Financial Analytics Market Size 2025-2029

The financial analytics market size is forecast to increase by USD 9.09 billion at a CAGR of 12.7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for advanced risk management tools in today's complex financial landscape. With the exponential rise in data generation across various industries, financial institutions are seeking to leverage analytics to gain valuable insights and make informed decisions. However, this data-driven approach comes with its own challenges. Data privacy and security concerns are becoming increasingly prominent as financial institutions grapple with the responsibility of safeguarding sensitive financial information. Ensuring data security and maintaining regulatory compliance are essential for businesses looking to capitalize on the opportunities presented by financial analytics.

- As the market continues to evolve, companies must navigate these challenges while staying abreast of the latest trends and technologies to remain competitive. Effective implementation of robust data security measures, adherence to regulatory requirements, and continuous innovation will be key to success in the market. Data visualization tools enable effective communication of complex financial data, while financial advisory services offer expert guidance on financial modeling and regulatory compliance.

What will be the Size of the Financial Analytics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the dynamic market, sensitivity analysis plays a crucial role in assessing the impact of various factors on financial models. Data lakes serve as vast repositories for storing and processing large volumes of financial data, enabling advanced quantitative analysis. Financial regulations mandate strict data compliance regulations, ensuring data privacy and security. Data analytics platforms integrate statistical software, machine learning libraries, and prescriptive analytics to deliver actionable insights. Financial reporting software and business intelligence tools facilitate descriptive analytics, while diagnostic analytics uncovers hidden trends and anomalies. On-premise analytics and cloud-based analytics cater to diverse business needs, with data warehouses and data pipelines ensuring seamless data flow.

- Scenario analysis and stress testing help financial institutions assess risks and make informed decisions. Data engineering and data governance frameworks ensure data accuracy, consistency, and availability. Data architecture, data compliance regulations, and auditing standards maintain transparency and trust in financial reporting. Predictive modeling and financial modeling software provide valuable insights into future financial performance. Data security measures protect sensitive financial data, safeguarding against potential breaches.

How is this Financial Analytics Industry segmented?

The financial analytics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solution

- Services

- Deployment

- On-premises

- Cloud

- Sector

- Large enterprises

- Small and medium-sized enterprises (SMEs)

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

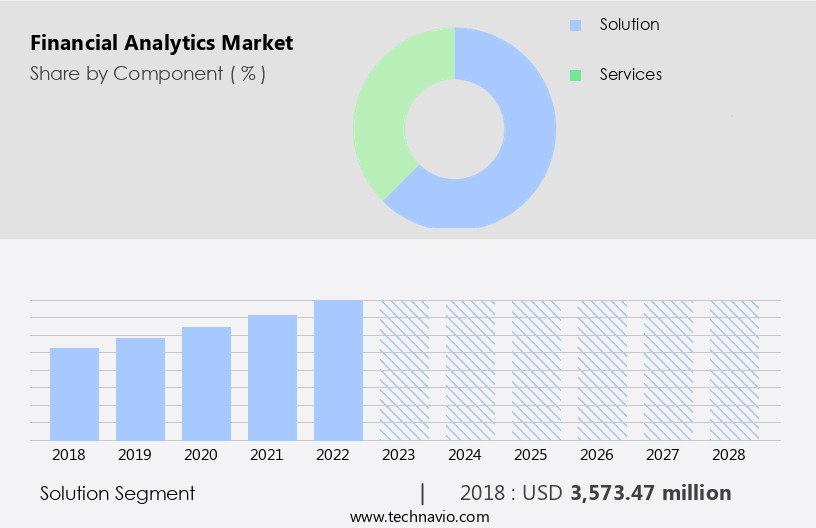

By Component Insights

The solution segment is estimated to witness significant growth during the forecast period. Financial analytics solutions play a pivotal role in assessing and managing various financial risks for organizations. These tools help identify potential risks, such as credit risks, market risks, and operational risks, and enable proactive risk mitigation measures. Compliance with stringent regulations, including Basel III, Dodd-Frank, and GDPR, necessitates robust data analytics and reporting capabilities. Data visualization, machine learning, statistical modeling, and predictive analytics are integral components of financial analytics solutions. Machine learning and statistical modeling enable automated risk analysis and prediction, while predictive analytics offers insights into future trends and potential risks.

Data governance and data compliance help organizations maintain data security and privacy. Data integration and ETL processes facilitate seamless data flow between various systems, ensuring data consistency and accuracy. Time series analysis and ratio analysis offer insights into historical financial trends and performance. Customer segmentation and sensitivity analysis provide valuable insights into customer behavior and financial impact. Deep learning and scenario planning offer advanced analytical capabilities, enabling organizations to make informed decisions based on complex financial data. Cash flow analysis and profitability analysis provide insights into financial health and performance. Overall, financial analytics solutions are essential for organizations to effectively manage their financial risks, ensure regulatory compliance, and make informed strategic decisions.

The Solution segment was valued at USD 3.97 billion in 2019 and showed a gradual increase during the forecast period.

The Financial Analytics Market is expanding rapidly with the integration of business intelligence software and data science, enabling organizations to derive actionable insights from complex financial data. A robust data governance framework ensures the security, accuracy, and accessibility of financial information, enhancing compliance and efficiency. Adherence to accounting standards and financial reporting standards plays a crucial role in maintaining transparency and credibility across industries. Companies are increasingly relying on financial analytics services to optimize decision-making, risk management, and strategic planning.

Robotic process automation and business process automation streamline financial operations, ensuring data accuracy and reducing manual errors. Data cleansing and data transformation are essential for maintaining data quality, ensuring that financial data is accurate, consistent, and reliable. Cloud computing and data warehousing provide scalable and secure storage solutions for financial data. Decision support systems and financial consulting offer valuable insights for strategic decision-making. Hedge funds, investment banking, and valuation analysis leverage financial analytics for portfolio optimization and investment analysis. Risk management, compliance monitoring, and fraud detection are critical applications of financial analytics. Regulatory reporting and financial reporting provide transparency and ensure compliance with various regulations.

Regional Analysis

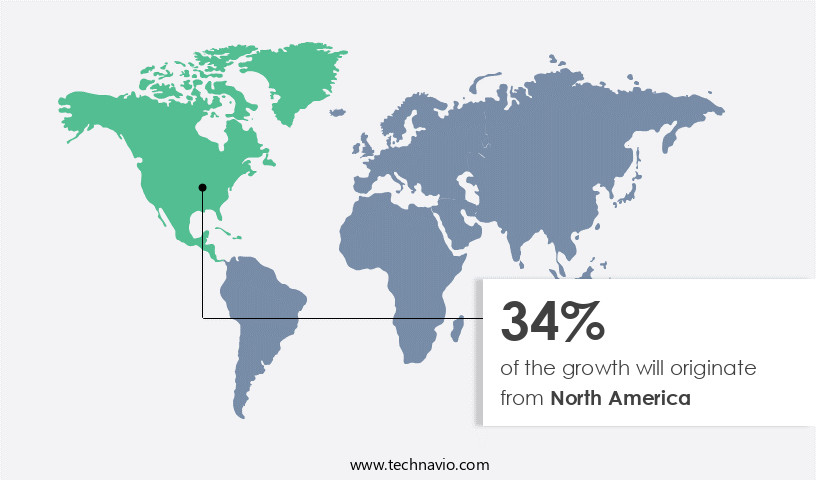

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the financially regulated North American market, institutions prioritize regulatory compliance, risk management, and fraud detection through advanced financial analytics solutions. Asset managers, hedge funds, and individual investors in this region leverage these tools for portfolio optimization, market trend assessment, and informed decision-making. The North American financial sector is a technology innovator and generates massive data volumes. Companies are capitalizing on financial analytics to derive valuable insights from big data, enhance operational efficiency, and maintain a competitive edge.

These solutions facilitate deep learning, scenario planning, profitability analysis, and big data analysis. The financial sector's reliance on financial analytics continues to grow as the industry embraces technological advancements to remain competitive.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Financial Analytics market drivers leading to the rise in the adoption of Industry?

- The market is driven by a significant demand for risk management tools, which are essential for mitigating potential hazards and protecting businesses from financial losses. Financial analytics tools play a pivotal role in assessing and managing various financial risks for organizations. In today's complex business environment, companies face numerous risks, such as financial, operational, cybersecurity, regulatory, and geopolitical risks. These tools help identify, assess, and manage these multifaceted risks proactively. Market risk analysis is particularly crucial in volatile financial markets. Financial analytics tools use historical data and statistical models, such as Monte Carlo simulation and artificial intelligence, to assess market trends and anticipate potential losses based on different scenarios. Natural language processing and data governance ensure data quality, while data compliance adheres to regulatory requirements.

- Data integration is essential for financial reporting and regulatory reporting. Fraud detection, audit & assurance, and data storytelling are additional features that provide valuable insights and transparency. Advanced risk management tools employ data quality checks, data compliance, and data integration to ensure accurate and reliable financial reporting. Artificial intelligence and machine learning algorithms enable advanced risk modeling and predictive analytics. These tools help organizations make informed decisions, mitigate risks, and stay compliant with regulatory requirements.

What are the Financial Analytics market trends shaping the Industry?

- The exponential growth of data generation is a significant market trend. This increasing rate of data production is a key development in various industries. In today's data-driven business landscape, the exponential growth of financial data from various sources necessitates advanced analytics tools to process and derive valuable insights. Financial analytics solutions cater to this requirement by enabling organizations to make sense of both structured and unstructured financial data. The digital age has led to an explosion of financial data, originating from various sources such as online transactions, point-of-sale systems, e-commerce platforms, social media, and IoT devices. Cloud computing has revolutionized the market, allowing businesses to store, process, and analyze large volumes of data more efficiently. Market research indicates that portfolio optimization, business process automation, valuation analysis, investment banking, and compliance monitoring are among the primary applications of financial analytics.

- Furthermore, techniques such as data transformation, time series analysis, customer segmentation, ratio analysis, sensitivity analysis, and cash flow analysis are integral to financial analytics. These advanced analytics tools enable organizations to gain a deeper understanding of their financial performance, identify trends, mitigate risks, and make informed decisions. By leveraging financial analytics, businesses can streamline their operations, enhance customer experience, and maintain regulatory compliance.

How does Financial Analytics market face challenges during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, as organizations must balance the need to collect and use data to drive innovation and business growth with the imperative to protect sensitive information from unauthorized access, use, or disclosure. Financial analytics tools, which include data warehousing, decision support systems, and predictive analytics, are increasingly being adopted by various industries for profitability analysis and risk assessment. However, the implementation of these tools presents significant data security challenges. With the rise of big data and artificial intelligence, there is an increased capability to track, retrieve, and analyze vast amounts of data from connected servers. This data can be used to gain valuable insights for financial consulting and hedge funds, among others. However, it also poses a risk of unauthorized access to sensitive organizational data. Moreover, IT infrastructure is often a complex web of open-source code, which can lead to vulnerabilities.

- Cloud infrastructure, which is multi-tenant by nature, is particularly susceptible to these risks due to potential glitches in source codes. These issues can impact various applications running in the cloud environment. ETL processes, data mining, and deep learning are essential components of financial analytics. They enable organizations to gain insights from their data and make informed decisions. However, they also require robust security measures to protect against data breaches and ensure data privacy.

Exclusive Customer Landscape

The financial analytics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the financial analytics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, financial analytics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company specializes in financial analytics, delivering advanced predictive analysis solutions to empower businesses with actionable insights.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- BankTree Software Ltd.

- Databricks Inc.

- ExlService Holdings Inc.

- Fair Isaac Corp.

- Fractal Analytics Pvt. Ltd.

- Genpact Ltd.

- H2O.ai Inc.

- Hitachi Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- Oracle Corp.

- Perfios Software Solutions Pvt. Ltd.

- Quantiphi Inc.

- Ramp Business Corp.

- SAP SE

- SAS Institute Inc.

- SparkCognition Inc.

- Teradata Corp.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Financial Analytics Market

- In February 2024, IBM announced the acquisition of Watson Financial Services from SS&C Technologies for approximately USD1.1 billion. This acquisition aimed to strengthen IBM's position in the market by integrating Watson's AI and machine learning capabilities with SS&C's financial data and analytics solutions (IBM Press Release, 2024).

- In May 2024, SAS and Microsoft entered into a strategic partnership to integrate SAS' analytics capabilities into Microsoft's Power Platform. This collaboration enabled users to leverage SAS' advanced analytics tools directly within Microsoft's Power BI and Power Apps, expanding the reach of financial analytics solutions (Microsoft News Center, 2024).

- In October 2024, Fidelity International launched Fidelity Analytics, a cloud-based platform that offers advanced analytics and reporting capabilities to institutional investors. The platform integrates data from various sources, including internal and external data, to provide actionable insights and improve investment decision-making (Fidelity International Press Release, 2024).

- In January 2025, the European Union's General Data Protection Regulation (GDPR) came into full effect, imposing stricter data privacy rules on financial institutions and analytics providers. This regulatory development necessitated significant investments in data security and privacy technologies, driving growth in the market (European Commission, 2022).

Research Analyst Overview

The market continues to evolve, driven by the ever-changing dynamics of various sectors. Financial consulting firms employ advanced technologies such as data visualization and business intelligence to provide insights that inform strategic decisions. Robotic process automation and machine learning streamline data cleansing and statistical modeling, enhancing data quality and enabling more accurate risk management. Hedge funds and investment analysis rely on predictive analytics and deep learning for profitable market sizing and customer segmentation. Data security and data warehousing are crucial components of financial analytics, ensuring data governance and compliance. Decision support systems integrate data from multiple sources, including ETL processes and real-time market data, to facilitate informed decision-making.

Risk analysis and predictive analytics employ various techniques, such as regression analysis, Monte Carlo simulation, and scenario planning, to assess potential risks and opportunities. Financial statements and profitability analysis provide valuable insights into a company's financial health, while cash flow analysis and sensitivity analysis offer a deeper understanding of its financial position. Deep learning and artificial intelligence enable more sophisticated financial modeling and valuation analysis, while portfolio optimization and investment banking leverage data transformation and time series analysis. Market research and business process automation are integral to the market, providing valuable industry insights and streamlining operations. Compliance monitoring and ratio analysis ensure regulatory reporting and fraud detection, while data integration and data transformation enable seamless data flow between systems.

Cloud computing offers scalable solutions for handling large volumes of data, enabling more comprehensive financial analytics. Organizations must prioritize data security to mitigate risks and protect their valuable data assets. This can be achieved through various measures, including data encryption, access controls, and regular vulnerability assessments. By investing in these measures, organizations can reap the benefits of financial analytics while minimizing the risks associated with data security. Recent research suggests that these challenges are not insurmountable, and many organizations are finding success in implementing financial analytics tools with robust security measures in place. By focusing on data security, organizations can unlock the full potential of financial analytics to drive profitability and gain a competitive edge.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Financial Analytics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.7% |

|

Market growth 2025-2029 |

USD 9.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.3 |

|

Key countries |

US, China, Canada, UK, Germany, India, Japan, France, Italy, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Financial Analytics Market Research and Growth Report?

- CAGR of the Financial Analytics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the financial analytics market growth of industry companies

We can help! Our analysts can customize this financial analytics market research report to meet your requirements.