other types of conductive inks that have gained popularity due to their unique properties. The market for conductive inks is expected to grow significantly due to the increasing demand for printed electronics and flexible electronics. These technologies are gaining popularity due to their potential to reduce manufacturing costs and increase design flexibility. Nanomaterials, such as gold and platinum, are also being explored as alternatives to traditional conductive materials. Printed circuits, batteries, and solar energy are some of the major industries driving the growth of the market. The increasing demand for electrical demand and the need for alternative energy solutions are also expected to boost the market.

Solar energy installation, urbanization, and the development of smart packaging and biosensors are other factors contributing to the growth of the market. In conclusion, the market is a dynamic and innovative field, offering solutions for various applications In the electronic industry. The market is driven by the demand for printed and flexible electronics, solar energy, and various other industries. The use of different conductive materials, such as carbon particles, metals, polymers, and nanomaterials, enables the creation of conductive paths on various substrates, leading to new and innovative applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 1738.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, China, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Conductive Inks Market Research and Growth Report?

- CAGR of the Conductive Inks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the conductive inks market growth of industry companies

We can help! Our analysts can customize this conductive inks market research report to meet your requirements.