Dermatology Market Size 2025-2029

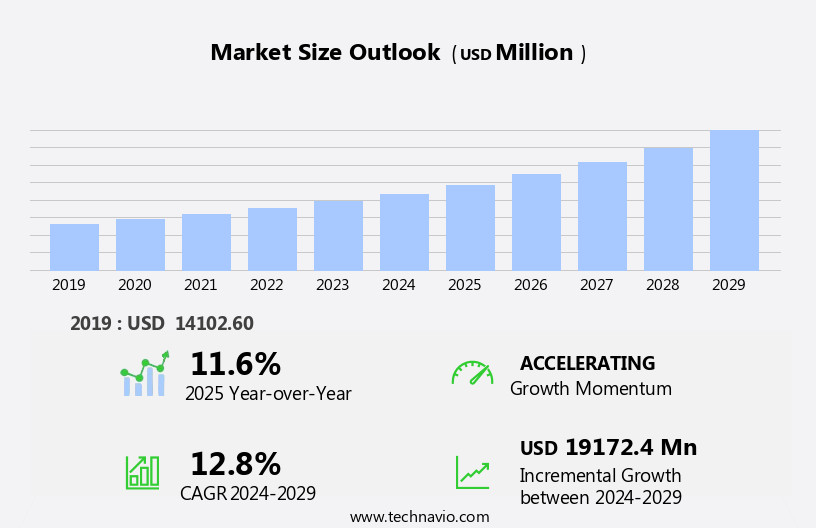

The dermatology market size is forecast to increase by USD 19.17 billion, at a CAGR of 12.8% between 2024 and 2029.

- The market is characterized by three key drivers: the increasing prevalence of skin disorders, the rise of tele dermatology, and the ongoing pursuit for safer treatments. The burgeoning prevalence of skin conditions, such as acne, psoriasis, and eczema, fuels the demand for effective dermatological solutions. This trend is further amplified by the aging population, which is more susceptible to various skin diseases. Another significant trend shaping the market is the growing adoption of tele dermatology, enabling remote diagnosis and treatment through digital platforms. This not only increases accessibility to care but also reduces the burden on traditional healthcare facilities.

- However, the market faces challenges, including the potential side effects of dermatological treatments and safety concerns. As patients become more aware of the risks associated with certain treatments, there is a growing emphasis on developing safer alternatives. Companies that can successfully navigate these challenges by offering effective, safe, and accessible solutions will be well-positioned to capitalize on the market's growth opportunities.

What will be the Size of the Dermatology Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

For instance, photodynamic therapy holds promise for improving wound healing, while innovative eczema treatments focus on addressing the root causes of the condition. Sweat glands and skin infections are also areas of ongoing research and development. New diagnostic tools, such as diagnostic imaging, are enabling earlier detection and more effective treatment of various skin conditions. Allergic contact dermatitis and acne treatment continue to be major concerns, with a growing emphasis on personalized treatment plans and the integration of natural ingredients. In the realm of surgical procedures, dermatology clinics are increasingly offering minimally invasive options, such as skin grafts and tattoo removal, to cater to the evolving needs and preferences of their clientele.

How is this Dermatology Industry segmented?

The dermatology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Acne

- Psoriasis

- Dermatitis

- Skin cancer

- Others

- End-user

- Skin clinics

- Hospitals

- Others

- Type

- Diagnostic Devices

- Treatment Devices

- Diagnostic Devices

- Treatment Devices

- Geography

- North America

- US

- Canada

- Europe

- Finland

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

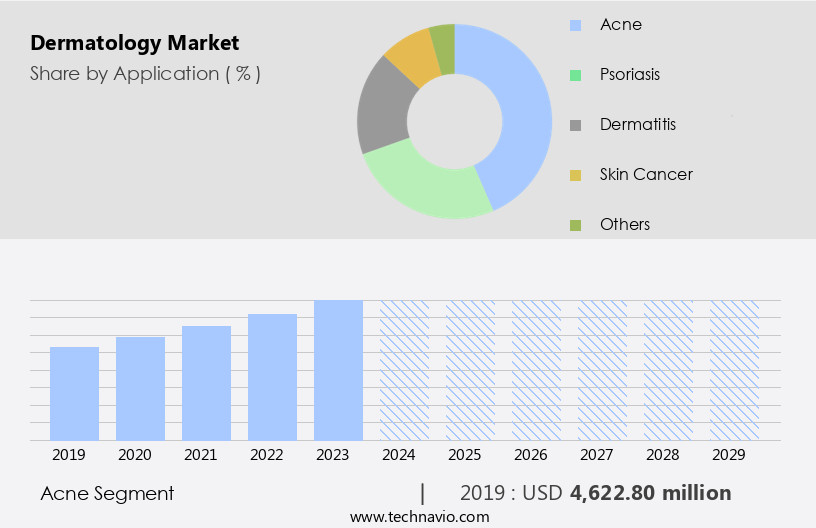

By Application Insights

The acne segment is estimated to witness significant growth during the forecast period.

The market encompasses various applications, with acne treatment being a significant segment. Acne, characterized by blackheads, whiteheads, and pimples, affects both adolescents and adults, leading to an increasing demand for effective treatments. This growth can be attributed to advancements in dermatological therapies and heightened skincare consciousness. Acne treatment innovation continues, with the introduction of topical creams, oral medications, and laser procedures. Moreover, the market expansion is fueled by the launch of advanced products and technologies, broadening access to acne treatment solutions for patients globally. Rosacea, a chronic inflammatory condition causing redness and pimples, is another prevalent application in the market.

Rosacea treatment demand is driven by its impact on self-esteem and quality of life. Furthermore, glycolic acid peels, a popular rosacea treatment, offer exfoliating benefits, making them a sought-after option. Psoriasis vulgaris, a chronic autoimmune condition causing red, scaly patches on the skin, is another application driving market growth. Psoriasis treatment, including photodynamic therapy and biologic agents, is essential for managing this condition. Additionally, the market caters to various other skin conditions, such as atopic dermatitis, skin infections, allergic contact dermatitis, and skin cancer detection. Dermatological lasers play a crucial role in treating various skin conditions, including squamous cell carcinoma, basal cell carcinoma, and actinic keratosis.

Moreover, the market offers treatments for skin aging, hair loss, and wound healing, utilizing ingredients like hyaluronic acid, vitamin C, and salicylic acid. The market's evolution is further characterized by the integration of diagnostic imaging and surgical procedures, ensuring accurate skin condition diagnosis and effective treatment. In conclusion, the market is driven by the growing demand for effective treatments for various skin conditions, the launch of innovative products and technologies, and the increasing awareness of skin health.

The Acne segment was valued at USD 4.62 billion in 2019 and showed a gradual increase during the forecast period.

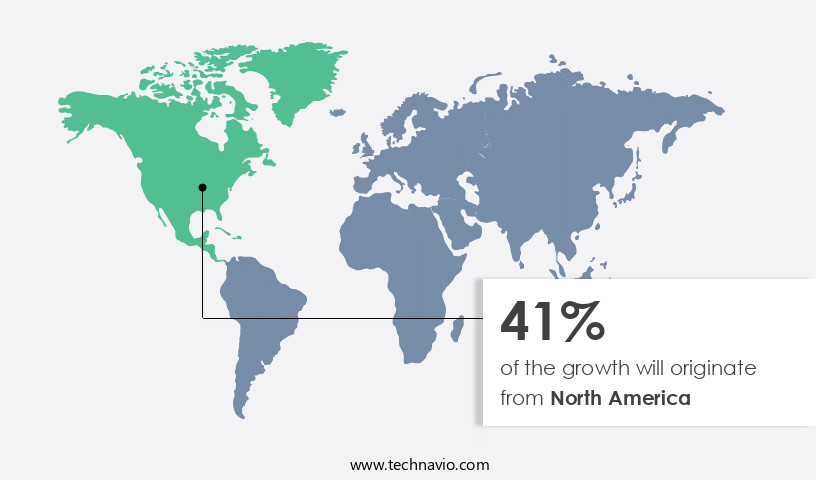

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth due to the expanding geriatric population and the high prevalence of chronic and infectious skin conditions. In the US, the rising awareness among the elderly population regarding diagnostic tests for skin diseases has fueled the demand for dermatology services. Furthermore, the increasing desire among older adults to appear younger has led to a surge in the demand for cosmetic procedures. Dermatological lasers, rosacea treatment, glycolic acid, psoriasis vulgaris, chemical peels, skin cancer detection, and various other treatments are increasingly being sought after for managing skin conditions and enhancing appearance. The market is also witnessing significant advancements in areas such as photodynamic therapy, wound healing, and eczema treatment.

Additionally, the focus on anti-aging creams, hair loss treatment, and vitamin C serums caters to the growing demand for skincare products. The market is further propelled by the increasing incidence of skin infections, allergic contact dermatitis, and skin cancer, necessitating timely and effective treatments. The market is also witnessing advancements in diagnostic imaging techniques for skin conditions and the development of new surgical procedures for skin grafts and tattoo removal. The sebaceous glands, sweat glands, hair follicles, acne vulgaris, basal cell carcinoma, and squamous cell carcinoma are some of the key areas of focus in the market. The market is also witnessing a growing emphasis on uv protection and skin barrier function to combat oxidative stress and skin aging.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and innovative market, healthcare professionals specialize in diagnosing and treating various skin conditions, from common acne and eczema to complex dermatological diseases. Patients seek expert care for melanoma, psoriasis, rosacea, and other skin disorders, driving the demand for advanced treatments and therapies. Dermatology practices employ cutting-edge technologies, such as laser treatments, chemical peels, and phototherapy, to address diverse skin concerns. Additionally, the market prioritizes research and development of new treatments, including immunotherapies and gene therapies, to improve patient outcomes. Skin care products, both prescription and over-the-counter, play a significant role in the market, addressing preventative measures and complementing medical treatments. Telemedicine and teleconsultations expand access to dermatological care, ensuring that patients receive timely and convenient diagnoses and treatments. The market continues to evolve, focusing on personalized care, patient education, and the integration of technology to enhance the overall patient experience.

What are the key market drivers leading to the rise in the adoption of Dermatology Industry?

- The rising incidence of skin disorders serves as the primary catalyst for market growth in this sector. The market is experiencing significant growth due to the rising prevalence of various skin disorders. Acne, a common dermatological issue, affects approximately 9.4% of the global population, impacting both adolescents and adults. Another chronic inflammatory skin condition, psoriasis, affects around 2-3% of the global population, with an increasing number of diagnoses reported, particularly in regions with high environmental pollution and stress levels. Skin cancer is a major concern, with the World Health Organization (WHO) estimating that nearly one-third of all cancers diagnosed globally are skin cancers, including melanoma. Advancements in technology have led to the development of innovative treatments for these conditions.

- For instance, laser therapy, a non-invasive treatment, is increasingly being used for rosacea treatment and skin cancer detection. Glycolic acid chemical peels are also gaining popularity for treating various skin conditions, such as acne and aging skin. Dermatological lasers are used for the treatment of psoriasis vulgaris and atopic dermatitis, helping to restore skin barrier function. Furthermore, the detection and treatment of squamous cell carcinoma, a type of skin cancer, have been significantly improved through the use of advanced diagnostic tools. Overall, the market is expected to continue growing due to the increasing burden of skin disorders and the availability of effective treatments.

What are the market trends shaping the Dermatology Industry?

- Tele dermatology, characterized by the increasing prevalence of remote consultations and diagnoses in dermatology, represents a significant market trend. In the market, telemedicine and virtual consultations have emerged as significant developments in recent years. Technological advancements have enabled patients to receive dermatological consultations remotely, eliminating geographical restrictions and reducing the need for in-person appointments. This trend has revolutionized healthcare accessibility, allowing individuals to consult dermatologists from the comfort of their homes. The convenience and time-saving benefits of telemedicine enable dermatologists to focus on critical conditions, such as skin cancer, and deliver optimal therapies. Moreover, telemedicine has expanded dermatological care to a larger population, driving market growth. Anti-aging creams, photodynamic therapy, wound healing, eczema treatment, acne treatment, and skin infections are some of the key areas where telemedicine has shown promising results.

- Furthermore, the increasing prevalence of skin conditions, including allergic contact dermatitis and skin infections, necessitates the need for accessible and efficient healthcare solutions. In summary, The market is witnessing significant growth due to the increasing adoption of telemedicine and virtual consultations. This trend has made dermatological care more accessible and convenient, enabling individuals to receive expert advice and treatment for various skin conditions from the comfort of their homes. The ease and affordability of telemedicine consultations are expected to drive market growth during the forecast period.

What challenges does the Dermatology Industry face during its growth?

- The expansion of the dermatology industry is significantly influenced by the complex interplay of side effects and safety concerns, which necessitates rigorous research and implementation of safe and effective treatments.

- The market is experiencing significant growth due to the increasing prevalence of various skin conditions and the demand for effective treatments. Two common areas of focus are wrinkle reduction and acne vulgaris. For wrinkle reduction, ingredients like hyaluronic acid are widely used, while salicylic acid is popular for treating acne. However, the market faces challenges, including safety concerns and the limitations of automated solutions. Seborrheic dermatitis, actinic keratosis, and tattoo removal are other significant sectors in dermatology. Seborrheic dermatitis is a chronic condition characterized by inflamed, red, and itchy patches on the skin, often affecting the scalp.

- Actinic keratosis is a precancerous skin condition caused by prolonged sun exposure. Tattoo removal, driven by the growing trend of body art and the advancement of laser technology, is another lucrative segment. Diagnostic imaging plays a crucial role in dermatology, enabling accurate identification and assessment of various skin conditions. However, the use of chatbots for dermatology consultations raises concerns due to their potential inaccuracies and lack of human oversight. Misdiagnoses or incorrect treatment suggestions from chatbots can lead to adverse effects or delayed medical interventions, making patient safety a priority. The hair follicles and sebaceous glands are essential components of skin health, and their proper functioning is vital for maintaining skin health.

- Dermatology treatments can impact these structures, and understanding their role is essential for ensuring the safety and efficacy of various treatments. Overall, the market is dynamic and complex, requiring a balanced approach to harness its potential while addressing the challenges it presents.

Exclusive Customer Landscape

The dermatology market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dermatology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dermatology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aesthetic Group - This company specializes in supplying dermatology instruments, including biopsy punches and curettes, for accurate and effective diagnostic and treatment processes within the medical field.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aesthetic Group

- Alma Lasers Ltd.

- Biofrontera AG

- Bioglint Derma Care

- Bruker Corp.

- Candela Corp.

- Canfield Scientific Inc.

- Cutera Inc.

- Cynosure LLC

- Dermatology and Co.

- DermLite LLC

- Ernst Pharmacia TM

- Fourrts India Laboratories Pvt. Ltd.

- Genesis Biosystems Inc.

- HEINE Optotechnik GmbH and Co. KG

- Image Derm Inc.

- LEO Pharma AS

- Lumenis Be Ltd.

- Novotech Health Holdings

- Solta Medical

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dermatology Market

- In January 2024, Galderma, a leading dermatology player, launched Soolantra Plus, an improved version of its existing rosacea treatment, with the FDA's approval. This new formulation offers enhanced efficacy and improved patient compliance (Galderma Press Release, 2024).

- In March 2024, Pfizer and Anapa Biotech announced a strategic collaboration to develop and commercialize Anapa's innovative gene therapy for vitiligo. This partnership aims to bring a potential cure for this chronic skin condition to market (Pfizer Press Release, 2024).

- In May 2024, Allergan plc completed the acquisition of Oculeve, a privately held ophthalmic medical device company, for approximately USD400 million. This acquisition expanded Allergan's presence in the ophthalmology and the markets (Allergan Press Release, 2024).

- In April 2025, the European Commission approved Novartis's new psoriasis treatment, Bafepilimab, marking the first interleukin-36 receptor antagonist to enter the European market. This approval is expected to significantly impact the market, with an estimated peak annual sales potential of USD1.5 billion (Novartis Press Release, 2025).

Research Analyst Overview

- The market encompasses medical devices, over-the-counter products, and prescription medications, driven by consumer behavior and industry trends. Medical technology companies invest heavily in clinical trials for innovative formulation technologies and non-invasive treatments, such as skin resurfacing and aesthetic medicine. Cosmetics manufacturers integrate active compounds into their products, catering to the price elasticity of consumers. Distribution channels expand, reaching healthcare professionals and consumers alike, fueling growth. Regulatory approvals and marketing and advertising strategies play crucial roles in brand loyalty. Dermatological pharmaceuticals and cosmetic surgery continue to shape the landscape, with product innovation and patient education key drivers.

- Skincare ingredients and price elasticity influence consumer preferences, while distribution channels and regulatory approvals shape sales forecasts. Overall, the market remains dynamic, with medical technology companies and cosmetics manufacturers driving advancements in skincare and aesthetic medicine.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dermatology Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

188 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.8% |

|

Market growth 2025-2029 |

USD 19.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.6 |

|

Key countries |

US, Finland, China, Canada, India, Japan, Germany, South Korea, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dermatology Market Research and Growth Report?

- CAGR of the Dermatology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dermatology market growth of industry companies

We can help! Our analysts can customize this dermatology market research report to meet your requirements.