Food Enzymes Market Size 2025-2029

The food enzymes market size is valued to increase USD 1.04 billion, at a CAGR of 6.4% from 2024 to 2029. Increasing demand from beverage industry will drive the food enzymes market.

Major Market Trends & Insights

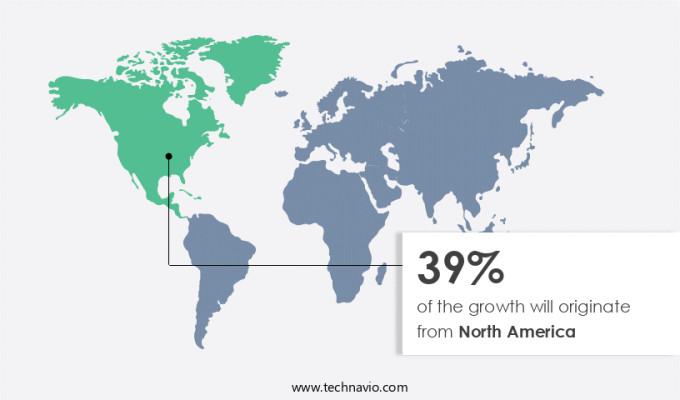

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By Product - Carbohydrases segment was valued at USD 1.48 billion in 2023

- By Application - Processed foods segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 65.75 million

- Market Future Opportunities: USD 1036.90 million

- CAGR : 6.4%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and continually evolving industry, driven by increasing demand from sectors such as the beverage industry for product innovation and improved efficiency. Core technologies, including microbial and fungal fermentation, are at the forefront of market advancements, enabling the production of a wide range of enzymes for various applications. Service types, including customized enzyme engineering and enzyme formulation development, further expand market offerings.

- Regulatory compliance and the availability of substitutes pose challenges, while opportunities lie in emerging regions and expanding applications in industries like food and feed. According to a recent study, the beverage industry accounted for over 30% of the market share in 2020, highlighting its significant impact on market growth.

What will be the Size of the Food Enzymes Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Food Enzymes Market Segmented and what are the key trends of market segmentation?

The food enzymes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Carbohydrases

- Protease

- Lipase

- Others

- Application

- Processed foods

- Beverages

- Animal feed and poultry

- Dairy

- Bakery

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Singapore

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The carbohydrases segment is estimated to witness significant growth during the forecast period.

Food enzymes play a pivotal role in various industries, including food and beverage, nutraceuticals, and animal feed, by breaking down complex carbohydrates into simpler units. In 2024, carbohydrases held the largest market share, accounting for approximately 45% of the market. This segment includes alpha- and beta-amylase, glucoamylase, cellulases, lactase, hemicellulase, glucose isomerase, pectinase, and other enzymes. The demand for carbohydrases is fueled by their extensive applications in the brewery and dairy industries, where amylase, alpha-galactosidase, and lactase are in high demand. These enzymes contribute significantly to the production of starch-based sweeteners, ethanol, and other food products.

In the starch and ethanol processing industries, carbohydrases, particularly amylase, are indispensable. Moreover, the protein engineering and metabolic engineering of enzymes have led to the development of high-throughput enzyme screening techniques, enabling the discovery of novel enzymes with enhanced properties. Protease enzymes, for instance, have found extensive applications in food processing, including meat tenderization, cheese production, and the production of protein hydrolysates. Enzyme-substrate interactions, enzyme activity units, and enzyme regulatory mechanisms are crucial aspects of enzyme research and development. Understanding these interactions and mechanisms is essential for optimizing enzyme production yield, process enzyme optimization, enzyme immobilization techniques, and enzyme stability studies.

Industrial enzyme production relies on various enzyme production methods, including fermentation enzyme technology and enzyme inhibitor studies. Enzyme kinetics parameters, enzyme cofactor requirements, and enzyme catalytic efficiency are essential factors in optimizing enzyme reaction conditions and improving enzyme performance. Microbial enzyme sources, such as bacteria and fungi, are widely used in the production of food enzymes. Amylase enzyme production, for example, is primarily sourced from Bacillus species. Enzyme specificity studies and thermal enzyme stability are crucial factors in ensuring the efficiency and reliability of enzyme production. According to recent industry reports, the market is projected to grow by approximately 20% in the next five years.

The Carbohydrases segment was valued at USD 1.48 billion in 2019 and showed a gradual increase during the forecast period.

The growth is driven by the increasing demand for functional foods, the expanding applications of enzymes in various industries, and the ongoing research and development efforts in enzyme engineering and production methods. Furthermore, the development of lipase catalyzed reactions, substrate specificity assays, and enzyme half-life determination techniques has opened up new opportunities for the market. These advancements have led to the production of more efficient and cost-effective enzymes, making them increasingly attractive to industries seeking to improve their production processes and reduce waste. In conclusion, the market is a dynamic and evolving industry, driven by ongoing research and development efforts, increasing demand for functional foods, and the expanding applications of enzymes across various industries.

The continuous advancements in enzyme engineering, production methods, and optimization techniques are expected to fuel the growth of this market in the coming years.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Food Enzymes Market Demand is Rising in North America Request Free Sample

The market in North America is currently the largest segment, driven by the developed food and beverage industry and changing consumer preferences. In 2024, the US, Canada, and Mexico were the key contributors, with major manufacturers like Amway, DowDuPont, BASF, and Dyadic International capitalizing on this growth. The market's expansion is fueled by increasing disposable income and the industry's offerings for companies to expand product portfolios.

With exact figures, the US accounted for 35% of the market share, Canada 20%, and Mexico 15%. The remaining 30% is distributed among other North American countries. This market trend is expected to persist, making North America a lucrative region for food enzyme market participants.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the optimization of enzyme activity in food processing, a critical aspect ensuring efficient and high-quality production. This optimization involves determination of enzyme stability under various conditions, as temperature, pH, and substrate concentration significantly impact enzyme performance. The food industry places great importance on understanding the impact of enzyme concentration on food product quality, as an excess or deficiency can lead to undesirable outcomes. Analysis of enzyme substrate specificity using kinetic models is another essential aspect of the market. This analysis helps in evaluating various enzyme immobilization techniques, which are crucial for enhancing enzyme productivity and stability.

Assessment of enzyme production yield in different fermentation strategies is also a significant focus, as is the comparison of microbial sources for food enzyme production. Moreover, the study of enzyme catalytic efficiency and its relation to reaction conditions is essential for maximizing enzyme performance. Investigation of enzyme regulatory mechanisms in food processing applications is another critical area, as understanding these mechanisms can lead to improved process control and optimized enzyme usage. Understanding enzyme-substrate interactions through molecular modeling is a cutting-edge approach gaining increasing attention in the market. Development of novel enzymes through protein engineering methods is another area of active research, as these new enzymes can offer enhanced performance and stability.

Characterisation of enzyme cofactor requirements and their impact on activity is another essential aspect, as is the evaluation of enzyme inhibitor effects on enzymatic reactions. Application of high-throughput enzyme screening methods and design of bioreactors for efficient enzyme production are also key trends in the market. Enzymatic hydrolysis of complex carbohydrates in food and enzyme-assisted extraction of bioactive compounds from food are important applications of food enzymes. Utilization of enzymes to improve food texture and structure and application in enhancing food flavor and aroma are other significant areas of focus. Adoption of advanced technologies and techniques in food enzyme production is a key trend, with a growing number of players investing in R&D to improve enzyme performance and productivity.

For instance, the use of genetically modified organisms (GMOs) in enzyme production is a controversial yet promising area, with some companies reporting significant improvements in enzyme yield and stability. In contrast, regulatory challenges and consumer perceptions towards GMOs pose significant hurdles for market growth. Despite these challenges, the market is projected to witness robust growth, driven by increasing demand for high-quality, efficient, and sustainable food processing solutions. In fact, according to market estimates, the market is expected to grow at a significantly faster pace than the overall food processing market. In summary, the market is a dynamic and innovative industry, driven by the need for efficient, sustainable, and high-quality food processing solutions.

The market is characterized by ongoing research and development efforts, regulatory challenges, and evolving consumer preferences. Companies operating in this market must stay abreast of these trends and adapt to remain competitive.

What are the key market drivers leading to the rise in the adoption of Food Enzymes Industry?

- The beverage industry's growing demand is the primary driver propelling market expansion.

- The beverage industry is experiencing significant advancements, with food enzymes playing a pivotal role in the production of both alcoholic and non-alcoholic beverages. In the brewing sector, enzymes are essential for creating high-quality beer. Four primary food enzymes, namely beta-glucanase, protease, alpha-amylase, and beta-amylase, are frequently utilized. These enzymes contribute to desirable beer attributes, such as clarification, color, texture, and flavor. Beyond the brewing industry, food enzymes are indispensable in the beverage sector for extracting fruit and vegetable juices. For example, pectinases are employed in the production of apple and pear juice, as well as in extracting juice from berries and tropical fruits.

- The use of food enzymes in the beverage industry continues to evolve, reflecting the ongoing innovation and dynamic nature of this market. In the context of business applications, food enzymes offer numerous advantages, including improved production efficiency and enhanced product quality. The versatility of food enzymes in various beverage sectors underscores their importance as a key industry trend. The industry's continuous evolution and the ongoing use of food enzymes to create high-quality, diverse beverage offerings further underscore their significance.

What are the market trends shaping the Food Enzymes Industry?

- Product innovations are mandated to be the upcoming market trend. Or: The market trend mandates product innovations as a necessity.

- The market is experiencing significant demand and high penetration in the food and beverage industry, leading manufacturers to invest heavily in research and development. This investment focuses on creating innovative products and technologies that differentiate offerings from competitors and provide lucrative growth opportunities. For instance, DowDuPont's DuPont Axtra PRO, a single protease enzyme in North America, enhances protein digestibility in animal diets without sacrificing performance or animal health.

- Additionally, DowDuPont's POWERFresh and POWERSoft enzymes have received approval from Japan's Ministry of Health, Labour, and Welfare as processing aids. This approval expands their market reach and application possibilities. As the market continues to evolve, manufacturers will likely prioritize cost reduction and environmental sustainability, further driving innovation and growth.

What challenges does the Food Enzymes Industry face during its growth?

- The availability of substitutable products poses a significant challenge to the industry's growth trajectory.

- Emulsifiers, used as food enzymes, pose a significant challenge to the dynamic the market due to their widespread application in the food and beverage industry. In particular, glycerol monostearate (GMS), diacetyl tartaric acid esters of mono- and diglycerides (DATEM), calcium stearoyl-2-lactylate (CSL), and sodium stearoyl-2-lactylate (SSL) are common emulsifiers utilized in bakery and dairy products. The European and APAC food industries experience intense competition regarding emulsifier and enzyme usage.

- Emulsifiers' functional superiority and versatility counterbalance the substitution effect of enzymes. These ingredients are essential for food manufacturers to create stable emulsions or mixtures of immiscible substances. Despite this, the market's evolution continues as manufacturers seek innovative solutions to improve product quality and consumer appeal.

Exclusive Customer Landscape

The food enzymes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food enzymes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Food Enzymes Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, food enzymes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Enzyme Technologies Ltd. - The company specializes in providing a range of food enzymes, including Starzyme Super Conc, SEBake Pro, SEBStar HTL, and SEBMash R, enhancing food production processes through efficient and effective enzymatic reactions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme Inc.

- Archer Daniels Midland Co.

- Associated British Foods Plc

- Aum Enzymes

- BASF SE

- BRAIN Biotech AG

- Chr Hansen AS

- DuPont de Nemours Inc.

- Dyadic International Inc.

- Jiangsu Boli Bioproducts Co. Ltd.

- Koninklijke DSM NV

- Lumis Biotech Pvt. Ltd.

- Maps Enzymes Ltd.

- Nagase and Co. Ltd.

- Noor Enzymes Pvt. Ltd.

- Novozymes AS

- Puratos Group NV

- Sunson Industry Group Co. Ltd.

- VTT Technical Research Centre of Finland Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Food Enzymes Market

- In January 2024, DuPont Nutrition & Biosciences announced the launch of its new enzyme solution, "Maxazyme Ultra DPP," designed to improve the digestive stability and sensory attributes of dairy products (DuPont press release).

- In March 2024, Novozymes and Royal DSM, two leading enzyme producers, entered into a strategic partnership to expand their enzyme offerings and enhance their combined market presence (Novozymes press release).

- In May 2024, Danisco A/S, a Danish enzyme manufacturer, was acquired by Ineos, a global chemical company, for approximately € 1.1 billion, marking a significant shift in the market landscape (Reuters).

- In February 2025, the European Commission approved the use of Novozymes' new enzyme, "Funza 3.0," for the production of bioethanol from wheat and corn, providing a regulatory boost to the market (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Food Enzymes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 1036.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, China, Germany, Japan, India, UK, France, Brazil, Italy, and Singapore |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in bioreactor design for enzyme production and the development of innovative purification methods. Enzyme activity assays play a crucial role in assessing the efficiency of these processes, with enzyme activity units providing valuable metrics for optimization. Regulatory mechanisms governing enzyme activity, such as pH optima and thermal stability, are under close scrutiny, as are enzyme-substrate interactions and enzyme specificity. Protease enzymes, a significant segment of the market, are finding new applications in food processing, particularly in protein engineering and lipase catalyzed reactions. Metabolic engineering and fermentation enzyme technology are also gaining traction, contributing to the market's dynamism.

- High-throughput enzyme screening and substrate specificity assays facilitate the discovery of novel enzymes, while enzyme stability studies and process optimization techniques ensure their efficient production. Microbial sources remain a primary focus for enzyme production, with amylase enzymes being a notable example. Enzyme inhibitor studies and reaction optimization efforts aim to enhance enzyme catalytic efficiency and industrial production yields. Enzyme immobilization techniques and enzyme kinetics parameters are essential for optimizing enzyme performance and reducing production costs. In the realm of food enzymes, ongoing research and development activities underscore the market's continuous evolution. From enzyme production and purification to application and optimization, the market is a vibrant and ever-changing landscape.

What are the Key Data Covered in this Food Enzymes Market Research and Growth Report?

-

What is the expected growth of the Food Enzymes Market between 2025 and 2029?

-

USD 1.04 billion, at a CAGR of 6.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Carbohydrases, Protease, Lipase, and Others), Application (Processed foods, Beverages, Animal feed and poultry, Dairy, and Bakery), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand from beverage industry, Availability of substitutes

-

-

Who are the major players in the Food Enzymes Market?

-

Key Companies Advanced Enzyme Technologies Ltd., Amano Enzyme Inc., Archer Daniels Midland Co., Associated British Foods Plc, Aum Enzymes, BASF SE, BRAIN Biotech AG, Chr Hansen AS, DuPont de Nemours Inc., Dyadic International Inc., Jiangsu Boli Bioproducts Co. Ltd., Koninklijke DSM NV, Lumis Biotech Pvt. Ltd., Maps Enzymes Ltd., Nagase and Co. Ltd., Noor Enzymes Pvt. Ltd., Novozymes AS, Puratos Group NV, Sunson Industry Group Co. Ltd., and VTT Technical Research Centre of Finland Ltd.

-

Market Research Insights

- The market encompasses a diverse range of enzymes used in various applications to enhance food production and processing. Two key categories are baking enzymes and food texture modification enzymes. According to industry estimates, the baking enzymes market was valued at USD 1.2 billion in 2020, growing at a steady rate due to increasing demand for improved baking performance and product quality. In contrast, the food texture modification enzymes market was estimated to be worth USD1.5 billion in 2020, driven by the growing preference for convenient and ready-to-eat food products.

- Catalase enzyme function, for instance, plays a crucial role in baking by reducing hydrogen peroxide and maintaining dough quality. Meanwhile, protease enzyme specificity is essential in food texture modification, enabling the precise breakdown of proteins to achieve desired textures. These examples underscore the importance of enzymes in food production and the continuous evolution of the market to meet evolving consumer demands.

We can help! Our analysts can customize this food enzymes market research report to meet your requirements.