China Food Hydrocolloids Market Size 2025-2029

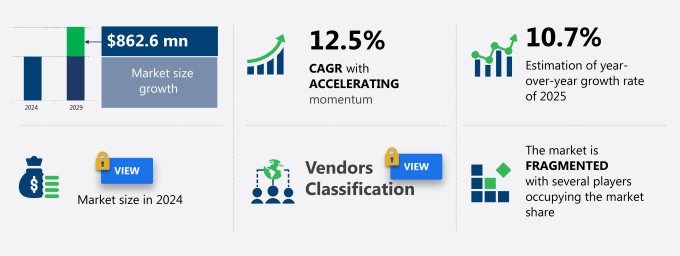

The China food hydrocolloids market size is forecast to increase by USD 862.6 million at a CAGR of 12.5% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing consumption of convenience foods, as hydrocolloids play a crucial role in enhancing the texture and shelf life of these products. Another trend influencing the market is the multifunctionality of hydrocolloids, which allows them to be used in various applications, from food and beverages to pharmaceuticals and cosmetics. However, high prices remain a challenge for market growth, as they limit consumer access and impede the adoption of hydrocolloids in mass-market applications. Overall, the market is expected to witness steady growth in the coming years, driven by these factors and the continued demand for convenient and functional food products.

What will be the Size of the Market During the Forecast Period?

- Food hydrocolloids, a diverse group of natural and synthetic substances, play a crucial role in the food industry. These versatile ingredients serve various functions, including stabilizing agents, coating agents, texture modification, natural thickeners, gelling agents, and emulsifiers. The market is driven by several factors, including food innovation, consumer food preferences, and food regulations. Food innovation is a primary driver for the market. As consumers seek new and exciting food experiences, food manufacturers turn to hydrocolloids to create unique textures, flavors, and appearances. These ingredients enable the development of functional foods, such as low-calorie, high-fiber, and plant-based options, catering to the growing demand for healthier food choices.

- Consumer food preferences continue to shape the market. With the rise of clean label and sustainable food trends, there is a growing demand for natural hydrocolloids derived from plant-based sources. Xanthan gum, a commonly used synthetic hydrocolloid, is now being replaced with natural alternatives like pectin, guar gum, and carrageenan. Food regulations also impact the market. Strict food labeling regulations require manufacturers to disclose the use of hydrocolloids in their products. This transparency is essential for maintaining consumer trust and adhering to food safety regulations. Furthermore, food ingredient sourcing is becoming increasingly important, with a focus on sustainable and ethically-sourced ingredients. The market is also influenced by food processing techniques.

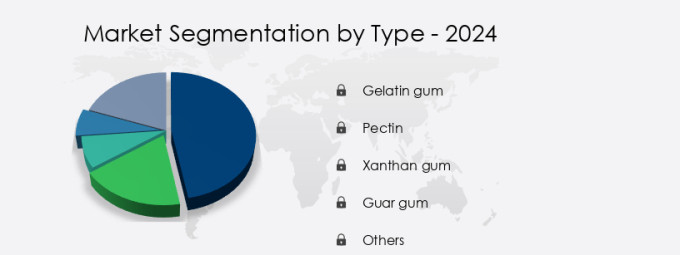

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Gelatin gum

- Pectin

- Xanthan gum

- Guar gum

- Others

- Application

- Dairy and frozen products

- Bakery/confectionery

- Beverages

- Meat and seafood products

- Others

- Geography

- China

By Type Insights

- The gelatin gum segment is estimated to witness significant growth during the forecast period.

In the dynamic food industry, food hydrocolloids have become essential additives due to their role in enhancing the texture, stability, and appearance of various food products. The gelatin gum segment dominates the market due to its versatility in applications, including clarifying agents in confections, desserts, jellies, and ice creams. Additionally, it serves as a protein source, replacing fats and carbohydrates in food processing. With the fast-paced lifestyle and the increasing preference for quick meal choices, the demand for food hydrocolloids is on the rise. Long-term contracts between food processors and suppliers ensure a stable supply of raw materials. Moreover, urbanization and population growth in North America have led to a rise in demand for processed and packaged foods.

This trend is driving the market, as these additives help maintain the desired texture, flavor, and shelf life of food products. Furthermore, consumers' increasing awareness of health concerns has led to a growing demand for food products with reduced sugar, fat, and salt content. Food processing companies are responding to this trend by focusing on food additives that can help reduce the content of these ingredients without compromising taste, texture, or aroma. In summary, the market is witnessing significant growth due to its role in enhancing food products' functionality, texture, and shelf life while catering to consumers' evolving preferences for healthier food choices.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the market?

The rising consumption of convenience foods is the key driver of the market.

- The market has experienced notable growth due to various factors, including increasing health consciousness and food safety concerns, rising per capita income, and changing lifestyle habits. Urbanization, an expanding young population, and an increase in the number of working women have also contributed to the market's expansion. With the modern lifestyle becoming increasingly hectic, there is a growing preference for convenience foods, leading to a higher demand for hydrocolloids in processed food products. These natural food ingredients provide essential textural properties, such as opacity, stickiness, coating, and thickness, to various food items, including jams, dairy products, beverages, and desserts.

- Gum arabic, carrageenan, pectin, agar, konjac mannan, locust bean gum, gaur gum, tara gum, and seaweed hydrocolloids are some of the natural food ingredients used as texture enhancers and rheology modifiers in food products. These hydrocolloids improve the spreadability, creaminess, and taste profiles of food items while extending their shelf life. Moreover, they enhance the texture and reduce brittleness in various food products. Raw material suppliers play a crucial role in the market by providing high-quality raw materials at competitive prices. Packaging strategies, such as vacuum sealing and canning, are essential to maintain the quality and nutritional requirements of food products during storage and transportation.

What are the market trends shaping the market?

The multifunctionality of hydrocolloids leading to their wide range of applications is the upcoming trend in the market.

- Food hydrocolloids are essential biopolymers employed extensively in the food industry for enhancing food quality and extending shelf life. These versatile ingredients serve multiple functions in various food formulations, acting as thickeners for gravies, soups, sauces, salad dressings, and toppings, as well as stabilizers, water retention agents, emulsifiers, and gel-forming agents in jams, restructured foods, jellies, marmalades, and low-sugar per calorie gels. Furthermore, food hydrocolloids are instrumental in ice cream production, controlling ice and sugar crystal formation, and regulating flavor release. In the baking sector, these compounds improve food texture and moisture retention, preventing starch retrogradation and enhancing overall product quality during storage.

- Food hydrocolloids are derived from natural sources like gaur gum, agar, seaweed hydrocolloids, konjac mannan, carrageenan, cellulosic derivatives, pectin, gum arabic, gelatin, locust bean gum, tara gum, alginate, and others. These natural food ingredients contribute to the desired textural properties, opacity, creaminess, stickiness, coating, and spreadability of food products. The market dynamics are influenced by various factors, including consumer preference for natural food ingredients, urbanization, hectic lifestyle, quick food preparation, long-term contracts, canning, raw material pricing, and packaging strategies. Food hydrocolloids are used in a wide range of food items, including beverages, dairy products, and meal choices, catering to the nutritional requirements and taste profiles of consumers.

What challenges does the market face during the growth?

High prices affecting product consumption are a key challenge affecting market growth.

- The market is driven by the increasing demand for natural food ingredients in various food products. Hydrocolloids, such as gaur gum, agar, seaweed hydrocolloids, konjac mannan, carrageenan, cellulosic hydrocolloids, pectin, gum arabic, gelatin, locust bean gum, tara gum, alginate, and others, play a crucial role in enhancing the textural properties of food items. They provide opacity, rheology, stickiness, coating, and spreadability, making them essential additives in dairy products, beverages, and other food applications.

- However, this trend does not significantly affect market growth in regions with high disposable income. Consumer preferences for quick food preparation and fast-paced lifestyles have led to an increase in demand for packaged food and convenience meal choices. Food hydrocolloids help extend shelf life, maintain texture and thickness, and improve the taste profiles of these products. Urban areas, with their diverse meal choices and hectic lifestyles, are major contributors to market growth. Food hydrocolloids are used in various food applications, including canning, beverages, and meal choices for instant consumption.

- Raw material suppliers employ packaging strategies to maintain product quality and extend shelf life, using methods such as vacuum sealing and proper labeling. The market's dynamics are influenced by factors such as taste profiles, product pricing, and nutritional requirements. Traditional cooking methods continue to be popular, but the convenience offered by processed food and the extended shelf life provided by hydrocolloids make them increasingly popular in modern kitchens. The market's future growth is expected to be influenced by factors such as raw material prices, product innovation, and changing consumer preferences.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Daniels Midland Co. - The company offers food hydrocolloids that are used in adhesives, acrylates, aqua flow, biofunctionals, cellulosics, composites, cyclodextrins, encapsulates, emollient esters, emulsifiers, film coating systems, guar and guar derivatives, and hydrogels.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACCEL Carrageenan Corp.

- Ashland Inc.

- Behn Meyer Deutschland Holding AG and Co. KG

- Cargill Inc.

- CP Kelco US Inc.

- Gino Biotech

- Hawkins Watts Ltd.

- International Flavors and Fragrances Inc.

- Kerry Group Plc

- Kevin Food Co.Ltd

- Koninklijke DSM NV

- Man Chang Company LTD.

- MCPI Corp.

- Qingdao Dehui Halobios Science and Technology Co. Ltd

- Rousselot SDN. BHD.

- Shanghai LeQuan Food Co.Ltd.

- Shishi Globe Agar Industries Co. Ltd.

- South Fujian Agar Co. Ltd.

- Yantai Xinwang Seaweed Co. Ltd

- Zhenpai Hydrocolloids Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for natural food ingredients in various food products. These natural ingredients, including gum arabic, pectin, carrageenan, agar, locust bean gum, and others, play a crucial role in enhancing the textural properties of food items. Jam is one of the primary food applications of hydrocolloids, where they serve as thickeners and stabilizers. Gaur gum, a galactomannan derived from the seeds of the Cyamopsis tetragonoloba plant, is widely used in jam production due to its high water-holding capacity and ability to impart desirable texture and spreadability. Dairy products are another significant application area for food hydrocolloids. These ingredients contribute to the creaminess and stability of dairy products, such as yogurt, ice cream, and cheese. Carrageenan, a red seaweed extract, is a popular hydrocolloid used in dairy applications due to its ability to form gels and stabilize emulsions. Opacity and texture are essential factors in food products, and hydrocolloids play a vital role in addressing these requirements. Agar, a gelatinous substance derived from red algae, is used to impart opacity and texture in desserts, jellies, and puddings. Cellulosic hydrocolloids, such as microcrystalline cellulose and sodium carboxymethyl cellulose, are used as bulking agents and texturizers in various food products.

Natural food ingredients are gaining popularity among consumers, leading to an increase in demand for hydrocolloids derived from natural sources. Seaweed hydrocolloids, such as alginate and carrageenan, are derived from seaweed and are widely used in food applications due to their natural origin and functional properties. Rheology, or the study of flow behavior, is an essential factor in food processing. Hydrocolloids play a crucial role in modifying the rheological properties of food products, ensuring the desired consistency and texture. Stickiness, coating, and thickening are some of the rheological properties that hydrocolloids help to achieve in various food applications. Sweeteners are widely used in food products, and hydrocolloids play a role in enhancing their functionality. For instance, pectin is used as a gelling agent in jams and jellies, while gum arabic is used as a stabilizer in beverages. Grocery shopping and meal choices have evolved with the fast-paced lifestyle of consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.5% |

|

Market Growth 2025-2029 |

USD 862.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.7 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.