Dental Implant Abutment Systems Market Size 2024-2028

The dental implant abutment systems market size is forecast to increase by USD 560.5 million at a CAGR of 7.08% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing prevalence of dental diseases and the subsequent need for restorative solutions. According to the World Health Organization, over 3.5 billion people worldwide have dental caries, and this number is projected to increase. Technological advances, such as the development of customizable and aesthetically pleasing abutment designs, are further driving market growth in dentures and oral hygiene, enhancing both functionality and patient satisfaction. However, limitations and complications associated with dental implant abutment systems, such as biocompatibility issues and the risk of peri-implantitis, remain challenges that must be addressed to ensure patient safety and satisfaction. Overall, the market is expected to continue growing, fueled by advances in technology and the rising demand for effective dental restorations.

What will be the Size of the Dental Implant Abutment Systems Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing prevalence of oral disorders such as tooth decay, periodontitis, and tooth loss. These conditions often necessitate dental implant procedures, which utilize abutment systems as essential components. Abutments serve as the connection between the dental implant and the dental restoration, such as a crown or dental bridge. Implant technology advancements, including surface treatments and implant design, have led to improved osseointegration and biocompatibility with the jawbone. Implant materials, predominantly titanium alloys, are allergy-free and have proven successful in dental implant surgeries.

- Hospitals, dental practices, research institutes, and prosthodontic residents rely on these systems to restore oral health and enhance dental aesthetics. Dental care and medical insurance coverage for dental implant procedures have also contributed to market growth. The market caters to various dental disorders, providing a range of products, including aligners, teeth whitening kits, and dental implant surgery-related accessories. The focus on prosthodontists' expertise in designing and implementing dental implant solutions further strengthens the market's influence.

How is this Dental Implant Abutment Systems Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Stock/pre-fabricated abutment systems

- Custom abutment systems

- Technology

- Pre-mill

- CAD/CAM

- Geography

- North America

- US

- Europe

- Germany

- France

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

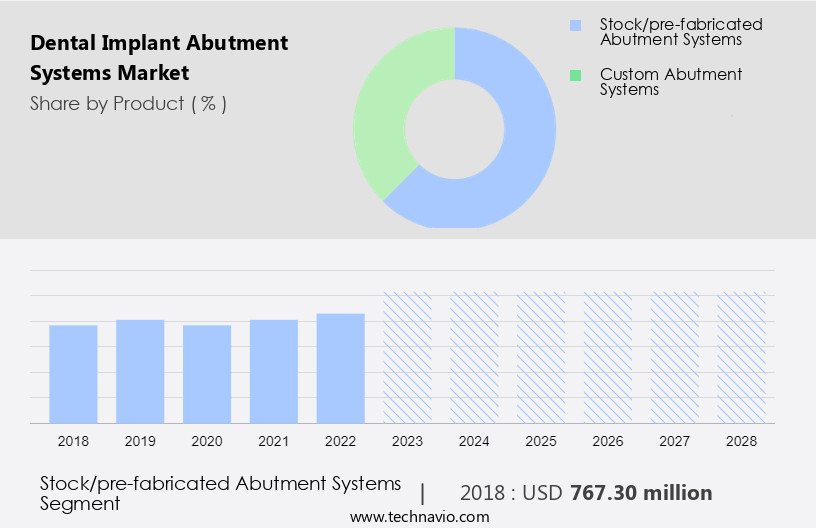

- The stock/pre-fabricated abutment systems segment is estimated to witness significant growth during the forecast period. Dental implant abutment systems play a crucial role in restoring self-esteem and improving oral health by supporting prosthetic restorations such as crowns and bridges. These systems are integral to dental operations, ensuring tooth alignment and color matching. Dental practitioners utilize advanced technologies like computer-aided design (CAD) and computer-aided manufacture (CAM) in conjunction with three-dimensional imaging and precision-guided surgery for optimal results. The abutment systems segment is categorized into zirconia and titanium, with each offering unique benefits. Zirconia abutments provide a white tooth-like tint, while titanium abutments offer superior heat conductivity, fracture toughness, and flexural strength. However, potential adverse reactions and immunological responses are considerations in the long-term viability of these materials.

- Dental clinics and dental specialists, including prosthodontists, oral surgeons, and periodontists, employ implant dentistry to address various oral disorders, such as periodontitis. Medical insurance coverage and dental aesthetic products, like teeth whitening kits, aligners, and veneers, contribute to the market's growth. Implant manufacturers continue to innovate, offering customized solutions to cater to diverse patient needs.

Get a glance at the market report of share of various segments Request Free Sample

The Stock/pre-fabricated abutment systems segment was valued at USD 767.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Dental implant abutment systems play a crucial role in restoring self-esteem and improving oral health by supporting prosthetic restorations such as crowns and bridges. Dental practitioners utilize advanced technologies like computer-aided design (CAD) and computer-aided manufacture (CAM) in conjunction with three-dimensional imaging and precision-guided surgery for optimal tooth alignment and color matching.

For more insights on the market size of various regions, Request Free Sample

The market for dental implant abutment systems is segmented into zirconia and titanium. Zirconia abutments offer benefits like biocompatibility, plaque affinity, and a white tooth-like tint, while titanium abutments provide advantages like heat conductivity, fracture toughness, and flexural strength. Dental clinics and dental specialists, including prosthodontists, oral surgeons, and periodontists, use implant dentistry to address oral disorders like Periodontitis. Implant manufacturers continue to innovate, offering medical insurance coverage for dental aesthetic products like teeth whitening kits, aligners, and veneers. However, potential adverse reactions and immunological responses may impact the long-term viability of dental implants.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Dental Implant Abutment Systems Industry?

- Increasing prevalence of dental diseases is the key driver of the market. Dental implant abutment systems play a crucial role in restoring the functionality and aesthetics of teeth lost due to various dental disorders such as dental caries, periodontal disease, oral cancer, and dental trauma. These disorders affect nearly half of the world's population, with approximately 3.5 billion people suffering from oral diseases, according to a World Health Organization study published in 2022. During dental implant surgery, a titanium abutment is fixed to the jawbone to serve as a foundation for the crown or dental bridge. Custom abutment systems are increasingly popular due to their allergy-free nature and biocompatibility. Digital technologies, including CAD/CAM systems and 3D printing, are revolutionizing the fabrication process of these systems.

- Prosthodontic residents and dental professionals use these advanced technologies for diagnosis and dental surgeries. However, insufficient reimbursement and high costs remain significant challenges in the market. Materials used in the manufacturing of these systems should be of the highest quality to ensure long-term success.

What are the market trends shaping the Dental Implant Abutment Systems Industry?

- Technological advances is the upcoming market trend. Dental implant abutment systems have experienced significant technological advancements to cater to the requirements of healthcare facilities and dental clinics. The integration of modern dentistry has led to the creation of advanced dental implant abutment systems, featuring enhanced surface innovations. Moreover, the rapid evolution of 3D printing technology has given rise to customized, biocompatible dental implant abutment systems. This manufacturing process incorporates scanning, CAD design, and 3D plastic and metal printing, providing a streamlined and painless solution for artificial tooth replacement. The use of allergy-free materials ensures biocompatibility, making these systems suitable for various dental disorders. However, insufficient reimbursement remains a challenge for the growth of the market.

- Digital technologies, such as CAD/CAM systems, are increasingly being utilized for diagnosis and dental surgeries, further driving the demand for dental implant abutment systems. Custom abutment systems, leveraging the power of CAD/CAM technology, offer personalized solutions for dental bridge applications.

What challenges does the Dental Implant Abutment Systems Industry face during its growth?

- Limitations and complications associated with dental implant abutment systems is a key challenge affecting the industry growth. These systems play a crucial role in the success of dental implant surgery by connecting the implant to the crown or dental bridge. However, these systems are not without challenges. One of the primary concerns is the failure of osseointegration or the development of periimplantitis due to bacterial leakage from the implant-abutment interface. Another issue is the lack of passive adaptation between the prosthesis and the abutment, leading to abutment screw fracture and misfit of the implant-abutment interface. Additionally, the loosening of abutment screws due to insufficient interlocking, excessive stress extension, incompatible prostheses, and poor machining components contribute to persistent inflammation around peri-implant tissue.

- These early dental implant abutment failures often occur within the first three to four months of the procedure. To address these challenges, custom abutment systems using CAD/CAM technology and 3D printing have gained popularity. These systems offer improved biocompatibility and allergy-free nature, making them a preferred choice for patients. Digital technologies, such as CAD/CAM systems, are also used for diagnosis and dental surgeries, ensuring precise and accurate fabrication of abutment systems. Despite these advancements, the high cost of these systems and insufficient reimbursement from dental insurance companies remain significant barriers to their widespread adoption. Furthermore, the materials used in the fabrication of abutment systems, such as titanium, require careful selection to ensure biocompatibility and long-term success.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adamas Implants Ltd.

- Argen Corp.

- Arum Europe GmbH

- Bio3 Implants GmbH

- Bioconcept Co. Ltd.

- Bone System Srl

- BTI Biotechnology Institute S.L.

- Cendres Metaux Management SA

- Cortex Dental Implants Industries Ltd.

- Danaher Corp.

- Dentsply Sirona Inc.

- DESS Dental Smart Solutions

- Ditron Dental

- Dyna Dental Engineering

- Dynamic Abutment Solutions

- Institut Straumann AG

- Nobel Biocare Services AG.

- ZEST Anchors LLC

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Dental implant abutment systems have revolutionized dental care, offering a durable and functional solution for missing teeth. These systems play a crucial role in dental implant procedures by connecting the implant to the dental crown, enabling natural-looking and stable tooth replacements. Hospitals, healthcare systems, dentistry practices, and research institutes are key end-users of these systems. Implant technology continues to advance, with innovations in implant design, materials, and surface treatments. Titanium alloys and ceramic materials are popular choices for their biocompatibility and durability. Oral health issues such as tooth decay and periodontal diseases, as well as lifestyle decisions and dietary preferences, contribute to tooth loss.

Moreover, dental implant therapy, using dental implant abutment systems, offers a long-term solution for missing teeth. Functionality and aesthetics are essential considerations for these systems. Patient experience, oral health issues, insurance coverage, and cosmetic dentistry are all factors influencing the market's growth. The technology continues to evolve, with the use of biomaterials like titanium-zirconia alloys and biocompatible titanium. Patient discomfort, dental tourism, age-related tooth loss, and implantation procedures are ongoing challenges in the market. However, advancements in implant designs and materials, as well as improvements in patient care, are expected to drive market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 560.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.48 |

|

Key countries |

US, Germany, Japan, China, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.