Europe Functional Beverage Market Size and Trends

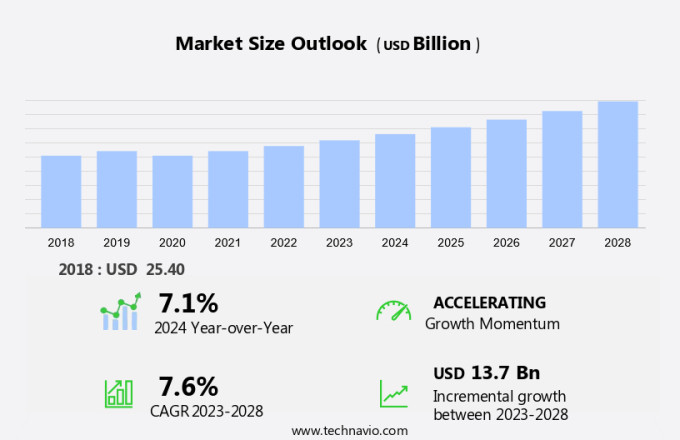

The Europe functional beverage market size is forecast to increase by USD 13.7 billion, at a CAGR of 7.6% between 2023 and 2028. Functional drinks have gained significant traction in the market due to their health benefits, including the promotion of gut health, diabetes awareness, and support for a healthy diet. Consumers are increasingly seeking alternatives to sugary drinks and artificial ingredients, leading to the popularity of low-sugar and zero-sugar options. Monster Energy and Straight Up Energy are notable brands catering to this demand. Caffeine continues to be a key ingredient for mental performance, but its consumption is a concern for some. Flavor variants are essential to cater to diverse consumer preferences. The market is expected to grow due to these trends, with e-commerce platforms facilitating easy access to functional beverages. However, concerns over sugar content and artificial additives persist, necessitating innovation in the development of healthier options.

Functional beverages have emerged as a significant category in the health and wellness market, catering to the increasing demand for health-enhancing products. These beverages, which include protein drinks, energy drinks, and probiotic drinks, among others, are formulated with active ingredients that offer various health benefits. Fitness enthusiasts and health-conscious consumers are the primary target audience for functional beverages. Marketing campaigns emphasizing the convenience and portability of these beverages have contributed to their growing popularity. The market for functional beverages is driven by several factors, including the rising prevalence of chronic diseases, the increasing trend toward veganism and plant-based diets, and the growing demand for organic foods. Digestive health is a key area of focus for functional beverages.

Moreover, probiotic drinks, in particular, have gained significant traction due to their ability to promote gut health. Vitamin C is another popular active ingredient, known for its immune-boosting properties. Protein drinks, which are a staple among fitness enthusiasts, are also gaining popularity among those seeking to maintain a healthy lifestyle. Dairy alternatives, such as lactose-free and plant-based products, are increasingly being used in functional beverages to cater to the growing demand for vegan and allergy-friendly options. Smoothie flavors, which offer a convenient and delicious way to consume essential vitamins, minerals, amino acids, and other nutrients, are also gaining popularity. The functional beverages market is expected to grow steadily, driven by the increasing awareness of the health benefits of these products.

Further, consumers are turning to functional beverages as a convenient and tasty way to incorporate essential nutrients into their diet. The market is also being fueled by the growing popularity of e-commerce and the increasing availability of functional beverages in grocery stores. New flavors and product innovations are expected to drive growth in the functional beverages market. Healthcare providers are also recognizing the potential of functional beverages in promoting health and preventing chronic diseases. As a result, the market is expected to continue its growth trajectory in the coming years. In conclusion, the functional beverages market is a dynamic and growing category in the health and wellness industry. Driven by the increasing demand for health-enhancing products and the convenience they offer, functional beverages are expected to continue gaining popularity among consumers. With a focus on digestive health, immunity-boosting ingredients, and plant-based and organic options, this market is poised for continued growth.

Market Segmentation

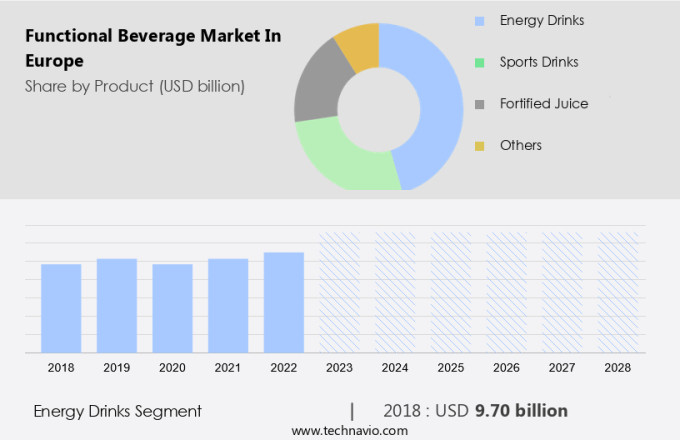

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product

- Energy drinks

- Sports drinks

- Fortified juice

- Others

- Geography

- Europe

- Germany

- UK

- France

- Spain

- Europe

By Product Insights

The energy drinks segment is estimated to witness significant growth during the forecast period. The European functional beverage market, specifically the energy drink segment, is experiencing notable expansion due to shifting consumer trends towards health and wellness. With hectic lifestyles on the rise, there is a growing demand for beverages that offer quick energy enhancements and functional advantages. Energy drinks are popularly marketed for their capacity to improve both physical performance and mental acuity, catering to a diverse consumer base, including athletes, scholars, and professionals. Brands offer a range of products, from conventional caffeinated beverages to sugar-free alternatives and natural energy drinks crafted from organic ingredients like green tea and guarana. These options enable brands to address various consumer preferences.

Get a glance at the market share of various segments Download the PDF Sample

The energy drinks segment accounted for USD 9.70 billion in 2018 and showed a gradual increase during the forecast period. Micronutrients and gut health are increasingly important considerations for consumers, leading to a growing interest in functional beverages. Diabetes awareness is also a significant factor, driving the demand for low-sugar and zero-sugar beverage options. Artificial ingredients and high sugar content are becoming less desirable, making natural and organic alternatives more attractive. Monster Energy, Zero Sugar, and Straight Up Energy are popular brands that cater to this trend. Caffeine remains a key component for many consumers seeking mental performance enhancement, but brands are also focusing on providing natural sources of energy and reducing overall caffeine content. Flavor variants are another essential factor, with brands offering a wide range of options to cater to diverse taste preferences. Overall, the functional beverage market in Europe is witnessing significant growth as consumers seek convenient, healthy, and functional beverage choices.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The health benefits of functional beverages is notably driving market growth. Functional beverages have gained popularity market due to their ability to support various body functions and contribute to a healthy lifestyle. These drinks offer numerous health benefits, including functional beverages, such as those containing prebiotics, can help prevent bowel diseases, diarrhea, and indigestion, thereby enhancing the immune system. Low-calorie, plant-based drinks, and functional teas are excellent options for individuals following weight management programs. Fortified functional beverages, like those containing calcium and vitamin D, can contribute to maintaining bone health. Beverages infused with antioxidants, like vitamins A and C, can support eye health and vision. Energy drinks and beverages containing caffeine and other stimulants can provide a quick mental energy boost.

Additionally, functional beverages, such as those containing plant sterols or stanols, can help lower cholesterol levels. For those with lactose intolerance or following a vegan diet, lactose-free and plant-based functional beverages are readily available. Functional beverages catering to specific dietary needs, like the keto diet or non-GMO, are increasingly popular. Consumers are increasingly seeking functional beverages with minimal processing and natural ingredients, making clean-label products a growing trend. Functional beverages cater to diverse health needs and dietary preferences, making them a versatile addition to a healthy lifestyle. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

The growing popularity of e-commerce is the key trend in the market. Functional beverages, including protein drinks and energy drinks, have gained significant traction among health-conscious consumers. The focus on health and wellness has led to an increase in demand for these beverages, particularly among fitness enthusiasts. Marketing campaigns highlighting the active ingredients in these drinks, such as vitamin C and dairy alternatives, have contributed to their popularity. Brands offering digestive health drinks, probiotic drinks, and veganism-friendly options have also seen growth. Smoothie flavors continue to be a favorite among consumers, providing a convenient and tasty way to incorporate essential nutrients into their diets.

Further, e-commerce distribution networks have played a crucial role in the expansion of the functional beverage market. The convenience of shopping online and the availability of a wide range of brands have made e-commerce retail sales a key driver of growth. The increasing number of e-commerce portals and the widespread use of smartphones have enabled vendors to reach a larger audience and offer a more convenient shopping experience. This trend is expected to continue as more consumers turn to online channels for their functional beverage needs. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

Increasing concerns of obesity is the major challenge that affects the growth of the market. Functional beverages, including ready-to-drink (RTD) functional juice, sparkling water, soda, tea, nootropic drinks, sports drinks, and nutraceutical drinks, have gained popularity among health-conscious consumers. These beverages offer additional health benefits beyond basic hydration. However, it is essential to be mindful of sugar intake, as the American Heart Association recommends a daily limit of 25 grams or 100 calories for women and 36 grams or 150 calories for men. Weight management is a significant concern for fitness enthusiasts, and functional beverages with low calorie and sugar content are preferred. Unfortunately, some functional beverages, such as energy drinks, contain high amounts of added sugar, with an average can containing 26.5 grams.

Additionally, energy drinks often include fat, artificial sweeteners, caffeine, and starch, which may not align with health goals. Fitness centers and gyms across the US are increasingly promoting healthier beverage options. Consumers are encouraged to opt for functional beverages with natural sweeteners, such as stevia or erythritol, and low or no added sugar. By making informed choices, consumers can enjoy the benefits of functional beverages while maintaining a balanced diet. Functional beverages cater to various health needs, from boosting energy and focus to enhancing immune function and muscle recovery. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Nestle SA: The company offers functional beverages such as NESCAFE.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AriZona Beverages USA LLC

- Califia Farms LLC

- Campbell Soup Co.

- Cargill Inc.

- Danone SA

- Energy Beverages LLC

- Fonterra Cooperative Group Ltd.

- Illycaffe Spa

- Keurig Dr Pepper Inc.

- Monster Energy Co.

- Mutalo Group

- Oatly Group AB

- PepsiCo Inc.

- Red Bull GmbH

- Sapporo Holdings Ltd.

- Starbucks Corp.

- Suntory Holdings Ltd.

- The Coca Cola Co.

- The Kraft Heinz Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Functional beverages have gained significant popularity in the health and wellness industry, catering to the increasing demand for health-enhancing products. Protein drinks and energy drinks are among the most common types of functional beverages, with fitness enthusiasts being their primary consumers. Marketing campaigns highlighting the active ingredients, such as vitamin C, amino acids, and minerals, have contributed to their growing popularity. Digestive health is another area where functional beverages have made a mark, with probiotic drinks and dairy alternatives gaining traction. Veganism and plant-based diets have also influenced the market, leading to an increase in the production of plant-based milk and other plant-based beverages. Micronutrients, such as vitamins and minerals, are essential for maintaining good health, and functional beverages offer a convenient way to incorporate them into one's diet. Gut health, diabetes awareness, and chronic disease prevention are some of the health benefits associated with these beverages.

However, concerns regarding the sugar content, artificial ingredients, and caffeine levels in some functional beverages have led to the emergence of low-sugar and zero-sugar options. CBD-infused beverages and personalized beverages are also gaining popularity, offering ingredient-level health and catering to individual health needs. Functional beverages are now available at various retail outlets, including online stores and grocery stores, and come in a wide range of flavors, from smoothie flavors to traditional ingredients. The market for functional beverages continues to evolve, with new flavors and product categories, such as nootropic drinks and functional tea, entering the scene regularly. Functional beverages offer a convenient and tasty way to support various body functions and boost immunity, making them an essential part of a healthy lifestyle. Whether it's mental performance, bone health, vision health, or weight management, there's a functional beverage out there to suit every health need.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market Growth 2024-2028 |

USD 13.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AriZona Beverages USA LLC, Califia Farms LLC, Campbell Soup Co., Cargill Inc., Danone SA, Energy Beverages LLC, Fonterra Cooperative Group Ltd., Illycaffe Spa, Keurig Dr Pepper Inc., Monster Energy Co., Mutalo Group, Nestle SA, Oatly Group AB, PepsiCo Inc., Red Bull GmbH, Sapporo Holdings Ltd., Starbucks Corp., Suntory Holdings Ltd., The Coca Cola Co., and The Kraft Heinz Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch