Core Banking Software Market Size 2025-2029

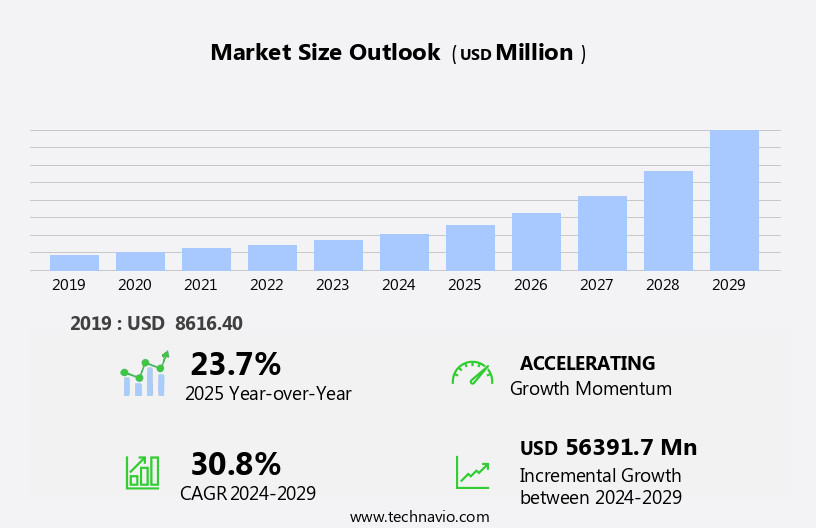

The core banking software market size is forecast to increase by USD 56.39 billion, at a CAGR of 30.8% between 2024 and 2029.

- The market is witnessing significant growth, driven by the adoption of cloud-based solutions for scalability, cost-effectiveness, and enhanced flexibility. These solutions enable banks to streamline their operations, reduce IT infrastructure costs, and offer personalized services to customers. However, the implementation of cloud-based systems presents challenges, including data security concerns and the need for seamless integration with legacy systems. Another key trend in the market is the modernization of legacy systems to meet the demands of digital banking. Banks are investing in upgrading their core banking platforms to support real-time transactions, omnichannel banking, and advanced analytics.

- This modernization process can be complex and costly, requiring significant resources and expertise. Despite these challenges, the benefits of upgrading legacy systems, such as improved customer experience and operational efficiency, make it a necessary investment for banks seeking to remain competitive in the digital age.

What will be the Size of the Core Banking Software Market during the forecast period?

The market continues to evolve, with various sectors integrating advanced technologies to enhance their operations. Online banking, investment portfolio management, loan management, real-time analytics, and core banking systems are no longer standalone entities but seamlessly integrated components. Financial analysis and business intelligence (BI) provide valuable insights, while digital banking and blockchain technology ensure secure and efficient transactions. User interface (UI) and artificial intelligence (AI) optimize customer experience, and open banking facilitates collaboration between financial institutions. Performance optimization, account opening, and predictive analytics streamline processes, and payment processing is now faster and more secure with API integration and cloud computing.

Commercial banking benefits from agile development and risk management, ensuring regulatory compliance and data quality management. Wealth management and investment banking leverage data analytics for informed decisions, while loan origination and fraud detection utilize machine learning (ML) and data encryption for improved accuracy and security. Branch banking and retail banking adapt to the digital age, offering mobile banking and financial reporting, customer segmentation, and account management services. Infrastructure management and system integration ensure seamless operations, enabling financial services to meet the evolving needs of their clients.

How is this Core Banking Software Industry segmented?

The core banking software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- End-user

- Banks

- Financial institutions

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

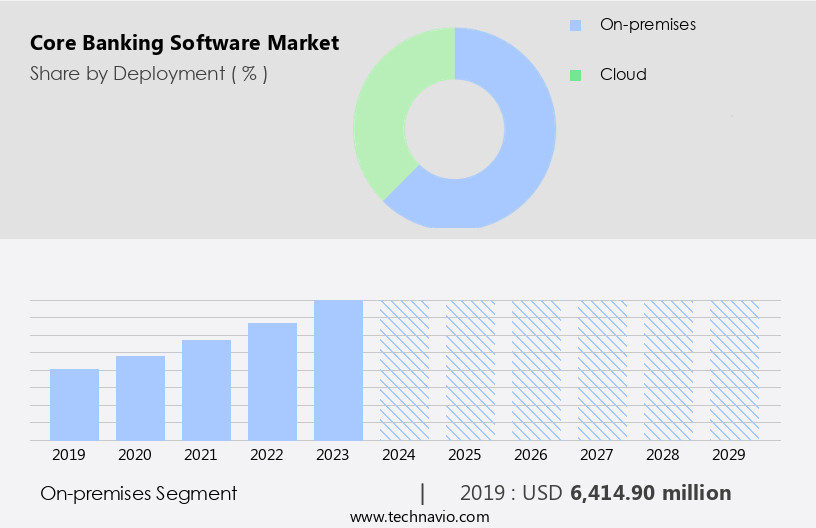

The on-premises segment is estimated to witness significant growth during the forecast period.

The global Core Banking Software (CBS) market continues to evolve, with on-premise deployment remaining a preferred choice for financial institutions. Despite the increasing adoption of cloud-based solutions, regulatory requirements such as GDPR and PCI-DSS necessitate on-premise installations for many organizations. Large financial institutions with complex infrastructure benefit from the enhanced control, security, and customization options provided by on-premise deployment. Data protection and compliance concerns are significant drivers for this choice. The CBS market is characterized by the integration of various functionalities, including deposit management, transaction processing, customer onboarding, wealth management, commercial banking, risk management, data quality management, user experience, loan origination, agile development, fraud detection, mobile banking, investment banking, data analytics, system integration, account management, infrastructure management, financial services, regulatory compliance, banking software, API integration, cloud computing, data security, online banking, investment portfolio management, loan management, real-time analytics, core banking system, financial analysis, business intelligence, digital banking, blockchain technology, user interface, artificial intelligence, open banking, performance optimization, account opening, predictive analytics, payment processing, machine learning, branch banking, retail banking, financial reporting, and customer segmentation.

The market's flexibility and dependability accommodate the growing use of cloud solutions while maintaining stringent data security and regulatory compliance.

The On-premises segment was valued at USD 6.41 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

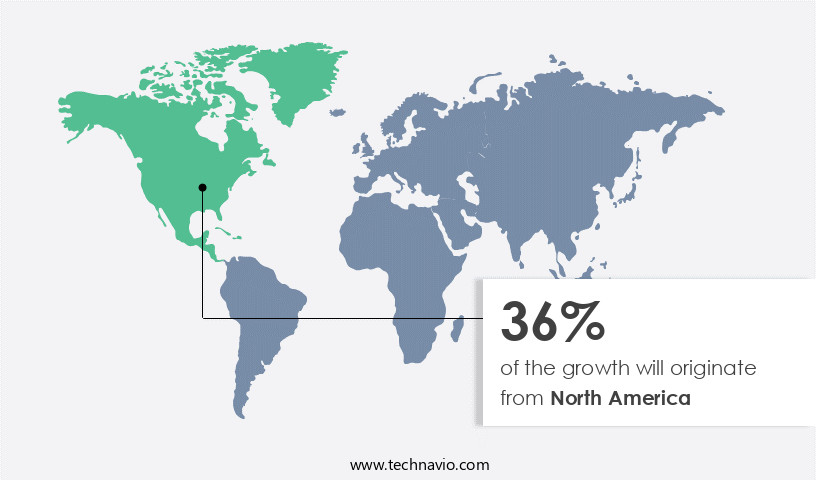

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the Core Banking Software (CBS) market is experiencing significant growth and transformation. Financial institutions are investing in advanced CBS solutions to enhance operational efficiency, improve customer experience, and ensure regulatory compliance as the banking sector increasingly embraces digitalization. Key players in the region include FIS, Fiserv, and Temenos. These companies provide comprehensive core banking platforms catering to various banking needs, such as retail banking, business banking, and wealth management. For example, FIS's FIS Profile solution empowers banks to streamline operations, automate processes, and deliver personalized services to consumers. The regional market is expected to continue expanding as banks strive to remain competitive in the rapidly evolving financial services landscape.

CBS solutions are integral to this evolution, enabling features like deposit management, data governance, transaction processing, customer onboarding, risk management, data quality management, user experience (UX), loan origination, agile development, fraud detection, mobile banking, investment banking, data analytics, system integration, account management, infrastructure management, loan management, real-time analytics, core banking system, financial analysis, business intelligence (BI), digital banking, blockchain technology, user interface (UI), artificial intelligence (AI), open banking, performance optimization, account opening, predictive analytics, payment processing, machine learning (ML), branch banking, retail banking, financial reporting, customer segmentation, and data encryption. These capabilities are essential for banks to meet the evolving needs of their clients and navigate the complex regulatory environment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Core Banking Software Industry?

- The primary catalyst propelling market growth is the continuous advancement of technology.

- The global Core Banking Software (CBS) market is experiencing significant growth due to the increasing digitization of financial services and the prevalence of mobile banking. This shift towards digital channels has led to an increased demand for CBS, as financial institutions seek to provide their clients with seamless access to banking services. CBS enables institutions to manage online accounts, facilitate transactions such as money transfers and bill payments, and offer investment banking services through a single platform. Moreover, CBS offers data analytics capabilities, allowing financial institutions to gain valuable insights into customer behavior and preferences. System integration and infrastructure management are also crucial aspects of CBS, ensuring regulatory compliance and data security.

- API integration and cloud computing are becoming increasingly popular in CBS solutions, offering cost savings, automation, and operational efficiency. In conclusion, the CBS market is driven by the need for financial institutions to adapt to the digital revolution and meet evolving customer expectations. By providing a comprehensive and integrated solution for account management, investment banking, data analytics, and regulatory compliance, CBS is an essential tool for financial services organizations looking to thrive in today's digital banking landscape.

What are the market trends shaping the Core Banking Software Industry?

- Cloud-based core banking solutions are gaining popularity due to their scalability, cost-effectiveness, and enhanced flexibility. This trend reflects the increasing demand for innovative and efficient banking technologies in the market.

- The global core banking system market is witnessing significant growth due to the adoption of advanced technologies such as online banking, investment portfolio management, loan management, real-time analytics, and digital banking. These solutions offer financial institutions benefits like scalability, cost efficiency, and increased flexibility. By transitioning to cloud-based core banking systems, banks can eliminate the need for on-premises infrastructure, thereby reducing hardware costs and enabling effective scaling of operations. Moreover, cloud-based systems provide enhanced security measures and reliable data backup, ensuring the protection of private banking data. Additionally, they offer remote accessibility to data and services from any location, promoting collaboration and enabling businesses to react quickly to market demands.

- Technologies like blockchain, business intelligence (BI), user interface (UI), artificial intelligence (AI), and open banking are also driving market growth. These innovations offer improved security, faster processing times, and personalized customer experiences. Overall, the shift towards advanced core banking technologies is enabling financial institutions to streamline operations, cut costs, and adapt to evolving market requirements.

What challenges does the Core Banking Software Industry face during its growth?

- Modernizing legacy systems and integrating them with existing infrastructure is a significant challenge that significantly impacts industry growth. This complex process requires a deep understanding of both the outdated technology and the current infrastructure to ensure seamless compatibility and optimal performance. The successful execution of this undertaking is essential for businesses aiming to remain competitive and adapt to the evolving technological landscape.

- The global Core Banking Software (CBS) market faces significant challenges in modernizing and integrating legacy systems. Many financial institutions continue to rely on outdated, complex legacy systems that fail to meet the demands of contemporary banking. Integrating new CBS solutions with existing infrastructure necessitates meticulous planning, data migration, and backward compatibility assurance. This process often involves substantial investments, prolonged procedures, and the risk of operational disruptions. Data consistency, security, and business continuity are crucial considerations during the modernization process. Strategic planning, company collaboration, and robust project management are essential to overcome these challenges and ensure a seamless transition.

- Performance optimization, account opening, predictive analytics, payment processing, machine learning, branch banking, retail banking, financial reporting, customer segmentation, and data encryption are critical features driving the CBS market. These functionalities enhance operational efficiency, improve customer experience, and bolster security. Payment processing and machine learning are two areas of significant growth in the CBS market. Payment processing streamlines transactions, reducing errors and increasing speed, while machine learning enables predictive analytics and personalized customer experiences. In conclusion, the CBS market presents numerous opportunities for financial institutions to enhance their operations and better serve their customers. However, legacy system modernization and integration remain significant challenges that require strategic planning, company engagement, and strong project management.

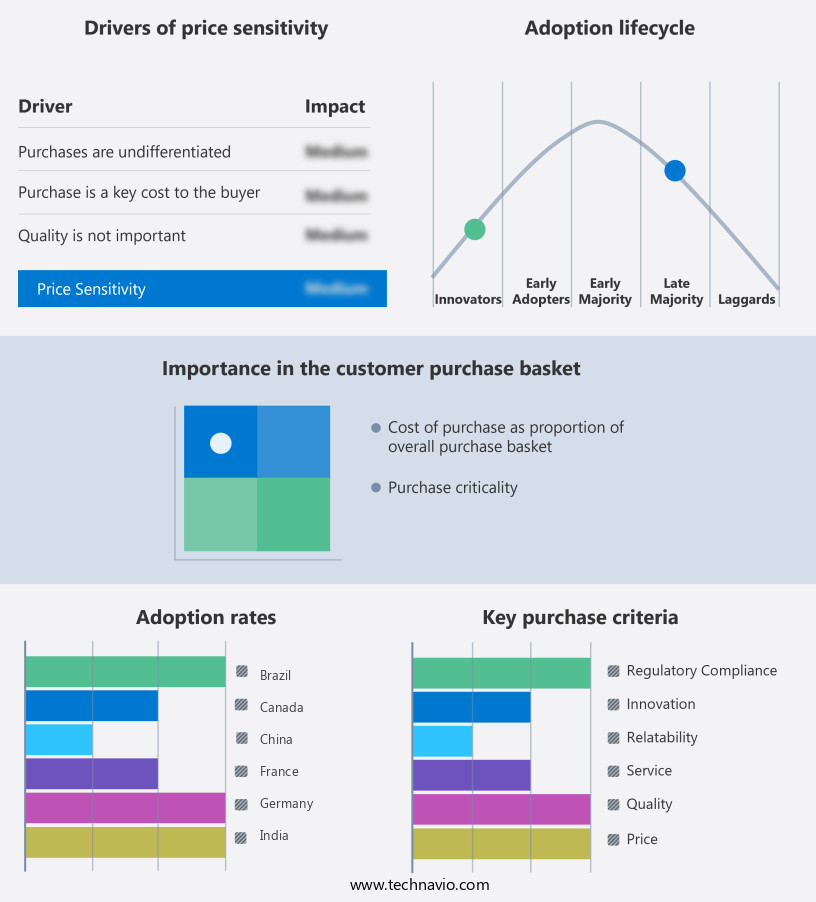

Exclusive Customer Landscape

The core banking software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the core banking software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, core banking software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Capgemini Services SAS - This company specializes in providing advanced capital management solutions through its core banking software, CapitalBanker. Designed for financial institutions, CapitalBanker streamlines operations, enhances security, and optimizes financial processes. The software offers robust functionalities, including account management, loan processing, treasury management, and real-time reporting. Its user-friendly interface and customizable features cater to various banking needs, enabling institutions to improve efficiency and deliver superior customer service. CapitalBanker's innovative technology ensures regulatory compliance and seamless integration with external systems, making it an indispensable tool for modern banking organizations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Capgemini Services SAS

- Capital Banking Solutions

- Fidelity National Information Services Inc.

- Finastra

- Fiserv Inc.

- HCL Technologies Ltd.

- Infosys Ltd.

- Intellect Design Arena Ltd.

- Mambu BV

- Nidec Corp.

- Nucleus Software Exports Ltd.

- Oracle Corp.

- SAP SE

- SoFi Technologies Inc.

- Sopra Steria Group SA

- Tata Consultancy Services Ltd.

- Temenos AG

- Unisys Corp.

- Wipro Ltd.

- ZKAPITOL Technologies Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Core Banking Software Market

- In February 2023, Infosys Finacle, a leading provider of core banking solutions, announced the launch of Finacle 10.0, the latest version of its digital banking solution. This release includes advanced digital banking capabilities, such as AI-powered analytics and real-time fraud detection, aiming to help banks enhance customer experience and ensure security (Infosys Press Release, 2023).

- In July 2024, Mastercard and Microsoft entered into a strategic partnership to develop and offer cloud-based core banking solutions to financial institutions. This collaboration combines Mastercard's banking expertise with Microsoft's Azure technology, enabling banks to modernize their operations and improve customer experiences (Mastercard Newsroom, 2024).

- In October 2024, Temenos, a global banking software company, raised USD400 million in a funding round led by BlackRock. This investment will support Temenos' continued growth and innovation in the market, as well as its expansion into new markets (Temenos Press Release, 2024).

- In March 2025, the European Central Bank (ECB) announced the launch of a new regulatory framework for digital operational resilience. This framework aims to ensure that financial institutions, including those using core banking software, can withstand cyber-attacks and other technological disruptions (ECB Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, digital innovation and compliance reporting are driving forces shaping the industry. User journey and customer experience are increasingly prioritized, with banking technology advancing to meet these demands. Big data and data visualization are transforming regulatory reporting, enabling more effective analysis and insights. Cloud migration and hybrid cloud solutions offer flexibility and scalability, but require robust security measures, including penetration testing, security audits, and multi-factor authentication. Business continuity planning and disaster recovery are essential components of core banking solutions, ensuring uninterrupted services. Biometric authentication and microservices architecture enhance security and efficiency, while data masking and system backup safeguard sensitive information.

- Support services and data lake integration are vital for optimizing operational efficiency and maintaining regulatory compliance.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Core Banking Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 30.8% |

|

Market growth 2025-2029 |

USD 56391.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

23.7 |

|

Key countries |

US, UK, Japan, Canada, China, Germany, France, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Core Banking Software Market Research and Growth Report?

- CAGR of the Core Banking Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the core banking software market growth of industry companies

We can help! Our analysts can customize this core banking software market research report to meet your requirements.