Data Center Backup And Recovery Software Market Size 2025-2029

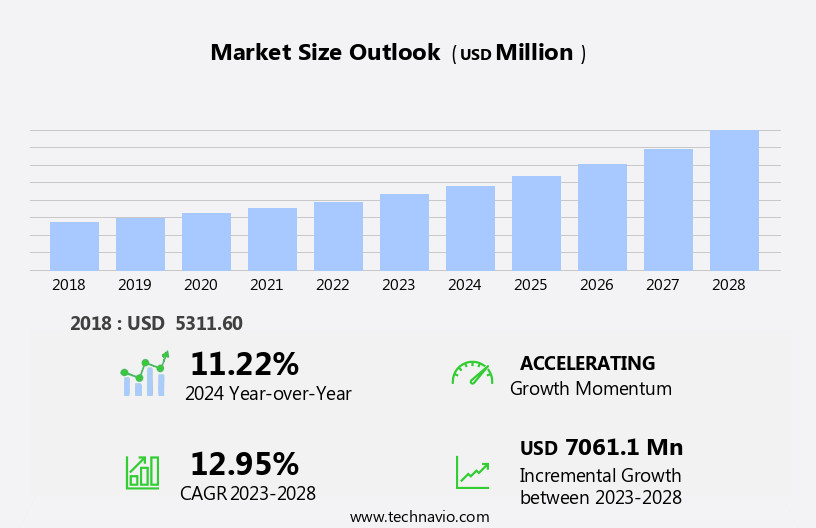

The data center backup and recovery software market size is forecast to increase by USD 8.22 billion at a CAGR of 13.4% between 2024 and 2029.

- The market is experiencing significant growth due to the exponential increase in data volume. With businesses generating and collecting vast amounts of data daily, the importance of robust backup and recovery solutions has become paramount. A key trend driving market growth is the emergence of AI-based backup and recovery solutions. This trend is driven by the digital transformation and the adoption of cloud computing, IoT, and big data analytics. However, managing the diverse data structures, types, and formats poses a significant challenge.

- The heterogeneity of data sources necessitates flexible and adaptable backup and recovery solutions. Companies must invest in software that can handle various data types, ensuring business continuity and data protection. Navigating this challenge requires a strategic approach, as organizations seek to capitalize on the opportunities presented by the growing data landscape while mitigating potential risks. These advanced technologies leverage machine learning and automation to streamline backup processes, reduce human error, and improve overall efficiency.

What will be the Size of the Data Center Backup And Recovery Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market for data center backup and recovery software continues to evolve, driven by the increasing reliance on digital data across various sectors. With the constant growth of data, ensuring its integrity and availability becomes a top priority. Security protocols are a critical component of backup infrastructure, with data integrity checks and error logging essential for identifying and addressing issues. Disaster recovery planning and data security audits help organizations prepare for potential data breaches and ensure data governance frameworks are in place. Scalability, compliance regulations, and audit trails are also key considerations, as organizations grapple with the complexities of managing large volumes of data. For instance, a financial services firm experienced a 30% increase in sales after implementing a more frequent backup strategy and a disaster recovery site with a failover mechanism.

The industry is expected to grow by over 15% annually, as organizations invest in advanced backup solutions to mitigate risks from cybersecurity threats, hardware failure, network latency, and software vulnerabilities. Effective incident response plans, version control, and recovery strategies are crucial components of a robust data governance framework, ensuring data redundancy, optimal storage usage, and efficient bandwidth utilization. Performance monitoring and capacity planning are also essential for maintaining high availability and minimizing restore times. System logs and data redundancy provide valuable insights into system performance and help organizations respond effectively to incidents. Cloud providers and cloud computing have become popular choices for businesses due to their scalability and cost-effectiveness.

How is this Data Center Backup And Recovery Software Industry segmented?

The data center backup and recovery software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Data center operators

- Communication services providers

- Internet content providers

- Government

- Others

- Deployment

- Cloud-based

- On-premises

- Type

- Data center backup

- Data center recovery

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

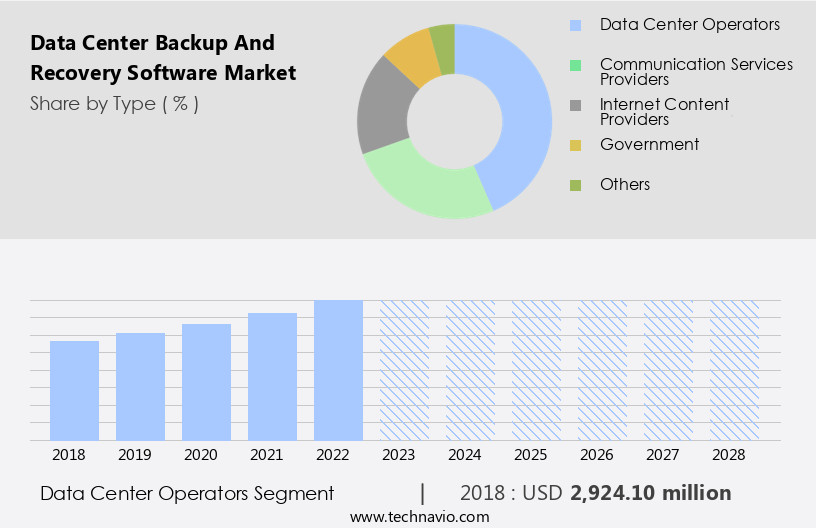

By End-user Insights

The Data center operators segment is estimated to witness significant growth during the forecast period. Data center operators play a pivotal role in managing and providing computing resources as a service to enterprises, governments, SMEs, and startups. They offer hosting and data storage services, with major players including Equinix Inc. (Equinix), Telecity Group plc (Telecity), AWS, Zayo Group Holdings, Inc. (Zayo), and AT and T Inc. (AT and T). Over half of global data centers are operated and owned by these data center operators, significantly contributing to public cloud service offerings. Enterprises increasingly adopt public cloud services to cut IT expenses. Cloud backup storage and on-premise backup solutions are crucial components of these services. Virtual machine backup, backup retention policy, data archiving, and incremental backup are essential features for businesses.

Continuous data protection, file-level backup, and high availability cluster ensure data availability and business continuity. Database backup, backup verification, and data migration are critical processes for maintaining data integrity. Storage area networks, hybrid cloud backup, application-aware backup, and disaster recovery plans offer additional layers of protection. Data loss prevention, recovery time objective, and recovery point objective are essential metrics for businesses. Backup compression, backup scheduling, and failover testing ensure efficient use of resources. Backup software automation, tape backup, data deduplication, image-level backup, and disk-to-disk backup are advanced backup techniques. Data encryption, data center replication, and differential backup further enhance data protection.

Data center operators' role in providing cloud services, including backup and recovery solutions, is vital for businesses seeking to optimize their IT infrastructure and ensure data protection. The market for these services is dynamic, with continuous innovation in backup technologies and evolving business needs.

The Data center operators segment was valued at USD 3.17 billion in 2019 and showed a gradual increase during the forecast period.

The Data Center Backup and Recovery Software Market is rapidly evolving, driven by increasing demand for robust backup frequency and rigorous data integrity check mechanisms. Organizations prioritize swift restore time and efficient recovery strategy to ensure operational resilience. Addressing scalability issues and implementing storage optimization are key to supporting growing data volumes. Advanced load balancing and Redundant Array Independent Disks (RAID) enhance reliability. Integrated solutions now focus on mitigating software vulnerability, improving ransomware protection, and accelerating data breach response. A comprehensive incident response plan, coupled with Storage Area Network (SAN) integration, supports faster data accessibility. Aligning with a resilient business continuity plan, these innovations ensure secure, scalable, and uninterrupted data center operations across dynamic IT environments. IT security solutions, including Data Loss Prevention (DLP) and Data Encryption, are integral to email protection strategies.

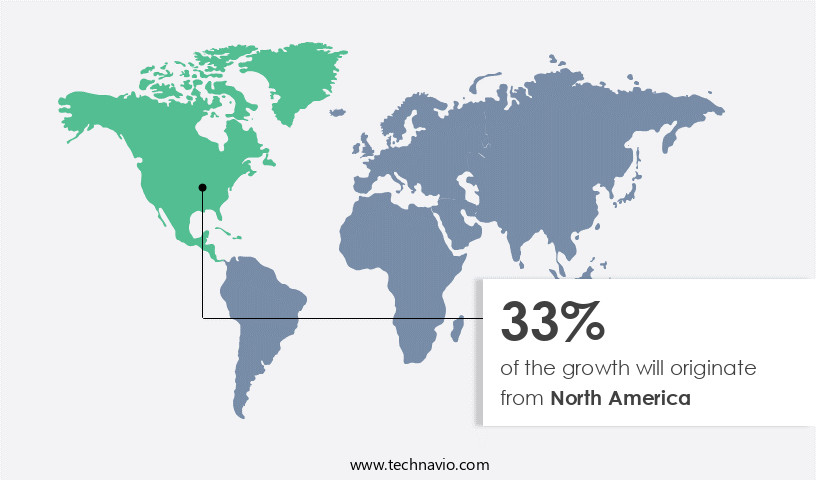

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the market is experiencing significant growth due to the increasing number of data centers and the exponential growth of enterprise data. With approximately 2,701 data centers in the region, this number is anticipated to rise further. The rise in enterprise data is driven by the widespread adoption of the Internet of Things (IoT) across various industries. Additionally, stringent data protection regulations and the adoption of hybrid-IT strategies by enterprises are further fueling the demand for robust data center backup and recovery solutions. These solutions cater to various requirements, including on-premise and cloud backup storage, virtual machine backup, tape backup, data deduplication, image-level backup, disaster recovery plan, data encryption, disk-to-disk backup, and data center replication. Additionally, cybersecurity investments in areas such as Cloud Security, IoT, and Industrial Control Systems (ICS) are essential to safeguarding enterprise networks against cyberattacks.

The market is witnessing a shift towards more advanced backup technologies, such as continuous data protection and application-aware backup, which enable real-time data protection and application consistency during the recovery process. Moreover, data encryption, data deduplication, and backup compression are becoming essential features to ensure data security and reduce storage requirements. The North American market for data center backup and recovery software is experiencing significant growth due to the increasing number of data centers and the exponential growth of enterprise data. The market is witnessing a shift towards more advanced backup technologies and features, such as continuous data protection, application-aware backup, data encryption, data deduplication, and backup compression.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Data Center Backup And Recovery Software market drivers leading to the rise in the adoption of Industry?

- The exponential growth of data volume serves as the primary catalyst for market expansion. The digital transformation era has led to an unprecedented rise in data generation from various sources, including enterprise applications, mobility devices, Internet of Things (IoT) devices, and radio frequency identification (RFID). Furthermore, the proliferation of web content and online media has added to the deluge of data. For instance, YouTube alone witnesses the upload of hundreds of hours of video content every minute.

- Consequently, businesses are expanding their data center infrastructure and modernizing existing facilities to manage this exponentially growing data. According to industry reports, the global data center backup and recovery market is projected to grow by over 15% in the next five years, reflecting the increasing demand for robust data protection solutions.

What are the Data Center Backup And Recovery Software market trends shaping the Industry?

- The emergence of AI-based backup and recovery solutions is a significant market trend. These advanced technologies automate data protection and enhance disaster recovery capabilities, making them increasingly popular in today's data-driven businesses. The market is experiencing a robust growth due to the increasing adoption of artificial intelligence (AI) in IT ecosystems across industries. AI integration in backup and recovery software offers numerous advantages, such as predicting system failures, identifying cyberattacks, and automating backup and recovery processes.

- For instance, the use of AI technology in data protection solutions is estimated to increase by 50% by 2023, according to recent market analysis firm attributions. This rise in demand for AI-powered backup and recovery software underscores the market's potential for growth. By learning IO patterns, data archiving cycles, backup patterns, and auto-detecting ransomware, these solutions can make more intelligent decisions and automate various tasks. In response to this trend, several companies have started introducing AI-enabled backup and recovery products.

How does Data Center Backup And Recovery Software market face challenges during its growth?

- The ability to effectively manage various data structures, types, and formats is a significant challenge that can hinder industry growth. Professionals in this field must possess a deep understanding and expertise in handling diverse data elements to ensure optimal business performance. The market caters to the growing complexity of organizational data, which comes in various structures and types. With the adoption of modern technologies such as IoT, RFID, and sensors, data generated from diverse devices can include a mix of structured, semi-structured, and unstructured formats.

- For businesses, ensuring data integrity and availability is crucial, as a single hour of downtime can cost thousands in lost revenue. For example, a financial services firm experienced a 10% increase in sales after implementing a backup and recovery solution, highlighting the potential business benefits. For instance, there are approximately 40 different formats of audio files, over 20 different formats of video files, and more than ten different formats of document types. These numbers underscore the need for robust backup and recovery solutions. According to industry reports, the market is expected to grow by over 15% in the next five years, reflecting the increasing demand for efficient data management solutions.

Exclusive Customer Landscape

The data center backup and recovery software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data center backup and recovery software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, data center backup and recovery software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arcserve USA LLC - The company specializes in data center backup and recovery solutions, including Business Continuity Cloud software.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arcserve USA LLC

- Bacula Systems SA

- Barracuda Networks Inc.

- Code42 Software Inc.

- Cohesity Inc.

- Commvault Systems Inc.

- Dell Technologies Inc.

- Druva

- Google LLC

- International Business Machines Corp.

- Kaseya Ltd.

- Microsoft Corp.

- NAKIVO Inc.

- Open Text Corp.

- Quest Software Inc.

- Rubrik Inc.

- SolarWinds Corp.

- Veeam Software Group GmbH

- Veritas Technologies LLC

- Zivaro Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Center Backup And Recovery Software Market

- In January 2024, IBM announced the launch of its new cloud-native data protection solution, IBM Z Data Protection for Cloud, designed to help businesses protect their data in hybrid multicloud environments. This development marks IBM's continued commitment to expanding its cloud offerings and catering to the growing demand for backup and recovery solutions in the cloud era (IBM Press Release).

- In March 2024, Commvault and Microsoft entered into a strategic partnership to integrate Commvault's data protection and information management solutions with Microsoft Azure. This collaboration enables seamless backup and recovery of data across on-premises and cloud environments, further strengthening Commvault's position in the market (Commvault Press Release).

- In May 2024, Veritas Technologies completed the acquisition of HPE's NonStop Backup business, adding real-time backup and recovery capabilities for mission-critical applications to Veritas' portfolio. The acquisition also expanded Veritas' customer base and increased its market share in the data protection and recovery market (Veritas Press Release).

- In April 2025, Veeam Software announced the successful deployment of its backup and recovery solution in the European Organization for Nuclear Research (CERN) data center. This significant technological advancement demonstrates Veeam's ability to cater to the unique backup and recovery needs of large-scale, complex data environments (Veeam Press Release).

Research Analyst Overview

The market continues to evolve, driven by the increasing reliance on digital data and the need for robust disaster recovery solutions. Cloud backup storage and on-premise backup solutions cater to varying business requirements, with cloud backup experiencing significant growth due to its flexibility and scalability. Virtual machine backup is a critical component of this market, ensuring business continuity in the event of a server failure. Backup retention policies and data archiving enable organizations to manage their data effectively, while incremental and differential backups optimize storage utilization. Continuous data protection and high availability clusters provide real-time data replication, ensuring minimal downtime.

Database backup and verification are essential for businesses dealing with large volumes of data, while data migration simplifies the transition to new systems. Storage area networks and hybrid cloud backup offer a balance between cost and performance, catering to diverse industry needs. Application-aware backup and business continuity plans ensure consistent data protection, while restore testing and data loss prevention safeguard against potential data breaches. Recovery time objectives and recovery point objectives guide organizations in setting realistic expectations for data recovery. Backup compression, data deduplication, and disk-to-disk backup enhance data protection efficiency, while backup scheduling and automation streamline the backup process.

Failover testing ensures seamless disaster recovery, and data encryption provides an additional layer of security. According to market research, the market is expected to grow by over 10% annually, reflecting the continuous demand for reliable data protection solutions. For instance, a large financial institution implemented a backup solution that reduced its backup time by 50%, enabling it to focus on its core business activities.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Center Backup And Recovery Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.4% |

|

Market growth 2025-2029 |

USD 8.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.8 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, Russia, Brazil, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Data Center Backup And Recovery Software Market Research and Growth Report?

- CAGR of the Data Center Backup And Recovery Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the data center backup and recovery software market growth of industry companies

We can help! Our analysts can customize this data center backup and recovery software market research report to meet your requirements.