Digital Insurance Market Size 2024-2028

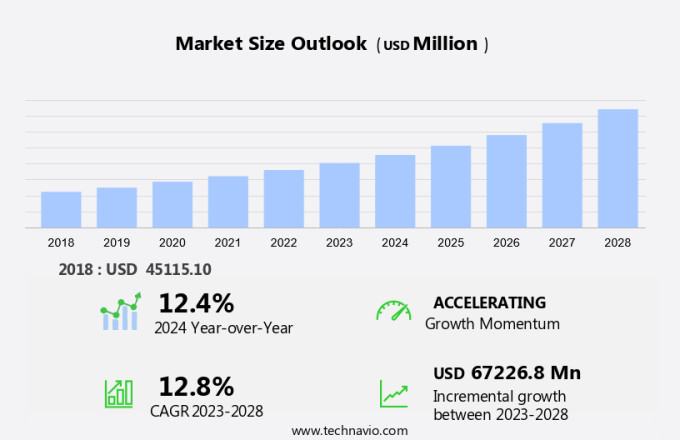

The digital insurance market size is forecast to increase by USD 67.23 billion, at a CAGR of 12.8% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of insurance policies being sold digitally. This trend is fueled by the emergence and advancement of Low Code/No Code (LCNC) development in the digital insurance sector. LCNC technologies enable insurers to create and customize digital insurance products quickly and efficiently, meeting the evolving needs of consumers. However, this market also faces challenges, primarily regulatory compliance. As digital insurance offerings expand, insurers must navigate complex regulatory landscapes to ensure they are meeting all necessary requirements.

- Compliance with data privacy and security regulations, for instance, is crucial in the digital insurance sector. Companies that effectively address these challenges and leverage LCNC technologies to streamline their digital offerings will be well-positioned to capitalize on the market's growth potential.

What will be the Size of the Digital Insurance Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Regulatory reporting, mobile apps, and customer churn are integral components shaping this industry's landscape. KYC/AML compliance, Payment Gateways, and Big Data are essential tools for insurers, enabling efficient policy administration and fraud detection. Cloud computing and data analytics facilitate real-time risk assessment and actuarial modeling, while IoT sensors and claims frequency data inform machine learning algorithms. Insurance broking, PPC marketing, and API integrations streamline the policy lifecycle management process. Catastrophe modeling and predictive modeling help insurers assess risk and manage claims processing more effectively.

Compliance regulations, such as GDPR, digital identity verification, and data privacy, ensure secure customer interactions. Insurtech solutions, including AI-powered chatbots, on-demand insurance, and policy renewals, enhance the customer experience. Usage-based insurance, embedded insurance, and investment strategies leverage data to offer personalized insurance products. Risk transfer, claims severity, and combined ratio are essential metrics for insurers, with solvency ratio and claims management systems ensuring financial stability. Wearable technology and open banking further expand the potential for innovation in the market.

How is this Digital Insurance Industry segmented?

The digital insurance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Direct sales

- Brokers/agents

- Affiliated partners

- End-user

- Individuals

- Businesses

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Distribution Channel Insights

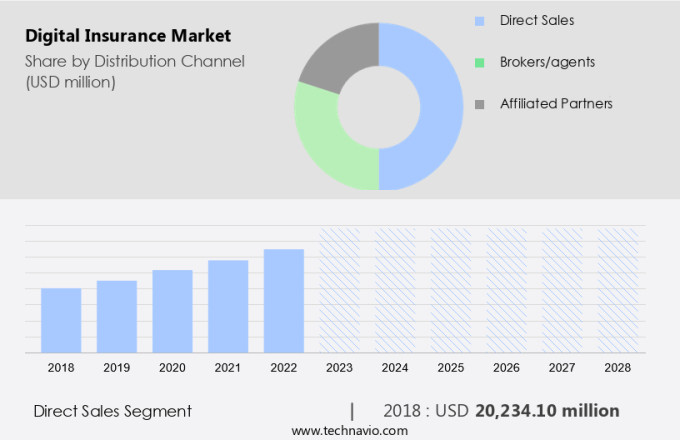

The direct sales segment is estimated to witness significant growth during the forecast period.

The market is experiencing a significant shift towards direct-to-consumer (DTC) models, eliminating the need for intermediaries such as brokers and agents. This model enables insurers to sell policies directly to consumers through digital platforms, fostering seamless interactions. The DTC approach offers numerous advantages, including cost efficiency. By removing intermediaries, insurers save on commission fees. Additionally, biometric authentication enhances security, while customer segmentation and predictive modeling provide personalized insurance solutions. Blockchain technology streamlines reinsurance treaties and policy administration systems, improving transparency and efficiency. Fraud detection and claims processing are optimized through ai-powered chatbots and claims management systems. On-demand insurance and usage-based models cater to evolving consumer needs.

Insurtech solutions, including api integrations, data analytics, and open banking, facilitate innovation and competition. Regulatory reporting, gdpr compliance, and kyc/aml compliance ensure data privacy and security. The market's evolution is further driven by digital identity verification, wearable technology, and investment strategies. Overall, the DTC model transforms the insurance industry, offering a more efficient, cost-effective, and personalized experience for consumers.

The Direct sales segment was valued at USD 20.23 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

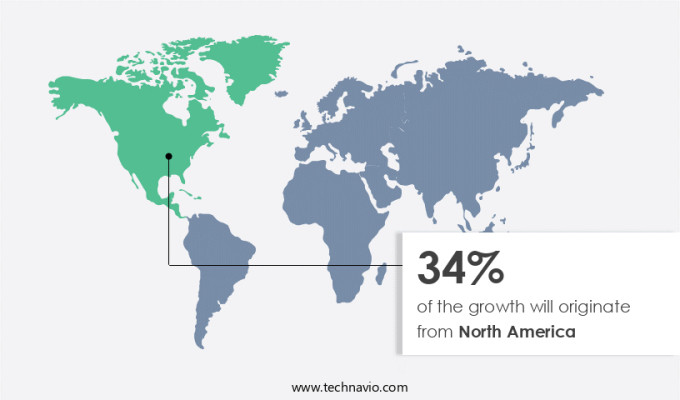

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is witnessing significant growth, fueled by technological innovations and shifting consumer preferences. This dynamic market is marked by the widespread adoption of digital platforms, enhancing accessibility and efficiency for both consumers and businesses. A pivotal trend shaping the regional digital insurance landscape is the emergence of Insurtech companies. These tech-driven firms deliver innovative insurance solutions, catering to the evolving market needs. In February 2023, a California-based Insurtech firm, NEXT Insurance, announced a strategic partnership with LegalZoom. This collaboration aims to streamline the insurance buying process for small businesses by integrating insurance offerings with LegalZoom's legal services platform.

Moreover, biometric authentication and API integrations are transforming the industry by ensuring secure and seamless customer experiences. Policy administration systems, fraud detection, and predictive modeling are other key areas where technology is driving improvements, leading to increased customer satisfaction and loyalty. Additionally, regulatory compliance, such as GDPR and KYC/AML, is being addressed through advanced digital identity verification and regulatory reporting solutions. Insurance platforms are incorporating machine learning and AI-powered chatbots to provide personalized insurance offerings and enhance claims processing. Wearable technology and usage-based insurance are also gaining traction, enabling real-time risk assessment and tailored insurance policies. Furthermore, open banking and big data are revolutionizing the industry by enabling real-time data access and analytics, leading to improved risk assessment and pricing models.

Blockchain technology is being explored for its potential in risk transfer, claims processing, and policy administration, offering increased transparency and security. Reinsurance treaties are being digitized, enabling real-time risk assessment and transfer, and reducing the need for intermediaries. Policy lifecycle management, including policy renewals and claims management, is being automated, leading to increased efficiency and reduced costs. Insurtech solutions are also addressing the challenges of on-demand insurance, catastrophe modeling, and investment strategies, providing customized solutions for various industries and use cases. Digital insurance policies, claims processing, and loss ratio analysis are other areas where technology is driving significant improvements, leading to increased competitiveness and customer satisfaction.

The market in North America is a dynamic and evolving landscape, shaped by technological advancements, changing consumer preferences, and regulatory requirements. The integration of various technologies, including biometric authentication, API integrations, machine learning, and blockchain, is driving innovation and improving the overall customer experience. The market is expected to continue growing, as businesses and consumers increasingly demand more accessible, efficient, and personalized insurance solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving the market, insurers leverage advanced technology to deliver innovative solutions that cater to customers' diverse needs. Digital platforms facilitate seamless policy purchases, real-time claims processing, and personalized risk assessments. Artificial intelligence and machine learning algorithms enhance underwriting, fraud detection, and customer engagement. Telematics devices monitor driving behavior for usage-based insurance. Blockchain technology ensures secure data sharing and smart contracts. Mobile apps enable on-the-go access to policies, claims, and customer service. Robo-advisors offer customized recommendations based on user data. Cybersecurity measures protect sensitive information. Digital transformation in the insurance industry continues to redefine customer experience and operational efficiency.

What are the key market drivers leading to the rise in the adoption of Digital Insurance Industry?

- The significant growth in the number of insurance policies sold is the primary factor fueling market expansion.

- The market is experiencing notable growth due to several factors. One significant driver is the increasing enrollment in Medicare, projected to reach 61 million in 2024, with further expansion to 74 million by 2034. This demographic shift underscores the rising demand for Health Insurance among the aging population. Moreover, advancements in technology are revolutionizing the insurance industry. Affiliate marketing strategies are being employed to expand customer reach, while insurtech solutions streamline policy administration systems. Biometric authentication and fraud detection systems ensure policyholder security and accuracy.

- Reinsurance treaties are being managed through blockchain technology for enhanced transparency and efficiency. Insurance premiums are being calculated using advanced catastrophe modeling and risk assessment techniques. API integrations enable seamless data exchange between insurers and third-party providers, ensuring accurate and timely policy renewals. These technological advancements are transforming the insurance landscape, making it more accessible and convenient for customers.

What are the market trends shaping the Digital Insurance Industry?

- The digital insurance sector is experiencing an emerging trend towards the development of Living Connected Care (LTC) solutions. LTC is a significant innovation in the industry, and its adoption is increasingly mandatory for insurers to remain competitive.

- The market is experiencing substantial growth and transformation due to the adoption of advanced technologies. Actuarial modeling and predictive analytics are increasingly being used to assess risk and price policies more accurately. Insurance platforms are integrating digital identity verification systems to ensure GDPR compliance and enhance security. On-demand insurance solutions are gaining popularity, offering customers flexible coverage for specific periods. AI-powered chatbots are streamlining customer interactions, providing personalized insurance recommendations based on data analysis. Policy lifecycle management systems enable insurers to automate processes, reduce errors, and improve efficiency. Social media marketing is being leveraged to reach wider audiences and engage customers.

- Data privacy and encryption are critical concerns, with insurers investing in robust security measures to protect sensitive customer information. The integration of LCNC platforms simplifies application development, reducing complexity and development time, and broadening the talent pool for insurance tech projects. These innovations are shaping the future of the digital insurance industry.

What challenges does the Digital Insurance Industry face during its growth?

- In the digital insurance sector, ensuring regulatory compliance is a critical challenge that significantly impacts industry growth. This requirement necessitates a profound understanding of various regulations and their implementation in the digital context, as non-compliance can lead to severe consequences, including legal action and reputational damage.

- The market is subject to rigorous regulatory reporting requirements, with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) shaping the industry landscape. Insurers must ensure compliance with customer data management, consent mechanisms, data breach reporting, and the lawful processing of personal information to avoid severe penalties, reputational damage, and customer trust erosion. Compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA) for medical information and the Gramm-Leach-Bliley Act (GLBA) for financial data is mandatory. Insurtech innovations, such as mobile apps, payment gateways, and IoT sensors, are transforming the market.

- Big data and cloud computing enable insurers to leverage data analytics for risk assessment, claims frequency analysis, and machine learning models to personalize insurance offerings. Customer churn is a significant concern, and insurers are investing in insurance broking and pay-per-click (PPC) marketing strategies to attract and retain customers. The market's future growth depends on the ability to balance regulatory compliance with technological innovation and customer expectations.

Exclusive Customer Landscape

The digital insurance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital insurance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital insurance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACKO General Insurance Ltd - In the digital insurance landscape, our company provides coverage for automobiles, bicycles, and health, leveraging advanced technology to streamline the buying process and deliver customized policies to clients worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACKO General Insurance Ltd

- Allianz SE

- AXA Group

- DeadHappy Ltd.

- Ethos Technologies Inc

- Getsafe Digital GmbH

- Go Digit General Insurance Ltd.

- Haven Life Insurance Agency LLC

- Hippo Enterprises Inc

- ICICI Prudential Life Insurance Co. Ltd

- Insured Nomads Corp

- Kin Insurance Technology Hub LLC

- Ladder Insurance Services, LLC

- Lemonade Inc.

- Life Insurance Corp. of India

- New York Life Insurance Co

- NEXT Insurance

- OPES insurance

- Oscar Insurance Corp.

- RELX Plc

- Root inc

- Sure inc

- The Allstate Corp.

- Turtlemint Insurance Broking Services Pvt Ltd

- Vitality Health Limited

- wefox Insurance AG

- Westland Insurance

- Willis Towers Watson Public Ltd. Co.

- Yu Life ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Insurance Market

- In January 2024, Lemonade, a leading digital insurtech company, announced the launch of its new product, "Lemonade for Business," expanding its offerings beyond home and auto insurance to include commercial insurance (Reuters). This move aimed to cater to the growing demand for digital business insurance solutions.

- In March 2024, Allstate and State Farm, two major insurance players, formed a partnership to collaborate on digital insurance initiatives, including the development of new digital products and the enhancement of their existing offerings (Wall Street Journal). This strategic alliance was aimed at strengthening their competitive positions in the rapidly evolving the market.

- In May 2024, Chubb, a well-established insurance company, completed the acquisition of ACE Group for approximately USD28.3 billion, creating the world's largest commercial insurer (SEC Filing). This merger was a significant move to expand Chubb's market presence and enhance its product offerings in the digital insurance space.

- In January 2025, the European Union's Executive European Commission approved the Digital Single Market Strategy for Insurance, allowing insurers to sell insurance products across EU borders, improving customer choice and competition in the European the market (European Commission Press Release). This regulatory approval was a significant step towards creating a unified the market in Europe.

Research Analyst Overview

- In the dynamic the market, API security assumes paramount importance to safeguard sensitive data during information exchange. User interface (UI) design and user experience (UX) optimization are key differentiators, as international insurers compete for customers' attention. Investment portfolio management, data analytics dashboards, and predictive analytics enable insurers to assess risk management strategies effectively. Insurance fraud prevention and claims adjustment are enhanced through data mining and machine learning. Mobile app development is a priority for insurers, offering convenience and personalized services. Legal compliance, financial modeling, and prescriptive analytics are integral to making informed decisions. Sales funnel optimization and marketing automation are essential for effective customer onboarding.

- Financial technology (fintech) innovations, such as microservices architecture and insurance comparison sites, disrupt traditional business models. Data governance, policy documentation, and information security management are crucial for maintaining trust and transparency. Insurance regulations demand adherence to capital allocation and third-party risk management standards. Business intelligence (BI) and decision support systems help insurers stay competitive in the rapidly evolving market. Cloud computing infrastructure and information security are vital components of a robust digital strategy.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Insurance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.8% |

|

Market growth 2024-2028 |

USD 67226.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.4 |

|

Key countries |

US, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Insurance Market Research and Growth Report?

- CAGR of the Digital Insurance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital insurance market growth of industry companies

We can help! Our analysts can customize this digital insurance market research report to meet your requirements.