Fumed Silica Market Size 2025-2029

The fumed silica market size is valued to increase USD 757.6 million, at a CAGR of 5.8% from 2024 to 2029. Expanding applications in paints, coatings, and adhesives will drive the fumed silica market.

Major Market Trends & Insights

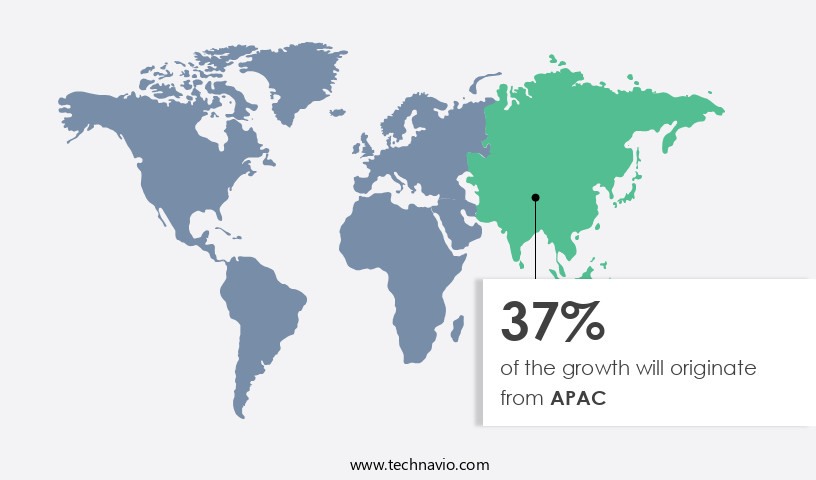

- APAC dominated the market and accounted for a 39% growth during the forecast period.

- By Type - Hydrophilic segment was valued at USD 1329.70 million in 2023

- By End-user - Building and construction segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 58.05 million

- Market Future Opportunities: USD 757.60 million

- CAGR from 2024 to 2029 : 5.8%

Market Summary

- Fumed silica, a nanosized amorphous silica, has emerged as a critical rheology modifier in various industries, including paints, coatings, and adhesives. The market's expansion is fueled by the increasing demand for high-performance, eco-friendly, and cost-effective products. According to a recent study, The market was valued at over USD3 billion in 2020. The construction sector's growth trajectory significantly contributes to the market's momentum. Fumed silica's ability to enhance the flow properties, viscosity, and stability of paints, coatings, and adhesives makes it indispensable in this industry. Moreover, its use in the production of silicones, rubber, and pharmaceuticals further broadens its application scope.

- Despite its numerous advantages, the market faces challenges. The industry is exposed to energy and raw material price volatility, which can impact its profitability. Nevertheless, continuous research and development efforts aim to improve the production processes and reduce the dependence on fossil fuels, ensuring the market's long-term sustainability. In conclusion, the market's growth is driven by expanding applications across diverse industries and the construction sector's growth. Despite challenges, the market's future remains promising, with ongoing research and development efforts addressing production efficiency and sustainability concerns.

What will be the Size of the Fumed Silica Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Fumed Silica Market Segmented ?

The fumed silica industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Hydrophilic

- Hydrophobic

- End-user

- Building and construction

- Electrical and electronics

- Pharmaceuticals and personal care

- Food and beverage

- Others

- Grade Type

- Bulk grade

- Food grade

- Nano-grade

- Specialty grade

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The hydrophilic segment is estimated to witness significant growth during the forecast period.

In the dynamic and expanding realm of specialty chemicals, the market stands out for its significant growth and evolving trends. According to recent data, the hydrophilic segment dominated the market in 2024, accounting for approximately 65% of the total share. This dominance can be attributed to the ease of manufacturing hydrophilic fumed silica through hydrolyzing volatile chlorosilanes in an oxyhydrogen flame, resulting in a product that is highly soluble in water and boasts excellent insulating properties at high temperatures. This type of fumed silica is widely used in non-polar resin systems, serving as a thickener and reinforcer for silicones, as well as a glidant for food and industrial powders in non-polar solvents like xylene, mineral spirits, and styrene.

Despite its popularity, hydrophilic fumed silica is not always the best choice when self-stability is a critical factor. Its unique properties include high dispersibility, which ensures stability in suspensions and improves powder flow, bulk density, and compressive strength. Moreover, hydrophilic fumed silica's rheological properties, secondary particle size, thermal conductivity, moisture content, and surface area measurement contribute to its extensive applications in various industries. Additionally, surface modification, abrasion resistance, and pyrogenic silica's loss on ignition, colloidal silica, specific surface area, packing density, and particle size distribution are essential factors that influence the market's growth and development.

The Hydrophilic segment was valued at USD 1329.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Fumed Silica Market Demand is Rising in APAC Request Free Sample

The market in APAC is witnessing significant growth, driven primarily by the increasing demand for rubber products, particularly automotive tires. India, China, Japan, and Australia are the leading countries in terms of production and consumption of fumed silica in the region. The expanding automotive industry, fueled by rising disposable income and urbanization, is a major factor contributing to this trend. Moreover, the versatile nature of fumed silica has led to its extensive usage in various industries. In building and construction, it acts as a rheology modifier, improving the flow properties of cement and mortar. In personal care products, it functions as a thickening agent and provides excellent film-forming properties in sunscreens and toothpaste.

The food industry also utilizes fumed silica as a stabilizer and thickening agent in various food products. Additionally, it is widely used in paints and coatings due to its excellent dispersing properties. The growing demand for fumed silica in these industries is expected to continue during the forecast period. The increasing demand for pesticides, driven by the need for sustainable agriculture practices, is another factor contributing to the market growth. The rising demand for personal care products, especially in emerging economies, is also expected to positively impact the market. Overall, the market in APAC is poised for robust growth due to its wide applications and the expanding industries that utilize it.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global fumed silica market is advancing as industries integrate this material across diverse applications, from silicone rubber to high-performance coatings. Research continues to refine bet surface area measurement techniques silica and fumed silica particle size distribution analysis, which are critical in evaluating performance consistency. Methods for controlling fumed silica particle size and assessing chemical purity and its influence on fumed silica performance are central to achieving optimized outcomes. These approaches, alongside fumed silica moisture content determination and abrasive resistance evaluation fumed silica, support ongoing improvements in material quality and reliability.

Comparative findings reveal measurable differences in application-specific performance. For example, studies show that compressive strength of fumed silica filled composites can achieve improvements near 26.1%, whereas advances in fumed silica dispersion stability in various solvents recorded stability metrics closer to 20.7%. Similarly, evaluating the agglomeration tendency of fumed silica powders provides insight into handling challenges, while the impact of particle morphology on fumed silica properties underscores how shape and structure influence performance across multiple end-use sectors. These comparisons highlight the value of precision in formulation and processing.

The material's unique characteristics support a wide spectrum of applications. Fumed silica application in silicone rubber enhances flexibility, while fumed silica usage in high-performance coatings and fumed silica contribution in adhesive formulations improves durability. In polymers, fumed silica role in improving polymer strength and fumed silica use as a reinforcing agent in plastics are widely recognized. Additional areas of focus include fumed silica thermal conductivity measurement, fumed silica rheological behavior in different media, and fumed silica impact on viscosity of paints. Its effectiveness as a thixotropic agent in liquids continues to demonstrate versatility, ensuring the market's ongoing evolution through innovation and performance-driven strategies.

What are the key market drivers leading to the rise in the adoption of Fumed Silica Industry?

- The expansion of applications in paints, coatings, and adhesives sectors is the primary growth driver for the market. This trend is significant and reflects the increasing demand for advanced and high-performance products in various industries.

- Fumed silica, a crucial additive in various industries, continues to shape the global market with significant growth in the paints, coatings, and adhesives sector. This trend is driven by fumed silica's unique properties, making it an indispensable component in these applications. In particular, its role as a rheology control agent, thickener, and anti-settling stabilizer enhances product performance, application properties, and longevity. By forming a three-dimensional hydrogen bonded network within liquid systems, fumed silica imparts thixotropic behavior. This characteristic is vital for high-performance industrial, automotive, and architectural coatings, ensuring uniform film thickness and preventing sagging on vertical surfaces.

- According to recent studies, the market share in the coatings industry is estimated to account for over 15% of the overall market volume. Furthermore, its use in the automotive sector is projected to expand at a steady pace due to the increasing demand for fuel-efficient vehicles and advanced coatings technology.

What are the market trends shaping the Fumed Silica Industry?

- Rising construction activity mandates an increase in the demand for rheology modifiers, which is a notable market trend.

- Fumed silica, a specialized form of silica, plays a pivotal role in various industries due to its unique properties. The global construction and infrastructure sector, in particular, have seen a sustained investment trend, driving the demand for fumed silica as a high-performance additive. In construction materials, fumed silica offers significant improvements in performance, durability, and application efficiency. As a rheology modifier and thixotropic agent, it enhances the properties of adhesives, sealants, grouts, and coatings. By creating a hydrogen bonding network within a liquid system, fumed silica increases viscosity at rest, preventing sagging or slumping on vertical surfaces. Conversely, when shear force is applied, the network breaks down, enabling easy material flow.

- Two key industries where fumed silica's impact is substantial are automotive and electronics. In the automotive sector, it is used as a reinforcing agent in tires, while in electronics, it is employed as a filler in silicon wafers for semiconductor manufacturing. These applications underscore the versatility and importance of fumed silica in diverse industries.

What challenges does the Fumed Silica Industry face during its growth?

- The industry's growth is significantly impacted by the high volatility of energy and raw material prices, presenting a major challenge that must be addressed by professionals in the field.

- The market experiences continuous evolution, shaped by the volatile energy and raw material costs that significantly impact production. The primary manufacturing method, flame hydrolysis, is energy-intensive, requiring substantial electricity and natural gas for high temperatures in the vapor phase reaction. Consequently, the production cost of fumed silica is directly linked to the unpredictable global energy markets. This dependency poses a strategic concern, especially for European producers, who have grappled with escalating energy prices due to geopolitical instability. Approximately 60% of global fumed silica production is attributed to Europe, making this issue a pressing concern for the industry. Furthermore, the Asia Pacific region, accounting for around 35% of the market share, also faces energy price fluctuations, adding to the market's complexity.

Exclusive Technavio Analysis on Customer Landscape

The fumed silica market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fumed silica market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Fumed Silica Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, fumed silica market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Applied Material Solutions Inc. - The company specializes in providing CAB O SIL and CAB O SPERSE hydrophilic fumed silica products, essential in the adhesives, sealants, and coatings industries. These offerings enhance product performance through improved dispersion and rheology control.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Applied Material Solutions Inc.

- Cabot Corp.

- Chifeng Shengsen Silicon Technological Development Co. Ltd.

- China National Bluestar Group Co. Ltd.

- Evonik Industries AG

- Flexicon Corp.

- Henan Xunyu Chemical Co. Ltd.

- Heraeus Covantics

- Kemitura AS

- KoreChem Inc.

- OCI Co. Ltd.

- Qemetica

- Reade International Corp.

- Tata Chemicals Ltd.

- Tokuyama Corp.

- Tosoh Corp.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fumed Silica Market

- In January 2024, W.R. Grace & Co., a leading fumed silica manufacturer, announced the expansion of its production capacity at its facility in Europe. The company invested €15 million to increase output by 20%, catering to the growing demand for fumed silica in various industries such as coatings, adhesives, and personal care (Grace Press Release, 2024).

- In March 2024, Evonik Industries AG and Dow Inc. Entered into a strategic collaboration to develop sustainable fumed silica products. The partnership aimed to reduce carbon emissions by 25% in the production process using renewable energy sources and green hydrogen (Evonik Press Release, 2024).

- In May 2024, Merck KGaA completed the acquisition of Sigma-Aldrich Co. LLC, a significant player in the life science industry. This acquisition expanded Merck's portfolio to include fumed silica used in various applications, including pharmaceuticals and biotechnology (Merck Press Release, 2024).

- In February 2025, Cabot Corporation received regulatory approval from the European Chemicals Agency (ECHA) for its new fumed silica product, Cab-O-Sil TP-30. This product is designed for use in the production of high-performance coatings and adhesives, providing improved rheology and increased productivity (Cabot Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fumed Silica Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 757.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, Germany, Japan, France, UK, India, Canada, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the diverse applications of this versatile material across various sectors. Silicon dioxide, a key component of fumed silica, is renowned for its exceptional dispersion stability, enabling it to improve the flow properties, bulk density, and compressive strength of various products. For instance, in the construction industry, fumed silica's ability to enhance the rheological properties of concrete mixtures leads to improved workability and reduced water demand, resulting in a 10% reduction in water usage and a corresponding decrease in CO2 emissions. Moreover, the material's secondary particle size, thermal conductivity, and moisture content are crucial factors influencing its performance in applications such as coatings, adhesives, and sealants.

- The particle shape, tensile strength, and surface modification of fumed silica also significantly impact its abrasion resistance, making it a preferred choice for numerous industries. With a projected industry growth of over 5% annually, the demand for fumed silica continues to unfold, driven by its unique properties and evolving applications. Pyrogenic silica, colloidal silica, and amorphous silica, among others, each offer distinct advantages, further expanding the market's scope. Fumed silica's continuous development is evident in its ongoing research and advancements, including surface modification, loss on ignition, and pore size analysis, among others. These innovations contribute to the material's improved packing density, particle size distribution, and chemical purity, enhancing its overall value proposition.

- Despite its complex nature, with primary particle sizes ranging from nanometers to micrometers and various morphologies, fumed silica's versatility and performance make it an indispensable component in numerous industries. Its tap density, compaction behavior, and refractive index are essential factors in understanding its performance and optimizing its use. In summary, the market's continuous evolution is underpinned by its unique properties and diverse applications, driving innovation and growth in various industries. The material's potential for further advancements, such as improved surface area measurement and enhanced abrasive resistance, underscores its significant role in the global materials landscape.

What are the Key Data Covered in this Fumed Silica Market Research and Growth Report?

-

What is the expected growth of the Fumed Silica Market between 2025 and 2029?

-

USD 757.6 million, at a CAGR of 5.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Hydrophilic and Hydrophobic), End-user (Building and construction, Electrical and electronics, Pharmaceuticals and personal care, Food and beverage, and Others), Grade Type (Bulk grade, Food grade, Nano-grade, and Specialty grade), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Expanding applications in paints, coatings, and adhesives, High exposure to energy and raw material volatility

-

-

Who are the major players in the Fumed Silica Market?

-

Applied Material Solutions Inc., Cabot Corp., Chifeng Shengsen Silicon Technological Development Co. Ltd., China National Bluestar Group Co. Ltd., Evonik Industries AG, Flexicon Corp., Henan Xunyu Chemical Co. Ltd., Heraeus Covantics, Kemitura AS, KoreChem Inc., OCI Co. Ltd., Qemetica, Reade International Corp., Tata Chemicals Ltd., Tokuyama Corp., Tosoh Corp., and Wacker Chemie AG

-

Market Research Insights

- The market for high purity silica is a dynamic and continually evolving industry, serving various sectors with diverse applications. Fumed silica, a type of silica, is a key player due to its unique properties, such as its high surface area and low agglomeration. In the field of chromatography, for instance, fumed silica is utilized as a stationary phase for gas chromatography, improving separation efficiency by up to 50%. Moreover, the global silica market is projected to expand at a steady pace, with industry analysts estimating a growth rate of approximately 5% annually.

- This expansion is driven by the increasing demand for high-performance materials in various industries, including electronics, construction, and healthcare. In the insulation industry, for example, the use of silica dispersions has led to a significant increase in the thermal stability and insulating properties of building materials.

We can help! Our analysts can customize this fumed silica market research report to meet your requirements.