Copra Meal Market Size 2024-2028

The copra meal market size is forecast to increase by USD 6.47 th at a CAGR of 3.96% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the rising trend in meat production and increasing consumption. This expansion is fueled by the global population's growing demand for animal protein, leading to an increased need for efficient and cost-effective animal feed solutions. One key trend shaping the market is the emergence of private-label brands, as consumers seek more affordable and trusted alternatives to branded products. Furthermore, the growing demand for feed enzymes, which improve nutrient absorption and enhance animal performance, is providing new opportunities for market participants. However, regulatory hurdles and supply chain inconsistencies temper growth potential.

- Regulatory bodies impose strict guidelines on copra meal production and usage, requiring adherence to stringent quality standards. Additionally, the volatile supply of copra due to weather conditions and harvesting seasons can lead to price fluctuations and supply chain disruptions. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on innovation, regulatory compliance, and supply chain resilience. By addressing these factors, they can differentiate themselves and secure a competitive edge in the market.

What will be the Size of the Copra Meal Market during the forecast period?

- The market is experiencing significant activity and trends in various areas of feed production. Feed certification plays a crucial role in ensuring the circular economy of the industry, as renewable energy sources are integrated into feed manufacturing processes. Feed labeling and byproduct utilization are key aspects of sustainable feed production, enhancing feed digestibility and reducing carbon footprint. Aquaculture production and livestock industries are focusing on feed innovation, with an emphasis on value-added products and alternative protein sources such as plant-based protein. Feed safety and animal health remain top priorities, with advancements in feed technology and feed analysis ensuring high-quality products.

- Feed formulation software and feed regulation are essential tools for optimizing feed efficiency and reducing costs. The use of bio-based materials in feed production and feed ingredient sourcing contributes to environmental impact reduction and animal welfare improvements. Feed traceability is increasingly important in the industry, ensuring transparency and accountability throughout the supply chain. Feed innovation continues to drive the market, with a focus on feed efficiency improvement and feed ingredient research. Circular economy principles, such as the utilization of agricultural waste, are gaining traction in the market, contributing to a more sustainable and eco-friendly industry. The integration of feed technology and feed regulation fosters a competitive landscape, with companies focusing on feed cost reduction and feed quality testing to maintain market position.

How is this Copra Meal Industry segmented?

The copra meal industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Poultry

- Swine

- Ruminant

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- India

- Indonesia

- The Philippines

- Rest of World (ROW)

- North America

By Distribution Channel Insights

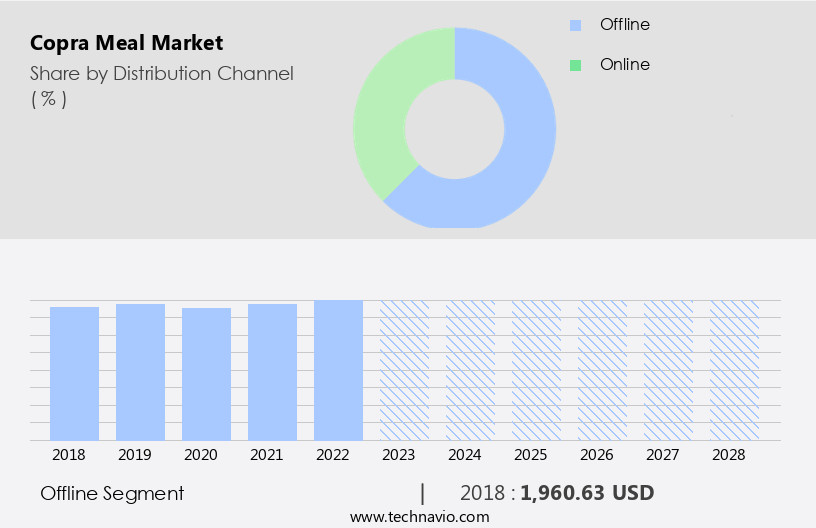

The offline segment is estimated to witness significant growth during the forecast period.

Copra meal, a valuable byproduct of coconut oil production, is gaining popularity in the animal feed industry due to its high nutritional value. The coconut industry's sustainability efforts and the increasing demand for non-GMO feed have further boosted its market potential. Coconut products, such as copra cake, oil, fiber, and water, are essential inputs in feed formulation. Feed mills process these raw materials into various feed types, including aquaculture feed, poultry feed, and organic feed. The coconut market's growth is driven by the rising demand for animal feed and sustainable agriculture. Feed efficiency is a crucial factor in the industry, making copra meal an attractive protein source with a favorable amino acid profile.

Coconut certification schemes ensure the traceability and quality of copra meal, further enhancing its appeal. Convenience and grocery stores have emerged as significant distribution channels for copra meal. The increasing number of convenience stores in major countries, such as the UK, China, India, and Japan, is contributing to the growth of this sector. Urbanization and changing lifestyles have led to the prevalence of convenience and grocery stores worldwide, catering to the time-pressed urban population. The growth of organized retail in both developed and developing economies has made supermarkets and hypermarkets the most popular distribution channels for copra meal and related products.

Attractive shelf displays and discounts offer unique shopping experiences for consumers, encouraging them to purchase copra meal in higher quantities. The coconut supply chain, from farming to processing and distribution, is undergoing continuous improvements to ensure energy efficiency and reduce waste. The coconut industry's focus on sustainable agriculture and quality control is essential to maintaining consumer trust and ensuring the long-term success of the market. In summary, the market is experiencing significant growth due to its nutritional value, sustainability, and the increasing demand for non-GMO feed. Convenience and grocery stores are becoming essential distribution channels, while the coconut industry's focus on sustainable agriculture and quality control is ensuring long-term success.

The Offline segment was valued at USD 1,960.63 th in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

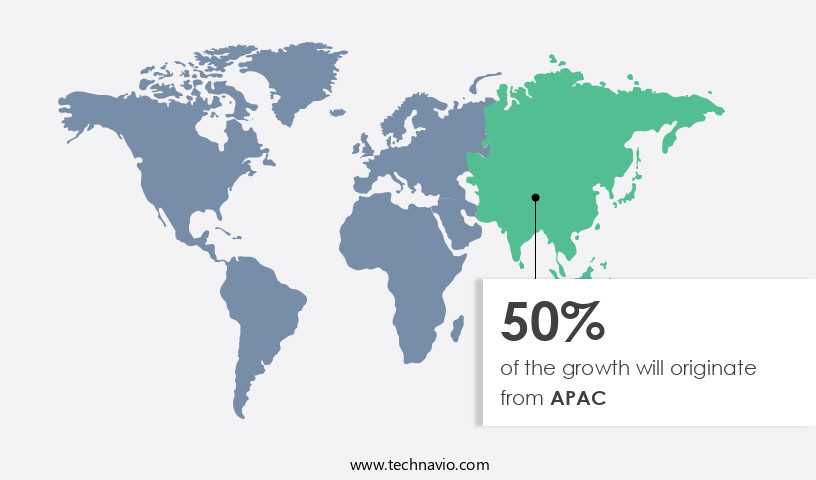

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) experienced significant growth in 2023, with the region accounting for the largest share of global consumption. The Philippines, as a key supplier, dominates the APAC market, exporting a substantial amount of copra meal, also known as coconut meal, to major consumers like South Korea, Japan, and Vietnam. India, China, and Japan were significant revenue contributors to the market due to increasing livestock populations and meat production. The demand for protein-rich animal feed, including copra meal, is on the rise in the region, fueling the growth of the meat industry.

Copra meal, derived from coconut byproducts such as copra cake and coconut fiber through coconut extraction, is a valuable source of crude protein and energy content. Its use in aquaculture feed and poultry feed, along with feed formulation and processing, contributes to improved feed efficiency. The coconut industry's sustainability efforts, including organic farming and certification, further enhance the market's appeal. Coconut byproducts, such as copra meal, coconut flour, and coconut fiber, are essential components of the feed manufacturing process. The nutritional value of copra meal, which includes essential amino acids and fiber, makes it an attractive protein source for the animal feed industry.

The coconut supply chain, from cultivation to processing, is crucial to maintaining the quality and traceability of copra meal.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Copra Meal market drivers leading to the rise in the adoption of Industry?

- The significant increase in meat production and consumption serves as the primary market driver.

- The market is experiencing significant growth due to the increasing demand for animal feed in response to rising meat consumption worldwide. In 2021, global per capita meat consumption surpassed 93.47 pounds, and chicken meat production reached over 135 million tons. The global population's rapid expansion has led to a surge in meat consumption, driving the need for sustainable agriculture practices and efficient protein sources. Copra meal, derived from coconut processing, is a valuable addition to the animal feed industry.

- Its high crude protein content and energy value make it an essential component of livestock nutrition, enhancing production efficiency and animal health. The coconut supply chain's expansion and advancements in coconut processing techniques have increased copra meal production capacity, further fueling market growth. Additionally, the emphasis on coconut traceability and adherence to coconut and copra meal standards ensures the sustainability and quality of this protein source.

What are the Copra Meal market trends shaping the Industry?

- Private-label brands are gaining increasing popularity in the market, representing an emerging trend.

- The market is experiencing a shift towards private label brands, reflecting evolving consumer preferences and market trends. In contrast to traditional branded offerings, private label brands, which are produced and marketed by retailers, have gained popularity due to their affordability and consistent quality. Retailers, by controlling the supply chain, can ensure product standards and provide cost savings to consumers. Additionally, private label brands cater to the increasing demand for aquaculture feed and feed formulation, which utilize copra cake, coconut oil, coconut fiber, and coconut husk as key ingredients in the coconut products industry.

- This trend is expected to persist as consumers continue to seek cost-effective, high-quality alternatives in the market.

How does Copra Meal market faces challenges face during its growth?

- The expanding need for feed enzymes poses a significant challenge to the industry's growth trajectory.

- Feed enzymes, derived from bacteria and fungi, enhance animal feed efficiency by aiding in the digestion of complex ingredients, such as phytates, proteins, and glucans. These enzymes are widely used in farm animal diets due to their ability to optimize feed conversion and minimize drawbacks. The focus of current research is on improving existing in-feed enzymes and expanding the range of digestible feed ingredients. The Scientific Committee for Animal Nutrition has established guidelines for acceptable usage, ensuring the needs of farmers, consumers, and animals are met.

- Coconut byproducts, including coconut water and copra meal, are gaining attention in the animal feed industry due to their nutritional value and sustainability. Coconut water is rich in electrolytes and amino acids, while copra meal offers a favorable amino acid profile. The coconut industry's commitment to sustainability through certification programs further increases its appeal as a non-GMO feed source.

Exclusive Customer Landscape

The copra meal market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the copra meal market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, copra meal market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agro Raya Co. - The company specializes in providing a range of copra meal products, including Crude Coconut Oil, Organic Certified Refined Coconut Oil, and Refined Bleached Coconut Oil.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agro Raya Co.

- BIOTECH UPLB

- CIIF OMG

- Cocoguru Coconut Industries Pvt. Ltd.

- Davao Bay Coconut Oil Mills Inc. and Third Millennium Oil Mills Inc.

- Dr Greenthumbs

- KERAFED

- NaMazco Trades and Exports PVT LTD

- PRIMA INDUSTRIES LTD.

- PT Agriutama Mandiri Indonesia Jaya

- PT Anugerah Wajah Pria

- PT. Golden Union Oil

- PT. INTINUSA NIAGA ABADI

- RICH MOON CO. LTD.

- Riverina

- Royal Flour Mills Pvt. Ltd

- Samar Coco Products Manufacturing Corp.

- Tantuco Enterprises Inc.

- Vaighai Agro

- Kripadhara

- Southern Corp.

- Sri Sellandiamman Oil Mill

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Copra Meal Market

- In January 2024, Archer Daniels Midland Company (ADM), a leading global food ingredient manufacturer, announced the launch of its new copra meal product line, NutriFuse Copra Meal, designed for sustainable aquaculture feed applications (ADM press release, 2024). This innovative product line is expected to contribute significantly to the market's growth, as the demand for sustainable and eco-friendly aquaculture feeds continues to rise.

- In March 2025, Cargill, a global leader in nutrition and agriculture, entered into a strategic partnership with Maruha Nichiro Corporation, a major Japanese seafood company, to expand its copra meal production capacity and strengthen its presence in the Asian market (Cargill press release, 2025). This collaboration is expected to boost both companies' market shares and enhance their offerings to customers in the region.

- In May 2024, the European Commission approved the use of copra meal as a feed ingredient for all farm animals, including pigs, poultry, and ruminants, marking a significant regulatory milestone for the market (European Commission press release, 2024). This approval is expected to increase the demand for copra meal in the European market and provide a competitive edge to manufacturers operating in the region.

- In October 2025, Bunge Limited, a leading agribusiness and food company, announced a major investment of USD 100 million in a copra crushing facility in the Pacific Islands, aiming to increase its copra meal production capacity and secure a stable supply of raw materials (Bunge press release, 2025). This investment is expected to significantly boost the company's market share and contribute to the overall growth of the market.

Research Analyst Overview

The market continues to evolve, with dynamic interactions between various sectors shaping its growth. Coconut products, such as copra cake and coconut oil, play a pivotal role in the market, with their applications extending to livestock feed and feed mill industries. The coconut market and trade are influenced by numerous factors, including the availability of raw materials, global demand, and production costs. Coconut fiber, an essential byproduct of copra cake production, is utilized in feed formulation, contributing to feed efficiency and nutritional value. Aquaculture feed is another significant application for copra meal, as it provides a sustainable protein source for fish and shrimp farming.

Coconut extraction processes, such as coconut oil and copra oil production, generate valuable copra meal as a byproduct. The feed industry's ongoing quest for sustainable agriculture and non-GMO feed sources further bolsters the demand for coconut meal. Feed manufacturing processes incorporate copra meal into animal feed formulations, enhancing their energy content, crude protein, and amino acid profile. Coconut water and coconut milk are also gaining popularity as alternative feed ingredients, providing additional nutritional benefits. The coconut industry's focus on sustainability, certification, and quality control ensures the continuous improvement of copra meal production and its applications. Coconut husk, a byproduct of coconut processing, is being explored for its potential use as feed additives and fuel sources, further expanding the market's scope.

The market's continuous evolution is driven by the diverse applications of coconut products and the ever-changing needs of the livestock feed, feed mill, and aquaculture industries. The integration of coconut byproducts into feed formulation, the pursuit of sustainable agriculture practices, and the ongoing research and development in the coconut industry all contribute to the market's dynamic nature.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Copra Meal Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.96% |

|

Market growth 2024-2028 |

USD 6.47 thousand |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.48 |

|

Key countries |

US, The Philippines, India, Indonesia, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Copra Meal Market Research and Growth Report?

- CAGR of the Copra Meal industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the copra meal market growth of industry companies

We can help! Our analysts can customize this copra meal market research report to meet your requirements.