Energy Drinks Market Size 2025-2029

The energy drinks market size is valued to increase USD 51.3 billion, at a CAGR of 8.7% from 2024 to 2029. Hectic lifestyle and need for instant energy will drive the energy drinks market.

Major Market Trends & Insights

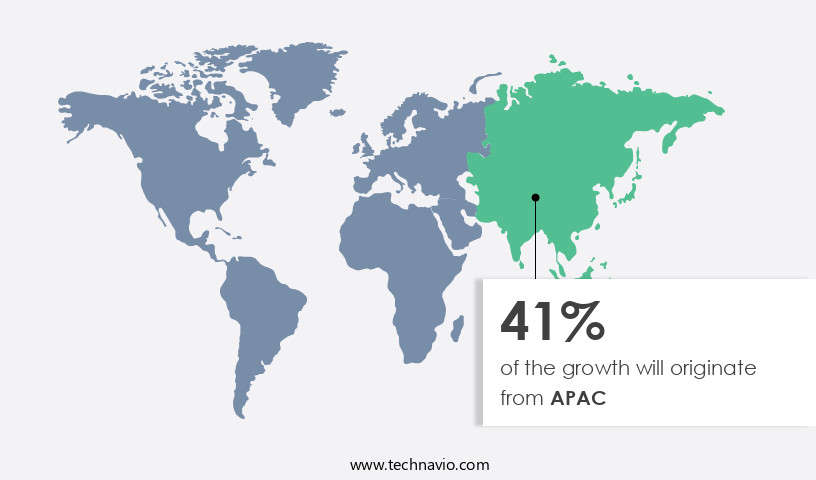

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By Product - Sparkling energy drinks segment was valued at USD 65.30 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 97.51 billion

- Market Future Opportunities: USD 51.30 billion

- CAGR from 2024 to 2029 : 8.7%

Market Summary

- The market represents a dynamic and continually evolving industry, fueled by consumer demand for products that offer instant energy and productivity. Core technologies, such as caffeine and taurine, remain at the heart of energy drink formulations, while applications span various sectors, including sports, workplaces, and education. The market is further segmented into product categories, including carbonated and non-carbonated beverages, and service types, such as ready-to-drink (RTD) and concentrate or powder formats. Despite the market's growth, it faces challenges, including stiff competition from low-cost substitutes and increasing regulations. For instance, the European Union has imposed stricter labeling requirements and caffeine limits on energy drinks.

- Nevertheless, opportunities abound, particularly in the increasing demand for low-calorie energy drinks, which cater to health-conscious consumers. According to recent reports, the low-calorie segment is expected to account for over 40% of the global energy drink market share by 2027. With the hectic pace of modern life showing no signs of slowing, the market continues to unfold, offering both challenges and opportunities for industry participants.

What will be the Size of the Energy Drinks Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Energy Drinks Market Segmented ?

The energy drinks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Sparkling energy drinks

- Still energy drinks

- Distribution Channel

- Offline

- Online

- Type

- Natural/organic

- Conventional

- Category

- Carbonated Energy Drinks

- Non-Carbonated Energy Drinks

- Natural Energy Drinks

- Sports Drinks

- Format

- Ready-to-Drink (RTD)

- Shots

- Powder

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The sparkling energy drinks segment is estimated to witness significant growth during the forecast period.

Sparkling energy drinks, characterized by their carbonation, have gained significant traction among consumers worldwide. These beverages, which can be made with carbonated water or soda water as their base, have become popular due to their association with providing instant energy. To meet this growing demand, companies are continually introducing new sparkling energy drink products and expanding their production capacities. For example, in April 2024, Breville launched InFizz Fusion, its first carbonated beverage, which can be used to carbonate various beverages, including juices, wine, alcohol, coffee, and tea. This innovation is expected to attract new customers and contribute to the expansion of the sparkling energy drink segment in the market.

Moreover, companies are differentiating their products through ingredient sourcing, vitamin fortification, and carbonation techniques. For instance, some energy drinks contain herbal extracts, such as guarana and taurine, while others use natural sweeteners. Additionally, quality control testing, sensory evaluation, and manufacturing processes are crucial elements in ensuring product consistency and safety. Advertising campaigns, pricing strategies, sales promotions, and brand positioning are essential components of marketing efforts in the energy drinks industry. Shelf life extension, electrolyte balance, and sugar substitutes are also significant factors in product development. Functional ingredients, such as vitamins and minerals, are increasingly popular, as consumers seek healthier alternatives.

The Sparkling energy drinks segment was valued at USD 65.30 billion in 2019 and showed a gradual increase during the forecast period.

The market is dynamic, with ongoing innovation strategies and regulatory compliance playing a critical role. Companies are continually improving their manufacturing processes and exploring new packaging materials and bottling techniques. Customer loyalty and distribution channels are essential for maintaining a competitive edge. The industry is expected to grow, with increasing demand from emerging markets and a focus on product differentiation and quality. For example, the market for energy drinks in Asia Pacific is projected to expand at a rate of 12% during the forecast period. Similarly, the European market is expected to grow by 8% due to the increasing popularity of functional beverages and the growing health consciousness among consumers.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Energy Drinks Market Demand is Rising in APAC Request Free Sample

The market holds substantial potential for expansion in the Asia Pacific (APAC) region, encompassing developed, developing, and least developed economies. In developed economies, a variety of energy drinks from both large and small companies are accessible. However, the developing and least-developed economies present significant growth opportunities. As disposable income levels have risen, consumers have been able to spend more on functional beverages, including energy drinks.

Additionally, the growth of organized retail and the proliferation of private labels offer sales channels for energy drinks in these economies. In the coming years, consumer preferences are expected to shift towards diverse flavors and health-conscious energy drink options.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry, driven by consumer preferences for beverages that enhance physical performance, provide mental alertness, and boost energy levels. The market's growth is underpinned by several key factors, including the effects of caffeine and guarana extract on athletic performance, the role of electrolytes in hydration during exercise, and the impact of sensory attributes on consumer acceptance of new flavors. Caffeine absorption rate and energy drink consumption are closely linked, with many consumers relying on these beverages to enhance focus and productivity. Guarana extract, a common energy drink ingredient, has been shown to improve athletic performance by delaying the onset of fatigue.

However, the use of artificial sweeteners in energy drinks can impact blood glucose levels, necessitating careful formulation and labeling. Electrolytes play a crucial role in hydration during exercise, making them a key component of energy drink formulations. Sensory attributes, such as taste, aroma, and appearance, significantly influence consumer acceptance of new flavors, making innovation in this area essential for market success. Measuring consumer perception of functional ingredients and optimizing carbonation for improved taste and shelf life are also critical considerations. Assessment of energy drink formulations for compliance with regulatory standards and sustainability practices in energy drink manufacturing are increasingly important.

Consumer preferences for natural vs. Artificial sweeteners vary widely, with some markets favoring natural alternatives. The relationship between caffeine concentration and consumer preference is another key factor influencing market trends. Evaluation of novel ingredient combinations in energy drinks and comparison of different manufacturing processes for efficiency are ongoing areas of research and development. Consumer preferences for various distribution channels and the effectiveness of marketing strategies on brand awareness also impact sales performance. Ingredient sourcing and sustainability practices are increasingly important for product quality and cost. A comparative study of various energy boost mechanisms reveals that natural sources, such as ginseng and green tea extracts, are gaining popularity among consumers seeking healthier alternatives.

While synthetic caffeine remains the most common energy drink ingredient, natural alternatives offer a point of differentiation and potential competitive advantage. In conclusion, the market is a complex and diverse industry, driven by consumer preferences for functional beverages and the ongoing quest for innovation and differentiation. Understanding the market's dynamics, from caffeine absorption rates and athletic performance to consumer perception and sustainability practices, is essential for businesses looking to succeed in this dynamic and competitive landscape. Adoption rates of natural energy drink ingredients are significantly higher than those of synthetic alternatives, offering a compelling value proposition for brands seeking to differentiate themselves in the market.

What are the key market drivers leading to the rise in the adoption of Energy Drinks Industry?

- The hectic lifestyle and requisite need for instant energy serve as the primary market motivators.

- In today's fast-paced world, consumers face increasing demands on their time and energy. Energy drinks have emerged as a popular solution, offering a blend of ingredients like ginseng, caffeine, and electrolytes to keep consumers alert and productive. These beverages have gained significant traction in various sectors, from office workers seeking an energy boost to athletes looking to replenish after strenuous activities. The productivity-enhancing benefits of energy drinks are noteworthy. Caffeine, a key ingredient, stimulates the central nervous system, increasing alertness and focus. Additionally, some energy drinks contain electrolytes and essential vitamins, which help restore energy balance and contribute to overall well-being.

- The global energy drink market is a dynamic and evolving landscape, with continuous innovation and expansion. Market players are focusing on developing new product lines and flavors to cater to diverse consumer preferences. The market's growth can be attributed to factors such as changing lifestyles, increased work demands, and the need for quick energy boosts. Energy drinks have proven their value in various applications, from office environments to sports events. Their ability to provide a quick energy boost and enhance focus and alertness makes them an indispensable part of modern life. As consumers continue to seek convenient and effective solutions to maintain their energy levels, the energy drink market is poised for continued growth and innovation.

What are the market trends shaping the Energy Drinks Industry?

- The upcoming market trend involves an increasing demand for low-calorie energy drinks. Low-calorie energy drinks are gaining popularity in the market.

- In the contemporary business landscape, health consciousness is on the rise among consumers, driven by the increasing prevalence of various diseases. This trend is significantly impacting the food and beverage industry, with a noticeable shift away from products high in sugar content. Energy drinks, in particular, are experiencing a transformation as consumers seek low-calorie alternatives. Several manufacturers, such as Red Bull, have responded to this demand by introducing sugar-free variants. This pattern reflects a broader consumer preference for healthier options and a move away from traditional energy drinks.

What challenges does the Energy Drinks Industry face during its growth?

- The industry's growth is significantly impacted by rigorous competition from economical alternatives, posing a major challenge.

- Energy drinks encounter significant competition from economical alternatives such as fruit juices, soft drinks, and other flavored beverages. Unlike energy drinks, these substitutes do not contain stimulants like ginseng and guarana. However, they offer energy-giving components like glucose, vitamins, and minerals. These substitutes have been available in the market prior to energy drinks' emergence and enjoy high consumer preference. Despite expansion in Western markets, energy drinks remain underrepresented in emerging economies.

- The affordability of substitutes, whether fresh or packaged, is a significant factor. Energy drink brands, with their association with sports events and substantial marketing expenses, contribute to the high cost of these beverages.

Exclusive Technavio Analysis on Customer Landscape

The energy drinks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the energy drinks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Energy Drinks Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, energy drinks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in producing energy drinks under a renowned brand, catering to individuals with diabetes while ensuring complete balanced nutrition.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Breville Group Ltd.

- Britvic plc

- Cargill Inc.

- Decathlon SA

- DyDo Group Holdings Inc.

- Hype Energy

- Keurig Dr Pepper Inc.

- Monster Beverage Corp.

- National Beverage Corp.

- Otsuka Holdings Co. Ltd.

- PepsiCo Inc.

- Red Bull GmbH

- Slades Beverages

- Suntory Beverage and Food Europe

- The Coca Cola Co.

- ZOA Energy

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Energy Drinks Market

- In January 2024, Red Bull GmbH, the world's leading energy drink brand, announced the launch of its new product, Red Bull Sugarfree Zero, in the US market. This zero-sugar, zero-calorie version of the popular energy drink aims to cater to the growing health-conscious consumer segment (Red Bull press release).

- In March 2024, Monster Beverage Corporation, the second-largest energy drink company, entered into a strategic partnership with Nestlé to distribute Monster Energy drinks in China. This collaboration was expected to significantly expand Monster's reach in the world's most populous country (Monster Beverage Corporation SEC filing).

- In April 2025, Rockstar Energy Drink, a privately held energy drink brand, raised USD350 million in a funding round led by Blackstone Group Inc. The investment was intended to support the company's global growth plans and new product development (Bloomberg News).

- In May 2025, the European Commission approved the acquisition of a majority stake in Swedish energy drink brand, Caffeine Power, by PepsiCo. The deal, worth €350 million, was expected to strengthen PepsiCo's presence in the European market (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Energy Drinks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 51.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.3 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The energy drink market continues to evolve, shaped by shifting consumer preferences and innovative industry developments. Ingredient sourcing plays a significant role, with an increasing focus on natural herbal extracts such as guarana and ginseng. Carbonation techniques vary, from traditional methods to newer, more efficient processes. Vitamin fortification is a key differentiator, with energy drinks offering various combinations of essential vitamins and minerals. Product formulation innovation is a constant, with new functional ingredients like taurine and electrolytes enhancing energy and hydration benefits. Quality control testing is crucial, ensuring consistent caffeine content levels and adherence to regulatory compliance.

- Advertising campaigns and sales promotions employ creative strategies to capture consumer attention, while shelf life extension and packaging materials cater to convenience and portability. Manufacturing processes are streamlined through advanced technology, such as canning and bottling techniques. Sensory evaluation is essential for maintaining flavor profiles, as consumer preferences for sweetness and bitterness continue to evolve. Competitor analysis drives pricing strategies, with brands offering various tiers to cater to diverse customer segments. Innovation and brand positioning are critical, as companies strive to differentiate themselves in a crowded market. Natural sweeteners and sugar substitutes are increasingly popular, reflecting consumer demand for healthier options.

- Regulatory compliance remains a priority, with electrolyte balance and nutritional labeling key considerations for manufacturers. Brand loyalty is fostered through effective distribution channels and supply chain management, ensuring consistent availability and customer satisfaction. Overall, the energy drink market's dynamics continue to unfold, driven by consumer preferences, innovation, and regulatory requirements.

What are the Key Data Covered in this Energy Drinks Market Research and Growth Report?

-

What is the expected growth of the Energy Drinks Market between 2025 and 2029?

-

USD 51.3 billion, at a CAGR of 8.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Sparkling energy drinks and Still energy drinks), Distribution Channel (Offline and Online), Type (Natural/organic and Conventional), Geography (APAC, North America, Europe, South America, and Middle East and Africa), Category (Carbonated Energy Drinks, Non-Carbonated Energy Drinks, Natural Energy Drinks, and Sports Drinks), and Format (Ready-to-Drink (RTD), Shots, and Powder)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Hectic lifestyle and need for instant energy, Stiff competition from low-cost substitutes

-

-

Who are the major players in the Energy Drinks Market?

-

Key Companies Abbott Laboratories, Breville Group Ltd., Britvic plc, Cargill Inc., Decathlon SA, DyDo Group Holdings Inc., Hype Energy, Keurig Dr Pepper Inc., Monster Beverage Corp., National Beverage Corp., Otsuka Holdings Co. Ltd., PepsiCo Inc., Red Bull GmbH, Slades Beverages, Suntory Beverage and Food Europe, The Coca Cola Co., and ZOA Energy

-

Market Research Insights

- The market exhibits dynamic growth, with sales reaching an estimated USD 60 billion worldwide in 2021. This figure represents a significant increase from the USD 45 billion recorded in 2016, signifying a 37% expansion in just five years. Marketing ROI and sales performance metrics are key focus areas for energy drink manufacturers, with distribution efficiency and promotional effectiveness also critical to success. Ingredient interactions, such as stimulant delivery systems and taste masking methods, are under constant scrutiny to meet dietary guidelines and consumer insights. Physical performance and cognitive enhancement are primary benefits sought by the target audience, driving innovation in product development.

- Sustainability initiatives, cost reduction strategies, and health and wellness concerns are increasingly influencing energy drink formulations. Energy boost duration, consumer perception, and cognitive enhancement are essential sales performance metrics, with brand equity and supply chain risks also significant factors. The market's evolution is marked by ongoing process optimization and ingredient standardization, as well as the emergence of new trends like hydration levels and waste management.

We can help! Our analysts can customize this energy drinks market research report to meet your requirements.