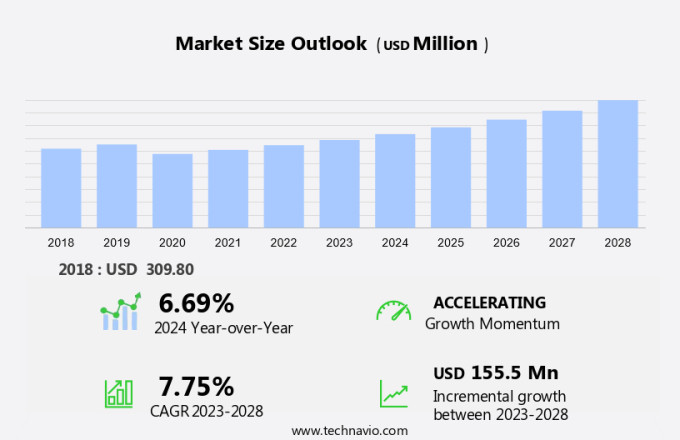

Edge Banding Materials Market Size 2024-2028

The edge banding materials market size is forecast to increase by USD 155.5 million, at a CAGR of 7.75% between 2023 and 2028. The market is witnessing significant growth due to the expansion of the commercial sector, with a focus on modern office spaces featuring swivel chairs and adjustable tables. Interior design trends favor surfaces that offer a blend of colors, textures, and patterns, making natural materials like stone a popular choice for edge banding.

Sustainability is a key consideration, leading to increased demand for edge banding materials sourced from eco-friendly and sustainable sources. The low availability of workforce and rising labor costs during the COVID-19 outbreak have driven manufacturers to explore automation and innovative production methods. Overall, the market is expected to experience steady growth in the coming years, with a focus on delivering high-quality, cost-effective, and sustainable edge banding solutions for cabinetry and countertops.

Market Analysis

Edge banding is an essential process in the production of wooden panels and furniture. It involves covering the raw edges of materials such as particleboard, MDF, plywood, and engineered wood with more aesthetically pleasing and protective materials. PVC and resins are popular edge banding materials due to their durability and resistance to wear and tear. Heat applicators and hot-melt glue are commonly used in the application process. PVC edge banding offers a smooth, uniform appearance and is suitable for high-traffic areas. Resins, on the other hand, provide a natural look and feel, making them ideal for interior design applications.

Moreover, the construction sector, residential complexes, commercial complexes, shopping malls, restaurants, cafes, theaters, stores, airports, offices, and hotels are significant consumers of edge banding materials. Furniture manufacturers also heavily rely on edge banding to enhance the appearance and durability of their products. Polyvinyl chloride (PVC) and resins are the most commonly used edge banding materials due to their versatility and durability. Hot-melt adhesive is used to secure the edge banding to the panel materials, ensuring a strong bond. Overall, the market is expected to grow significantly due to the increasing demand for furniture and interior design applications.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Residential

- Commercial

- Industrial

- Geography

- APAC

- China

- India

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

The residential segment is estimated to witness significant growth during the forecast period. The market caters to various industries, including shopping malls, restaurants, cafes, theaters, stores, airports, offices, and hotels. In these establishments, panel materials, such as laminates and composite materials, are commonly used for interior design and construction. Edge banding materials are essential in securing and finishing the exposed edges of these panel materials, providing a polished and cohesive look. The global economy's expansion is driving an increase in construction activities, particularly in the commercial sector. This trend is expected to continue, leading to a steady demand for edge banding materials in new buildings during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The residential segment was valued at USD 171.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The APAC construction industry is projected to expand at a considerable pace during the forecast period. Major contributors to the construction market in the region include India and China. In China, numerous construction projects are anticipated to be completed during the forecast period, leading to increased demand for edge banding materials. Emerging economies such as the Philippines, India, Indonesia, and Thailand are also expected to drive the growth of the edge banding materials industry in the region.

Additionally, these countries are witnessing an increase in the number of shopping malls, restaurants, cafes, theaters, stores, airports, offices, and hotels, which require panel materials for interior decoration and edge banding materials to enhance their aesthetic appeal. Composite materials and laminates are popular choices for edge banding due to their durability and resistance to wear and tear.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The global growth in commercial sector is notably driving market growth. Edge banding materials play a crucial role in enhancing the aesthetic appeal and protecting the edges of various panel materials used in different industries. These materials are widely adopted in various sectors such as retail stores, airports, offices, and hotels for their durability and versatility. The use of edge banding materials extends to various applications, including swivel chairs, adjustable tables, and surfaces for countertops, cabinetry, and interior design trends. Laminates and composite materials are popular edge banding options due to their resistance to wear and tear. Natural materials like wood and stone are also used, with an increasing preference for sustainable sources such as FSC-certified wood and recycled plastics.

Furthermore, the installation process for edge banding materials is relatively simple and can be done using plastic or other adhesives. In residential furniture manufacturing, edge banding materials are used extensively in the production of cabinets, tables, desks, shelves, wardrobes, kitchen cabinets, and bathroom cabinets. The choice of colors, textures, and patterns in edge banding materials continues to evolve, reflecting the latest interior design trends. Overall, edge banding materials offer functional and aesthetic benefits, making them an essential component in various industries. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

The increasing number of skyscrapers is the key trend in the market. Edge banding materials are essential components in the production of various panel materials used in various industries, including retail stores, airports, offices, and hotels. These materials enhance the aesthetics of surfaces such as countertops, cabinetry, adjustable tables, swivel chairs, and shelves. Laminates and composite materials are popular edge banding options due to their durability and versatility. Interior design trends favor natural materials like wood, stone, and sustainable sources such as FSC-certified wood and recycled plastics. Edge banding materials come in various colors, textures, and patterns to cater to these trends.

Additionally, the installation process is crucial, ensuring a seamless and professional finish. In residential furniture manufacturing, edge banding materials are used extensively in the production of cabinets, tables, desks, and wardrobes. Kitchen and bathroom cabinets, in particular, require edge banding for a polished look. Plastic edge banding is a common choice due to its ease of use and cost-effectiveness. However, the use of sustainable edge banding materials is gaining popularity for their environmental benefits. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

The low availability of workforce and rising labor costs during COVID-19 outbreak is the major challenge that affects the growth of the market. Edge banding materials play a crucial role in enhancing the aesthetic appeal and durability of various panel materials used in different sectors. In the realm of interior design, these materials are extensively utilized in stores, airports, offices, and hotels for cabinetry, countertops, and furniture manufacturing. Laminates and composite materials are popular choices due to their versatility and resistance to wear and tear. Swivel chairs, adjustable tables, and other office furniture benefit significantly from edge banding materials, ensuring a seamless and polished look. Surfaces, such as countertops and cabinetry, in residential and commercial settings, are often adorned with these materials, following the latest interior design trends that focus colors, textures, and patterns. Natural materials, like wood and stone, also find their place in edge banding applications. Sustainable sources, such as FSC-certified wood and recycled plastics, are increasingly preferred for their eco-friendliness.

However, the installation process of edge banding materials is relatively straightforward, making them a cost-effective solution for various applications. Plastic edge banding materials are widely used due to their ease of application and resistance to moisture. In the realm of residential furniture manufacturing, edge banding materials are essential for cabinets, tables, desks, shelves, wardrobes, and kitchen and bathroom cabinets. The diversity of these materials caters to various design preferences and functional requirements. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aero Plastics Inc. - The market caters to various industries with offerings including PVC edge bands and Semi-Rigid (Flex) edge bands. These materials ensure a polished and finished look for furniture and cabinetry, enhancing their aesthetic value.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asmar wood

- Blazic robni trakovi

- Coskunuzer Mobilya Ltd.Sti

- David Clouting Ltd.

- E3 Panels

- EdgeCo Inc.

- EONCRED GROUP

- Gdecor Industries India Pvt Ltd

- Moderne Kunststoff-Technik

- Paramount Composites India

- REHAU Ltd.

- Shri Balaji Timber Traders

- Squareone Decor

- Sri Umiya Industries

- SURTECO GmbH

- Ultra Tech Advanced Edge Banding

- Unipegasus Profiles Pvt. Ltd

- Vaibhav Industries

- Veena Polymers

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Edge banding materials play a crucial role in enhancing the aesthetic appeal and durability of wooden panels and furniture. The market is driven by the construction sector and interior design trends in both residential and commercial applications. PVC, wood, resin, and heat applicators are commonly used materials for edge banding due to their moisture resistance and ease of use. Hot-melt glue and hot-melt adhesive are essential components of the edge banding process, ensuring a strong bond between the edge banding material and the panel. Particleboard, MDF, plywood, and engineered wood are popular panel materials that utilize edge banding for improved appearance and protection.

Further, furniture demand is on the rise due to the growing middle-class population and housing shortage, leading to an increase in the production of modular furniture and residential complexes. Edge banding materials, including acrylic, ABS, and metal, offer various benefits such as abrasion resistance, impact resistance, and sustainability. The market for edge banding materials is segmented into organized and unorganized sectors. Organized sector players focus on producing high-quality, consistent products, while the unorganized sector caters to the budget-conscious market. The housing industry, furniture manufacturing, and commercial complexes such as shopping malls, restaurants, cafes, theaters, offices, hotels, and airports are significant consumers of edge banding materials.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

130 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.75% |

|

Market Growth 2024-2028 |

USD 155.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.69 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 33% |

|

Key countries |

China, US, Germany, India, and Turkey |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aero Plastics Inc., Asmar wood, Blazic robni trakovi, Coskunuzer Mobilya Ltd.Sti, David Clouting Ltd., E3 Panels, EdgeCo Inc., EONCRED GROUP, Gdecor Industries India Pvt Ltd, Moderne Kunststoff-Technik, Paramount Composites India, REHAU Ltd., Shri Balaji Timber Traders, Squareone Decor, Sri Umiya Industries, SURTECO GmbH, Ultra Tech Advanced Edge Banding, Unipegasus Profiles Pvt. Ltd, Vaibhav Industries, and Veena Polymers |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.