Electrically Conductive Coatings Market Size and Trends

The electrically conductive coatings market size is forecast to increase by USD 7.81 billion, at a CAGR of 7.8% between 2023 and 2028. Electrically conductive coatings have gained significant traction in various industries, including solar, aerospace, bioscience, and electronics. The market's growth is driven by the increasing focus on research and development, leading to advancements in nanotube technology. Solar panels and photovoltaic cells require conductive coatings for efficient energy transfer, making this market essential in the renewable energy sector. In the aerospace industry, electrically conductive coatings are used for moisture resistance and static charge dissipation in aircraft components. In the electronics industry, these coatings are crucial for EMI shielding and touch panels in smartphones, computers, LCDs, and other electronic displays. The adoption of electrically conductive coatings is on the rise due to their ability to enhance the performance and durability of these devices. Despite the economic slowdown, the market is expected to continue its growth trajectory due to the increasing demand for advanced technologies in various industries.

The market is witnessing significant growth due to the increasing demand for advanced technology applications. These coatings are essential in various industries, including aerospace and defense, electronics, and renewable energy. The aerospace and defense sector is a major consumer of electrically conductive coatings due to their antistatic properties, which protect against electrostatic discharge in aircraft and military equipment. In the electronics industry, these coatings are used for antistatic protection in devices like mobile phones, computers, LCDs, and wearable electronics, preventing damage to sensitive components. In renewable energy, electrically conductive coatings are applied to solar panels to improve efficiency by enhancing conductivity and reducing energy losses. These coatings also offer excellent mechanical qualities, including moisture resistance and corrosion protection, making them suitable for harsh environments. The demand for advanced conductive coatings is growing due to their superior conductivity and sustainability.

These coatings are available in various forms, such as water-based, solvent-based, and UV-curable coatings, providing excellent adhesion on metals and plastics. Additionally, the trend towards sustainable coatings, like water-based and UV-curable types, is contributing to market growth as they offer lower environmental impact and reduced energy consumption during curing. In conclusion, the electrically conductive coatings market is experiencing steady growth, driven by demand in aerospace, electronics, and renewable energy sectors, as well as the shift toward sustainable solutions. These coatings provide excellent performance, making them essential for a wide range of applications, with the advanced coatings segment expected to continue expanding.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- Consumer electronics industry

- Automotive industry

- Aerospace and defense industry

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

The consumer electronics industry segment is estimated to witness significant growth during the forecast period. The market in the consumer electronics sector is poised for significant expansion in the coming years. The primary driver of this growth is the increasing use of consumer electronics, particularly in the form of smartphones and laptops. The global demand for these coatings is primarily fueled by urbanization and the rising disposable income of consumers. In the Asia Pacific region, countries such as China, Vietnam, and Taiwan are leading the charge in the adoption of electrically conductive coatings due to their extensive use in consumer durables. These coatings are integral to various consumer electronics, including flat panel displays, personal computers, smartphones, air conditioner units, printed circuit boards, and control panel insulations. By providing both electric conductivity and scratch resistance, these coatings contribute significantly to the overall functionality and durability of these products. The market for electrically conductive coatings is expected to continue its positive trajectory, driven by the increasing demand for advanced consumer electronics and the need for sustainable and eco-friendly coating solutions. The market is segmented into water-based, solvent-based, and UV-curable coatings. Each type offers unique benefits and is used in various applications based on specific requirements. For instance, water-based coatings are popular due to their sustainability and low volatile organic compound (VOC) emissions, making them an attractive choice for companies prioritizing eco-friendly manufacturing processes.

Get a glance at the market share of various segments Download the PDF Sample

The consumer electronics industry segment was valued at USD 5.70 billion in 2018. On the other hand, solvent-based coatings offer superior conductivity and are widely used in applications where high conductivity is essential, such as in the production of flexible electronics and wearable devices. UV-curable coatings are popular due to their fast curing time and high solids content, making them a cost-effective solution for mass production applications. The market is also driven by the growing demand for advanced conductive coatings in various industries, including automotive, aerospace, and energy. The electrolysis process is a critical application area for electrically conductive coatings, where they are used to provide corrosion protection to various metals and alloys. The market is segmented into water-based, solvent-based, and UV-curable coatings, each offering unique benefits for various applications. The market is also driven by the growing demand for advanced conductive coatings in various industries, including automotive, aerospace, and energy.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

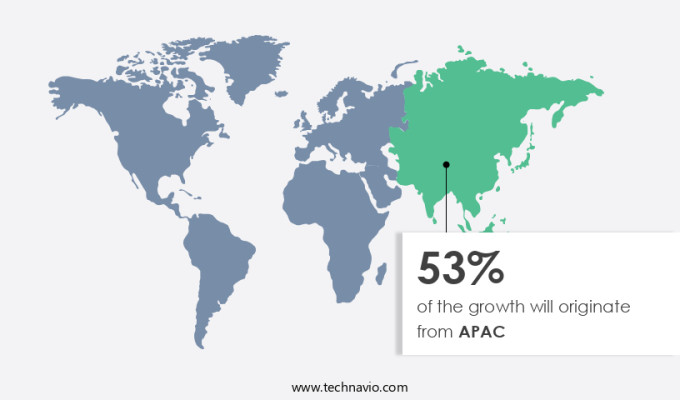

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in the Asia Pacific (APAC) region is experiencing significant growth due to the increasing production of automobiles and related components in countries like India and China. Major players in this market, including PPG Industries, are expanding their presence in APAC to capitalize on the region's numerous business opportunities. Factors such as population growth, rising disposable income, and the flourishing automotive industry are fueling the demand for electrically conductive coatings in APAC. Moreover, environmental regulations becoming increasingly stringent to minimize the emission of harmful compounds and the growing awareness of the health benefits of advanced electrically conductive coatings are expected to further drive market growth in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Electrically Conductive Coatings Market Driver

Increased focus on research and development is notably driving market growth. The market is experiencing significant growth, with major players such as PPG Industries and Akzo Nobel investing heavily in research and development to expand their product offerings. In May 2021, PPG Industries announced a USD13 million investment in its Jiading facility in China, adding eight new powder coating production lines and expanding its technology capabilities. This investment is projected to increase the plant's production capacity by over 8,000 metric tons per year.

Acrylics, epoxy, polyesters, and polyurethanes are commonly used base materials for electrically conductive coatings. These coatings are utilized for various applications, including antistatic protection and electromagnetic shielding in industries such as aerospace and defense. Materials like copper, aluminum, and silver are often used as conductive additives. Thus, such factors are driving the growth of the market during the forecast period.

Electrically Conductive Coatings Market Trends

The rise in adoption of nanotube technology is the key trend in the market. Electrically conductive coatings, incorporating nanotube technology, offer transparency and electrical conductivity with minimal impact on the coating's physical properties. Carbon nanotubes, a primary component, are single-layered graphite structures rolled into tubes. Applications for these coatings span touchscreens, large area displays, flexible displays, and solar voltaic collectors. Nanotube technology's advantages, however, are countered by the increasing costs of raw materials.

For example, the escalating price of silver has led to higher expenses for nano silver particles. This challenge necessitates ongoing research and development to mitigate these costs and expand the market's reach. In the realm of aerospace, bioscience, and electronics, including solar energy, smartphones, computers, LCDs, and electronic displays, touch panels, and static charge dissipation, as well as EMI shielding, electrically conductive coatings play a crucial role. Thus, such trends will shape the growth of the market during the forecast period.

Electrically Conductive Coatings Market Challenge

The slowdown in global economic growth is the major challenge that affects the growth of the market. The market has faced challenges due to various economic factors. Economic experts have identified the global financial crisis and the aftermath of the recession, a modest economic slowdown in China, political instability in Brazil, Europe, and the Middle East, and a weakened US economy with weakened exports due to strengthening dollars as major reasons for the market's stagnation. These economic conditions have resulted in decreased investments in various industries and markets worldwide, including electrically conductive coatings. The market's growth is expected to be negatively impacted during the forecast period due to the sluggish global economy.

Electrically conductive coatings are used in various industries such as chemical resistance, abrasion resistance, impact resistance, and for shielding against electrostatic interference and electromagnetic interference. These coatings are essential in the manufacturing of safety electronic boards, electric vehicles, consumer electronics, and mobile devices. The mechanical qualities of electrically conductive coatings make them indispensable in electronic manufacturing. However, the economic downturn has affected the demand for these coatings, particularly in industries that are sensitive to economic fluctuations. Hence, the above factors will impede the growth of the market during the forecast period

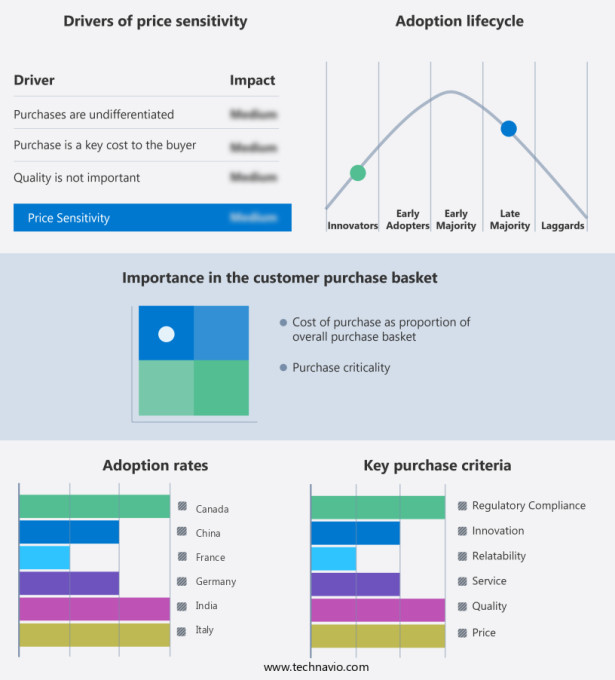

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Akzo Nobel NV - The company offers electrically conductive coating such as pyroflex 7D713 and 10P23.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abrisa Technologies

- Altana AG

- Axalta Coating Systems Ltd.

- Creative Materials Inc.

- Dymax Corp.

- First Graphene Ltd

- Henkel AG and Co. KGaA

- Hexcel Corp.

- Hitachi Ltd.

- Holland Shielding Systems BV

- Indium Corp.

- MG Chemicals Ltd.

- Parker Hannifin Corp.

- PPG Industries Inc.

- PTFE Applied Coatings

- RS Coatings

- Sika AG

- The Sherwin Williams Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Electrically conductive coatings are essential in various industries, including aerospace and defense, electronics, and renewable energy. These coatings provide antistatic protection and electromagnetic shielding, ensuring the safety and functionality of sensitive electronic components. Acrylics, epoxy, polyesters, polyurethanes, and other polymers are commonly used as base materials for conductive coatings. Copper, aluminum, and silver are common conducting fillers. Advanced conductive coatings offer mechanical qualities such as moisture resistance, scratch resistance, chemical resistance, abrasion resistance, and impact resistance. Pigments and conductive material ratios are crucial factors in determining the final properties of the coatings. Curing temperatures and polymeric derivatives also play a significant role in the manufacturing process. Conductive coatings are used in various applications, including safety electronic boards, electric vehicles, consumer electronics, and solar panels. In aerospace, they protect against electrostatic interference and electromagnetic interference. In the bioscience industry, they provide corrosion protection. Flexible circuit design, heating elements, and ground straps also utilize conductive coatings.

Sustainable coatings, such as water-based, solvent-based, and UV-curable coatings, are gaining popularity due to their reduced environmental impact. Conductive coatings are also used in 5G technology, the Internet of Things, and wearable electronics. The electrolysis process is used to apply conductive coatings to non-conductive substrates, creating a conductive path for electrical current. Air pollutants and volatile hazardous compounds are concerns in the production of conductive coatings. However, efforts are being made to minimize these emissions through the use of advanced manufacturing techniques and sustainable raw materials. Substrate materials such as plastics, metals, glass, and ceramics can all be coated with conductive materials. In summary, electrically conductive coatings play a vital role in various industries, providing essential functions such as antistatic protection, electromagnetic shielding, and corrosion protection. Advanced manufacturing techniques and sustainable raw materials are driving innovation in this field.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market Growth 2024-2028 |

USD 7.81 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.1 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 53% |

|

Key countries |

China, Japan, Germany, UK, India, South Korea, US, France, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abrisa Technologies, Akzo Nobel NV, Altana AG, Axalta Coating Systems Ltd., Creative Materials Inc., Dymax Corp., First Graphene Ltd, Henkel AG and Co. KGaA, Hexcel Corp., Hitachi Ltd., Holland Shielding Systems BV, Indium Corp., MG Chemicals Ltd., Parker Hannifin Corp., PPG Industries Inc., PTFE Applied Coatings, RS Coatings, Sika AG, and The Sherwin Williams Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.