Gambling Market Size 2025-2029

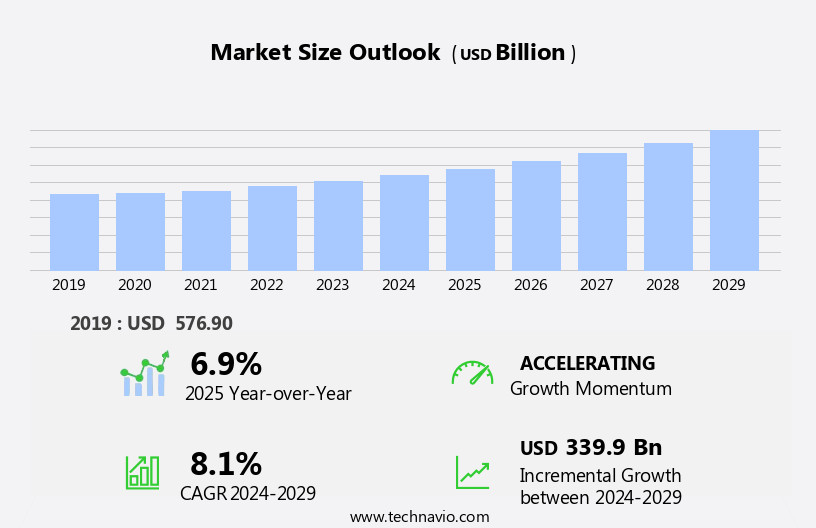

The gambling market size is forecast to increase by USD 339.9 billion at a CAGR of 8.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing popularity of e-sports betting. According to recent reports, the e-sports betting market is projected to reach a value of USD15 billion by 2023, growing at a steady pace. This trend is being fueled by the rising number of e-sports enthusiasts and the increasing acceptance of online gambling. However, the market also faces challenges, most notably the introduction of bitcoin gambling and the associated security and credibility issues. The anonymity offered by cryptocurrencies makes it difficult for regulatory bodies to monitor and control online gambling activities, leading to concerns regarding fraud, money laundering, and underage gambling.

- These challenges require immediate attention from market players to ensure the integrity of the industry and maintain consumer trust. Companies seeking to capitalize on market opportunities must prioritize security measures and adhere to regulatory requirements to mitigate risks and maintain a strong market position.

What will be the Size of the Gambling Market during the forecast period?

- The market continues to evolve, with online poker leading the charge in digital innovation. Live streaming technology brings a new level of immersion to players, while artificial intelligence and user experience enhance gameplay. Bonus offers remain a key player acquisition strategy, with fraud prevention and payment processing ensuring secure transactions. Mobile gaming dominates the landscape, driving affiliate marketing efforts and user engagement. Free spins and welcome bonuses are integral to customer retention, as brands strive for increased brand awareness. Real-time betting and in-play betting add excitement, with esports betting and daily fantasy sports gaining traction. User interface design and game integrity are crucial components of player experience, with age verification ensuring regulatory compliance.

- Digital marketing strategies, including social media and pay-per-click, drive revenue generation. Big data analytics and machine learning optimize operations, enhancing customer engagement and loyalty programs. Amidst this continuous dynamism, anti-money laundering measures and data security remain essential components of market integrity.

How is this Gambling Industry segmented?

The gambling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Lottery

- Betting

- Casino

- Platform

- Offline

- Online

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

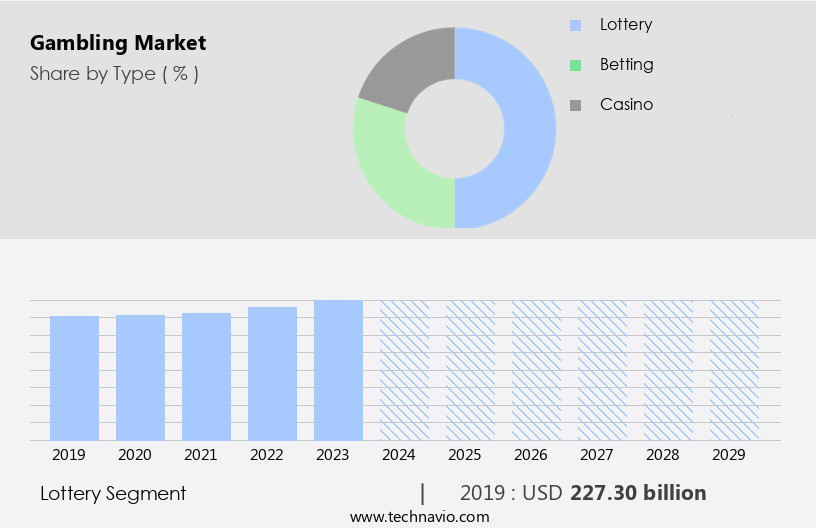

The lottery segment is estimated to witness significant growth during the forecast period.

The market encompasses various forms of entertainment, including lotteries, casino games, sports betting, and esports. In this dynamic industry, technology plays a pivotal role, with machine learning and artificial intelligence enhancing user experience (UX) and game design. User interface (UI) is also crucial, ensuring seamless interaction and age verification. Brand awareness is bolstered through influencer marketing and social media, while in-play betting and mobile gaming cater to evolving consumer preferences. Credit cards and digital payment processing facilitate transactions, with fraud prevention measures ensuring security. Bonus offers, such as welcome bonuses and deposit bonuses, incentivize player acquisition and retention.

Table games, virtual sports, and daily fantasy sports cater to diverse customer engagement, with real-time betting and live dealer games adding immersive elements. Sports betting and mobile app development continue to dominate the market, with betting odds and customer engagement driving revenue generation. Big data analytics and AML (anti-money laundering) measures ensure game integrity and regulatory compliance. Responsible gambling initiatives and loyalty programs foster long-term customer relationships. The market is witnessing a shift towards real-time betting, live streaming, and esports betting, reflecting the evolving consumer landscape. Digital marketing and data security are essential components, with pay-per-click (PPC) and revenue generation strategies shaping market dynamics.

Despite the challenges posed by regulatory frameworks and responsible gambling initiatives, the market continues to evolve, offering numerous opportunities for growth and innovation.

The Lottery segment was valued at USD 227.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

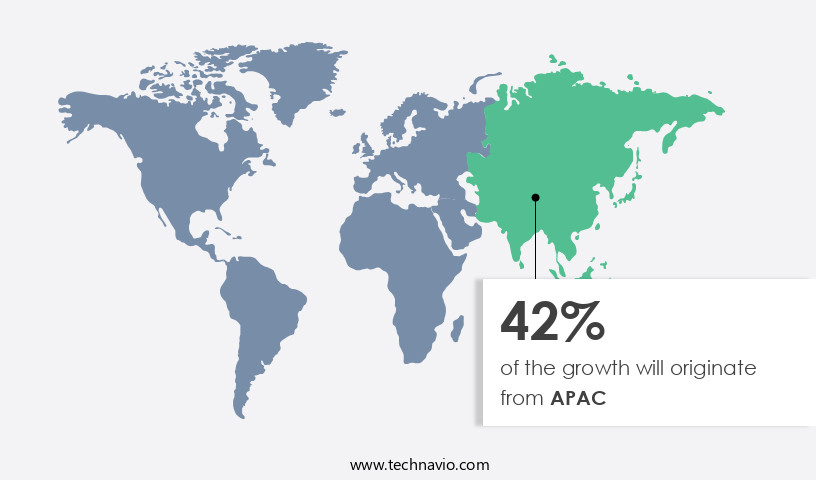

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing notable expansion due to the rising popularity of both offline and online gaming. Legal gambling is practiced in the US, Canada, and Mexico, with the US holding a substantial market share in the region. Traditional land-based casinos dominate the offline gaming sector in the US, prompting companies to strengthen their presence via strategic partnerships, alliances, and technological advancements. For instance, in August 2022, PLAYSTUDIOS Inc., a leading gambling company based in Las Vegas, announced an alliance with IHG Hotels and Resorts (IHG) to offer immersive gaming experiences to hotel guests.

Meanwhile, online gambling is gaining traction due to user-friendly interfaces, captivating game designs, and advanced technologies such as machine learning and artificial intelligence. Age verification systems ensure a secure and responsible gaming environment, while credit card payment processing and fraud prevention measures enhance user experience. Influencer marketing and affiliate programs boost brand awareness, and bonus offers, free spins, and welcome bonuses attract new players. In-play betting, daily fantasy sports, and real-time betting cater to diverse customer preferences. As the market evolves, mobile gaming, live streaming, and social media marketing are becoming increasingly important. Customer retention and player acquisition strategies include loyalty programs, responsible gambling initiatives, and anti-money laundering measures.

Big data analytics and revenue generation are crucial for market growth, while digital marketing and data security ensure a seamless user experience. companies are investing in mobile app development and live dealer games to cater to the changing market dynamics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gambling Industry?

- The significant growth in betting activities on e-sports is the primary catalyst fueling market expansion.

- The market is experiencing significant growth, particularly in the area of e-sports betting. This segment's expansion is driven by the increasing popularity of multiplayer online video games, where professionals compete in front of large audiences. Games like StarCraft 2, League of Legends, Hearthstone, Counter-Strike: Global Offensive, Heroes of the Storm, and Defense of the Ancients 2 have gained massive followings, leading to substantial prize money and a large customer base. To cater to this market, numerous casino service providers are focusing on e-sports betting. Some notable sportsbook sites include Bet365, Sport888, Flutter Entertainment Plc, William Hill, and Betway, among others.

- During the forecast period, industry players are expected to introduce new services and innovations to attract users. Game integrity, responsible gambling, mobile app development, and digital marketing are essential aspects of the e-sports betting landscape. Ensuring game fairness, implementing loyalty programs, adhering to anti-money laundering (AML) regulations, and employing data security measures are crucial for market success. Additionally, pay-per-click (PPC) campaigns, big data analytics, and revenue generation strategies are vital components of a successful e-sports betting business model.

What are the market trends shaping the Gambling Industry?

- Bitcoin gambling is gaining significant traction as the next major market trend. This emerging sector combines the excitement of traditional gambling with the innovative use of cryptocurrency technology.

- Bitcoin, a decentralized digital currency, offers significant advantages for gambling transactions. Its anonymity and lack of regulation make it an attractive option for users seeking privacy. Bitcoin transactions enable international gambling, quick payments, lower fraud risks, and no transaction fees. Platforms like Bitcasino.Io, a subsidiary of mBet Solutions NV, support bitcoin transactions for various casino games. Machine learning and user interface design enhance the gambling experience. Game design caters to user preferences, ensuring immersive and harmonious experiences. Age verification is crucial to prevent underage gambling, ensuring brand reputation and legal compliance. Influencer marketing can boost brand awareness, attracting new users.

- In-play betting adds excitement, increasing user engagement. Credit cards and other traditional payment methods remain popular, but bitcoin's advantages make it a compelling alternative. Esports betting is a growing sector, attracting younger demographics. Market dynamics include increasing user base, technological advancements, and regulatory changes. User experience, security, and innovation are key factors driving growth. Bitcoin's role in this market is significant, offering advantages that cater to the unique needs of the esports betting community.

What challenges does the Gambling Industry face during its growth?

- Online gambling faces significant growth challenges due to the complex security and credibility issues that persist in the industry. These concerns, which include data privacy, fraud prevention, and ensuring fair play, must be effectively addressed to build trust and confidence among consumers and regulators alike.

- The market faces challenges due to security and credibility concerns in online gambling. Many gambling websites lack transparency in dispute resolution, cash prize payouts, and fair gaming standards, diminishing operator and platform provider credibility. This hinders market expansion and discourages new users from engaging in online casino games, such as poker. Online gambling platforms are prime targets for cyber attacks and scammers, posing significant risks to user data, including sensitive financial information. Ensuring robust security measures and maintaining a high level of transparency are essential to mitigate these challenges and build trust within the online gambling community.

- Additionally, advancements in technology, such as live streaming, artificial intelligence, and mobile gaming, offer opportunities to enhance user experience and boost market growth. Bonus offers, free spins, and welcome bonuses are effective marketing strategies to attract and retain customers. Fraud prevention and payment processing systems are crucial components of a secure and credible online gambling platform. Affiliate marketing can also contribute to market expansion by reaching a wider audience and increasing brand visibility.

Exclusive Customer Landscape

The gambling market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gambling market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gambling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

888 Holdings plc - This company specializes in providing an extensive range of gaming experiences, featuring the XL retro series, Triple thread, and multiplayer modes. Players can engage in dynamic and diverse gaming sessions, fostering friendly competition among friends. Our offerings prioritize originality, enhancing search engine exposure and delivering a captivating experience for all. With a focus on innovation and variety, we cater to a global audience, offering a premier destination for gaming enthusiasts.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 888 Holdings plc

- Bet365 Group Ltd.

- Betsson AB

- Caesars Entertainment Inc.

- Camelot UK Lotteries Ltd.

- Crown Resorts Limited

- Entain Plc

- EquiLottery LLC

- Flutter Entertainment Plc

- Freaks 4U Gaming GmbH

- Galaxy Entertainment Group Ltd.

- Gateway Casinos and Entertainment Ltd.

- International Game Technology plc

- INTRALOT SA

- Kindred Group Plc

- Las Vegas Sands Corp

- MGM Resorts International

- New York State Gaming Commission

- SkyCity Entertainment Group

- The Betway Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gambling Market

- In February 2024, DraftKings and FanDuel, two leading players in the online sports betting and iGaming market, announced a merger to create a dominant player in the US market. The combined entity, valued at approximately USD26.5 billion, aims to capitalize on the growing legalization of sports betting and online gambling across the US (Bloomberg).

- In October 2024, Flutter Entertainment, the parent company of FanDuel, secured a strategic partnership with The Stars Group, a leading global online gaming company. The partnership allowed Flutter Entertainment to acquire a 58.2% stake in The Stars Group, expanding its reach in the online poker and casino markets (Reuters).

- In May 2025, the European Commission approved the merger between Betting and Gaming Group (B&GG) and Entain Plc, creating a leading European sports betting and gaming group. The merged entity, valued at â¬17 billion, will operate under the BetMGM brand and aims to capitalize on the growing European online the market (European Commission Press Release).

- In December 2025, Playtech, a leading technology supplier to the gambling industry, launched its new "Omni-channel" platform, which allows operators to offer a seamless experience across online, mobile, and retail channels. The platform, which utilizes artificial intelligence and machine learning, aims to enhance the customer experience and increase operator efficiency (Playtech Press Release).

Research Analyst Overview

In the dynamic the market, conversion rate optimization through email marketing and community building plays a crucial role in player acquisition and retention. Biometric authentication and data protection ensure account security, while withdrawal processing and transaction history analysis facilitate seamless user experience. Push notifications and user behavior analysis enable real-time engagement, driving player segmentation and A/B testing. Two-factor authentication, risk management, and compliance audits bolster trust and security. Customer feedback, prop bets, and betting history analysis inform marketing automation and responsible gambling tools.

Live chat support and customer service enhance the customer journey mapping. Game performance analysis and customer service are essential for player protection and data privacy. Fraud detection and churn rate reduction are integral parts of the regulatory framework. VIP programs, content marketing, brand ambassadors, and responsible gaming initiatives foster player engagement and loyalty. Gambling tax and gaming commission regulations shape the market landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gambling Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2025-2029 |

USD 339.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

US, China, UK, Canada, Germany, Japan, France, Mexico, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gambling Market Research and Growth Report?

- CAGR of the Gambling industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gambling market growth of industry companies

We can help! Our analysts can customize this gambling market research report to meet your requirements.