Deli Meat Market Size 2025-2029

The deli meat market size is forecast to increase by USD 110.9 billion at a CAGR of 9.3% between 2024 and 2029.

- The market is witnessing significant growth due to several key trends. The expansion of organized retail is driving market growth, as consumers increasingly prefer shopping at large retail stores for their deli meat needs. Deli meats, including beef, pork, chicken, hog, veal, and ovine, are consumed for their versatility in various dishes, such as charcuterie trays, sandwiches, and ready-to-eat meals. Additionally, the rise of plant-based and alternative protein options is challenging traditional players In the market. However, adhering to stringent food safety regulations and labeling requirements remains a major challenge for market participants. Ensuring the safety and quality of deli meat products is essential to maintain consumer trust and meet regulatory compliance. These factors, among others, are shaping the future of the market.

What will be the Size of the Deli Meat Market During the Forecast Period?

- The market encompasses a wide range of cured and uncured meat products derived from beef, hog, chicken, veal, ovine, and other animals. These meats are available in various forms, including loaves, sliced, prepackaged vacuum-packed portions, canned, and ready-to-cook options. The market's growth is driven by the increasing urbanization and the rising demand for convenience foods. Hypermarkets and supermarkets, as well as specialty stores, are the primary distribution channels for deli meats. Preservatives and food additives are essential in ensuring the extended shelf life of these products. The market for deli meats has seen a trend towards flavored ready-to-eat meats, which cater to diverse consumer preferences.

- In addition, the use of natural preservatives and minimally processed meats is also gaining popularity due to health-conscious consumers. The market is expected to continue its upward trajectory, fueled by the increasing demand for protein-rich, convenient, and flavorful food options.

How is this Deli Meat Industry segmented and which is the largest segment?

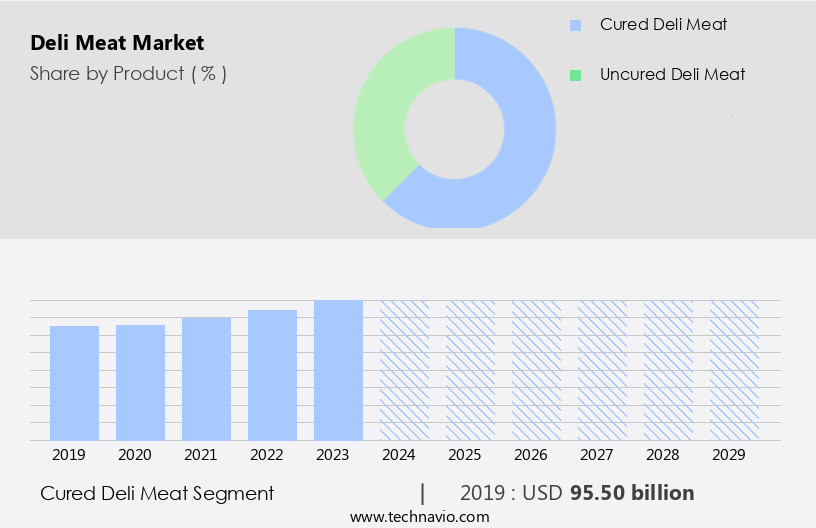

The deli meat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Cured deli meat

- Uncured deli meat

- Distribution Channel

- Offline

- Online

- Source

- Pork

- Chicken

- Beef

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Brazil

- North America

By Product Insights

- The cured deli meat segment is estimated to witness significant growth during the forecast period.

Cured deli meats, including beef, pork, hog, chicken, veal, and ovine varieties, undergo a curing process involving salt, enzymes, and preservatives to enhance flavor and extend shelf life. The prevalence of diseases linked to processed meat consumption, such as cardiovascular diseases and Type 2 diabetes, raises health concerns. Leading companies, such as Hormel Foods and Boar's Head Brand, employ innovative distributive strategies, including online shopping and convenience stores, to cater to the expanding consumer base. Urbanization and hectic lifestyles fuel the demand for convenience foods and dishes, driving the market for cured deli meats. Consumers seek natural, organic, and uncured alternatives, while synthetic hormones, antibiotics, toxic pesticides, and nitrites remain contentious ingredients.

Get a glance at the Deli Meat Industry report of share of various segments Request Free Sample

The cured deli meat segment was valued at USD 95.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market experiences significant growth due to increasing consumer demand for protein-rich, convenient snacking options and the health benefits associated with protein-based diets. Leading companies In the industry, including Hormel Foods and Boar's Head Brand, offer prepackaged vacuum-packed portions, ensuring extended shelf life and convenience for consumers. However, concerns regarding adverse health effects, such as cardiovascular diseases, Type 2 diabetes, and the presence of antibiotics, bacteria, preservatives, and food additives, may deter some consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Deli Meat Industry?

Growth in organized retail is the key driver of the market.

- Deli meats, including cured and uncured options from leading companies like Boar's Head Brand and Hormel Foods, continue to be a significant revenue generator in organized retail channels, such as supermarkets and hypermarkets. The growing urban population and hectic lifestyles have increased the demand for convenience foods, making deli meats an essential component of ready-to-eat (RTE) meals, sandwiches, charcuterie trays, and snacks. However, concerns regarding adverse health effects, such as cardiovascular diseases and Type 2 diabetes, associated with the consumption of processed meats have led consumers to seek healthier alternatives. As a result, the market for organic deli meats, free from antibiotics, synthetic hormones, toxic pesticides, and other food additives, is gaining traction.

- In addition, to cater to diverse consumer preferences, leading companies are introducing innovative flavors and natural ingredients, such as enzymes, spices, and yeasts, to enhance the flavor and nutritional value of their products. Prepackaged vacuum-sealed portions and online shopping options further add to the convenience of deli meat consumption. Despite these advancements, preservatives, bacteria, and moisture removal are essential considerations to ensure the shelf life and safety of deli meats. Salt, a common preservative, remains a contentious issue due to its association with high blood pressure. Therefore, companies are exploring alternative preservation methods and natural flavorings to cater to health-conscious consumers.

What are the market trends shaping the Deli Meat Industry?

Expansion of plant-based and alternative protein options is the upcoming market trend.

- The market is witnessing a significant shift towards plant-based and alternative protein options. This trend is fueled by various factors, including growing consumer consciousness regarding health and sustainability, dietary preferences, and environmental concerns related to meat production. Plant-based deli meat alternatives, which are derived from ingredients such as soy, pea protein, mushrooms, and other plant-based sources, are gaining traction among consumers who desire healthier and more sustainable protein choices. These alternatives provide a meat-like texture and taste while being devoid of animal products. Moreover, plant-based deli meat options offer several health benefits. They contain lower levels of saturated fat, cholesterol, and calories than traditional meat products.

- Furthermore, these attributes are particularly attractive to health-conscious consumers. Additionally, these alternatives are free from antibiotics, synthetic hormones, toxic pesticides, and other additives commonly found in cured meats, which are linked to adverse health effects such as cardiovascular diseases, Type 2 diabetes, and certain cancers. The convenience factor is another reason for the increasing popularity of plant-based deli meat alternatives. With hectic lifestyles and urbanization on the rise, consumers are increasingly opting for convenience foods, including prepackaged vacuum-packed portions, ready-to-cook meats, and ready-to-eat meals. Plant-based deli meat alternatives cater to this demand by offering long shelf life, ease of use, and versatility.

What challenges does the Deli Meat Industry face during its growth?

Concerns adhering to stringent food safety regulations and labeling requirements is a key challenge affecting the industry growth.

- The market faces intricate regulatory hurdles due to stringent food safety standards and labeling requirements. Deli meat manufacturers must adhere to various regulations governing hygiene practices, processing methods, ingredient labeling, and packaging. Compliance with these regulations is crucial to ensuring product safety, quality, and consumer trust. However, navigating multiple jurisdictions with differing regulatory frameworks and keeping up with frequent updates and revisions can be challenging. Adverse health effects from antibiotics, bacteria, preservatives, and synthetic hormones in deli meats are a significant concern for consumers. Consequently, there is a growing demand for natural, organic, and uncured deli meats, as well as innovative flavors and convenience options.

- Furthermore, this trend is driven by the prevalence of cardiovascular diseases, Type 2 diabetes, and other health issues linked to processed meat consumption. Deli meats' versatility makes them a staple in various dishes, from charcuterie trays and sandwiches to ready-to-cook meats and ready-to-eat meals. Their convenience and long shelf life make them popular on-the-go food products in convenience stores, hypermarkets/supermarkets, specialty stores, and online shopping platforms. The availability of a wide range of ingredients, such as enzymes, flavorings, spices, and yeasts, allows for the creation of diverse and flavorful RTE meats, loaves, and snacks. Maintaining the balance between preserving the health benefits of deli meats, such as valuable proteins, iron, zinc, and vitamins, while minimizing the use of additives and toxic pesticides is a key challenge for leading companies.

Exclusive Customer Landscape

The deli meat market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the deli meat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, deli meat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Boars Head Brand - The company offers deli meat such as Turkey, ham, beef, chicken, salami, and prosciutto.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BRF SA

- Butcher On The Block

- Cargill Inc.

- Conagra Brands Inc.

- CrisTim Group

- Dutch Valley Meats

- E.A. Sween Co.

- Evans Meats and Seafood Inc.

- Hormel Foods Corp.

- Nestle SA

- Pocino Foods Co.

- Samworth Brothers Ltd.

- Schneiders

- Seaboard Corp.

- Sierra Meat and Seafood

- Sigma Alimentos SA de CV

- The Kraft Heinz Co.

- Tyson Foods Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of cured and processed meat products, including beef, pork, poultry, and other varieties such as hog, ovine, and veal. These meats are often sliced and sold in prepackaged vacuum-sealed portions for convenience, making them a popular choice for consumers with hectic lifestyles. The availability of deli meats has expanded beyond traditional supermarkets and hypermarkets to include convenience stores, specialty stores, and even online shopping platforms. The consumer base for deli meats is diverse and growing, driven in part by the convenience they offer. However, concerns over adverse health effects associated with the consumption of processed meats have emerged.

In addition, some studies suggest a link between processed meat consumption and cardiovascular diseases, type 2 diabetes, and certain types of cancer. Manufacturers have responded to these concerns by introducing natural deli meats, which are free from synthetic hormones, toxic pesticides, and other additives. These meats are often labeled as organic or uncured, and may contain ingredients such as enzymes, spices, and natural flavorings to enhance their taste. Some innovative flavors and new product offerings have also emerged in response to changing consumer preferences. Despite these concerns, the market continues to grow, driven in part by the versatility of the product.

Furthermore, deli meats are used in a variety of dishes, from sandwiches and charcuterie trays to ready-to-cook meals and on-the-go snacks. They are also used in a range of cuisines, from classic American sandwiches to European-style dishes. The market dynamics of the deli meat industry are complex, with leading companies employing various distributive strategies to reach consumers. These strategies include direct sales, partnerships with retailers, and online sales channels. Shelf life and moisture removal are key considerations In the production and distribution of deli meats, as are quality and safety concerns. The prevalence of diseases associated with processed meat consumption has led to increased scrutiny of the industry, particularly with regard to the use of antibiotics and preservatives in deli meats.

Moreover, some consumers are seeking out alternative sources of protein, such as plant-based options or organic meats, in response to these concerns. Despite these challenges, the market remains a significant revenue generator, driven by consumer demand for convenient, flavorful, and versatile food products. The market is expected to continue growing, driven by urbanization, population growth, and changing consumer preferences. While concerns over health effects have led to increased scrutiny of the industry, innovations in natural and organic deli meats, as well as new product offerings and distributive strategies, are helping to meet changing consumer preferences and drive growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market growth 2025-2029 |

USD 110.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.3 |

|

Key countries |

US, Germany, Canada, China, UK, Japan, Italy, India, France, and Brazil |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Deli Meat Market Research and Growth Report?

- CAGR of the Deli Meat industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the deli meat market growth of industry companies

We can help! Our analysts can customize this deli meat market research report to meet your requirements.