Enterprise AI Market Size 2025-2029

The enterprise AI market size is forecast to increase by USD 94.23 billion at a CAGR of 54.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of AI technologies, particularly chatbots, in various industries. This trend is not limited to large corporations but is also gaining traction among Small and Medium-sized Enterprises (SMEs), as they recognize the benefits of automating routine tasks and improving customer engagement. However, the market's growth is not without challenges. Another trend is the growing interest in chatbot and their application in enterprise settings, particularly among Small and Medium-sized Enterprises (SMEs). The fourth industrial revolution brings self-driving cars, augmented reality, and virtual reality to the forefront, with AI playing a crucial role in these technologies.

- This skills gap presents both an opportunity and a challenge for businesses, as they can either invest in upskilling their existing workforce or partner with AI service providers to overcome this hurdle. As the market continues to evolve, companies seeking to capitalize on the opportunities and navigate challenges effectively must stay informed about the latest trends and developments in enterprise AI.

What will be the Size of the Enterprise AI Market during the forecast period?

- The market is witnessing significant growth as businesses in various industries seek to optimize their operations and improve profitability. AI technologies, such as predictive analytics solutions and advanced robotics, are being integrated into business processes to increase efficiency and reduce costs. Digitalization is a critical aspect of modern manufacturing, and AI is playing an increasingly important role in digital manufacturing. By analyzing process flows and identifying inefficiencies, AI can help streamline production processes and improve operating efficiency. This, in turn, leads to cost savings and better business outcomes.

- By implementing AI governance and integrating AI into their enterprise software applications, they can gain valuable insights from their data and make informed decisions. The adoption of AI is not limited to manufacturing alone. In the realm of autonomous mobility, AI is being used to develop self-driving vehicles and optimize transportation logistics. In the realm of IIOT, AI is being used to analyze big data, AI analytics, and improve predictive maintenance. Operating costs are a major concern for businesses, and AI is proving to be an effective solution.

How is the Enterprise AI Industry segmented?

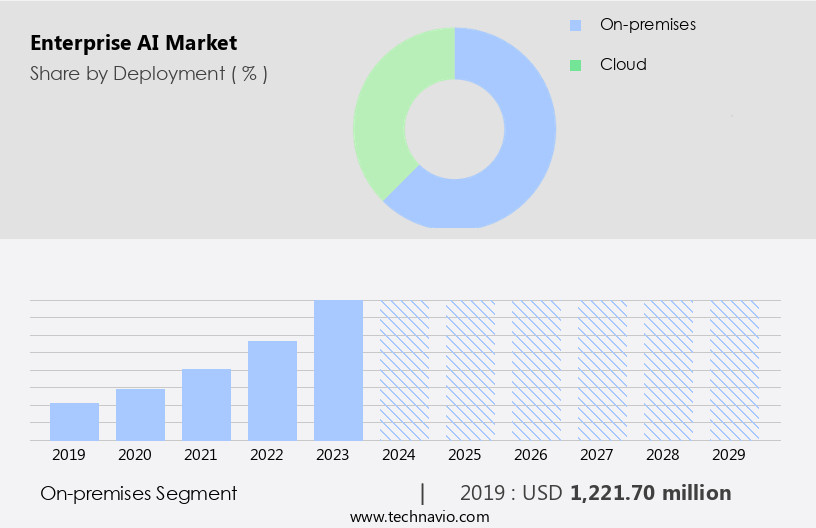

The enterprise AI industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- End-user

- Advertising and media and entertainment

- Retail and e-commerce

- Medical and life sciences

- BFSI

- Others

- Component

- Solutions

- Services

- Application

- Marketing

- Customer support and experience

- Security and risk

- Process automation

- HR and recruitment

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period. The market encompasses the deployment of artificial intelligence (AI) infrastructure within an organization's premises for business process enhancement. On-premises AI infrastructure, which involves installing AI systems on a company's own property, is gaining popularity due to heightened security concerns. With the increasing demand for data security and control, many businesses prefer on-premises AI infrastructure over cloud-based alternatives. This segment's growth is driven by the integration of AI into various industries, including manufacturing processes, business processes, and industrial automation. Key technologies such as edge computing, augmented reality, and virtual reality are also contributing to the market's expansion.

The implementation of AI in industries like manufacturing, banking, and transportation is leading to significant operating cost savings and improved operational efficiency. Integrated systems, autonomous mobility, and digital transformation are other significant trends shaping the market. Key players in this sector include leading technology companies and startups specializing in cutting-edge robotics and AI.

Get a glance at the market report of share of various segments Request Free Sample

The On-premises segment was valued at USD 1.22 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market holds a significant share in the global market due to the widespread adoption of AI by businesses in the region. Key players, such as IBM, Intel, and Microsoft, are driving market growth through their integration of AI into various business functions and the provision of AI tools and solutions. Collaboration among industry participants is also contributing to the expansion of the market, particularly in the BFSI sector. AI systems are being developed and implemented to enhance business processes, improve operating efficiency, and reduce operating costs across industries.

The fourth industrial revolution, characterized by the integration of AI, robotics, and the Internet of Things, is transforming manufacturing processes, industrial automation, and information management. Edge computing, augmented reality, and virtual reality are also gaining traction in the enterprise AI landscape. Key trends include the adoption of predictive analytics solutions, public cloud, and cloud service elasticity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Enterprise AI Industry?

- Increasing interest in chatbot AI is the key driver of the market. Chatbot AI, an application of Artificial Intelligence, is transforming customer engagement by enabling businesses to automate responses to customer queries. The technology allows customers to communicate with a robot application instead of a human, with automated replies processed by an AI algorithm. These interactions generate vast amounts of data, which can be analyzed to derive patterns and insights, enabling AI to learn and understand consumer behavior. This capability to provide accurate and timely responses without human intervention is driving market growth.

- Chatbot AI is a cost-effective solution for firms seeking to integrate AI into their applications, offering a simple and efficient alternative to traditional customer service channels. This technology is poised to revolutionize the way businesses interact with their customers, enhancing the overall customer experience.

What are the market trends shaping the Enterprise AI Industry?

- Adoption of enterprise AI by SMEs is the upcoming market trend. Small and Medium-sized Enterprises (SMEs) are increasingly integrating Artificial Intelligence (AI) into their business operations to gain a competitive edge against larger Multinational Corporations (MNCs). Historically, SMEs have been hesitant to adopt new technologies due to cost constraints.

- However, the advantages of AI, such as automation, data analysis, and improved efficiency, are compelling SMEs to invest. The think big, start small approach is gaining popularity among SMEs, allowing them to implement AI in a few business processes before scaling up. Despite the initial investment, the long-term benefits of AI adoption outweigh the costs. SMEs may face challenges in competing with MNCs, but the strategic use of AI can help level the playing field.

What challenges does the Enterprise AI Industry face during its growth?

- Lack of AI professionals is a key challenge affecting the industry's growth. The market faces a significant hurdle in the form of insufficient technical expertise among enterprises. Implementing AI requires a thorough knowledge of the technology, yet there exists a scarcity of proper documentation for firms to follow.

- The high cost of AI integration necessitates a meticulous analysis of all aspects before implementation. Enterprises often turn to experienced AI professionals for guidance. The shortage of experts with the necessary AI knowledge poses a considerable barrier to the adoption of AI within business operations. This talent deficiency impedes the growth of the market.

Exclusive Customer Landscape

The enterprise AI market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the enterprise AI market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, enterprise AI market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abacus.AI - The company offers Enterprise AI, which is used by companies to empower developers to build custom models from data sets. They also use LLM Ops and ML Ops.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abacus.AI

- Alphabet Inc.

- Alteryx Inc.

- Amazon.com Inc.

- Databricks Inc.

- Dataiku Inc.

- DataRobot Inc.

- H2O.ai Inc.

- Hewlett Packard Enterprise Co.

- Hypersonix Inc.

- Intel Corp.

- International Business Machines Corp.

- Microsoft Corp.

- Oracle Corp.

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Sentient Technologies

- Snowflake Inc.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Artificial Intelligence (AI) is revolutionizing business processes and outcomes by automating and optimizing various functions in the industrial sector. This transformation is often referred to as the Fourth Industrial Revolution, characterized by the integration of physical and digital systems through the Internet of Things (IoT), intelligent robots, and automated technologies. Businesses across industries are embracing AI to streamline their manufacturing processes, improve operating efficiency, and reduce costs. The integration of AI in business processes is enabling continuous process improvement and real-time data analysis, leading to enhanced productivity and better decision-making. The rise of AI is also driving the development of advanced manufacturing techniques, such as digital manufacturing and integrated systems.

These technologies enable real-time monitoring and control of production processes, resulting in improved quality and reduced waste. Edge computing and augmented reality are also gaining traction in the manufacturing sector, enabling real-time data processing and analysis at the edge of the network. The adoption of AI in enterprise applications is not limited to manufacturing alone. AI is also being used in various sectors, including finance, healthcare, retail, and logistics, to name a few. AI governance and predictive analytics solutions are becoming essential components of enterprise software applications, enabling businesses to make informed decisions based on data insights. The strategic investment in AI is a response to the increasing demand for automation and digital transformation.

Pittsburgh-based startups and cutting-edge robotics companies are leading the way in developing innovative AI solutions. These solutions are enabling businesses to improve their operating efficiency, reduce costs, and gain a competitive edge in their respective markets. The use of AI in enterprise applications is also driving the growth of public cloud and cloud service elasticity. The cloud infrastructure enables businesses to scale their AI applications as per their requirements, providing them with the flexibility to respond to changing business needs. The impact of AI on IT and telecommunications is significant, with AI-powered solutions enabling the automation of various functions, including network management, security, and customer support.

Self-driving cars and virtual reality are also areas where AI is making a significant impact, with AI-powered systems enabling real-time data processing and analysis, leading to improved safety and enhanced user experience. The market is witnessing significant growth, driven by the increasing demand for automation, digital transformation, and real-time data analysis. AI is enabling businesses to improve their operating efficiency, reduce costs, and gain a competitive edge in their respective markets. The integration of AI in various sectors, including manufacturing, finance, healthcare, retail, and logistics, is leading to innovative solutions and new business models. The strategic investment in AI is a response to the changing business landscape, and the use of AI is driving the growth of public cloud and cloud service elasticity.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

254 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 54.1% |

|

Market growth 2025-2029 |

USD 94.23 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

46.7 |

|

Key countries |

US, Canada, UK, Germany, China, Italy, France, The Netherlands, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Enterprise AI Market Research and Growth Report?

- CAGR of the Enterprise AI industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the enterprise AI market growth and forecasting

We can help! Our analysts can customize this enterprise AI market research report to meet your requirements.