Drum Liner Market Size 2025-2029

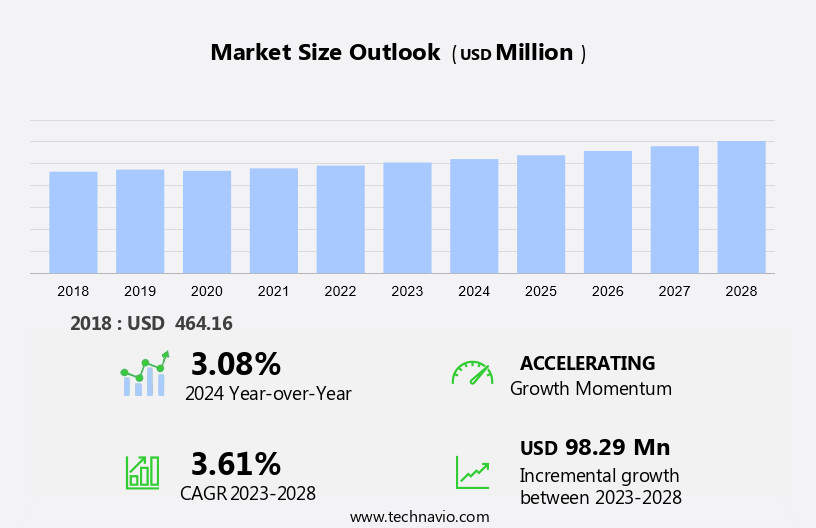

The drum liner market size is forecast to increase by USD 98.29 million at a CAGR of 3.4% between 2024 and 2029.

- The market is experiencing significant growth due to the expansion of the chemical warehousing and storage industry. The increasing adoption of sustainability in the value chain of drum liners, particularly in the use of materials like polyethylene and polypropylene, is driving market growth. However, the market is challenged by the volatility of raw material prices, specifically those of natural gas and crude oil, which are key inputs in the production of drum liners. Additionally, the demand for drum liners in various industries, such as textiles, agrochemicals, paints and coatings, specialty chemicals, food packaging, and cosmetics, continues to rise. In the US, the market for drum liners is particularly strong in sectors like construction and snack food packaging, where rigid and flexible packaging solutions are preferred. Overall, the market is expected to continue its growth trajectory, with a focus on innovation and cost-effectiveness in response to raw material price fluctuations.

What will be the Size of the Drum Liner Market During the Forecast Period?

- The market encompasses the production and supply of drums lined with flexible materials, primarily plastic films such as polyethylene, polypropylene, and polyester. This market plays a significant role in the flexible packaging industry, particularly in the transportation and storage of various goods, including chemicals and flammables, adhesives, inks and coatings, food products, and cosmetic materials. The market is experiencing steady growth, driven by increasing demand in emerging economies and the shift towards domestic and localised production.

- Revenue pockets lie in the production of flat bottom and elastic drum liners, catering to diverse industries. The use of these liners in the transportation and storage of sensitive materials ensures product protection and reduces waste, making them an essential component in various supply chains. The use of adhesives, plastic films, and air freight for drum liner transportation also influences market trends.

How is this Drum Liner Industry segmented and which is the largest segment?

The drum liner industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Flexible

- Rigid

- End-user

- Chemicals and flammables

- Adhesives and coatings

- Food products

- Pharmaceutical

- Others

- Product Type

- Shrink liner

- Round bottom liner

- Others

- Type

- Standard liner

- Custom liner

- Heat-resistant liner

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- South America

- Brazil

- Middle East and Africa

- APAC

By Material Insights

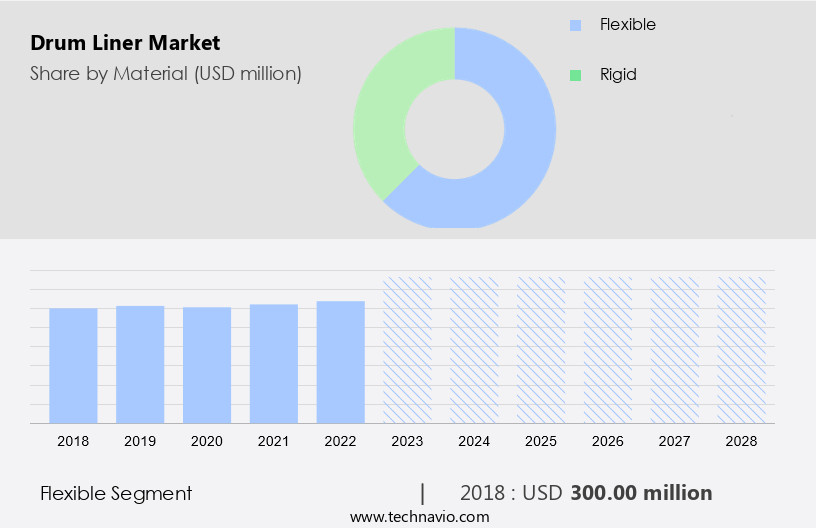

- The flexible segment is estimated to witness significant growth during the forecast period.

Flexible drum liners, primarily made of low-density polyethylene (LDPE) material, are a key packaging solution in various industries due to their one-time use and easy recyclability. The primary demand for these liners originates from the chemical sector, driven by the expanding packaging, pharmaceutical, and food industries. Chemicals are integral raw materials or intermediates in the production of finished goods such as fertilizers, plastics, and synthetic rubber. In the chemical and fertilizer sector, drum liners are preferred due to their inertness towards the reactive contents they contain. These industries rely on drum liners to prevent leakage and damage caused by the use of traditional packaging materials like paper or jute sacks. The increasing demand for chemicals in various applications further boosts the market for flexible drum liners.

Get a glance at the market report of share of various segments Request Free Sample

The flexible segment was valued at USD 300 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

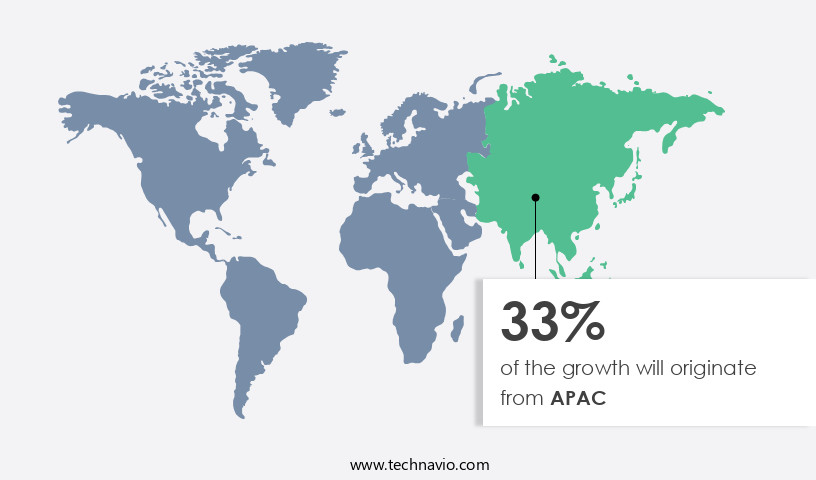

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is witnessing significant growth, particularly in the pharmaceutical and chemical industries. The expansion of pharmaceutical companies in emerging economies, such as Myanmar and Vietnam, is driving the demand for drum liners in APAC. These liners are essential for the safe transportation of chemicals used in the manufacturing processes of pharmaceuticals, food products, and textiles. China, Bangladesh, and India are major consumers of textile chemicals due to their dominance in the global textile industry. The chemical market's growth is attributed to the increasing demand from these industries. Drum liners are available in various materials, including plastic films like Polyethylene, Polypropylene, Polyester, and Polyvinylchloride.

Flexible packaging, such as elastic drum liners, is also gaining popularity due to its ability to conform to the shape of the drum. End-user businesses, including pharmaceuticals and cosmetics, are increasingly focusing on sustainable and eco-friendly solutions, leading to the demand for biodegradable and recyclable liners.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Drum Liner Industry?

The growth of global chemical warehousing and storage market is the key driver of the market.

- The market encompasses various materials such as Plastic films including Polyethylene, Polypropylene, and Polyester, as well as Polyvinylchloride. Flexible packaging, a primary application, is a significant market driver. Emerging economies, particularly in Asia Pacific, are witnessing substantial growth due to increasing disposable income and purchasing power. The region's supermarkets, hypermarkets, and end user businesses in sectors like pharmaceuticals and cosmetics are major consumers. Elastic drum liners, suitable for chemicals and flammables, are gaining popularity due to their ability to conform to drum shapes like round bottom and flat bottom. Adhesives, Inks and coatings, food products, and cosmetic materials also utilize these liners.

- Ecofriendly liners are increasingly being adopted to reduce environmental impact. Despite the dominance of steel drums, semirigid variations and disposable plastic drums are gaining traction due to their cost-effectiveness and ease of use. The APAC region, with countries like China, South Korea, Japan, and Saudi Arabia, is expected to lead the market growth, driven by the agrochemicals and polymers industry.

What are the market trends shaping the Drum Liner Industry?

Adoption of sustainability in value chain of drum liners is the upcoming market trend.

- Drum liners, a crucial component of flexible packaging, are manufactured using various materials such as Plastic films including Polyethylene, Polypropylene, and Polyester. Sustainability is a key focus in the production process, with manufacturers utilizing recycled raw materials to minimize waste and reduce carbon footprint. The value chain of drum liners begins with raw material processing, where natural resins and man-made polymers are used due to their ease of recycling. The production process employs thermoforming, blow molding, and heat-sealing techniques with minimal energy consumption and carbon emission. Customized drum liners are produced to cater to the specific requirements of end-users in industries such as chemicals and flammables, adhesives, inks and coatings, food products, cosmetics, pharmaceuticals, and semirigid variations.

- Emerging economies are witnessing significant growth in demand for drum liners due to increasing disposable income and purchasing power. Drum liners come in various types, including shrink liners with round bottom and flat bottom designs, as well as elastic drum liners. Ecofriendly liners are also gaining popularity among end-user businesses. The market is dynamic, with manufacturers continually innovating to meet the evolving needs of their customers.

What challenges does the Drum Liner Industry face during its growth?

Volatility of raw material prices is a key challenge affecting the industry growth.

- Drum liners, an essential component of flexible packaging, primarily utilize plastic films as their primary material. Among these, polyethylene, including High Density Polyethylene (HDPE) and Low Density Polyethylene (LDPE), dominates the market due to its high tensile strength and resistance to tears. However, the price volatility of polyethylene, which is derived from natural gas and crude oil, poses a challenge. The demand for polyethylene in drum liners is influenced by various factors, including the growth of emerging economies and the increasing demand for flexible packaging in sectors like chemicals and flammables, adhesives, inks and coatings, food products, cosmetic materials, and pharmaceuticals.

- End user businesses in supermarkets, hypermarkets, and multinational packaging companies are significant consumers of drum liners. The market for drum liners also includes variations like shrink liners, round bottom, flat bottom, and elastic drum liners. As consumers in emerging economies gain disposable income and purchasing power, the demand for eco-friendly liners is increasing. Natural gas and crude oil price fluctuations will continue to impact the cost of polymer resins, thereby affecting the pricing dynamics of the market.

Exclusive Customer Landscape

The drum liner market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the drum liner market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, drum liner market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc: The company offers drum liners for bulk packaging, food packaging, crisps, snacks and nuts packaging, and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Balmer Lawrie and Co. Ltd.

- BASCO Inc.

- Berry Global Inc.

- CDF Corp.

- Dana Poly Inc.

- DG Air Freight Pvt. Ltd.

- FEECO International Inc.

- Glasnost India

- Global Industrial Co.

- Greif Inc.

- Guardair Corp.

- Heritage Packaging

- International Plastics Inc.

- Labelmaster

- Primepac Industrial Ltd.

- Sri Lakshmi Vishnu Plastics

- The Cary Co.

- The Dow Chemical Co.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products utilized in various industries for the containment and protection of goods during transportation and storage. This market is characterized by the use of flexible materials, including plastics such as polyethylene, polypropylene, and polyester, as well as polyvinylchloride (PVC). Flexible packaging, a significant application area for drum liners, has experienced substantial growth in recent years due to its advantages in terms of cost-effectiveness, lightweight, and ease of use. The demand for drum liners is driven by several factors, including the increasing consumption of chemicals and flammables, adhesives, inks and coatings, food products, and cosmetic materials. Emerging economies have become key contributors to the growth of the market due to their expanding manufacturing sectors and increasing disposable income and purchasing power. Domestic and localized production of end user businesses, particularly in industries such as pharmaceuticals and cosmetics, is driving the demand for drum liners in these regions. The market offers various types, including shrink liners, round bottom, and flat bottom designs, as well as elastic drum liners.

The choice of liner type depends on the specific requirements of the application, such as the nature of the contained material and the transportation method. Steel drums, while historically popular, have seen a decline in usage due to the advantages offered by flexible and elastic drum liners. Semirigid variations of drum liners are also gaining traction due to their ability to offer a combination of the benefits of both rigid and flexible liners. Multinational packaging companies have been expanding their presence in the market through acquisitions and partnerships, while supermarkets and hypermarkets continue to be significant end users due to their large-scale operations and the need for efficient and cost-effective packaging solutions. Ecofriendly liners are gaining popularity in the market due to increasing environmental concerns and regulations. These liners are made from sustainable materials and offer reduced carbon footprint and improved sustainability. The market is expected to continue its growth trajectory due to the increasing demand for flexible and sustainable packaging solutions, expanding industries in emerging economies, and the need for efficient and cost-effective packaging solutions for end user businesses.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 98.29 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, India, Japan, Germany, France, UK, Italy, Canada, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Drum Liner Market Research and Growth Report?

- CAGR of the Drum Liner industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the drum liner market growth of industry companies

We can help! Our analysts can customize this drum liner market research report to meet your requirements.