Distributed Temperature Sensing Market Size 2024-2028

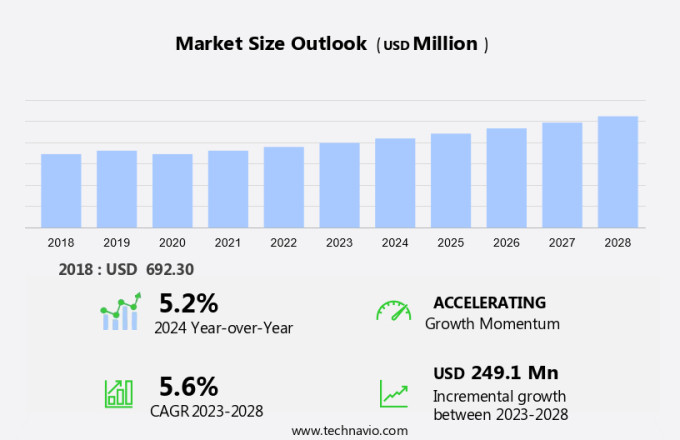

The distributed temperature sensing market size is forecast to increase by USD 249.1 million, at a CAGR of 5.6% between 2023 and 2028.

- The Distributed Temperature Sensing (DTS) market is experiencing significant growth due to the increasing demand for optimized performance and safety enhancement in various industries, particularly in the oil and gas sector. DTS technology's ability to provide real-time temperature monitoring and measurement over long distances makes it an essential tool for ensuring operational efficiency and safety in this sector. However, the market faces a notable challenge: the short service life of fiber optic cables used in DTS systems. This issue necessitates frequent maintenance and replacement, which can increase operational costs.

- Companies in the DTS market must address this challenge by investing in research and development to extend the lifespan of fiber optic cables or exploring alternative sensing technologies. By doing so, they can capitalize on the vast opportunities presented by the growing importance of DTS in the oil and gas sector and other industries requiring real-time temperature monitoring.

What will be the Size of the Distributed Temperature Sensing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The distributed temperature sensing (DTS) market continues to evolve, driven by the increasing demand for real-time monitoring and data analysis in various sectors. DTS systems, which utilize fiber optic cables to measure temperature distributions in real time, find applications in reservoir management, data acquisition, data logging, asset integrity management, safety and security, pressure transducers, data visualization, calibration services, and power generation. Cloud computing and edge computing are transforming the way data is processed and analyzed, enabling faster response times and more accurate results. DTS technology is being integrated into these platforms to provide advanced capabilities for industries such as chemical processing, environmental monitoring, and pipeline monitoring.

The market dynamics are shaped by ongoing advancements in technology, including machine learning, deep learning, and artificial intelligence, which are used for predictive maintenance, corrosion detection, and leak detection. These technologies enable early warning systems and production optimization, ensuring the efficient and safe operation of critical infrastructure. Furthermore, the market is witnessing the emergence of software platforms that provide data security and seamless integration of hardware components. Training services and installation services are also becoming essential to ensure the effective implementation and utilization of DTS systems. The evolving nature of the market is reflected in the expanding scope of applications, from wellhead monitoring and subsea monitoring to flow measurement and process control.

The continuous unfolding of market activities underscores the importance of DTS technology in ensuring the safety, efficiency, and productivity of various industries.

How is this Distributed Temperature Sensing Industry segmented?

The distributed temperature sensing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Oil and gas

- Manufacturing

- Industrial infrastructure monitoring

- Environmental monitoring

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The oil and gas segment is estimated to witness significant growth during the forecast period.

In the oil and gas industry, fiber optic cables with Distributed Temperature Sensing (DTS) technology have gained significant traction due to their advantages, including electrical immunity, resistance to harsh environments, long-term measurement stability, and dense multiplexing capability. These features enable the retrieval of crucial operational and safety data from challenging measurement locations. DTS technology is primarily used in pipeline monitoring and surveillance systems. The oil and gas sector has seen increased focus on improving oil recovery since 2005, driven by the widespread adoption of multilateral hydraulic fracturing and continuous investment in thermally enhanced oil recovery techniques.

This trend has boosted the demand for DTS technology. companies in the market are increasingly concentrating on enhancing oil production through various means. For instance, they are developing advanced software platforms that employ machine learning and artificial intelligence to optimize production. Additionally, they are integrating real-time monitoring, data analysis, and edge computing to enable predictive maintenance and early warning systems. These solutions help prevent downtime, reduce operational costs, and ensure asset integrity management. Environmental monitoring is another area where DTS technology is being employed extensively. It is used to monitor temperature, flow, and pressure in water treatment and chemical processing applications.

DTS-based solutions enable continuous monitoring, ensuring safety and security while maintaining data security. Infrastructure monitoring and reservoir management are other applications where DTS technology is being utilized to optimize processes and enhance efficiency. The market for DTS technology is witnessing significant growth due to its versatility and ability to provide accurate, real-time data. The integration of DTS technology with other advanced technologies such as cloud computing, deep learning, and big data analytics is further driving market growth. Asset integrity management, leak detection, and corrosion detection are some of the key applications where DTS technology is being used to ensure safety and extend the life cycle of assets.

In summary, the DTS market is witnessing robust growth due to its applications in various industries, including oil and gas, chemical processing, power generation, and water treatment. The advantages of DTS technology, such as real-time monitoring, data analysis, and accuracy, make it an essential component in critical applications where safety and efficiency are paramount. companies are focusing on developing advanced solutions that leverage machine learning, artificial intelligence, and edge computing to optimize processes and enhance operational efficiency. The market is expected to continue growing as industries increasingly adopt technology-driven solutions to improve productivity, reduce costs, and ensure safety and security.

The Oil and gas segment was valued at USD 235.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

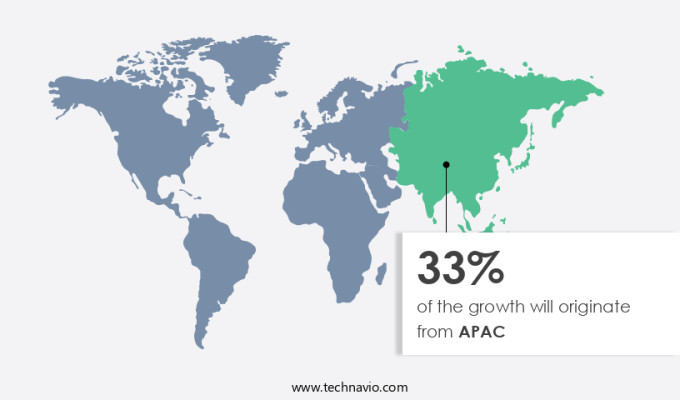

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The distributed temperature sensing (DTS) market is witnessing significant growth due to the increasing demand for real-time temperature and strain monitoring in various industries. DTS technology, which utilizes the scattering characteristics of laser light in optical fibers, enables continuous, non-intrusive measurements of temperatures and strain along the fiber length. This technology is particularly valuable for pipeline and process monitoring, where its high reliability and wide coverage are essential. Cloud computing and edge computing have further enhanced the capabilities of DTS systems by enabling data acquisition, logging, and analysis in real-time. Data analytics and machine learning algorithms, such as deep learning, are being integrated into DTS software platforms to provide predictive maintenance services and early warning systems for leak detection and corrosion prevention.

The chemical processing, power generation, and water treatment industries are major consumers of DTS technology due to the need for precise temperature monitoring and process control. Infrastructure monitoring, reservoir management, and safety and security are other applications where DTS systems are gaining popularity. Hardware components, including temperature sensors, pressure transducers, and fiber optic cables, are integral to the functioning of DTS systems. Calibration services and installation services are essential to ensure accurate and reliable measurements. The adoption of DTS systems is driven by the need for improved asset integrity management, production optimization, and data security. Data visualization tools enable users to easily interpret and act on the data generated by DTS systems.

Continuous technological advancements have led to the development of more sophisticated DTS systems, incorporating artificial intelligence and big data analytics to provide more accurate and actionable insights. These advancements are expected to further fuel the growth of the DTS market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Distributed Temperature Sensing Industry?

- The primary focus in the market is on optimizing performance and enhancing safety, which is essential for professional growth and maintaining consumer trust.

- Distributed Temperature Sensing (DTS) technology plays a crucial role in subsea monitoring and pipeline monitoring for the oil and gas industry. The advancements in DTS systems' performance and reliability in extreme conditions, such as high temperatures, pressures, and hydrogen-rich environments, align with the industry's requirements. Fiber optic cables, used as fully distributed and direct sensors, excel in data functions and transport. Raman-based backscatter methods are employed for fiber interrogation, enabling pipeline and well operators to measure entire wellbores and pipeline spans with a near real-time resolution of less than 1 meter, up to a distance of nine miles. DTS systems offer significant benefits, including corrosion detection, leak detection, production optimization, and infrastructure monitoring.

- These early warning systems are essential for ensuring safety and efficiency in oil and gas operations. Additionally, the integration of big data and software platforms enhances data security and analysis capabilities. DTS technology's ability to provide accurate, real-time data makes it an indispensable tool for the industry.

What are the market trends shaping the Distributed Temperature Sensing Industry?

- The growing significance of DTS (Dynamic Positioning System) in the oil and gas sector represents a notable market trend. This advanced technology plays a crucial role in ensuring precise positioning and stability of offshore drilling platforms and vessels, thereby enhancing operational efficiency and safety.

- Distributed Temperature Sensing (DTS) technology plays a crucial role in the efficient management of reservoirs in various industries, particularly in the oil and gas sector. This technology is essential for ensuring data acquisition and data logging to maintain asset integrity and enhance safety and security. The accuracy of temperature readings is vital for pressure transducers and power generation processes, as maintaining precise temperatures is necessary for optimal performance and product quality. DTS systems provide real-time temperature monitoring, allowing for immediate detection of deviations from the normal temperature range. In the oil and gas industry, fiber optics equipped with DTS capabilities are installed in pipelines and drills to ensure temperature stability during extraction activities.

- These systems are integral to preventing potential disasters caused by temperature fluctuations and ensuring the safety and efficiency of operations. Moreover, data visualization tools and calibration services are essential components of DTS systems, enabling users to analyze and interpret the data effectively. By providing valuable insights into temperature trends and patterns, these tools enable better decision-making and improved operational efficiency. Overall, DTS technology is a critical investment for businesses seeking to optimize their operations, maintain asset integrity, and ensure safety and security in their industries.

What challenges does the Distributed Temperature Sensing Industry face during its growth?

- The short service life of fiber optic cables poses a significant challenge to the industry's growth, necessitating continuous research and innovation to enhance their durability and extend their lifespan.

- Fiber optic cables, a key component in Distributed Temperature Sensing (DTS) systems, face challenges such as wear and tear, short lifespans, installation errors, environmental factors, and physical damage. These issues lead to higher replacement costs for end-users and increased production expenses for manufacturers. For instance, extreme weather conditions can cause temperature fluctuations, resulting in micro-bending and signal loss. Natural disasters like earthquakes can physically damage cables, necessitating frequent repairs or replacements. These factors hinder the widespread adoption of fiber optic networks, as customers may be reluctant to invest in a technology with high maintenance requirements. To mitigate these challenges, advanced technologies like real-time monitoring, data analysis, cloud computing, edge computing, and data analytics are being integrated into DTS systems.

- These technologies enable continuous monitoring of temperature sensors, allowing for early detection and prevention of potential issues. Strain gauges, a type of sensor, can also be used to monitor cable tension and detect damage. Maintenance services and training programs can further enhance the performance and longevity of DTS systems. Overall, these advancements aim to reduce the need for frequent replacements and minimize downtime, making DTS a more cost-effective and reliable solution for environmental monitoring, flow measurement, and other applications.

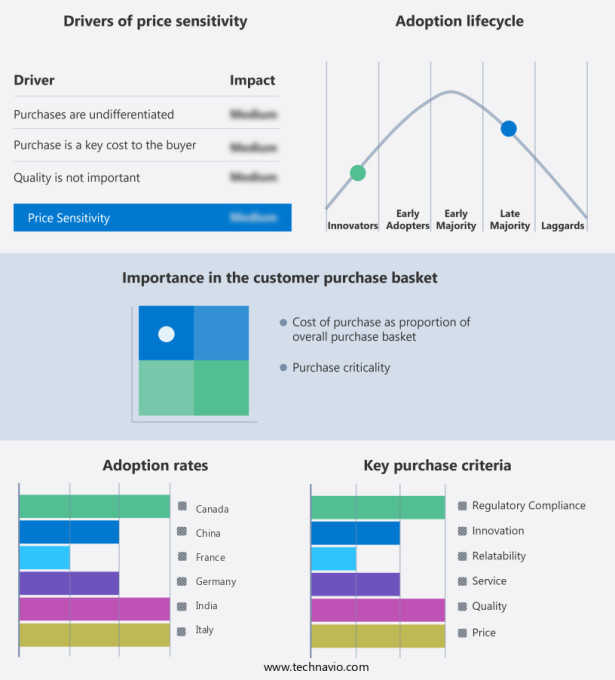

Exclusive Customer Landscape

The distributed temperature sensing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the distributed temperature sensing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, distributed temperature sensing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AP Sensing GmbH - The DTS N45 Series is a cutting-edge distributed temperature sensing system. This technology enables real-time, high-precision temperature monitoring across long distances and complex infrastructures. The system's advanced design ensures reliable and accurate temperature measurements, even in challenging environments. By providing actionable insights into temperature data, the DTS N45 Series empowers organizations to optimize processes, improve efficiency, and enhance safety. This innovative solution is an essential tool for industries requiring precise temperature monitoring, such as oil and gas, power generation, and process manufacturing.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AP Sensing GmbH

- Baker Hughes Co.

- Bandweaver

- Banner Engineering Corp.

- Furukawa Electric Co. Ltd.

- GESO GmbH and Co. KG

- Halliburton Co.

- Honeywell International Inc.

- Johnson Controls International Plc

- Luna Innovations Inc.

- NXP Semiconductors NV

- Opsens Inc.

- Qualcomm Inc.

- Robert Bosch GmbH

- Schlumberger Ltd.

- STMicroelectronics International NV

- Sumitomo Electric Industries Ltd.

- Texas Instruments Inc.

- Weatherford International Plc

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Distributed Temperature Sensing Market

- In February 2024, Honeywell International Inc. Announced the launch of its new distributed temperature sensing (DTS) system, known as the "Thermal IQ DTS," designed for oil and gas pipeline applications. This innovative solution, which offers real-time temperature monitoring, is expected to enhance pipeline safety and efficiency (Honeywell, 2024).

- In May 2024, Sensirion AG, a Swiss sensor manufacturer, entered into a strategic partnership with ABB Ltd., a leading technology company, to integrate Sensirion's DTS sensors into ABB's Ability⢠Gas Turbine Optimization solution. This collaboration aims to improve the performance and efficiency of gas turbines by providing real-time temperature data (ABB, 2024).

- In September 2025, Emerson Electric Co. Completed the acquisition of AspenTech Corporation, a leading software company specializing in process optimization. The acquisition is expected to strengthen Emerson's position in the DTS market by combining Emerson's temperature sensing expertise with AspenTech's process optimization software (Emerson, 2025).

- In December 2025, the European Union passed the revised Gas Directive, which includes provisions for mandatory temperature monitoring of gas pipelines. This regulatory development is expected to create significant growth opportunities for DTS technology providers in the European market (European Parliament, 2025).

Research Analyst Overview

- In the distributed temperature sensing (DTS) market, the integration of advanced technologies such as distributed acoustic sensing (DAS), fiber Bragg grating (FBG), and sensor networks, is driving innovation and enhancing asset lifecycle management. DTS solutions enable real-time risk assessment and predictive analytics for alarm management, facilitating cost reduction and fault diagnosis. The Internet of Things (IoT) and data integration play a crucial role in improving operational efficiency, while data compliance and data governance ensure regulatory adherence. DTS applications extend to environmental compliance in smart cities, smart grids, and digital transformation projects.

- Root cause analysis and remote operations enable decision support systems to optimize performance and improve overall system reliability. Simulation and modeling tools facilitate the design and implementation of DTS systems, ensuring optimal performance and reducing potential errors.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Distributed Temperature Sensing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2024-2028 |

USD 249.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.2 |

|

Key countries |

US, Canada, China, Japan, Germany, India, UK, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Distributed Temperature Sensing Market Research and Growth Report?

- CAGR of the Distributed Temperature Sensing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the distributed temperature sensing market growth of industry companies

We can help! Our analysts can customize this distributed temperature sensing market research report to meet your requirements.