Footwear Adhesives Market Size 2024-2028

The footwear adhesives market size is forecast to increase by USD 501.2 million at a CAGR of 3.9% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for international footwear brands, leading to a surge in the usage of adhesives in the production process. Moreover, the emergence of new technologies, such as water-based adhesives, is gaining popularity due to their environmental benefits and improved product quality. However, the high cost of raw materials poses a significant challenge for market participants, potentially increasing production costs and affecting profitability. Companies in the market must navigate this challenge by exploring alternative sourcing options or investing in research and development to create cost-effective, high-performance adhesive solutions.

- By staying abreast of market trends and addressing these challenges, footwear manufacturers and adhesive suppliers can capitalize on the growing demand for footwear and secure a competitive edge in the industry.

What will be the Size of the Footwear Adhesives Market during the forecast period?

- The market continues to evolve, driven by the constant demand for efficient and high-performing adhesives in various footwear sectors. These adhesives play a crucial role in footwear assembly, enhancing bonding strength, aging resistance, and water resistance. Polyurethane adhesives and low voc adhesives are popular choices due to their superior bonding capabilities and eco-friendliness. Adhesive distribution systems, such as automated dispensing systems and roll coating, ensure consistent application and improve overall efficiency. The trend towards sustainable footwear production has led to the development of bio-based adhesives and eco-friendly adhesives, which offer both environmental benefits and excellent adhesion performance.

- Adhesion testing remains a critical aspect of footwear manufacturing, ensuring the quality of bonding in various footwear types, including casual footwear, Sports Footwear, industrial footwear, and formal footwear. New adhesive technologies, such as pressure-sensitive adhesives and spray application, offer innovative solutions for footwear assembly and repair. Footwear manufacturers continually explore product innovation, utilizing adhesive additives and formulations to enhance performance and optimize cost. Temperature resistance, chemical resistance, and peel strength are essential considerations for various footwear applications. The adhesives industry trends reflect the ongoing quest for improved efficiency, sustainability, and performance enhancements in footwear production.

How is this Footwear Adhesives Industry segmented?

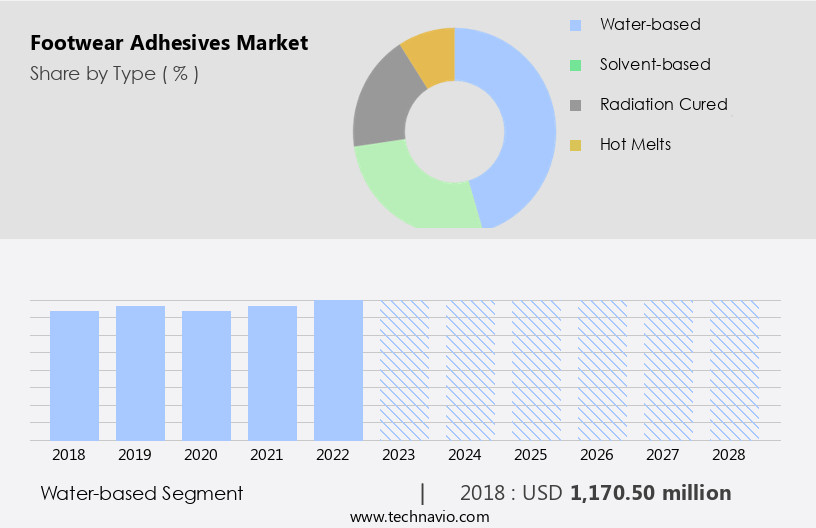

The footwear adhesives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Water-based

- Solvent-based

- Radiation cured

- Hot melts

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

The water-based segment is estimated to witness significant growth during the forecast period.

Footwear assembly processes have seen significant advancements with the adoption of water-based adhesives in various applications such as leather, synthetic, orthopedic, and athletic shoes. These adhesives are used for upper construction, bonding, toe cap and counter attachment, sole preparation, and sole assembly. Traditional solvent-based adhesives have been supplemented with water-based alternatives, which offer benefits like aging resistance, water resistance, and improved bonding strength. The formulation of water-based adhesives involves a combination of additives, polymers, and water. They can bond with both porous and non-porous substrates, activating when the water in the adhesive evaporates or is absorbed. companies are also focusing on developing eco-friendly adhesives, bio-based adhesives, and adhesives with enhanced performance characteristics like tensile strength, peel strength, shear strength, temperature resistance, and chemical resistance.

Automated dispensing systems, roll coating, and spray application methods are used for efficient adhesive distribution. The footwear industry is witnessing trends like cost optimization, supply chain management, and quality control. New adhesive technologies are being developed to cater to the evolving demands of the market. Adhesive formulations are being innovated to enhance shoe performance, such as improving the bonding time, pressure-sensitive properties, and open time. Adhesive additives are also being explored to improve adhesion performance and shoe repair. The use of sustainable materials and adhesives is gaining importance in the production of casual footwear and formal footwear. Footwear manufacturers are focusing on research and development to create high-performance shoes using advanced adhesive technologies.

The Water-based segment was valued at USD 1170.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 57% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In developing nations like India and China, the rise in disposable income among consumers has significantly impacted the footwear market. According to the Ministry of Statistics and Programme Implementation of India, per capita income increased from around USD950 in FY2015 to USD1,250 in FY2019. This income growth has enhanced the living standards of consumers, leading to increased demand for high-quality footwear from both local and international brands. The rapid urbanization in these countries has also given rise to prominent fast-fashion and athletic footwear brands. Efficiency improvements in footwear assembly have been a key trend in the industry.

Polyurethane adhesives and low voc adhesives have gained popularity due to their superior bonding strength and reduced environmental impact. Aging resistance and water resistance are essential requirements for footwear, leading to the widespread use of these adhesives. Adhesive distribution systems, such as automated dispensing systems and resin systems, have streamlined the footwear manufacturing process. Sustainable footwear, including bio-based adhesives and eco-friendly adhesives, have gained traction due to increasing consumer awareness and regulations. Footwear manufacturers have focused on performance enhancements, including tensile strength, shear strength, and peel strength, to cater to various footwear categories like casual footwear, sports footwear, and industrial footwear.

Adhesive formulations, such as water-based adhesives and solvent-based adhesives, have been developed to cater to specific applications. Product innovation and adhesive additives have played a crucial role in enhancing adhesive performance. Shoe repair and bonding time have also been areas of focus for manufacturers to improve customer satisfaction. Pressure-sensitive adhesives and spray application have gained popularity due to their ease of use and cost optimization. New adhesive technologies, such as contact adhesives, Hot melt adhesives, and adhesive curing methods, have been introduced to address the evolving needs of the footwear industry. Temperature resistance, chemical resistance, and adhesion testing are essential considerations in the selection of adhesives for various footwear applications.

In conclusion, the footwear industry is witnessing significant growth in developing nations, driven by increasing disposable income and urbanization. Efficiency improvements, sustainability, and performance enhancements are key trends shaping the market. Adhesive manufacturers are focusing on developing innovative adhesive solutions to cater to the diverse requirements of the footwear industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Footwear Adhesives Industry?

- The surge in consumer preference for international footwear brands serves as the primary catalyst for market growth.

- The market has experienced significant growth due to the increasing demand for high-performance footwear from international brands. These brands prioritize the use of advanced adhesive technologies, such as resin systems and automated dispensing systems, to ensure quality control and enhance the overall performance of their footwear. The application methods, including roll coating and adhesive application, play a crucial role in the production process, with a focus on optimizing dry time for increased efficiency. Polymer chemistry, specifically Eva adhesives, has been a key trend in the footwear adhesives industry. Raw material sourcing is another critical factor, with footwear manufacturers seeking reliable suppliers to maintain consistent product quality.

- The market dynamics are driven by factors such as consumer preferences for durability, comfort, and design, as well as the increasing disposable income of consumers in emerging markets. In conclusion, the market is expected to continue its growth trajectory as international brands prioritize advanced adhesive technologies to meet the evolving demands of consumers.

What are the market trends shaping the Footwear Adhesives Industry?

- Water-based adhesives are gaining popularity in the market as an emerging technology, offering several advantages over traditional adhesives. This trend is driven by the increasing demand for eco-friendly and sustainable solutions in various industries.

- The market is witnessing significant advancements in response to growing health concerns among consumers regarding the use of organic solvents. Studies reveal that footwear factory workers are at risk of adverse health effects due to occupational exposures to these chemicals. Exposure to organic solvents in adhesives can increase the risk of various cancers, including leukemia, bladder, kidney, and stomach, as well as damage to the central nervous system. To address these concerns, manufacturers are innovating with new adhesive technologies and additives that enhance adhesion performance while reducing the reliance on organic solvents. Pressure-sensitive adhesives and water-based adhesives are gaining popularity due to their lower environmental impact and improved health safety.

- Product innovation is a key driver in the market, with spray application and brush application methods being common choices for their ease of use and cost optimization. Adhesive curing times and bonding strength are critical factors in the footwear industry, particularly for athletic footwear. New adhesive technologies, such as solvent-free adhesives and adhesive additives, are being developed to meet the stringent requirements of athletic footwear manufacturers. These advancements are expected to further fuel the growth of the market. In conclusion, the market is evolving to meet the demands of consumers and manufacturers for safer, more sustainable, and high-performance adhesive solutions.

- The focus on reducing the use of organic solvents and improving adhesive performance through innovation and additives is driving the growth of the market.

What challenges does the Footwear Adhesives Industry face during its growth?

- The escalating costs of raw materials pose a significant challenge to the industry's growth trajectory.

- Footwear assembly relies heavily on adhesives for efficiency improvements and enhancing the properties of footwear. companies employ various types of adhesives, including water-based and hot melt, to cater to diverse footwear segments such as casual and sports. The production of water-based adhesives involves chemicals like chloroprene, styrene-butadiene, SBR, and PUR, while hot melt adhesives use raw materials such as polyamide, PSA, APAO, and polyester. One of the key challenges for companies is the high cost of raw materials. However, advancements in adhesive technology offer solutions. For instance, low VOC adhesives and bio-based adhesives are gaining popularity due to their aging resistance and sustainability.

- Adhesive distribution plays a crucial role in ensuring bonding strength and adhesion testing is essential to ensure product quality. Tensile strength, water resistance, and bonding strength are critical factors influencing the selection of footwear adhesives. companies prioritize these properties to cater to the diverse requirements of footwear segments. For instance, sports footwear demands high tensile strength and water resistance, while sustainable footwear requires bio-based adhesives. In conclusion, the market is driven by the need for efficiency improvements, durability, and sustainability. companies must navigate the challenges posed by raw material costs and regulatory requirements while innovating to meet evolving consumer demands.

- Adhesive technology continues to evolve, offering opportunities for companies to differentiate themselves and cater to diverse footwear segments.

Exclusive Customer Landscape

The footwear adhesives market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the footwear adhesives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, footwear adhesives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Artecola QuaÂmica SA - The company specializes in providing a range of footwear adhesives, including ARTEPRYMER, ARTEMELT, ARTELINE, ARTEFILM, ARTECOL, and RÃGIA. These innovative adhesive solutions cater to various footwear manufacturing requirements, ensuring optimal bonding and durability. The ARTEPRYMER series offers high initial bond strength, ARTEMELT delivers excellent elasticity, ARTELINE provides superior wet tack, ARTEFILM ensures quick curing, ARTECOL offers high temperature resistance, and RÃGIA provides excellent resistance to moisture. By utilizing these advanced adhesive technologies, footwear manufacturers can enhance product quality, increase efficiency, and reduce production costs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Artecola QuaÂmica SA

- Bostik Ltd.

- Chemical Technology Pty Ltd.

- Covestro AG

- Eastman Chemical Co.

- Great Eastern Resins Industrial Co. Ltd.

- H.B. Fuller Co.

- Helios Kemostik d.o.o.

- Henkel AG and Co. KGaA

- Jubilant Industries Ltd.

- KECK Chimie

- Pidilite Industries Ltd

- Taiwan PU Corp.

- Texyear Industrial Adhesives Pvt. Ltd.

- XCHEM International LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Footwear Adhesives Market

- In March 2024, Henkel AG & Co. KGaA, a leading adhesives manufacturer, introduced a new line of footwear adhesives, called Loctite SPORTS. This innovative product range is designed to cater to the specific requirements of the footwear industry, offering high bonding strength, durability, and resistance to moisture and chemicals (Henkel AG & Co. KGaA press release, 2024).

- In July 2025, H.B. Fuller Company, another major player in the adhesives industry, announced a strategic partnership with Wolverine World Wide, Inc. This collaboration aimed to develop and commercialize advanced adhesive solutions for Wolverine's footwear products, enhancing their performance and sustainability (H.B. Fuller Company press release, 2025).

- In October 2024, 3M, a global technology company, unveiled its new Scotch-Weld DP8000 Series adhesives, which are specifically designed for the footwear industry. These adhesives offer superior bonding strength, flexibility, and resistance to moisture, making them ideal for various footwear applications (3M press release, 2024).

- In December 2025, Sika AG, a Swiss Specialty Chemicals company, completed the acquisition of Parexel Chemical Corporation, a leading manufacturer of footwear adhesives. This acquisition expanded Sika's footprint in the North American the market and strengthened its position as a global market leader (Sika AG press release, 2025).

Research Analyst Overview

The market plays a pivotal role in the footwear manufacturing process, ensuring the durability and performance of various footwear components. Adhesive performance testing is crucial in assessing footwear quality, focusing on factors such as upper bonding, footwear safety, and footwear construction. Footwear trends continue to evolve, with an increasing emphasis on Wearable Technology, data analytics, and personalized footwear. Heel and outsole bonding are critical in maintaining footwear durability, while midsole bonding ensures footwear comfort and shock absorption. Footwear design incorporates renewable resources and sustainable footwear materials, aligning with the circular economy and biodegradable adhesives. Smart footwear integration, including sensor technology, is transforming the industry, offering enhanced footwear functionality and customization.

Adhesion failure analysis is essential in addressing adhesive issues and improving footwear performance. Footwear repair services are gaining popularity, providing cost-effective solutions for extending footwear life and reducing waste. In the realm of footwear technology, footwear safety, footwear comfort, and footwear aesthetics remain top priorities. The industry continues to innovate, integrating advanced materials and manufacturing processes to meet evolving consumer demands.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Footwear Adhesives Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market growth 2024-2028 |

USD 501.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.7 |

|

Key countries |

China, Germany, US, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Footwear Adhesives Market Research and Growth Report?

- CAGR of the Footwear Adhesives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the footwear adhesives market growth of industry companies

We can help! Our analysts can customize this footwear adhesives market research report to meet your requirements.