Europe Light Commercial Vehicle Market Size 2025-2029

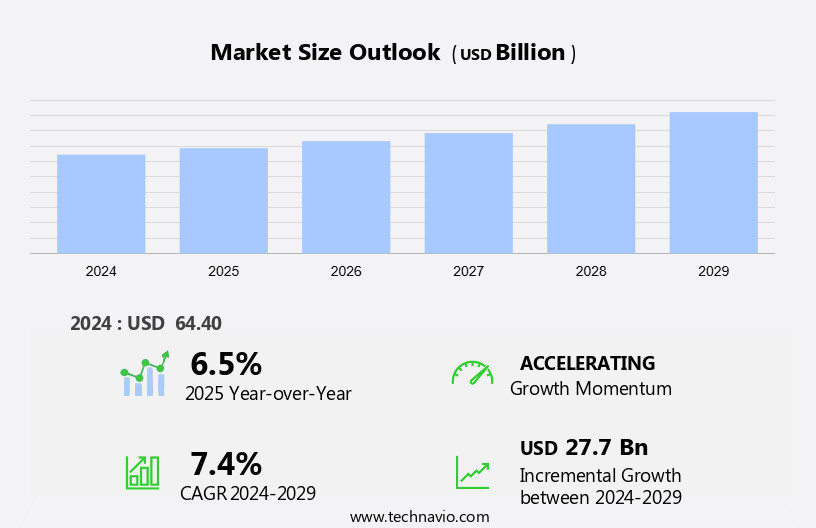

The europe light commercial vehicle market size is forecast to increase by USD 27.7 billion billion at a CAGR of 7.4% between 2024 and 2029.

- The European Light Commercial Vehicle (LCV) market is experiencing significant growth, driven by the increasing utility of pickup trucks and the integration of telematics systems. The demand for pickup trucks is on the rise due to their versatility and ability to handle various cargo and passenger transport needs. Telematics systems, which provide real-time vehicle data and analytics, are increasingly being adopted to enhance fleet management and improve operational efficiency. However, the market growth is not without challenges. The high manufacturing cost of LCVs remains a significant barrier, particularly for small and medium-sized enterprises (SMEs) that form a large portion of the market.

- To overcome this challenge, OEMs and suppliers are exploring cost-effective manufacturing solutions, such as local production and modular design, to make LCVs more affordable. Companies seeking to capitalize on the market opportunities and navigate challenges effectively should focus on innovation, cost optimization, and customer-centric solutions. By addressing the evolving needs of customers and staying abreast of market trends, they can differentiate themselves and gain a competitive edge in the European LCV market.

What will be the size of the Europe Light Commercial Vehicle Market during the forecast period?

- The European light commercial vehicle (LCV) market encompasses a diverse range of motor vehicles, including pickup trucks, small trucks, utility vehicles, and refrigerated LCVs, used primarily for industrial activities, logistics, and passenger transport. This market is experiencing significant growth due to the rise of e-commerce, which has increased the demand for efficient delivery services and larger cargo capacity. Advancements in technology are also driving market expansion, with trends toward downsized engines, emission norms, and fuel efficiency. Additionally, the integration of telematics systems and driver assistance technologies is enhancing vehicle performance and safety. Autonomous driving technologies are gaining traction in the LCV sector, particularly in urban logistics and construction transport applications.

- Electric trucks and those powered by internal combustion engines are both present in the market, with the former gaining popularity due to environmental concerns and the latter's proven reliability. Food trucks, rubbish collection, street sweeping, and passenger transport are among the various industries utilizing LCVs for their business needs. Overall, the European LCV market is a dynamic and evolving sector, with a focus on innovation, sustainability, and meeting the diverse demands of various industries.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Conventional fuel vehicles

- Alternative fuel vehicles

- Vehicle Type

- Light commercial pick-up trucks

- Light commercial vans

- Variant

- ICE

- Hybrid and electric vehicles

- Geography

- Europe

- France

- Germany

- Spain

- UK

- Europe

By Type Insights

The conventional fuel vehicles segment is estimated to witness significant growth during the forecast period.

The European light commercial vehicle (LCV) market is primarily driven by the demand for diesel and gasoline-powered vehicles, including pick-up trucks and commercial vans. Utilities, cable providers, electricians, florists, caterers, and plumbers are significant users of conventional fuel LCVs. The growth of small businesses in Europe is fueling the adoption of these vehicles. Emission norms and CO2 emission targets are influencing the shift towards electric and hybrid trucks, including battery electric vehicles and electric LCVs. Freight transporters, e-commerce delivery services, food trucks, and specialized LCVs for applications such as rubbish collection, street sweeping, mobile repairs, and last-mile delivery are also driving market growth.

Adoption of driverless driving technology and connected vehicle technology is expected to further enhance the efficiency and productivity of LCVs in Europe. The skilled workforce and increasing focus on reducing carbon footprint are key factors contributing to the market's growth.

Get a glance at the market share of various segments Request Free Sample

The Conventional fuel vehicles segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Light Commercial Vehicle Market?

- Increased utility of pickup trucks is the key driver of the market.

- European consumers are shifting their preferences towards light commercial vehicles, particularly pickup trucks, due to their superior cargo-carrying capacity and versatility. These vehicles cater to both commercial and non-commercial needs, offering increased trunk space and towing capability. Pickup trucks in Europe come with various seating options, such as extended cab trims, which provide additional passenger seats without compromising cargo bed space. This flexibility makes pickup trucks a more practical choice compared to SUVs, crossovers, hatchbacks, or sedans, especially for families and businesses requiring transportation of larger cargo loads.

What are the market trends shaping the Europe Light Commercial Vehicle Market?

- Integration of telematics systems in light commercial vehicles is the upcoming trend in the market.

- Telematics, a fusion of telecommunication, electrical engineering, road transportation, and vehicular technologies, is revolutionizing the transportation industry. In particular, light commercial vehicles are benefiting from telematics integration, enabling increased operational efficiency. Global Positioning System (GPS) and Global System for Mobile Communications (GSM) are key telematics technologies used in light commercial vehicles, providing real-time, accurate location and movement data. Third-party telematics providers, such as TomTom Telematics, offer customized solutions like the WEBFLEET package, catering specifically to the needs of light commercial vehicles.

- These systems enable vehicle owners, fleet operators, and insurance providers to monitor and optimize their operations effectively.

What challenges does Europe Light Commercial Vehicle Market face during the growth?

- High manufacturing cost of light commercial vehicles is a key challenge affecting the market growth.

- Light commercial vehicles' manufacturing involves significant investment due to the intricacy of components like braking systems, axles, suspension, and hauling and steering cylinders. The prices of raw materials, such as stainless steel, hardened steel, cast iron, and metal alloys, are subject to constant fluctuations. Integration of new technologies to enhance vehicle performance and comply with fuel emission regulations increases manufacturing costs. Furthermore, these vehicles necessitate regular maintenance and repairs, adding to their total cost of ownership.

- OEMs face the challenge of balancing manufacturing expenses with the need to install advanced technologies to meet regulatory requirements.

Exclusive Europe Light Commercial Vehicle Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ford Motor Co.

- GAZ International LLC

- General Motors Co.

- Hyundai Motor Co.

- Isuzu Motors Ltd.

- Iveco Group N.V

- Mercedes Benz Group AG

- Mitsubishi Motors Corp.

- PACCAR Inc.

- Renault SAS

- Robert Bosch GmbH

- Stellantis NV

- Suzuki Motor Corp.

- Tesla Inc.

- Toyota Motor Corp.

- Volkswagen AG

- Volvo Car Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The light commercial vehicle (LCV) market in Europe is experiencing significant shifts as industrial activities continue to evolve. This sector, which includes pickup trucks, light duty trucks, and utility vehicles, plays a crucial role in various industries such as logistics, e-commerce, food service, and waste management. One of the most notable trends shaping the LCV market is the adoption of advanced technologies. Autonomous driving technologies are increasingly being integrated into LCVs, offering potential benefits such as increased efficiency, reduced labor costs, and improved safety. However, the implementation of these technologies raises questions regarding the skills required for operation and maintenance, as well as the regulatory frameworks governing their use.

Another trend influencing the LCV market is the shift towards electric and hybrid powertrains. With increasing pressure to reduce carbon footprints and meet CO2 emission targets, many freight transporters are turning to electric trucks as a more sustainable alternative to traditional internal combustion engine (ICE) vehicles. Tax credits and incentives offered by governments further incentivize the adoption of electric LCVs. The LCV market in Europe is diverse, with various segments catering to specific industrial needs. For instance, refrigerated LCVs are essential for e-commerce delivery and food service industries, while small trucks and utility vehicles are popular for last-mile delivery and mobile repairs.

Specialized LCVs, such as those used for rubbish collection and street sweeping, also have a significant presence in the market. Emission norms continue to be a significant factor influencing the LCV market. Strict regulations governing excess emission premiums and CO2 emissions have led to the phasing out of gasoline-powered and diesel-powered LCVs in favor of electric and hybrid alternatives. This trend is expected to continue as governments worldwide strive to meet their climate goals. The logistics business is a significant consumer of LCVs, with e-commerce delivery being a major driver of growth. The increasing popularity of online shopping has led to a in demand for efficient and cost-effective delivery solutions.

Food trucks and mobile food service businesses also rely heavily on LCVs to transport and distribute their products. Despite the adoption of advanced technologies and the shift towards electric powertrains, the LCV market remains labor-intensive. A skilled workforce is essential for the operation, maintenance, and repair of these vehicles. Connected vehicle technology is being adopted to address this challenge, offering remote diagnostics and predictive maintenance capabilities. In , the LCV market in Europe is undergoing significant changes as industrial activities evolve and technologies advance. The adoption of autonomous driving technologies, the shift towards electric powertrains, and the increasing importance of emission norms are some of the key trends shaping this market.

The diverse range of applications for LCVs, from logistics and e-commerce to food service and waste management, ensures that this sector will continue to be an essential component of the European industrial landscape.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 27.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch