FMCG Market Size 2025-2029

The FMCG market size is valued to increase by USD 456.9 billion, at a CAGR of 3.2% from 2024 to 2029. Growing preference for e-commerce online distribution will drive the FMCG market.

Major Market Trends & Insights

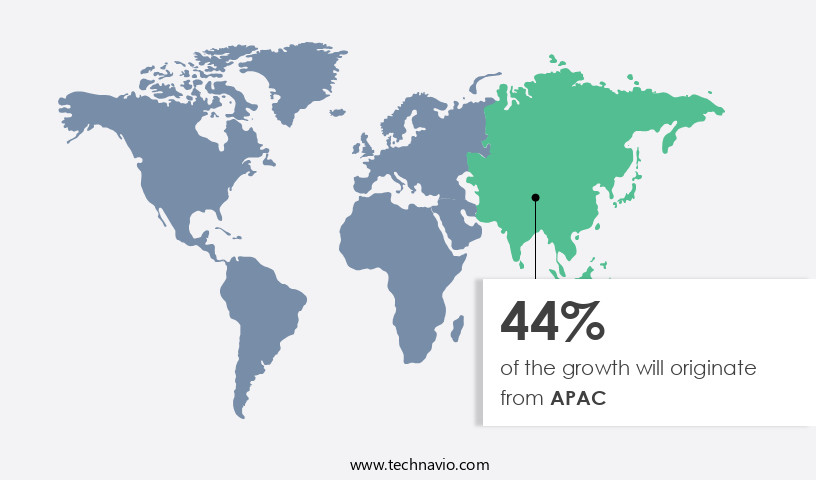

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By Type - Food and beverage segment was valued at USD 1277.40 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 27.75 billion

- Market Future Opportunities: USD 456.90 billion

- CAGR from 2024 to 2029 : 3.2%

Market Summary

- The Fast-Moving Consumer Goods (FMCG) market continues to experience significant shifts, driven by evolving consumer preferences and advancements in technology. The increasing popularity of e-commerce platforms for FMCG purchases has disrupted traditional distribution channels, leading to a more convenient and accessible shopping experience for consumers. Simultaneously, the demand for ready-to-eat food products has surged due to hectic lifestyles and the growing trend of on-the-go meals. Despite this progress, challenges persist, particularly in emerging economies where infrastructure development lags behind. Inadequate storage facilities and transportation networks can hinder the efficient distribution of FMCG products, leading to spoilage and supply chain disruptions.

- However, these hurdles also present opportunities for innovation and investment in modern logistics solutions. As the market adapts to these trends and challenges, it remains a dynamic and vital sector for businesses worldwide. Companies must stay agile and responsive to consumer demands, leveraging technology and strategic partnerships to navigate the complex landscape and capitalize on emerging opportunities. The future of the market promises continued growth and transformation, as it adapts to the evolving needs and preferences of consumers in an increasingly interconnected and globalized world.

What will be the Size of the FMCG Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the FMCG Market Segmented ?

The FMCG industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Food and beverage

- Personal and beauty care

- Health and hygiene care

- Home care

- Distribution Channel

- Offline

- Online

- Product Type

- Premium

- Mass market

- Private label

- Production Type

- In-house

- Contract-based

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The food and beverage segment is estimated to witness significant growth during the forecast period.

In the dynamic and ever-evolving world of fast-moving consumer goods (FMCG), the food and beverage sector experienced a significant surge in demand during 2024. This growth was driven by improving economic conditions and increasing disposable income levels in both developed and developing countries. As a response, manufacturers have been investing in advanced food processing and packaging solutions to cater to this expanding market. Product differentiation has become a key focus for companies, with innovative new offerings such as Thomas's October 2023 launch of a croissant bread, which combines the flaky layers of a croissant with the convenience of sliced bread.

In this competitive landscape, effective marketing mix modeling, supply chain visibility, and consumer insights are essential. Quality control measures, inventory control, and sales performance indicators are crucial for maintaining brand loyalty and market share. Retailer relationships, consumer segmentation, and data analytics are also vital for demand planning and e-commerce platform success. With the increasing importance of digital marketing and social media engagement, product traceability and product lifecycle management are becoming increasingly important for transparency and customer trust. The market is expected to continue its growth trajectory, with consumer packaged goods companies continually refining their marketing campaign effectiveness, sales promotion strategies, and pricing strategies to meet evolving consumer behavior patterns.

The Food and beverage segment was valued at USD 1277.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How FMCG Market Demand is Rising in APAC Request Free Sample

The Asia Pacific (APAC) region is a significant contributor to the Fast-Moving Consumer Goods (FMCG) market, with major revenue generators including China, India, Japan, South Korea, Indonesia, Singapore, and Australia. The region's expanding population, increasing disposable income, and evolving consumer preferences are key drivers for the demand in personal care products, food and beverages, consumer goods, and medicines. Concurrently, the retail and manufacturing sectors are experiencing growth in countries like China, India, Japan, South Korea, Australia, and Indonesia. In the retail sector, companies are implementing promotional campaigns to attract customers. Urbanization and changing lifestyles further fuel the market's continuous evolution in APAC.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Fast-Moving Consumer Goods (FMCG) market is a dynamic and competitive business landscape, requiring effective promotional campaign strategies to capture consumer attention. Optimizing supply chain efficiency is crucial in the FMCG sector to ensure timely delivery and minimize stockouts. Understanding consumer behavior and purchasing patterns is essential for FMCG companies to measure marketing campaign return on investment and improve inventory management in distribution. Data analytics plays a pivotal role in enhancing FMCG sales performance by providing insights into consumer preferences and market trends. FMCG product lifecycle management and optimization help companies extend the life of their products and maximize profits. Building brand loyalty in the FMCG sector can be achieved through strategies such as developing effective pricing strategies, implementing sustainable packaging solutions, and customer segmentation and targeted marketing.

Social media is an effective tool for building brand awareness in the FMCG sector, allowing companies to reach a large and diverse audience. Analyzing the FMCG customer journey and experience is crucial for identifying pain points and opportunities for improvement. Optimizing e-commerce logistics and managing retailer relationships efficiently are essential for FMCG companies to meet customer demands and maintain strong partnerships. Effective quality control and assurance is necessary in the FMCG sector to ensure product safety and meet regulatory compliance. Predictive analytics for FMCG demand forecasting helps companies anticipate market trends and adjust production accordingly. Efficient warehouse management systems and the new product development process are essential for managing inventory and bringing new products to market quickly and cost-effectively. Managing product recalls and regulatory compliance is crucial for maintaining brand reputation and customer trust.

What are the key market drivers leading to the rise in the adoption of FMCG Industry?

- The increasing trend toward e-commerce and online distribution is the primary market driver.

- The market has experienced significant evolution in recent years, with e-commerce playing a pivotal role in driving sales. This shift can be attributed to the convenience and wide product range offered by e-commerce platforms. For instance, consumers can now easily purchase a diverse selection of kombucha brands online. The global increase in smartphone usage has contributed to the surge in e-commerce companies, catering to the growing demand for online FMCG purchases. Consumers appreciate the personalized shopping assistance and product suggestions provided by these platforms.

- Furthermore, e-commerce enables users to gather information and compare various food and beverage, personal care, skincare, cosmetics, and hair care products available on the website. This trend underscores the importance of e-commerce in the FMCG sector and highlights its potential applications across various industries.

What are the market trends shaping the FMCG Industry?

- The consumption of ready-to-eat food products is increasingly popular and represents an emerging market trend.

- The market is experiencing a dynamic evolution, with the ready-to-eat (RTE) food sector emerging as a significant growth area. This shift is influenced by shifting consumer preferences, urbanization, and increasing disposable incomes. The burgeoning population of working professionals, dual-income households, and students is fueling demand for convenient meal solutions that require minimal preparation time while delivering nutritional value. Advancements in food processing and packaging technologies, such as modified atmosphere packaging (MAP), vacuum sealing, and microwaveable packaging, have significantly boosted the RTE sector. These innovations enhance product shelf life, improve quality, and offer added convenience. Furthermore, the surge in e-commerce penetration and online grocery platforms has made RTE products more accessible to a broader consumer base.

- The convenience food market is projected to grow at a robust pace, with RTE foods accounting for a substantial market share. For instance, the RTE segment is estimated to account for over 20% of the market share, while the global RTE food packaging market is projected to reach a value of over USD50 billion by 2025, growing at a CAGR of around 5%.

What challenges does the FMCG Industry face during its growth?

- In emerging economies, the absence of adequate infrastructure represents a significant obstacle to the expansion and growth of industries.

- The Fast-Moving Consumer Goods (FMCG) market is experiencing significant growth in emerging economies, particularly in the Asia Pacific (APAC) region. This expansion is driven by several factors, including improving economic conditions, urbanization, and increasing health consciousness. The food processing industry's growth in these regions further boosts the demand for FMCG products. However, APAC faces challenges in providing adequate infrastructure for storing and manufacturing essential food processing ingredients, such as preservatives, emulsifiers, and enzymes.

- Proper handling and care, including maintaining specific temperatures and preventing contamination, are crucial to preserve these ingredients' chemical compositions. Despite these challenges, the market's potential for growth in APAC remains robust.

Exclusive Technavio Analysis on Customer Landscape

The fmcg market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fmcg market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of FMCG Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, fmcg market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Associated British Foods - This company specializes in Fast-Moving Consumer Goods (FMCG), producing a range of items including anti-aging cream, toothpaste, and hair oil. Their product offerings cater to various personal care needs, showcasing a commitment to innovation and consumer satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Associated British Foods

- Colgate-Palmolive

- Danone

- Godrej Consumer Products Ltd.

- Grupo Bimbo SAB de CV

- JBS S.A.

- Kimberly-Clark Corp.

- Kraft Heinz Co.

- L'Oréal SA

- Marico Limited

- Mondelez International Inc.

- Nestlé SA

- PepsiCo

- Procter & Gamble Co

- Reckitt Benckiser Group PLC

- Tyson Foods Inc.

- Unilever PLC

- Wilmar International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in FMCG Market

- In August 2024, Unilever, a leading FMCG company, announced the launch of its new plant-based meat alternative brand, "V-Leaf," in partnership with Greenleaf Foods, a subsidiary of Maple Leaf Foods (Reuters, 2024). This strategic collaboration aimed to cater to the growing demand for sustainable and ethical food options.

- In November 2024, Nestle, the world's largest FMCG company, completed the acquisition of Aimmune Therapeutics, a biotech firm specializing in peanut allergy treatments, for approximately USD2.6 billion (Bloomberg, 2024). This acquisition expanded Nestle's portfolio into the medical nutrition sector, positioning the company to offer innovative solutions for food allergies.

- In March 2025, PepsiCo and Starbucks entered a strategic partnership to co-create, manufacture, and distribute Starbucks' ready-to-drink coffee products under the Starbucks and Tazo brands (Wall Street Journal, 2025). This collaboration enabled PepsiCo to strengthen its position in the coffee market and Starbucks to expand its reach beyond its traditional retail stores.

- In May 2025, the European Commission approved the merger of Danone and WhiteWave Foods, creating a leading player in The market (European Commission Press Release, 2025). This merger combined Danone's dairy and water businesses with WhiteWave's plant-based food and beverage offerings, allowing the new entity to cater to diverse consumer preferences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled FMCG Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2025-2029 |

USD 456.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The fast-moving consumer goods (FMCG) market continues to evolve, with ongoing activities shaping its dynamics across various sectors. Shelf life optimization and marketing mix modeling are crucial strategies for FMCG companies, ensuring product quality and effective marketing campaigns. Quality control measures and supply chain visibility are essential components of the production process, enabling timely response to consumer behavior patterns and insights. Logistics and transportation, customer relationship management, and distribution channels are integral to delivering products to consumers efficiently. New product development, retail inventory management, and inventory control are essential for maintaining sales performance indicators and product traceability.

- Product lifecycle management, social media engagement, and retailer relationships contribute to brand loyalty metrics and market share dynamics. The FMCG industry anticipates significant growth, with expectations of a 3% annual expansion. For instance, a leading FMCG company successfully increased sales by 5% through effective pricing strategies and data analytics, highlighting the importance of these tactics. The market is further influenced by consumer packaged goods trends, such as product differentiation, demand forecasting, and e-commerce platforms. Customer segmentation and sales promotion strategies are also key elements of digital marketing efforts. In summary, the market is characterized by continuous dynamism, with companies adapting to evolving consumer preferences and market conditions.

- Strategies like shelf life optimization, marketing mix modeling, and supply chain management play a vital role in navigating the complex landscape of consumer behavior patterns, logistics, and retail relationships.

What are the Key Data Covered in this FMCG Market Research and Growth Report?

-

What is the expected growth of the FMCG Market between 2025 and 2029?

-

USD 456.9 billion, at a CAGR of 3.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Food and beverage, Personal and beauty care, Health and hygiene care, and Home care), Distribution Channel (Offline and Online), Product Type (Premium, Mass market, and Private label), Geography (APAC, North America, Europe, Middle East and Africa, and South America), and Production Type (In-house and Contract-based)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing preference for e-commerce online distribution, Lack of proper infrastructure in emerging economies

-

-

Who are the major players in the FMCG Market?

-

Associated British Foods, Colgate-Palmolive, Danone, Godrej Consumer Products Ltd., Grupo Bimbo SAB de CV, JBS S.A., Kimberly-Clark Corp., Kraft Heinz Co., L'Oréal SA, Marico Limited, Mondelez International Inc., Nestlé SA, PepsiCo, Procter & Gamble Co, Reckitt Benckiser Group PLC, Tyson Foods Inc., Unilever PLC, and Wilmar International Ltd.

-

Market Research Insights

- The market for fast-moving consumer goods (FMCG) is a dynamic and ever-evolving landscape, characterized by constant innovation and adaptation to consumer preferences and trends. According to industry reports, The market is projected to grow by 3% annually over the next decade. For instance, sales of plant-based food and beverage products have experienced significant growth in recent years, with some categories seeing increases of up to 20%. This trend is driven by consumer demand for healthier and more sustainable options.

- Additionally, e-commerce channels have gained traction in the FMCG sector, with online sales accounting for over 15% of total sales in some regions. These figures underscore the importance of effective product portfolio management, retail operations, and e-commerce logistics for FMCG companies.

We can help! Our analysts can customize this FMCG market research report to meet your requirements.