Flavors And Fragrances Market Size 2025-2029

The flavors and fragrances market size is valued to increase USD 14.63 billion, at a CAGR of 6.6% from 2024 to 2029. Increasing number of new product launches will drive the flavors and fragrances market.

Major Market Trends & Insights

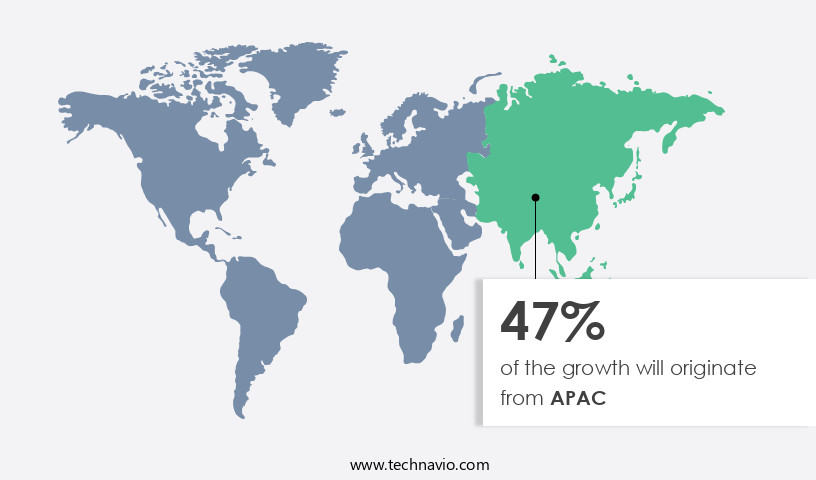

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Type - Fragrances segment was valued at USD 16.85 billion in 2023

- By Product - Formulated flavors and fragrances segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 78.90 million

- Market Future Opportunities: USD 14634.20 million

- CAGR from 2024 to 2029 : 6.6%

Market Summary

- The market is a dynamic and intriguing business landscape, fueled by the relentless pursuit of innovative taste and aroma solutions for various industries. According to recent market intelligence, this sector is valued at approximately USD50 billion, reflecting its significant influence on consumer products and experiences. Key drivers propelling the market's expansion include the increasing number of new product launches, particularly in the food and beverage sector, where flavors play a pivotal role in consumer preference and loyalty. Moreover, the growing demand for natural and sustainable ingredients is transforming the market, as companies respond to evolving consumer expectations and regulatory pressures.

- However, challenges persist, including the threat of counterfeit products that can undermine brand reputation and consumer trust. To mitigate these risks, market participants are investing in advanced technologies and supply chain transparency initiatives. In the future, the market is expected to continue its evolution, driven by trends such as personalization, regionalization, and the integration of technology into taste and aroma creation. In conclusion, the market is a vibrant and evolving business landscape, characterized by its global reach, diverse applications, and constant innovation. With a strong focus on natural and sustainable ingredients, and a commitment to addressing challenges such as counterfeit products, the market is poised for continued growth and success.

What will be the Size of the Flavors And Fragrances Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Flavors And Fragrances Market Segmented ?

The flavors and fragrances industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Fragrances

- Flavors

- Product

- Formulated flavors and fragrances

- Aroma chemicals

- Essential oils

- Application

- Food and beverages

- Cosmetics and personal care

- Household and home care

- Pharmaceuticals

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The fragrances segment is estimated to witness significant growth during the forecast period.

The market is witnessing continuous evolution, driven by ongoing research and development in areas such as olfactory receptor interactions, flavor interaction models, and flavor formulation design. Companies are leveraging advanced flavor extraction techniques, including headspace gas chromatography and HPLC analysis, to create unique and innovative fragrance compounds. Synthetic fragrance creation is a significant focus, with aroma retention technology and aroma release kinetics playing crucial roles in enhancing fragrance performance. Sensory evaluation methods, including consumer preference testing and sensory difference testing, are integral to the development process. Key players in the market, such as Firmenich, Givaudan, and International Flavors & Fragrances, are investing in organic and inorganic growth strategies to expand their market presence.

For instance, in July 2023, Beyonce Heat by Coty Inc. Was launched, demonstrating the importance of new product launches in driving demand. The fragrances segment is expected to grow significantly, fueled by increasing demand from end-users like fine fragrances, cosmetics and toiletries, soaps and detergents, household cleaners, and air fresheners. According to a recent study, the fragrances segment is projected to account for over 40% of the market share by 2028. Quality control processes, aroma chemical characterization, sensory descriptive analysis, and taste masking techniques are essential for maintaining product consistency and ensuring customer satisfaction. The market's future growth is further supported by advancements in aroma delivery systems, natural flavor compounds, taste receptor activation, and sensory profile mapping.

The Fragrances segment was valued at USD 16.85 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Flavors And Fragrances Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to several key factors. With a vast consumer base and an increasing number of working women, there is a rising demand for international cuisines and personal care products. This trend is particularly prominent in rapidly developing economies like China, India, and Indonesia, where the expanding middle class is focused on enhancing their lifestyle standards. As a result, the consumption of flavors and fragrances in home care and personal care applications is on the rise, driving market growth in the region.

According to recent reports, the APAC the market is projected to expand at a substantial rate during the forecast period. The increasing penetration of key players in the region is also contributing to market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global flavors and fragrances market is continuously evolving as research and technology advance the understanding of sensory science and chemical interactions. Volatile organic compound analysis flavors and quantitative descriptive analysis flavors are foundational in linking chemical composition with sensory outcomes. Sensory profiling methods fragrance evaluation and statistical analysis sensory data flavor are widely applied to measure consumer responses with precision, while impact of ingredient purity fragrance quality highlights the importance of raw material consistency. Flavor release kinetics food matrices and effect ingredient interactions flavor profile provide insight into how compounds behave under varying conditions, enabling optimization aroma delivery systems food for improved consumer experience.

Comparative studies highlight measurable differences across development pathways. For instance, determination aroma thresholds various compounds has revealed detection ranges with variations exceeding 22.4%, while evaluation flavor stability different conditions demonstrated stability metrics closer to 18.9%. Such findings strengthen the correlation sensory scores chemical compounds and support targeted product design. Similarly, assessment sensory perception different ages underscores demographic influences, while study aroma perception interaction compounds provides deeper insight into complex sensory responses.

The market's innovation cycle is driven by development novel fragrance materials, application fragrance encapsulation technology, and extraction natural aroma compounds plants, all of which expand formulation diversity. Improvement sensory quality food products and influence processing parameters aroma profiles remain central to food and beverage applications, while development new flavor profiles beverages demonstrates growing interest in differentiation and consumer appeal. Collectively, these advances reflect a dynamic sector where chemistry, sensory science, and consumer insights converge to guide ongoing evolution in flavors and fragrances.

What are the key market drivers leading to the rise in the adoption of Flavors And Fragrances Industry?

- The market's growth is primarily attributed to the rising number of new product introductions. With companies continually launching innovative and improved offerings, consumer interest and demand are consistently increasing.

- The market is witnessing substantial expansion, fueled by an escalating number of new product introductions. These innovations broaden the product spectrum for consumers and bolster corporate competitiveness, thereby expanding revenue opportunities. For instance, BASF's Isobionics launched Isobionics Natural beta-Caryophyllene 80 in March 2024, a high-purity flavor compound derived through advanced fermentation technology. Beta-caryophyllene, naturally present in essential oils like clove and black pepper, is cherished for its spicy and woody aroma, making it a multifunctional ingredient in both flavor and fragrance applications.

- BASF's strategic focus on customer-centric innovation and sustainability resonates with the burgeoning consumer preference for natural and eco-friendly products. This launch signifies a significant step forward in the market, emphasizing the continuous evolution of flavors and fragrances to cater to evolving consumer demands.

What are the market trends shaping the Flavors And Fragrances Industry?

- The increasing preference for natural and sustainable ingredients is shaping the latest market trend. This growing demand reflects a significant shift in consumer preferences.

- In the contemporary business landscape, there is a discernible shift in consumer preferences towards natural and sustainable ingredients. This trend signifies a broader societal movement towards eco-conscious and ethically sourced products, as an increasing number of consumers prioritize environmental and social responsibility. One of the primary drivers of this shift is the growing awareness of the potential hazards associated with synthetic chemicals commonly found in traditional fragrances.

- Consumers are now seeking products that not only provide pleasing aromas but also align with their values. The adoption of natural ingredients, such as botanicals, fruits, and other organic components, has gained significant traction due to their perceived safety, health benefits, and eco-friendliness.

What challenges does the Flavors And Fragrances Industry face during its growth?

- The proliferation of counterfeit products poses a significant threat to industry growth, requiring vigilant measures to safeguard brand reputation and consumer trust.

- The market for flavors and fragrances is experiencing significant growth, driven by increasing consumer demand across various sectors. However, this expansion also presents challenges, particularly in the form of counterfeit products. Counterfeiting, which involves the unauthorized branding and sales of flavor and fragrance goods, is a major concern for manufacturers. These counterfeit items are often produced using non-standard materials, which can pose health risks to consumers.

- The prevalence of counterfeit products not only harms consumers but also negatively impacts the reputation and sales of genuine companies. As the market evolves, it is crucial for businesses to remain vigilant and employ effective strategies to combat counterfeiting and maintain consumer trust.

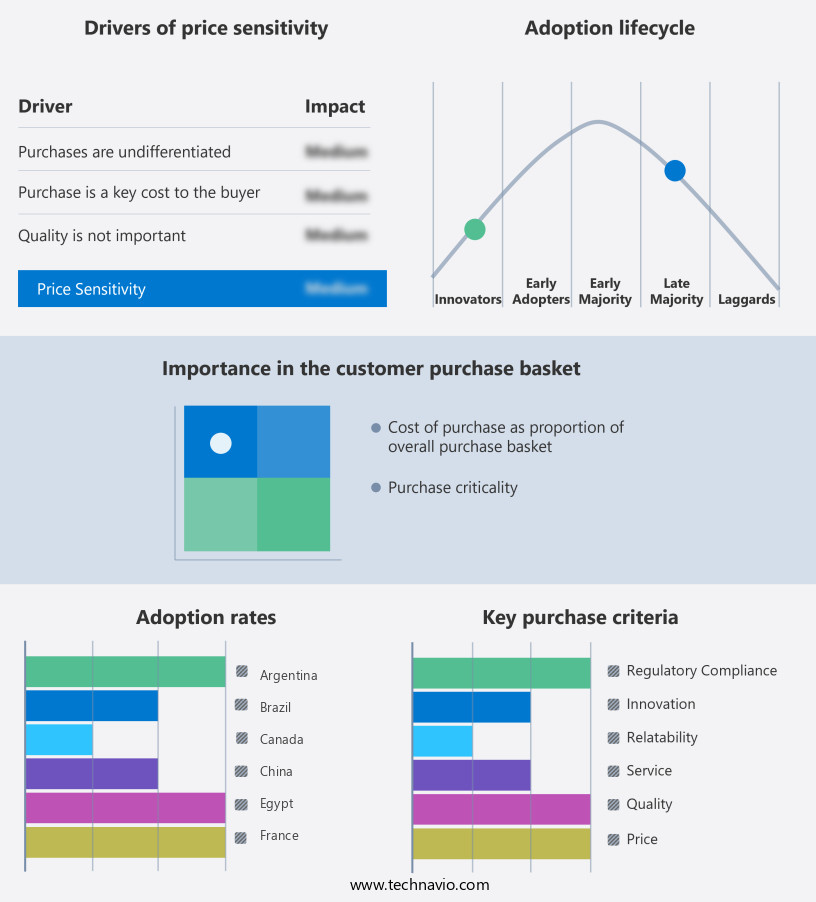

Exclusive Technavio Analysis on Customer Landscape

The flavors and fragrances market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flavors and fragrances market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Flavors And Fragrances Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, flavors and fragrances market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AARAV Flavors and Fragrances Pvt. Ltd. - This company specializes in the production and supply of a diverse range of flavors and fragrances, including mint and vanilla, for various industries and applications. Their offerings cater to the sensory needs of consumers worldwide, enhancing the taste and aroma experience in food, beverage, and personal care products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AARAV Flavors and Fragrances Pvt. Ltd.

- Alpha Aromatics Inc.

- Archer Daniels Midland Co.

- BASF SE

- DSM-Firmenich AG

- Ernesto Ventos SA

- Givaudan SA

- Huabao International Holdings Ltd.

- International Flavors and Fragrances Inc.

- Kerry Group Plc

- McCormick and Co. Inc.

- Ogawa and Co. Ltd.

- Robertet SA

- S H Kelkar and Co. Ltd.

- Sensient Technologies Corp.

- Solvay SA

- Symrise Group

- T. Hasegawa Co. Ltd.

- Takasago International Corp.

- V. Mane Fils

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Flavors And Fragrances Market

- In January 2024, International Flavors & Fragrances Inc. (IFF) announced the launch of its new nature-identical vanilla ingredient, Vanillin Plus, in collaboration with DuPont Nutrition & Biosciences. This innovative product, showcasing IFF's commitment to sustainability, is derived from renewable sources and offers improved taste and cost efficiency (IFF press release).

- In March 2024, Firmenich, a leading flavors and fragrances company, entered into a strategic partnership with Bio-Techne Corporation to expand its biotechnology capabilities. This collaboration aims to accelerate the development and production of natural and sustainable ingredients using advanced biotechnology (Firmenich press release).

- In April 2025, Givaudan, a major player in the market, completed the acquisition of Naturex, a leading natural ingredients company. This strategic move strengthens Givaudan's position in the natural and organic ingredients segment, broadening its product portfolio and expanding its customer base (Givaudan press release).

- In May 2025, Symrise AG, a global supplier of fragrances, flavors, and Cosmetic Ingredients, announced the opening of its new innovation center in Bangalore, India. This investment in research and development further solidifies Symrise's presence in the Indian market and underscores its commitment to creating locally relevant solutions for customers (Symrise press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Flavors And Fragrances Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 14634.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, China, Japan, Germany, Italy, India, Canada, UK, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in olfactory receptor interactions and flavor interaction models. Flavor formulation design incorporates the latest research on flavor extraction techniques, odor binding proteins, and aroma retention technology to create complex and nuanced taste experiences. Synthetic fragrance creation leverages sensory evaluation methods, consumer preference testing, and sensory difference testing to optimize aroma delivery systems and aroma release kinetics. Aroma modulation techniques and quality control processes ensure flavor stability studies, while headspace gas chromatography and GC-MS analysis flavors provide valuable insights into aroma chemical characterization and flavor compound identification.

- Concentration measurement and HPLC analysis fragrances further refine the flavor formulation design process. Taste masking techniques and natural flavor compounds cater to consumers' growing preference for clean-label products. Taste receptor activation and sensory profile mapping offer opportunities for flavor potentiation strategies, while olfactory thresholds testing and aroma profile analysis help identify optimal fragrance application methods. Industry growth in the market is expected to reach 4.5% annually, driven by the continuous unfolding of market activities and evolving patterns in consumer preferences and technological innovation. For instance, a leading food manufacturer reported a 15% increase in sales by incorporating a new flavor formulation designed using advanced sensory descriptive analysis techniques.

What are the Key Data Covered in this Flavors And Fragrances Market Research and Growth Report?

-

What is the expected growth of the Flavors And Fragrances Market between 2025 and 2029?

-

USD 14.63 billion, at a CAGR of 6.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Fragrances and Flavors), Product (Formulated flavors and fragrances, Aroma chemicals, and Essential oils), Application (Food and beverages, Cosmetics and personal care, Household and home care, Pharmaceuticals, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing number of new product launches, Threat of counterfeit products

-

-

Who are the major players in the Flavors And Fragrances Market?

-

AARAV Flavors and Fragrances Pvt. Ltd., Alpha Aromatics Inc., Archer Daniels Midland Co., BASF SE, DSM-Firmenich AG, Ernesto Ventos SA, Givaudan SA, Huabao International Holdings Ltd., International Flavors and Fragrances Inc., Kerry Group Plc, McCormick and Co. Inc., Ogawa and Co. Ltd., Robertet SA, S H Kelkar and Co. Ltd., Sensient Technologies Corp., Solvay SA, Symrise Group, T. Hasegawa Co. Ltd., Takasago International Corp., and V. Mane Fils

-

Market Research Insights

- The market for flavors and fragrances is a dynamic and ever-evolving industry, driven by continuous research and innovation. Two key statistics illustrate its significance. First, the market for flavor compounds is projected to expand by 4% annually over the next decade, according to industry analysts. Second, a recent study found that the addition of a specific flavor ingredient increased sales of a popular food product by 15%. For instance, the optimization of aroma delivery and the understanding of aroma perception thresholds have led to the development of new taste modulation strategies and fragrance encapsulation methods. The integration of flavor chemistry techniques, such as taste receptor profiling and sensory attribute scaling, has enabled the creation of more nuanced and complex flavor profiles.

- Furthermore, the use of flavor masking ingredients and aroma compound libraries has allowed for flavor interaction studies and the optimization of flavor quality attributes. The industry's focus on sensory data analysis and olfactory perception models has led to advancements in fragrance material selection and consumer acceptance testing. Overall, the market is characterized by its ongoing quest for innovation and improvement.

We can help! Our analysts can customize this flavors and fragrances market research report to meet your requirements.