Direct Drive Wind Turbine Market Size 2024-2028

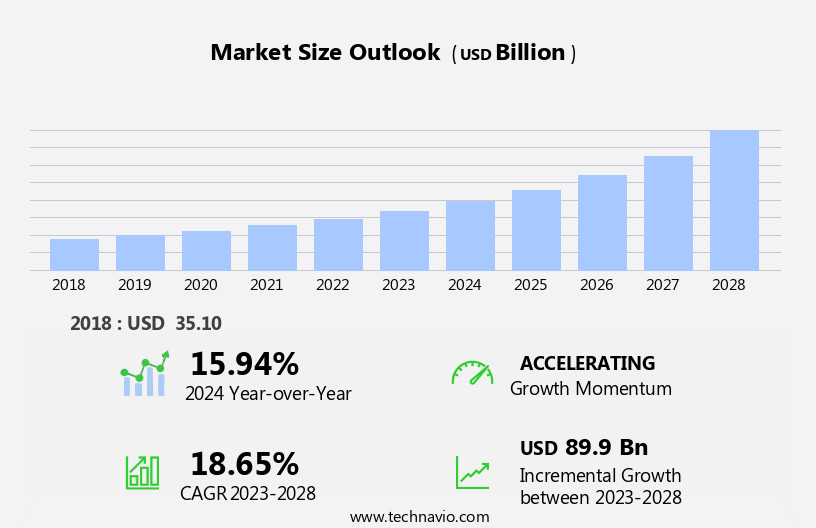

The direct drive wind turbine market size is forecast to increase by USD 89.9 billion at a CAGR of 18.65% between 2023 and 2028.

- Direct drive wind turbines have gained significant traction in sectors like renewable energy due to their unique design and advantages over conventional wind turbines. These turbines, which utilize a direct drive system between the wind rotor and the generator, offer increased efficiency and reliability. The market for direct drive wind turbines is driven by several key factors.

- Favorable government policies promoting the use of renewable energy and the rising number of offshore wind farm installations are significant growth drivers. However, the intermittent nature of wind energy poses a challenge, requiring advanced automation and grid integration solutions. The use of permanent magnets in direct drive wind turbines, particularly those with spa (super permanent magnets) technology, is a notable trend.

- This technology enhances the turbine's performance and reduces its environmental footprint by minimizing the need for rare earth materials. Direct drive wind turbines also offer improved power quality, making them an attractive option for grid-connected applications.

What will be the Size of the Direct Drive Wind Turbine Market During the Forecast Period?

- The market represents a significant segment withIn the broader renewable energy sector, driven by the increasing demand for clean energy and advancements in wind turbine. Direct drive wind turbines, which utilize permanent magnet synchronous or electrically excited synchronous generators without traditional gearboxes, offer several advantages, including lower maintenance requirements, simpler design, and increased efficiency. The market for direct drive wind turbines is experiencing robust growth due to the benefits they provide in terms of weight reduction, reliability, and ease of installation, particularly in offshore locations. The global market size is anticipated to expand substantially, driven by government policies promoting clean energy and technological advancements in direct drive systems.

- Despite the advantages, the initial capital investment for direct drive wind turbines can be higher than traditional turbines. However, the long-term savings from reduced maintenance and increased efficiency make them a compelling choice for wind power plant operators. The complexity in design and production of direct drive systems presents challenges, but ongoing research and development efforts are addressing these issues. Floating wind turbines, a subsegment of the direct drive market, are gaining traction due to their ability to harness wind energy in deeper waters, expanding the potential capacity of wind power plants. The market dynamics are influenced by various factors, including production capacity, lockdown protocols, and the overall direction of the wind energy sector.

How is this Direct Drive Wind Turbine Industry segmented and which is the largest segment?

The direct drive wind turbine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Capacity

- Less than 1MW

- 1MW to 3MW

- More than 3MW

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

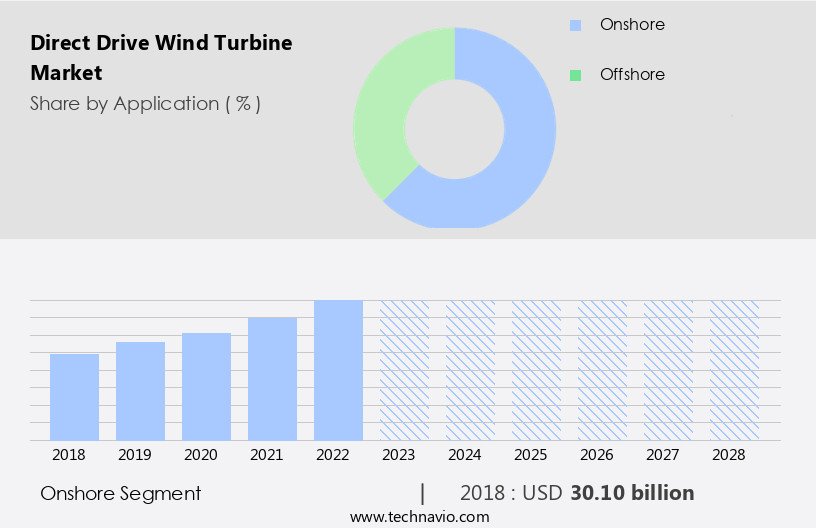

- The onshore segment is estimated to witness significant growth during the forecast period.

The global wind energy market primarily consists of onshore installations, which accounted for approximately 90% of the total wind power capacity in 2021, according to the Global Wind Energy Council (GWEC). In 2021, new onshore wind installations amounted to 72.5 GW, representing a growth of 10% compared to the previous year. Notably, Europe, Latin America, Africa, and the Middle East experienced significant increases of 19%, 27%, and 120% in new onshore wind installations, respectively. However, China and the US, the two leading wind markets, experienced a decline in new installations in 2021. The wind energy sector is witnessing technological advancements, such as direct drive systems, floating wind turbines, and 3D printing, aimed at enhancing efficiency, reducing maintenance costs, and increasing overall capacity.

Government policies and incentives continue to play a crucial role In the growth of the renewable energy sector. The integration of innovative technologies, such as condition monitoring and predictive maintenance, is also contributing to the sector's expansion. Despite the challenges posed by lockdown protocols and production disruptions, the wind energy market is expected to continue its growth trajectory, driven by the increasing demand for clean energy and advancements in gearbox technology.

Get a glance at the Direct Drive Wind Turbine Industry report of share of various segments Request Free Sample

The Onshore segment was valued at USD 30.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

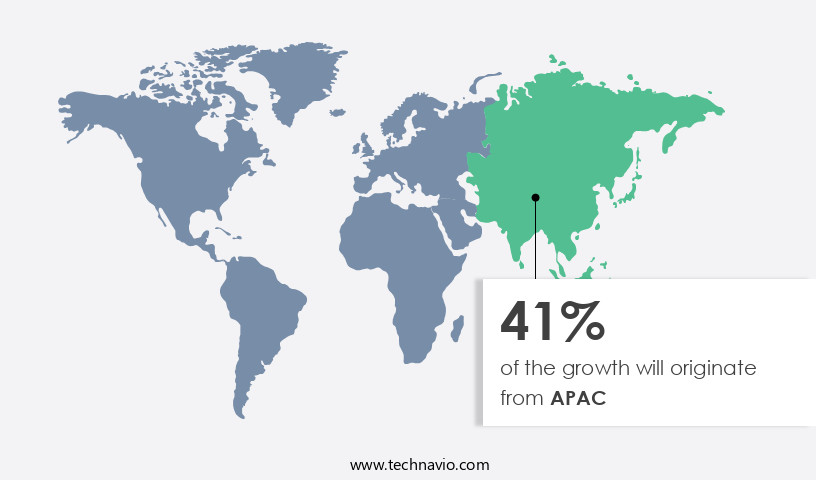

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to the increasing focus on renewable energy sources and the rising energy demands driven by population growth and improved living standards. Countries In the region, particularly China and India, are shifting their power generation focus towards wind energy to reduce greenhouse gas (GHG) emissions caused by fossil fuels. This shift has led to an increase in new wind installations, both onshore and offshore, to meet the growing energy needs. Advancements in gearbox technology, such as permanent magnet synchronous and electrically excited synchronous generators, have simplified the design of wind turbines, making them more efficient and requiring lower maintenance.

Direct drive systems, which eliminate the need for traditional gearboxes, further reduce weight and maintenance problems, making wind turbines more cost-effective In the long run. Policies and incentives from governments and renewable energy players have made the wind sector a hotspot for investment in APAC. Taiwan's wind sector and Chinese manufacturers, such as Goldwind and Fujian Equipment Manufacturing, are leading the way in wind power generation. Floating wind turbines and offshore wind power are also gaining popularity due to their higher capacity and potential to generate more electricity. The overall cost of wind energy has been decreasing due to technological advancements, making it a more competitive and attractive energy source.

Integration of innovative technologies, such as condition monitoring and predictive maintenance, has increased the efficiency of wind turbines and reduced maintenance costs, making them a more viable and cost-effective option for energy generation. The offshore sector, particularly new offshore installations, is expected to see significant growth due to favorable wind speeds and the potential for higher capacity. According to the International Renewable Energy Agency (IRENA), APAC is the dominant wind market, with over 50% of the world's total wind installed capacity. The region's wind power capacity is expected to continue growing, making it a business destination for wind turbine manufacturers and investors alike.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Direct Drive Wind Turbine Industry?

Favorable government policies is the key driver of the market.

- Wind energy generation is a key component of the global shift towards clean energy, with wind turbines being a dominant player in this sector. The wind energy market is driven by government policies encouraging renewable energy and the integration of innovative technologies. Permanent magnet synchronous and electrically excited synchronous generators are commonly used in wind turbines. Direct drive systems, which eliminate the need for gearboxes, are gaining popularity due to their lower maintenance requirements and complexity in design. Offshore wind power is a growing segment, with floating wind turbines and advancements in gearbox technology enabling installation in deeper waters.

- The offshore sector presents an opportunity for significant capacity expansion, with new offshore wind installations expected to increase the overall cost-effectiveness of wind power. The offshore wind annual installed capacity is projected to reach new heights, with IRENA reporting a record 15.5 GW installed in 2020. Direct drive wind turbines offer several advantages, including increased efficiency, reduced maintenance costs, and improved condition monitoring through predictive maintenance. However, their initial capital investment is higher than traditional turbines. Chinese manufacturers, such as Goldwind and Fujian Equipment Manufacturing, are leading the way In the development of direct drive systems. The wind energy market is a hotspot for investment, with incentives and capacity targets driving growth in both onshore and offshore installations.

- In 2008, the US Department of Energy set a goal of providing 20% of the total electricity supply from wind power by 2030. This policy, along with advancements in wind turbine technology, has made wind power a business destination for numerous players In the renewable energy sector. Despite the challenges, the wind energy market continues to grow, offering significant potential for businesses and investors.

What are the market trends shaping the Direct Drive Wind Turbine Industry?

Rising number of offshore wind farm installations is the upcoming market trend.

- Offshore wind energy generation is experiencing significant growth due to the increasing demand for clean and renewable energy sources. Compared to onshore wind farms, offshore wind projects offer better operational conditions, with more consistent wind speeds and directions at sea. This results in higher fan utilization rates for offshore wind turbines, leading to an annual generating capacity that is significantly greater than onshore wind power plants. The complexity in design of offshore wind turbines, including the use of permanent magnets in generators and direct drive systems, requires advanced gearbox technology for efficient energy transfer. While the initial capital investment for offshore wind projects is higher than onshore installations, the low maintenance requirements and long-term efficiency make it a worthwhile investment.

- Advancements in wind turbine technology, such as the integration of innovative condition monitoring and predictive maintenance systems, are further reducing maintenance costs and increasing overall efficiency. The offshore sector is expected to be a hotspot for investment In the renewable energy market, with players like Goldwind and Fujian Equipment Manufacturing leading the way in wind turbine manufacturing. IRENA reports that offshore wind installed capacity is expected to reach 110 GW by 2030, with floating wind turbines and 3D printing technology playing a key role In the development of new offshore wind power projects. Policies and incentives from governments around the world are also driving the growth of the offshore wind market, making it an attractive business destination for investors.

- Despite the challenges of offshore wind installation, the capacity of offshore wind power is expected to surpass onshore wind installations In the near future. The offshore wind industry is poised for continued growth, with advancements in technology and increasing investments In the sector.

What challenges does the Direct Drive Wind Turbine Industry face during its growth?

Intermittent nature of wind energy is a key challenge affecting the industry growth.

- The global wind energy market is experiencing significant growth due to increasing demand for clean energy and government policies promoting renewable energy sources. Wind energy generation relies on gearboxes, permanent magnets, and generators to convert wind energy into electricity. However, the complexity in design and maintenance of traditional gearbox turbines can pose challenges, leading to weight and maintenance problems, which increase initial capital investment. Advancements in wind turbine technology, such as permanent magnet synchronous and electrically excited synchronous generators, offer solutions for low maintenance and higher efficiency. The integration of innovative technologies like condition monitoring, predictive maintenance, and 3D printing is revolutionizing the wind energy sector.

- Offshore wind power is gaining popularity due to its higher capacity and potential to generate more electricity compared to onshore installations. Floating wind turbines are the latest advancements in offshore wind energy, allowing installation in deeper waters. However, offshore wind installations come with higher overall costs due to complex logistics and installation processes. The wind energy market is dominated by Chinese manufacturers like Goldwind and Fujian Equipment Manufacturing, but European players are also significant contributors. The industry is expected to continue growing, with investments in Taiwan's wind sector and new offshore wind installations becoming a hotspot for investment.

- IRENA reports that wind installed capacity reached 735 GW in 2020, and the annual growth rate for offshore wind energy is projected to be 15% from 2021 to 2026. The wind power industry offers opportunities for businesses, with wind turbine direct drive systems and offshore sector investments expected to increase. Wind speed and wind energy policies also play a crucial role In the market's growth.

Exclusive Customer Landscape

The direct drive wind turbine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the direct drive wind turbine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, direct drive wind turbine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - Direct drive wind turbines, characterized by their simplified design and elimination of the need for a gearbox, offer streamlined installation and management processes. This technology, which the company specializes in, enables enhanced operational efficiency and reduced maintenance requirements, making it an attractive option for renewable energy investors and operators.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Anhui Hummer Dynamo Co. Ltd.

- Bachmann electronic GmbH

- Bora Energy

- Emergya Wind Technologies BV

- ENERCON GmbH

- Extol Wind

- Foshan Ouyad Electronic Co. Ltd.

- General Electric Co.

- Leitwind SPA

- M Torres Disenos Industriales SAU

- Mervento Power Technology AB

- Northern Power Systems Srl

- Qingdao Hengfeng Wind Power Generator Co. Ltd.

- ReGen Powertech Pvt. Ltd.

- Rockwell Automation Inc.

- Shanghai Electric Group Co.

- Siemens AG

- XEMC Darwind BV

- Xinjiang Goldwind Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global wind energy market continues to expand as the demand for clean energy sources grows. Wind energy, as a significant contributor to the renewable energy sector, has gained considerable traction due to its ability to generate electricity in a sustainable and low-emission manner. Two primary types of wind turbines exist In the market: those with traditional gearboxes and direct drive systems. Direct drive wind turbines have gained popularity due to their simplicity in design and low maintenance requirements. In contrast to traditional turbines that utilize gearboxes, direct drive systems eliminate the need for complex gear trains, thereby reducing the overall weight and complexity of the turbine.

This design feature is particularly advantageous for offshore wind power generation, where the transportation and installation of heavy components can be costly and challenging. The advancements in direct drive wind turbine technology have been significant, with the integration of innovative components such as permanent magnets and generators. Permanent magnet synchronous generators (PMSG) and electrically excited synchronous generators (ESG) have emerged as preferred options for direct drive systems due to their high efficiency and reliability. Despite the benefits, the initial capital investment for direct drive wind turbines can be higher than that of traditional gearbox turbines due to the use of advanced technologies.

However, the long-term cost savings from reduced maintenance requirements and increased efficiency make direct drive systems an attractive option for wind power plant operators. The wind industry has witnessed numerous technological advancements in recent years, including the development of floating wind turbines and the application of 3D printing in wind turbine components. These innovations have expanded the potential for wind energy generation in various locations, including offshore areas with high wind speeds. Policies and incentives have played a crucial role In the growth of the wind energy market. Governments worldwide have implemented regulations and subsidies to promote the adoption of renewable energy sources, making wind power an attractive business destination for investors.

The wind sector has become a hotspot for investment, with major players such as Goldwind and Fujian Equipment Manufacturing Company leading the charge In the development and production of wind turbines. The wind installed capacity has grown significantly, with both onshore and offshore wind installations contributing to the overall capacity expansion. The offshore wind sector, in particular, has seen remarkable growth due to the vast potential for wind energy generation in offshore locations. The offshore wind annual installed capacity has been increasing steadily, with new offshore wind projects coming online each year. The wind power market is expected to continue its growth trajectory, driven by technological advancements, policy support, and the increasing demand for clean energy.

The integration of condition monitoring and predictive maintenance systems in wind turbines has further improved the efficiency and reliability of wind power generation, making it a more attractive option for businesses and investors. In conclusion, the wind energy market is poised for continued growth as the world transitions towards cleaner energy sources. Direct drive wind turbines, with their simplicity in design and low maintenance requirements, are an attractive option for wind power plant operators, particularly in offshore locations. The integration of innovative technologies and the support of favorable policies and incentives will continue to drive the expansion of the wind energy market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.65% |

|

Market growth 2024-2028 |

USD 89.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.94 |

|

Key countries |

China, US, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Direct Drive Wind Turbine Market Research and Growth Report?

- CAGR of the Direct Drive Wind Turbine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the direct drive wind turbine market growth of industry companies

We can help! Our analysts can customize this direct drive wind turbine market research report to meet your requirements.