Emulsion Polymers Market Size 2024-2028

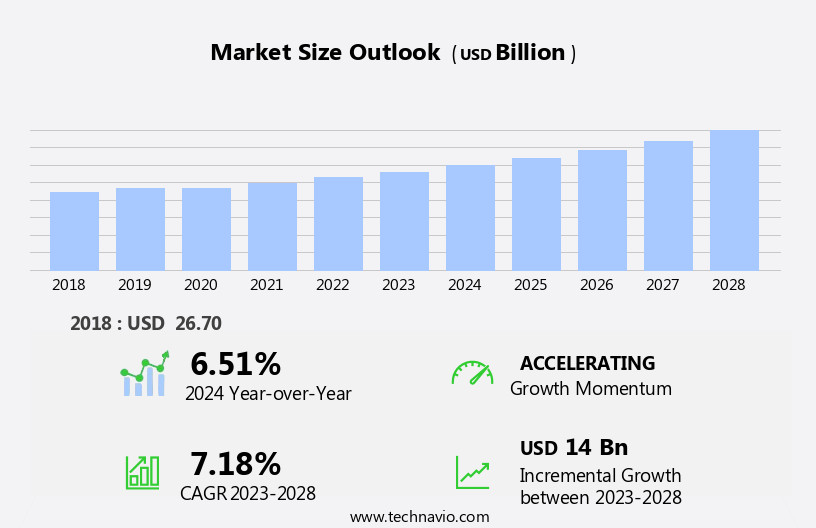

The emulsion polymers market size is forecast to increase by USD 14 billion at a CAGR of 7.18% between 2023 and 2028.

- Emulsion polymers have witnessed significant growth in various industries, particularly in paints and coatings applications. The increasing demand for eco-friendly products is driving the market, as emulsion polymers are produced using a more sustainable process compared to traditional solvent-borne polymers.

- However, the market growth is also challenged by rising raw material costs, which can impact the profitability of manufacturers. The trend towards smart manufacturing and the growing demand for protective coatings are expected to continue fueling the market's expansion. Emulsion polymers offer numerous benefits, including improved application properties, reduced volatile organic compound emissions, and enhanced durability. As the demand for environmentally friendly and cost-effective solutions continues to increase, the market is poised for continued growth.

What will be the Size of the Emulsion Polymers Market During the Forecast Period?

- The market encompasses a diverse range of chemical products utilized in various industries, including construction, textiles and coatings, paper, consumer durables, and adhesives. These polymers, formed through the dispersion of monomers in water using surfactants, exhibit excellent properties such as low VOC emissions, making them ideal for use in green buildings and sustainable applications.

- Acrylics, vinyl acetate polymers, SB latex, and polymers derived from radical polymerization are among the prominent types. Emulsion polymers find extensive use In the production of paints and coatings, paper and paperboard, and adhesives. Monomers like polyethylene, polypropylene, and polyvinyl chloride are common raw materials In the manufacturing process.

- The market is driven by factors such as increasing demand for sustainable and eco-friendly products, growing construction industry, and advancements in polymerization technologies.

How is this Emulsion Polymers Industry segmented and which is the largest segment?

The emulsion polymers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Paints and coatings

- Paper and paperboard coatings

- Adhesives

- Others

- Material

- Acrylic

- Styrene-butadiene latex

- Vinyl acetate polymers

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

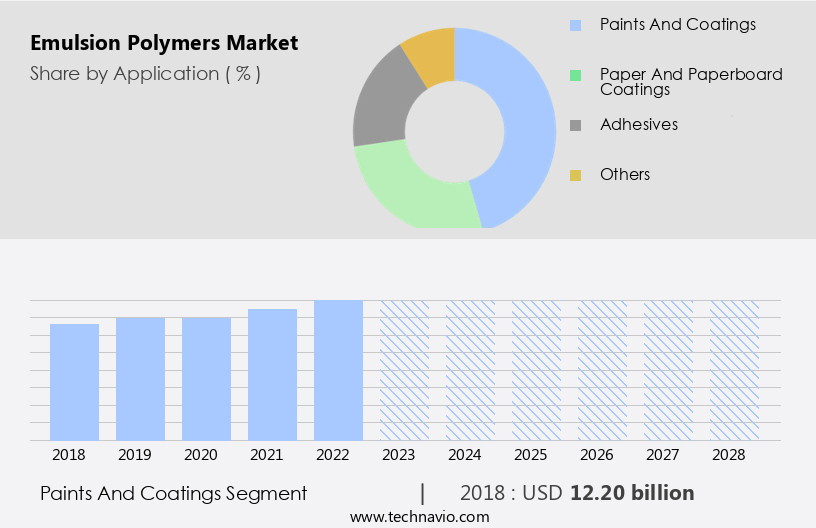

- The paints and coatings segment is estimated to witness significant growth during the forecast period.

Emulsion polymers held a significant market share In the global paints and coatings industry in 2023. The expansion of the construction and automotive sectors, primarily in Asia Pacific, is a primary growth driver for the market in this segment. The preference for eco-friendly and biodegradable products is another significant factor fueling market growth. The increasing demand for low Volatile Organic Compound (VOC) emission paints is anticipated to boost the usage of emulsion polymers in this application area. These polymers offer enhanced water resistance in paints, providing additional protection to building exteriors. The emulsion polymers utilized in coatings applications include vinyl acetate, styrene butadiene, polyethylene, polypropylene, polyvinyl chloride, polyurethane, polyethylene terephthalate, and polystyrene.

These polymers contribute to waterborne coatings, architectural paints, adhesives and sealants, waterproofing coatings, flooring adhesives, and cement modification. The demand for emulsion polymers is also influenced by the urbanization, housing, and industrialization trends, as well as the increasing construction activity. Emulsion polymer coatings provide benefits such as adhesion, film forming, durability, waterproofing, and surface treatments. Furthermore, the emulsion polymers sector is also involved in plastic waste management and the production of acrylics and vinyl acetate polymers.

Get a glance at the Emulsion Polymers Industry report of share of various segments Request Free Sample

The Paints and coatings segment was valued at USD 12.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

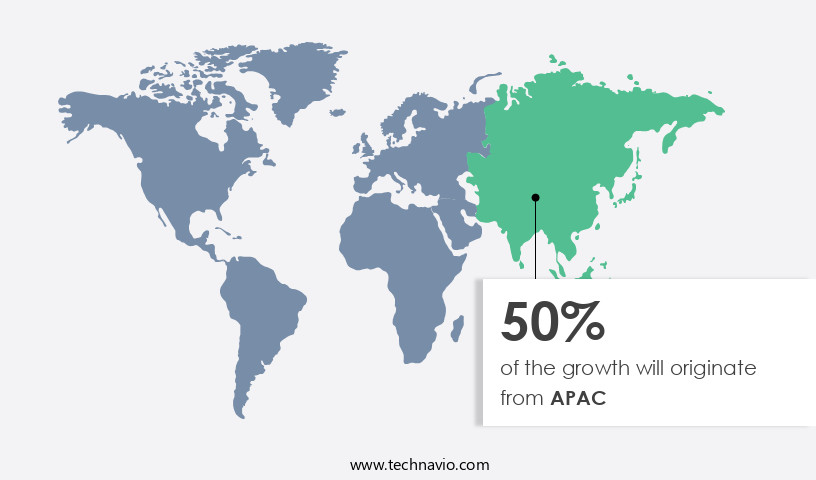

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Emulsion polymers are essential raw materials in various industries, including construction, textiles, coatings, paper, consumer durables, and adhesives. In 2023, APAC held the largest market share In the market, driven by factors such as favorable weather conditions, low labor costs, and government support. China is a significant producer and consumer of emulsion polymers, contributing to the market's growth in APAC. End-use sectors, particularly automobile and construction, will fuel the regional market's expansion during the forecast period. Strict regulations to reduce VOC emissions from products are also propelling the demand for emulsion polymers as alternatives to traditional solvent-based materials.

Key industries using emulsion polymers include paper and paperboard, adhesives and sealants, waterproofing coatings, paints, flooring adhesives, and cement modification. Emulsion polymers offer benefits such as film forming, adhesion, durability, and waterproofing, making them suitable for various applications. Vinyl acetate, styrene butadiene, polyethylene, polypropylene, polyvinyl chloride, polyurethane, polyethylene terephthalate, and polystyrene are common types of emulsion polymers. The market is expected to continue growing due to urbanization, housing, and industrialization, as well as the increasing demand for biodegradable products and green building initiatives.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Emulsion Polymers Industry?

Increased demand for emulsion polymers in paints and coating applications is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for water-borne coatings in various industries, including construction, textiles, paper, consumer durables, and adhesives. Emulsion polymers, which include Acrylics, Vinyl Acetate Polymer, Styrene Butadiene Latex (SB Latex), and others, are used as raw materials In the production of these products. The construction sector's expansion, driven by urbanization and housing needs, is a major contributor to the market's growth. Emulsion polymers offer advantages such as improved adhesion, film forming, durability, and waterproofing in various applications. In the construction industry, they are used for cement modification, surface treatments, and waterproofing coatings.

- In the paper and paperboard industry, they are used as sizing agents and coating materials. In the textile industry, they are used for textile finishing and coating applications. In the adhesives and sealants sector, they are used for flooring adhesives and other applications. Emulsion polymers are also used In the production of VOC free paints for green buildings, which is a growing trend due to increasing awareness of environmental issues. The emulsion polymers used in paints and coatings have fewer VOC components, making them more eco-friendly. The market's growth is also driven by the increasing industrialization and construction activity, which require the use of various adhesives, sealants, and coatings.

- The raw materials used In the production of emulsion polymers include monomers and surfactants. Monomers such as Polyethylene, Polypropylene, Polyvinyl Chloride, Polyurethane, Polyethylene Terephthalate, and Polystyrene are used to produce various types of emulsion polymers. Surfactants are used to stabilize the emulsion and improve its performance. The market's growth is expected to continue due to the increasing demand for sustainable and eco-friendly products, including biodegradable adhesives and sealants. In conclusion, the market is experiencing significant growth due to the increasing demand for water-borne coatings in various industries, including construction, textiles, paper, consumer durables, and adhesives. The market's growth is driven by factors such as urbanization, improving GDP, and increasing awareness of environmental issues.

- The market offers opportunities for growth due to the increasing demand for sustainable and eco-friendly products. Emulsion polymers offer advantages such as improved adhesion, film forming, durability, and waterproofing, making them a preferred choice for various applications.

What are the market trends shaping the Emulsion Polymers Industry?

Increasing demand due to its eco-friendly production process of emulsion polymer is the upcoming market trend.

- Emulsion polymers are produced through the emulsion polymerization process, which involves the emulsification of a monomer using water and a surfactant. Monomers such as styrene, acrylonitrile, butadiene, acrylate, and methacrylate esters are commonly used in this process. Emulsion polymerization can be carried out in batches, semi-batches, or continuously. This manufacturing process consumes less energy, resulting in a lower carbon footprint, making emulsion polymers an eco-friendly choice. Additionally, their low maintenance and handling costs contribute to their increasing demand. Emulsion polymers find extensive applications in various industries, including textiles, paper and paperboard, adhesives and sealants, waterproofing coatings, paints, flooring adhesives, and cement modification.

- In the construction industry, they are used in waterborne coatings, architectural paints, and surface treatments. In the textile industry, they are used In the production of VOC free paints for interior decor. The chemical industry utilizes emulsion polymers In the production of biodegradable products and industrial adhesives. The paper industry uses emulsion polymers for paper and paperboard production. Emulsion polymers are also used in plastic waste management and In the production of acrylics polymers, such as vinyl acetate, styrene butadiene, polyethylene, polypropylene, polyvinyl chloride, polyurethane, polyethylene terephthalate, and polystyrene. The increasing urbanization and housing demand, along with the trend towards green buildings, have led to a surge In the use of waterborne coatings and eco-friendly adhesives and sealants, driving the growth of the market.

- The market is expected to continue growing due to the increasing demand for durable and waterproofing coatings, adhesives, and sealants in various industries.

What challenges does the Emulsion Polymers Industry face during its growth?

Increasing raw materials cost is a key challenge affecting the industry growth.

- Emulsion polymers, a crucial component in various industries, include Polymer Emulsion, Acrylics, Vinyl Acetate Polymer, Styrene Butadiene Latex (SB Latex), and others, are essential in Water Borne Coatings, Adhesives and Sealants, Paper and Paperboard, and Coating Applications. The market for these polymers is influenced by several factors, including the price volatility of raw materials such as naphtha and ethane. The dependence of these raw materials on crude oil reserves creates supply constraints and price fluctuations. The construction sector, a significant consumer of emulsion polymers, is witnessing growth due to urbanization and housing demands. Green buildings, a trend In the industry, require VOC free paints and coatings, increasing the demand for water-based emulsion polymers.

- The textile industry also relies on these polymers for textile finishing. The chemical industry uses emulsion polymers in various applications, including cement modification, surface treatments, and plastic waste management. The demand for biodegradable products is driving the growth of the Acrylics Polymer sector. The increasing industrialization and construction activity further boost the demand for emulsion polymers. However, the high production cost due to raw material scarcity and price fluctuations can hinder the market growth during the forecast period. Despite these challenges, the market for emulsion polymers is expected to grow, driven by the increasing demand from various industries.

Exclusive Customer Landscape

The emulsion polymers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the emulsion polymers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, emulsion polymers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Akzo Nobel NV

- Alberdingk Boley GmbH

- Apcotex Industries Ltd.

- Arkema Group

- Asian Paints Ltd.

- BASF SE

- Celanese Corp.

- Chang Chun Group

- Clariant International Ltd.

- DIC Corp.

- Dow Chemical Co.

- Eastman Chemical Co.

- H.B. Fuller Co.

- PTT Global Chemical Public Co. Ltd.

- Scott Bader Co. Ltd.

- Sumitomo Chemical Co. Ltd.

- Trinseo PLC

- Wacker Chemie AG

- Zeon Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Emulsion polymers are a type of polymer dispersion in which the polymer particles are suspended in water. These polymers are widely used in various industries due to their unique properties, such as excellent adhesion, film forming, and durability. The emulsion polymer market is driven by the increasing demand for water-based coatings and adhesives, particularly In the construction, textiles, paper, consumer durables, and paint and coatings industries. The global chemical industry has seen a significant shift towards the production of emulsion polymers due to their environmental benefits. With the growing emphasis on green buildings and reducing volatile organic compound (VOC) emissions, the demand for VOC-free paints and coatings has surged.

Emulsion polymers play a crucial role in this trend as they enable the production of waterborne coatings, which have lower VOC emissions compared to their solvent-based counterparts. The construction industry is a major consumer of emulsion polymers. The increasing urbanization and housing demand have led to a surge in construction activity, driving the demand for emulsion polymers in various applications such as cement modification, surface treatments, and waterproofing coatings. In addition, emulsion polymers are used extensively in flooring adhesives, providing excellent adhesion and durability. The textile industry is another significant end-user of emulsion polymers. They are used in various applications such as textile finishing, coating, and sizing.

Emulsion polymers offer several advantages over traditional methods, including improved performance, reduced water usage, and reduced environmental impact. The paper and paperboard industry also utilizes emulsion polymers extensively. They are used in various applications such as coating and sizing, providing excellent water resistance and printability. Emulsion polymers are also used In the production of biodegradable products, aligning with the growing trend towards sustainability. The production of emulsion polymers involves the polymerization of monomers In the emulsion phase. Radical polymerization is a common method used for the production of emulsion polymers. The choice of monomer and surfactant plays a crucial role in determining the properties of the final product.

Commonly used monomers include acrylics, vinyl acetate, styrene butadiene, polyethylene, polypropylene, polyvinyl chloride, polyurethane, polyethylene terephthalate, and polystyrene. The market is expected to grow significantly In the coming years due to the increasing demand for waterborne coatings and adhesives, particularly In the construction, textiles, paper, consumer durables, and paint and coatings industries. The market is driven by various factors, including urbanization, industrialization, and the growing emphasis on sustainability. Emulsion polymers offer several advantages over traditional solvent-based polymers, including improved performance, reduced environmental impact, and lower VOC emissions. They are also easier to handle and apply, making them a preferred choice for various applications.

Emulsion polymers are a versatile class of polymers with wide applications in various industries. Their unique properties, such as excellent adhesion, film forming, and durability, make them an essential component of various products. The market is expected to grow significantly In the coming years due to the increasing demand for waterborne coatings and adhesives, particularly In the construction, textiles, paper, consumer durables, and paint and coatings industries. The market is driven by various factors, including urbanization, industrialization, and the growing emphasis on sustainability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.18% |

|

Market growth 2024-2028 |

USD 14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.51 |

|

Key countries |

China, US, India, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Emulsion Polymers Market Research and Growth Report?

- CAGR of the Emulsion Polymers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the emulsion polymers market growth of industry companies

We can help! Our analysts can customize this emulsion polymers market research report to meet your requirements.