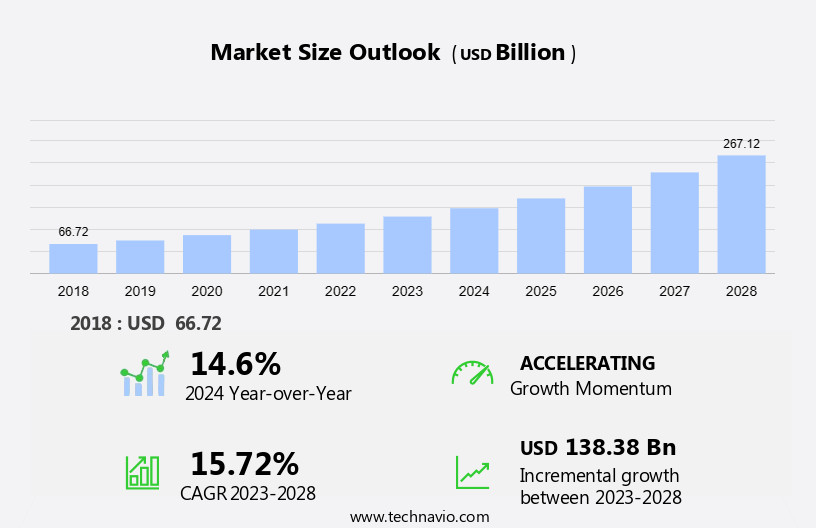

eHealth Software and Services Market Size 2024-2028

The ehealth software and services market size is forecast to increase by USD 138.38 billion at a CAGR of 15.72% between 2023 and 2028.

- The market is experiencing significant growth due to the digitization of the healthcare industry. With the increasing adoption of connected devices and technologies, there is a surge In the demand for efficient and effective healthcare solutions. However, the market also faces challenges from open-source service providers, who offer cost-effective alternatives to proprietary software. The trend towards remote patient monitoring and telehealth services is expected to drive market growth, as more patients seek convenient and accessible healthcare options.

- Additionally, the integration of artificial intelligence and machine learning technologies in healthcare applications is revolutionizing diagnosis and treatment methods, providing personalized care to patients.Overall, the market is poised for robust growth In the coming years, as it addresses the evolving needs of the healthcare industry and consumers.

What will be the Size of the eHealth Software and Services Market During the Forecast Period?

- The market encompasses a range of solutions and services that enable the remote management of health parameters through telemedicine consultation, diagnosis, treatment, prevention, and monitoring. This market is experiencing significant growth due to the increasing demand for patient-centric care, digitization, and the integration of qualitative tools for managing chronic conditions such as diabetes and hypertension. Tele-health and mHealth technologies, including self-monitoring devices for vital signs and physiological parameters like blood pressure and blood sugar levels, are driving innovation in this sector. Regulatory requirements and compliance risks present challenges for market participants, particularly In the areas of Medicaid and R&D expenditures.

- The market is segmented by specialty, with consultation and diagnosis services leading the way, while treatment and prevention segments are also gaining traction. The market's direction is towards more integrated, automated, and user-friendly solutions that improve access to care and enhance the overall patient experience.

How is this eHealth Software and Services Industry segmented and which is the largest segment?

The ehealth software and services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Type

- Services

- Software

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Deployment Insights

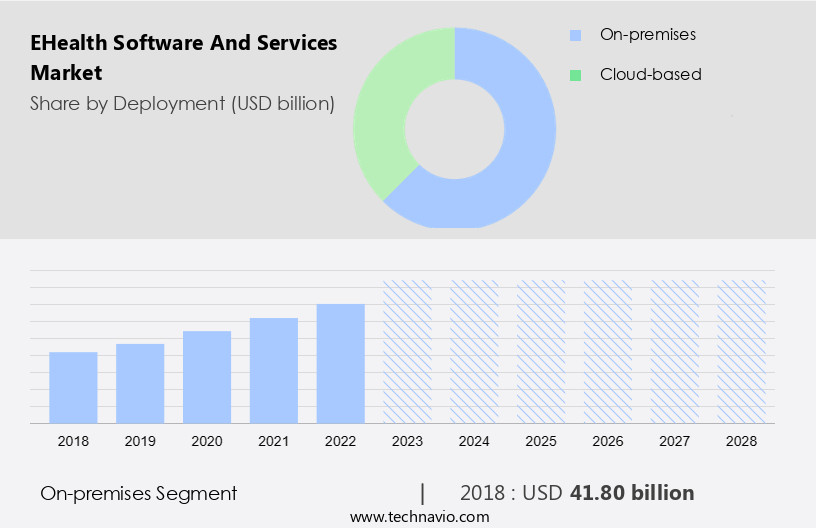

- The on-premises segment is estimated to witness significant growth during the forecast period.

On-premises deployment of eHealth software and services enables healthcare organizations to host and manage their entire infrastructure withIn their premises, providing them with direct control over hardware, software configurations, and data management. This approach caters to the unique needs and regulatory requirements of certain healthcare environments, particularly those with stringent compliance and security concerns. With on-premises deployment, organizations can customize their eHealth systems to meet specific needs, ensuring regulatory compliance and maintaining data security. This level of control is essential for delivering patient-centric care, digitizing tele-health and mHealth services, and implementing qualitative tools for consultation, diagnosis, treatment, prevention, and monitoring of health parameters such as blood pressure and blood sugar levels.

Despite the initial investment, on-premises deployment offers long-term benefits, including improved patient outcomes, data interoperability, and compliance with regulatory requirements in outpatient care settings. However, healthcare organizations must consider potential legal liabilities and regulatory apprehensions when implementing on-premises eHealth solutions. Insurers, healthcare providers, and payers are increasingly adopting eHealth solutions to enhance patient care and reduce costs In the era of the Affordable Care Act.

Get a glance at the market report of various segments Request Free Sample

The On-premises segment was valued at USD 41.80 bn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

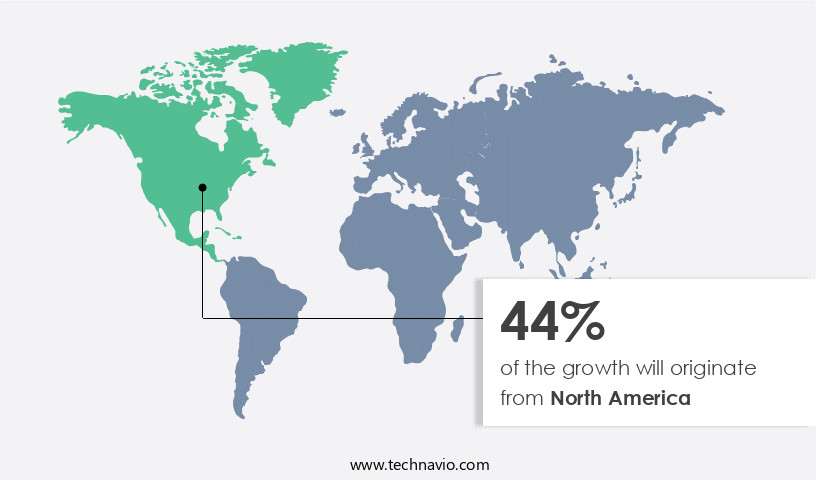

- North America is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is a significant contributor to the global industry, driven by stringent regulatory requirements and incentivizing policies. With advanced healthcare IT solutions widely adopted In the US and Canada, these countries lead the region's market growth. Regulatory frameworks mandating the use of eHealth software and services are rigorous in North America. Tele-health, mHealth, and qualitative tools are integral components of this market, enabling remote patient consultation, diagnosis, treatment, and prevention. ERAD, Sectra, Evident, and Allscripts Care Director are notable providers of diagnostic services and monitoring segments, including hypertension, diabetes, and physiological parameters like blood pressure and blood sugar levels.

Insurers, healthcare providers, and payers are key stakeholders in this market, with the Affordable Care Act further boosting its expansion. Data interoperability, patient-centric care, and outpatient care models are critical trends shaping the market's future. Despite regulatory apprehensions and legal liabilities, the market's growth is expected to continue, fueled by the digitization of healthcare services and telemedicine.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of eHealth Software and Services Industry?

Growing digitization of healthcare industry is the key driver of the market.

- The healthcare industry's shift towards digitization is significantly impacting the market for eHealth software and services. Tele-Health and mHealth solutions enable remote consultations, diagnosis, and treatment through advanced devices and technologies. Hospital systems are increasingly adopting these digital tools to manage patient data centrally, enhancing patient-centric care. EPrescribing (eRX), telemedicine services, and electronic intensive care units (eICUs) are leading the charge in this digital transformation. Telemedicine, including Smartphone applications and monitoring services, allows for real-time patient monitoring and consultation, while diagnostic services segment offers advanced diagnostic tools and services. Healthcare providers and payers are investing heavily in R&D expenditures to develop and implement these solutions.

- Patient outcomes are improved through better monitoring and adherence to treatment plans. However, regulatory requirements and compliance risks pose challenges. In the monitoring segment, self-monitoring devices for health parameters like blood pressure and blood sugar levels are gaining popularity. Specialty areas like hypertension and diabetes are prime targets for these solutions. Diagnostic services segment offers advanced diagnostic tools and services, enabling early detection and intervention. Medicaid and other insurers are increasingly covering telemedicine services, making them more accessible to a wider population. Data interoperability remains a concern, but advancements in technology are addressing these challenges. Outpatient care settings are adopting these digital solutions to improve efficiency and patient care. Healthcare consumers are embracing these services for their convenience and affordability. The Affordable Care Act and regulatory apprehensions present legal liabilities, but the benefits of eHealth software and services far outweigh the risks.

What are the market trends shaping the eHealth Software and Services Industry?

Growing use of connected devices and technologies is the upcoming market trend.

- The market is experiencing significant growth due to the increasing adoption of tele-Health and mHealth solutions. Telemedicine services enable consultation, diagnosis, and treatment through digital communication channels, while mHealth involves the use of smartphone applications and self-monitoring devices for patient-centric care. Qualitative tools such as Sectra, Evident, and eRAD facilitate data interoperability and regulatory compliance, addressing regulatory requirements and compliance risks. R&D expenditures In the healthcare sector are driving the digitization of healthcare services, including the monitoring segment for physiological parameters like blood pressure, blood sugar levels, and vital signs. Specialty areas like diabetes and hypertension benefit from adherence monitoring and diagnostic services.

- Insurers, healthcare providers, and healthcare payers are collaborating to offer affordable care act-compliant outpatient care settings, strengthening services through ePrescribing and monitoring services. The Affordable Care Act and regulatory apprehensions necessitate legal liabilities for healthcare organizations, making the adoption of eHealth software and services crucial for patient outcomes. The IoT, including telemedicine and monitoring services, plays a significant role In the market's growth by providing real-time patient data and improving accessibility to healthcare services. The diagnostic services segment is expected to grow due to the increasing demand for accurate and timely diagnosis.

What challenges does the eHealth Software and Services Industry face during its growth?

Threat from open-source service providers is a key challenge affecting the industry growth.

- The market is witnessing significant growth due to the increasing adoption of tele-Health and mHealth solutions. Telemedicine services, including consultation, diagnosis, treatment, and prevention, are becoming increasingly popular, especially in patient-centric care models. Tele-Health solutions enable the remote monitoring of health parameters such as blood pressure, blood sugar levels, and vital signs using self-monitoring devices and manual methods. Qualitative tools like Sectra, Evident, and eRAD are used for diagnostic services, while Allscripts Care Director focuses on adherence monitoring and outpatient care. R&D expenditures In the healthcare industry are driving the digitization of healthcare services, making regulatory requirements and compliance risks more prominent.

- Medicaid, healthcare payers, and insurers are investing in eHealth solutions to improve data interoperability and patient outcomes. The affordable care act has further accelerated the adoption of eHealth services in healthcare settings, with healthcare providers and payers embracing telemedicine, smartphone applications, monitoring services, and diagnostic services. The market dynamics are influenced by regulatory apprehensions and legal liabilities, making it essential for companies to ensure compliance with regulatory frameworks. The monitoring segment, including physiological parameters and diagnostic services, is expected to dominate the market due to the increasing demand for remote patient monitoring and early disease detection. Healthcare consumers are becoming more engaged In their healthcare, leading to the strengthening of healthcare services through ePrescribing and other digital solutions.

Exclusive Customer Landscape

The ehealth software and services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ehealth software and services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ehealth software and services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AdvancedMD Inc. - The company provides a comprehensive eHealth software and services solution, featuring the AdvancedMD clinical app. This innovative application prioritizes tasks with donuts, offers patient cards, and includes a physician dashboard to streamline practice operations for various roles, thereby enhancing clinical care and fostering a more personalized patient experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AdvancedMD Inc.

- Aerotel Medical Systems Ltd.

- Alphabet Inc.

- American Well Corp.

- Apple Inc.

- athenahealth Inc.

- E HealthLine.Com Inc.

- eHealth Global Technologies Inc.

- Esaote Spa

- GE Healthcare Technologies Inc.

- Included Health Inc.

- Intelerad Medical Systems Inc.

- KareXpert Technologies Pvt. Ltd.

- Konica Minolta Inc.

- Koninklijke Philips N.V.

- McKesson Corp.

- Medisafe Project Ltd.

- Microsoft Corp.

- Onex Corp.

- Oracle Corp.

- Pro Medicus Ltd.

- RamSoft Inc.

- ScImage Inc.

- Siemens AG

- Veradigm LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of tele-health and mHealth solutions designed to enhance patient-centric care and digitize various aspects of healthcare delivery. This dynamic industry is characterized by continuous innovation, driven by the growing demand for efficient, accessible, and cost-effective healthcare solutions. Tele-health and mHealth services enable consultation, diagnosis, treatment, prevention, and monitoring of health parameters outside traditional healthcare settings. These solutions leverage qualitative tools to facilitate remote patient-provider communication and data exchange. The market is witnessing significant investment in Research and Development (R&D) to expand the capabilities of these solutions and address the evolving needs of care providers and healthcare payers.

The shift towards patient-centric care and digitization has led to the proliferation of telemedicine services, which enable the remote monitoring of various health parameters, including blood pressure, blood sugar levels, and vital signs. Self-monitoring devices and smartphone applications play a crucial role in this segment, empowering patients to take an active role in managing their health. The diagnostic services segment of the market is another area of growth, as these solutions enable accurate and timely diagnosis, reducing the need for manual methods and improving overall patient outcomes. Telemedicine and monitoring services are key components of this segment, offering diagnostic services remotely and in real-time.

Regulatory requirements and compliance risks are critical considerations In the market. Ensuring data interoperability and security is essential for maintaining the trust and confidence of healthcare consumers and adhering to regulatory standards. Insurers and healthcare payers are increasingly recognizing the value of these solutions and are investing In their implementation in outpatient care settings. Despite the numerous benefits of eHealth software and services, there are regulatory apprehensions and legal liabilities associated with their use. Healthcare providers must ensure compliance with relevant regulations and standards to mitigate risks and protect patient privacy. The Affordable Care Act and other healthcare strengthening services have further emphasized the importance of these solutions in improving healthcare access and affordability.

In conclusion, the market is a dynamic and innovative industry, driven by the growing demand for efficient, accessible, and cost-effective healthcare solutions. The market is characterized by continuous innovation, driven by the need to address the evolving needs of care providers, healthcare payers, and healthcare consumers. The use of telemedicine services, self-monitoring devices, and diagnostic services is transforming healthcare delivery, enabling remote consultation, diagnosis, treatment, and monitoring of various health parameters. Regulatory requirements and compliance risks are critical considerations in this market, and healthcare providers must ensure compliance with relevant standards to mitigate risks and protect patient privacy.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.72% |

|

Market growth 2024-2028 |

USD 138.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.6 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this eHealth Software and Services Market Research and Growth Report?

- CAGR of the eHealth Software and Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ehealth software and services market growth of industry companies

We can help! Our analysts can customize this ehealth software and services market research report to meet your requirements.