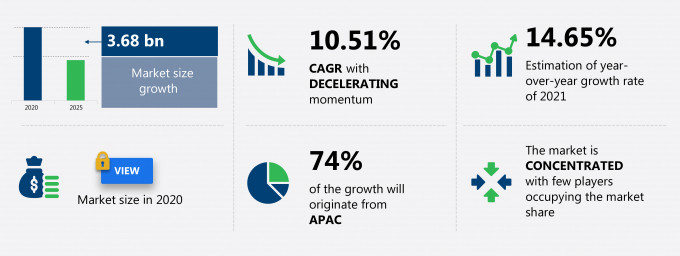

The epitaxy deposition market share is expected to increase by USD 3.68 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 10.51%.

This epitaxy deposition market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers epitaxy deposition market segmentations by end user (foundries, memory manufacturers, and IDMs) and geography (APAC, North America, Europe, and South America). The epitaxy deposition market report also offers information on several market vendors, including AIXTRON AG, Applied Materials Inc., ASM International NV, CANON ANELVA Corp., CSD Epitaxy Inc., CVD Equipment Corp., KOKUSAI ELECTRIC Corp., SemiTEq JSC, Tokyo Electron Ltd., and Veeco Instruments Inc. among others.

What will the Epitaxy Deposition Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Epitaxy Deposition Market Size for the Forecast Period and Other Important Statistics

Epitaxy Deposition Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The increased investments in fabs is notably driving the epitaxy deposition market growth, although factors such as impact of ongoing trade war in semiconductor industry may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the epitaxy deposition industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Epitaxy Deposition Market Driver

The increased investments in fabs is a major factor driving the global epitaxy deposition market share growth. The global semiconductor market is witnessing increased investments in the construction of new fabs and expansion of the existing fabs, owing to the growing demand for integrated circuits from sectors such as consumer electronics, data centers, automotive, industrial, and telecommunication. Integrated circuits are used in automobiles for sensing and processing applications; consumer electronics devices such as smartphones and wearables; Industry 4.0 and IIoT applications; and high-density storage devices such as SSDs. Semiconductor integrated circuits are also used to develop hardware such as GPUs, ASICs, and FPGAs to support artificial intelligence and machine learning implementations. Growing investments in fabs by vendors are attributed to the increased production volume of integrated circuits. In addition, technology advancements such as node size transition are some of the factors attracting investments in the semiconductor foundries. Process nodes have reduced from 3X nm to sub 1X nm over the past few years. Owing to the abovementioned factor, new fabs are being established to fulfill the increasing demand for integrated circuits, which will drive the global epitaxy deposition market.

Key Epitaxy Deposition Market Trend

The increasing demand for high-end graphic DRAM is another factor supporting the global epitaxy deposition market share growth. Graphics DRAM is a type of semiconductor memory used with GPU to offer increased bandwidth. Developments in graphic DRAM have increased its adoption in multiple applications. This, in turn, is driving the memory market, thereby fueling the growth of the global semiconductor market. Epitaxy deposited wafers are predominantly used in the manufacturing of DRAM. Thus, the growing demand for high-end graphic DRAM is likely to boost the growth of the global epitaxy deposition market during the forecast period. Some of the opportunities for innovations in the mobile DRAM market is the reduction in the cost of manufacturing mobile DRAM to sustain competition. DRAM is increasingly adopted in high-bandwidth applications, including artificial intelligence, virtual reality, self-driving cars, high-end gaming, and high-definition displays (4K), across industries. DRAM helps increase the bandwidth of the GPU used in these applications. The market is witnessing increased adoption of advanced technologies such as artificial intelligence and virtual reality. Such factors will drive the growth of the market.

Key Epitaxy Deposition Market Challenge

The impact of ongoing trade war in semiconductor industry will be a major challenge for the global epitaxy deposition market share growth during the forecast period. The global semiconductor industry is significantly impacted by the ongoing trade war between the US and China. Both countries have levied tariffs and restrictions on multiple goods, including electronic products and integrated circuits. This has increased the average selling price of integrated circuits and the overall equipment that integrates these integrated circuits and electric components. As a result, the demand for these products has decreased in the respective markets, which is likely to create a demand-supply imbalance of electric components and integrated circuits in the market. The semiconductor industry is affected by changing tariff regimes and foreign trade policies. Tariff increase, anti-dumping duties, and import restrictions on key inputs are making it very difficult for companies to forecast the behavior of raw material prices and ascertain price and volume levels that are ideal for locking in future raw material contracts. The steep hike in tariffs has affected the growth of the global semiconductor industry, which is likely to hamper the growth of the global epitaxy deposition market during the forecast period.

This epitaxy deposition market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global epitaxy deposition market as a part of the global semiconductor equipment market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the epitaxy deposition market during the forecast period.

Who are the Major Epitaxy Deposition Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- AIXTRON AG

- Applied Materials Inc.

- ASM International NV

- CANON ANELVA Corp.

- CSD Epitaxy Inc.

- CVD Equipment Corp.

- KOKUSAI ELECTRIC Corp.

- SemiTEq JSC

- Tokyo Electron Ltd.

- Veeco Instruments Inc.

This statistical study of the epitaxy deposition market encompasses successful business strategies deployed by the key vendors. The epitaxy deposition market is concentrated and the vendors are deploying growth strategies such as focusing on pricing and marketing to compete in the market.

Product Insights and News

- AIXTRON AG- The company offers a deposition system for compound semiconductors called the AIX G5 WW C. It allows high throughput batch epitaxy with single wafer control. It also offers the metal organic chemical vapor deposition (MOCVD) technology for depositing thin layers of atoms onto a semiconductor wafer.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The epitaxy deposition market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Epitaxy Deposition Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the epitaxy deposition market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of global semiconductor equipment market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Epitaxy Deposition Market?

For more insights on the market share of various regions Request for a FREE sample now!

74% of the market’s growth will originate from APAC during the forecast period. South Korea (Republic of Korea), China, Taiwan, and Japan are the key markets for epitaxy deposition market in APAC. Market growth in this region will be faster than the growth of the market in regions.

The presence of a large number of end-users, including consumer electronics, automotive, data centers, and capital equipment manufacturers will facilitate the epitaxy deposition market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In March 2020, India imposed full lockdown to prevent the community spread of the diseases. Thus, lockdown and temporary closure of manufacturing facilities in various APAC countries hindered the growth of the epitaxy deposition market in APAC during 2020.

What are the Revenue-generating End User Segments in the Epitaxy Deposition Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The epitaxy deposition market share growth by the foundries segment will be significant during the forecast period. Currently, there is an increase in the adoption of communication devices and consumer electronics worldwide. The demand for devices such as smartphones, tablets, LCD, and LED TVs is constantly increasing. With advances in the consumer electronics sector, such as the emergence of 3D and UHD TVs and hybrid laptops, the demand for semiconductor wafers will increase steadily. There is a high demand for the production of integrated circuits as all these devices need semiconductor integrated circuits. Therefore, the growing demand for semiconductor integrated circuits in the electronics industry is likely to drive the growth of the foundries segment during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the epitaxy deposition market size and actionable market insights on post COVID-19 impact on each segment.

|

Epitaxy Deposition Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.51% |

|

Market growth 2021-2025 |

3.68 billion |

|

Market structure |

Concentrated |

|

YoY growth (%) |

14.65 |

|

Regional analysis |

APAC, North America, Europe, and South America |

|

Performing market contribution |

APAC at 74% |

|

Key consumer countries |

South Korea (Republic of Korea), China, Taiwan, and Japan |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

AIXTRON AG, Applied Materials Inc., ASM International NV, CANON ANELVA Corp., CSD Epitaxy Inc., CVD Equipment Corp., KOKUSAI ELECTRIC Corp., SemiTEq JSC, Tokyo Electron Ltd., and Veeco Instruments Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Epitaxy Deposition Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive epitaxy deposition market growth during the next five years

- Precise estimation of the epitaxy deposition market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the epitaxy deposition industry across APAC, North America, Europe, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of epitaxy deposition market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch