North America Gas Engine Market Size 2024-2028

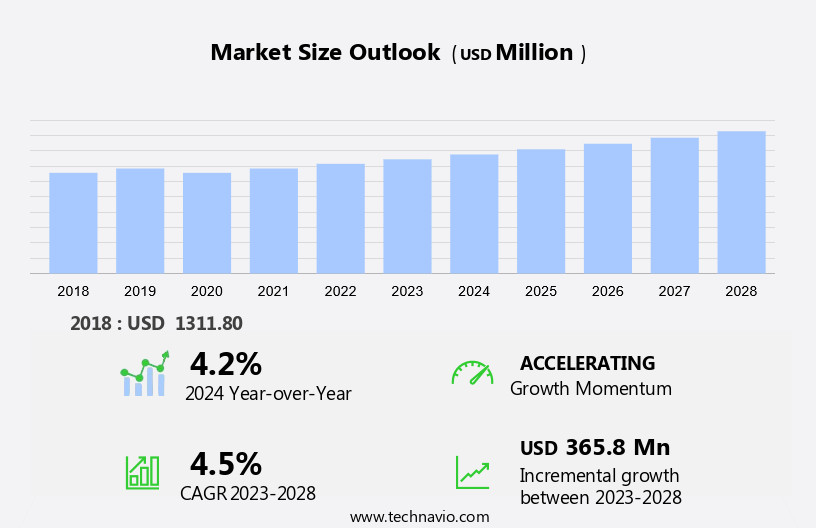

The North America gas engine market size is forecast to increase by USD 365.8 million at a CAGR of 4.5% between 2023 and 2028.

- In North America, the market is experiencing significant growth due to several key drivers. One major factor is the increasing demand for efficient heat and power generation, leading to a shift from traditional coal-fired power plants towards more environmentally-friendly natural gas-fired power generation. Natural gas is a cleaner burning fuel compared to coal and produces fewer greenhouse gas emissions. Additionally, the integration of selective catalytic reduction (SCR) systems in gas engines and power plants helps reduce nitrogen oxide emissions, making gas engines a more attractive option for power generation. Moreover, the use of alternative fuels such as biogas, syngas, hydrogen, and butane in gas engines is gaining popularity due to their renewable and sustainable nature.

- Natural gas is also increasingly being used in desalination plants and as a fuel for gas turbines, further expanding its application areas. However, the presence of close substitutes, such as renewable energy sources and other types of power generation, poses a challenge to the gas engine market. The adoption of sensors and advanced technologies in gas engines and power grids is crucial to improve efficiency, reduce emissions, and enhance overall performance. The market is also witnessing an increasing trend towards the use of natural gas in the transportation sector, particularly in the form of compressed natural gas (CNG) and liquefied natural gas (LNG) as alternative fuels for vehicles.

What will be the size of the North America Gas Engine Market during the forecast period?

- The market encompasses the production and application of gas engines in various sectors, including utilities, manufacturing, transportation, and others. Gas engines, a type of heat engine that utilizes the energy from combustion processes to generate mechanical power, are predominantly hydrocarbon-fuelled, with applications ranging from diesel and gasoline engines to those using gaseous fuels. Market dynamics are driven by factors such as fuel efficiency and emissions reduction, with ongoing advancements in gas engine technology leading to increased energy efficiency and reduced pollutant emissions. The utilities sector, particularly power generation, is a significant consumer of gas engines due to their versatility and reliability.

- In the transportation sector, the automotive industry is exploring the potential of gas engines in the transition towards emissions-free fuel systems. The medium term outlook for the market remains positive, with continued growth expected in industries such as marine, industrial, and manufacturing.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Power generation

- Co-generation

- Others

- End-user

- Power

- Industrial

- Residential

- Commercial

- Geography

- North America

- US

- North America

By Application Insights

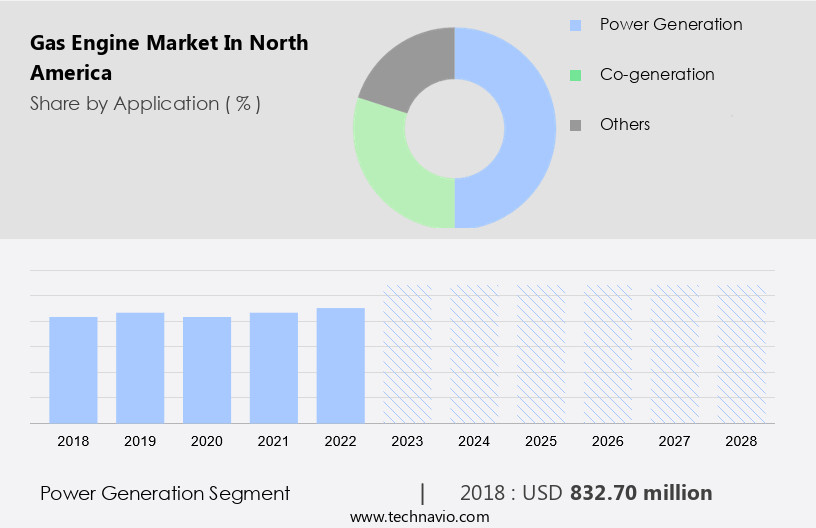

- The power generation segment is estimated to witness significant growth during the forecast period.

Gas engines play a significant role in power generation and standby power systems for various end-users in North America, including utilities, industries, commercial, and residential sectors. Natural gas, as a clean and efficient energy source, is widely used in gas-fired power plants. In these plants, the expansion of hot gases pushes pistons within cylinders, converting linear motion into rotational energy via crankshafts to generate power. Gas engines produce power ranging from 5 kilowatts (kW) to 20 megawatts (MW), making them suitable for small-scale backup generators and large-scale power generation through the combination of multiple engines. Natural gas engines contribute to electricity generation, powering industries, and providing energy to residential and commercial settings.

Gas engine technology focuses on enhancing fuel efficiency, reducing emissions, and improving energy efficiency. Pollutants, such as nitrogen oxides, sulfur oxides, and particulate matter, are major concerns in gas engine operations. To address these concerns, advanced combustion processes, emissions control technologies, and greenhouse gas regulations are crucial. Renewable energy sources, including solar, wind, natural gas reserves, biogas, syngas, hydrogen, and synthetic natural gas, are increasingly integrated into modern power infrastructure for resilient and sustainable power generation.

Get a glance at the market share of various segments Request Free Sample

The Power generation segment was valued at USD 832.70 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of North America Gas Engine Market?

Increasing demand for efficient heat and power generation is the key driver of the market.

- In North America, the market is experiencing significant growth due to the increasing demand for power and heat generation in various sectors. Gas engines play a crucial role in electricity generation, as they are the primary source of power for many utility companies and manufacturing facilities. The shift towards modern power infrastructure and renewable energy integration has led to an increase in the use of gas engines for decentralized and distributed power generation. The rise of industrialization and commercialization in countries like the US and Canada has led to an increase in electricity consumption. Households have adopted more electrical appliances, and manufacturing processes have become more mechanized and less labor-intensive.

- Furthermore, the automotive sector is transitioning towards electric vehicles, leading to a decrease in carbon emissions from traditional internal combustion engines. Gas engines offer several advantages, including fuel efficiency, emissions reduction, and energy efficiency. Gas engine technology has advanced significantly, leading to the development of emissions-free fuel systems and the use of special gases such as biogas, syngas, hydrogen, and synthetic natural gas. These gases offer higher power output and lower emissions compared to traditional hydrocarbon-based fuels like diesel, gasoline, and propane. Air quality and environmental sustainability are becoming increasingly important, leading to stricter emissions regulations. Gas engine manufacturers are focusing on emissions control technologies, such as nitrification and oxidation, to reduce pollutants like nitrogen oxides, sulfur oxides, and particulate matter.

What are the market trends shaping the North America Gas Engine Market?

Shift from conventional coal-fired to gas-fired power plants is the upcoming trend In the market.

- The market encompasses various sectors, including utilities, manufacturing, transportation, and more. Gas engine technology continues to evolve, focusing on fuel efficiency and emissions reduction. Combustion processes are being optimized to minimize pollutants like nitrogen oxides, sulfur oxides, and particulate matter, contributing to improved air quality and environmental sustainability. Natural gas, coal, and renewable energy sources like solar and wind are key fuel sources. Natural gas reserves and special gases, such as biogas, syngas, hydrogen, and renewable gases, are increasingly utilized for power generation. Gas engine oils are essential for maintaining the performance and longevity of these engines.

- Power output and electricity generation are significant applications, with water providers integrating renewable energy into power grids for resilient and modern power infrastructure. Cogeneration plants and decentralized power generation are becoming increasingly popular for their efficiency and emissions control. Gas engine generators are employed in various industries, including automotive, marine, and industrial sectors. The automotive sector is transitioning towards carbon emission reduction and sustainable energy sources for backup power solutions. CHP applications provide combined heat and power, enhancing overall system efficiency. Gas engine technology offers numerous advantages, including mechanical drive, power generation, and the potential for emissions-free fuel systems.

What challenges does North America Gas Engine Market face during the growth?

Presence of close substitutes is a key challenge affecting the market growth.

- Gas engines play a significant role in various sectors, including utilities, manufacturing, and transportation, in North America. Gas engine technology continues to evolve, focusing on fuel efficiency and emissions reduction. Combustion processes are being optimized to minimize pollutants such as nitrogen oxides, sulfur oxides, and particulate matter, contributing to improved air quality and environmental sustainability. Natural gas, coal, and renewable energy sources like solar, wind, biogas, syngas, hydrogen, and synthetic natural gas are the primary fuels used in gas engines. Natural gas reserves are abundant, making it an attractive choice for power generation, electricity production, and automotive applications. Gas engine oils are specifically formulated to meet the demands of these engines.

- The power output of gas engines can range from a few kilowatts to several megawatts, making them suitable for various applications, including cogeneration plants, power generation facilities, decentralized power generation, and distributed power generation. Gas engines are also used in CHP applications, providing resilience and emissions control in the automotive sector and industrial processes. Gas engines are essential components of modern power infrastructure, offering a reliable and efficient alternative to traditional combustion engines. They are increasingly being integrated into renewable energy systems to provide backup power solutions and ensure grid stability. The transition to greener energy sources is ongoing, with a focus on reducing carbon emissions and adhering to environmental regulations.

Exclusive North America Gas Engine Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Caterpillar Inc.

- China National Petroleum Corp.

- China Yuchai International Ltd.

- Cummins Inc.

- DEUTZ AG

- Fairbanks Morse LLC

- HD Hyundai Co. Ltd.

- IHI Corp.

- INNIO Jenbacher GmbH and Co. OG

- JFE Engineering Corp.

- Kawasaki Heavy Industries Ltd.

- Kohler Co.

- Liebherr International AG

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd.

- R Schmitt Enertec GmbH

- Rolls Royce Holdings Plc

- Siemens AG

- Westport Fuel Systems Inc.

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant sector with the broader energy industry, encompassing various applications in utilities, manufacturing, and transportation sectors. Gas engines, which convert chemical energy from gaseous fuels into mechanical power, play a crucial role in power generation and industrial processes. Gas engine technology continues to evolve, with a focus on fuel efficiency and emissions reduction. Combustion processes have been optimized to minimize pollutants such as nitrogen oxides, sulfur oxides, and particulate matter, contributing to improved air quality and environmental sustainability. Natural gas, coal, and renewable energy sources like solar, wind, biogas, syngas, hydrogen, and others are the primary fuel sources for gas engines.

Moreover, the natural gas reserves in North America provide a stable and abundant fuel source for this market. The special gas segment, including biogas, syngas, and hydrogen, is gaining traction due to its potential as a sustainable energy source. Renewable gases offer several advantages, including reduced greenhouse gas emissions and improved environmental sustainability. Power output from gas engines ranges from small-scale applications to large-scale power generation plants and utilities. Gas engines provide electricity to water providers and contribute to the resilient power infrastructure of modern power grids. Gas engines are used in various industries, including utilities, manufacturing, transportation, and marine applications.

Furthermore, in the automotive sector, there is a growing trend towards carbon emission reduction and the adoption of sustainable energy sources for backup power solutions. Cogeneration plants and power generation facilities utilize gas engines for decentralized and distributed power generation, providing an alternative to traditional centralized power generation systems. CHP applications offer increased efficiency and reduced emissions, making them an attractive option for industries seeking to reduce their carbon footprint. Gas engine technology is continually evolving to meet the demands of various industries and environmental regulations. Emissions control systems, such as nitrification and oxidation processes, are being integrated into gas engines to minimize emissions and improve overall efficiency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 365.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch