US Enterprise Data Management Market Size 2024-2028

The US enterprise data management market size is forecast to increase by USD 5.59 billion at a CAGR of 13.6% between 2023 and 2028.

- The market, including Enterprise Data Management (EDM) software, is experiencing significant growth due to increasing demand for data integration and visual analytics. The BFSI industry's reliance on data warehousing and data security continues to drive market expansion. Technological advancements, such as artificial intelligence and machine learning are revolutionizing EDM solutions, offering enhanced capabilities for data processing and analysis. However, the high cost of implementing these advanced EDM solutions remains a challenge for some organizations. Additionally, data security concerns and the need for regulatory compliance are ongoing challenges that require continuous attention and investment. In the telecom sector, the trend towards digital transformation and the generation of vast amounts of data are fueling the demand for strong EDM solutions. Overall, the EDM software market is expected to continue its growth trajectory, driven by these market trends and challenges.

What will be the size of the US Enterprise Data Management Market during the forecast period?

- The Enterprise Data Management (EDM) market in the BFSI sector is experiencing significant growth due to the industry's expansion and strict regulations. With the increasing volume, velocity, and complexity of data, IT organizations in banks and other financial institutions are prioritizing EDM solutions to handle massive datasets and ensure information accuracy. These systems enable data synchronization, address validation, and single-source reporting, addressing data conflicts and silos that hinder effective business operations. EDM solutions are essential for both internal applications and external communication, allowing for leveraging analytics to gain a competitive edge. In the BFSI sector, where risk control is paramount, EDM plays a crucial role in managing and consuming datasets efficiently.

- The market is characterized by a competitive environment, with IT investments focused on multiuser functionality and Big Data capabilities to meet the diverse needs of various business verticals, including manufacturing and services industries. Overall, EDM is a strategic imperative for businesses seeking to stay competitive and compliant in today's data-driven economy.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud

- Ownership

- Large enterprise

- Small and medium enterprise

- End-user

- Commercial banks

- Savings institutions

- Geography

- US

By Deployment Insights

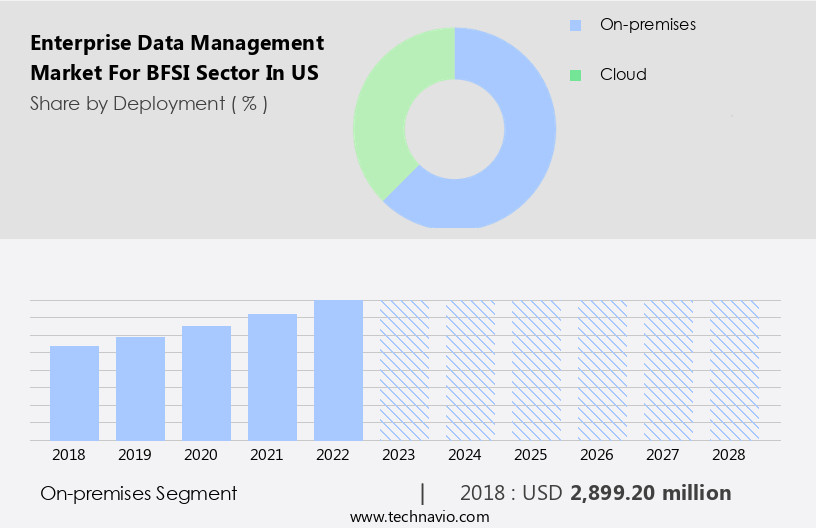

- The on-premises segment is estimated to witness significant growth during the forecast period. The BFSI sector in the US is witnessing a significant expansion in the enterprise data management market, driven by strict regulations and the competitive environment. Large organizations, including commercial banks, insurance companies, and non-banking financial institutions, are prioritizing data management to ensure information accuracy and risk control. Enterprise Data Management (EDM) solutions are crucial for internal applications and external communication, enabling data synchronization and business operations. Leveraging analytics, IT organizations manage vast datasets and datasets' consumption, addressing data conflicts and ensuring data quality for reporting. EDM encompasses handling massive data through Business Analytics, ETL tools, data pipelines, and data warehouses, as well as data visualization tools.

Get a glance at the market share of various segments Request Free Sample

The on-premises segment was valued at USD 2.9 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Enterprise Data Management Market?

- Growing demand for data integration and visual analytics is the key driver of the market. In the BFSI sector, strict regulations necessitate the effective management of large volumes of structured and unstructured data. The industry's expansion and competitive environment necessitate the need for advanced data management solutions. Enterprises are leveraging Enterprise Data Management (EDM) systems to address the challenges of data synchronization, internal applications, and external communication. EDM solutions facilitate data set consumption, minimize data conflicts, and ensure data quality, reporting, and data security. IT organizations handle massive datasets from various business operations, data producers, and data consumers. Data strategies are essential to gain a competitive edge by ingesting, storing, transforming, analyzing data, and deploying it through Business Analytics, ETL tools, data pipelines, and data warehouses.

- Companies offer cloud deployment, on-demand scalability, and support and maintenance to address organizational productivity concerns. AI and Big Data methods enable data privacy, risk management solutions, and data visualization tools. Data address validation and data migration are crucial for data integration and data security. Data management solutions help BFSI companies in risk control, information accuracy, and data integration across business verticals, including banks and manufacturing.

What are the market trends shaping the US Enterprise Data Management Market?

- Increase in technological development in EDM is the upcoming trend in the market. The BFSI sector in the US and Canada is witnessing significant expansion due to industry growth in manufacturing, telecommunications, infrastructure development, and retail activities. This expansion generates a large volume of structured and unstructured data, necessitating the adoption of Enterprise Data Management (EDM) solutions. The competitive environment demands businesses to leverage analytics for gaining a competitive edge and ensuring data accuracy and security. EDM solutions facilitate data synchronization, internal applications, and external communication, addressing data conflicts and ensuring data quality. IT organizations in the BFSI sector handle massive datasets from various data producers and consumers, requiring efficient data set consumption and data management strategies.

- Data privacy and security are crucial, and EDM tools offer data handling, ingesting, storing, transforming, analyzing, and reporting capabilities. companies cater to the specific needs of industries like BFSI by offering solutions for data warehousing, data migration, data integration, and data visualization tools. Big Data methods, such as ETL tools and data pipelines, enable organizations to handle and analyze vast amounts of data, providing authentic information for risk control and business operations. Multiuser functionality and on-demand scalability in cloud deployment ensure support and maintenance, making EDM solutions indispensable for organizational productivity.

What challenges does US Enterprise Data Management Market face during the growth?

- High price of EDM solution is a key challenge affecting the market growth. The BFSI sector in the US faces a challenging environment due to strict regulations and intense competition. Enterprise Data Management (EDM) solutions are essential for managing internal applications, external communication, and data synchronization to support business operations. Leveraging analytics and IT organizations require handling massive datasets for data set consumption, addressing data conflicts, ensuring data quality, and generating reports. However, the high cost of EDM solutions, which include handling structured data from various data producers and consumers, can be a barrier for BFSI organizations. Despite the limitations, the industry's expansion and the need for risk control, information accuracy, and data warehousing drive the adoption of EDM solutions.

- Organizations aim to deploy IT strategies that provide a competitive edge, such as data address validation, multiuser functionality, and single-source reporting. Big Data methods, including ETL tools, data pipelines, and data visualization tools, are crucial for managing and analyzing data. Data security, ingesting, storing, transforming, and integrating data are also essential aspects of EDM. Data privacy and organizational productivity are key concerns, with the risk of redundant or erroneous data and data mishandling posing significant risks. Cloud deployment offers on-demand scalability and support and maintenance benefits, making it an attractive option for BFSI organizations. Risk management solutions that ensure authentic information and data management, data security, and deployment mode flexibility are essential for the sector's success.

Exclusive US Enterprise Data Management Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Broadcom Inc.

- Cloudera Inc.

- GoldenSource

- Informatica Inc.

- International Business Machines Corp.

- Mindtree Ltd.

- Oracle Corp.

- Salesforce Inc.

- SAP SE

- Talend Inc

- Teradata Corp.

- Zaloni Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Enterprise Data Management in the BFSI Sector: Navigating Strict Regulations and Industry Expansion Enterprise Data Management (EDM) plays a pivotal role in the Business Finance Services Industry (BFSI), enabling organizations to effectively manage and leverage data for internal applications and external communication. In today's competitive environment, EDM is essential for businesses to handle massive data, maintain data quality, and gain a competitive edge. EDM encompasses various aspects, including data synchronization, reporting, data mishandling, and data security. IT organizations in the BFSI sector face the challenge of managing datasets from various data producers and ensuring data set consumption is accurate and conflict-free.

In addition, data privacy is another critical concern, as authentic information must be protected to maintain organizational productivity and adhere to regulatory requirements. Data silos are a common issue in the BFSI sector, with different business verticals, such as banks and manufacturing, generating and consuming data independently. Big data methods, like data warehousing, data migration, and data integration, are essential for breaking down these silos and creating a unified data management strategy. The BFSI sector is subject to strict regulations, making data handling and management a complex process. IT teams must ensure data is ingested, stored, transformed, and analyzed in a secure and compliant manner.

Furthermore, ETL tools and data pipelines are crucial for efficiently moving data between systems and data warehouses, while data visualization tools help in deriving valuable insights from the data. Risk control is another essential aspect of EDM in the BFSI sector. IT teams must implement risk management solutions to mitigate the risks associated with data mishandling and ensure information accuracy. On-demand scalability and cloud deployment are essential for meeting the ever-evolving data management needs of the industry. Support and maintenance are critical components of EDM, ensuring that systems are up and running and that data remains secure and accessible.

In addition, as the competitive environment continues to evolve, BFSI organizations must continually adapt their data strategies to maintain a competitive edge. With the increasing volume and complexity of data, IT teams must implement strong data management strategies that prioritize data security, data quality, and data privacy while adhering to strict regulatory requirements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.6% |

|

Market growth 2024-2028 |

USD 5.59 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

11.7 |

|

Competitive landscape |

Leading Companies, Market Report, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch