Generator Market for Nuclear Power Size 2024-2028

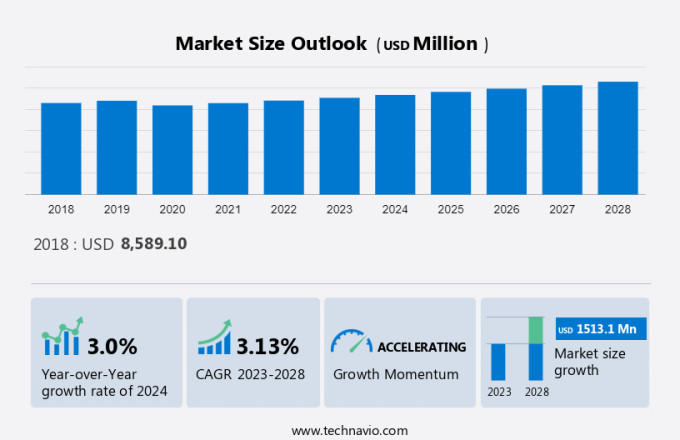

The generator market for nuclear power size is forecast to increase by USD 1.51 billion, at a CAGR of 3.13% between 2023 and 2028. The market is experiencing significant growth, driven by several key factors. Firstly, there is a rising focus on clean energy sources to reduce greenhouse gas emissions, making nuclear power an attractive option due to its low carbon footprint. Secondly, technological advances in nuclear energy, such as small modular reactors and advanced fuel types, are increasing efficiency and safety while decreasing costs. However, competition from other renewable energy sources, particularly solar and wind, and public perception issues surrounding nuclear safety and waste disposal, pose challenges to market expansion.

What will be the size of the Market During the Forecast Period?

Forecast 2024-2028

To learn more about this report, Request Free Sample

Market Dynamic

The market is a significant sector in the energy industry, providing large-scale electrical energy through mechanical sources. Nuclear power generators, a crucial component of this market, convert the heat energy generated from nuclear reactions into electrical energy. Unlike diesel generators, which run on fossil fuels, nuclear generators do not emit greenhouse gases during operation. The IT sector, Technology, and various industries, such as the Service sector, Hospitals, Hotels, Restaurants, IT, telecommunication centers, Banking, Insurance, Real estate, and Professional services, rely heavily on uninterrupted power supply. Nuclear power generators offer a reliable solution, ensuring uninterrupted power supply to these sectors. A nuclear power generator consists of a Prime Mover, which is a nuclear reactor, a Rotor, and a Stator. The Rotor, which rotates, generates a Magnetic Field, and the Stator, which does not rotate, has Output Terminals that transfer the Electrical energy produced. The Nuclear Power Market is expected to grow significantly due to the increasing demand for electrical energy and the need for clean energy sources. In conclusion, the market plays a vital role in providing reliable and clean energy sources to various industries. Nuclear power generators, with their ability to produce large-scale electrical energy without greenhouse gas emissions, are a crucial component of this market. The increasing demand for electrical energy and the need for clean energy sources are expected to drive the growth of the Nuclear Power Market.

Key Market Driver- Increasing dependency on nuclear power

According to the World Nuclear Association, the 128 nuclear reactors operating in EU member states accounted for 28% of the EU's total electricity generation in 2021. Nuclear energy accounts for about 17% of electricity outside the EU, with 53 reactors in Russia, Ukraine, and Switzerland supplying other European countries.

Moreover, many countries in Europe are turning to clean energy sources, such as nuclear power, which produces clean energy without leading to the depletion of fossil fuels. Additionally, the generators used in nuclear reactors ensure continuous, uninterrupted power supply for several months. Hence, these factors are expected to drive the growth of the market during the forecast period.

Significant Market Trends- Developments in nuclear fusion technology

Governments around the world are focusing on new developments and innovations in nuclear reactor projects through joint cooperation with other countries. For example, China, the European Union, India, Japan, South Korea, Russia, and the United States are cooperating in the construction and operation of the International Thermonuclear Experimental Reactor (ITER), an experimental device based on fusion technology.

Moreover, the success of this demonstration is expected to set a good precedent for the safe use of nuclear reactors based on fusion technology in the future. Thus, such cooperation regarding the use of nuclear fusion technology for power generation is expected to drive the growth of the market during the forecast period.

Major Market Challenge- Competition from other renewable energy sources

Renewable energy sources include geothermal energy, solar, wind, hydropower, and biomass. According to the IEA, in 2020 renewable energy and natural gas accounted for 28% and 24% of the world's total electricity generation, respectively, significantly increasing the popularity of renewable energy around the world. There is increasing focus on the use of clean energy sources for power generation. As a result, the demand for the use of renewable energy sources is rapidly increasing.

Additionally, the increased use of renewable energy is reducing the demand for nuclear power. Therefore, the increase in power generation from renewable energy sources such as geothermal, solar, wind, hydropower, and biomass is expected to hinder the growth of the nuclear industry and, in turn, hinder the adoption of generators for nuclear power generation, thereby negatively impacting the growth of the market during the forecast period.

Market Segmentation

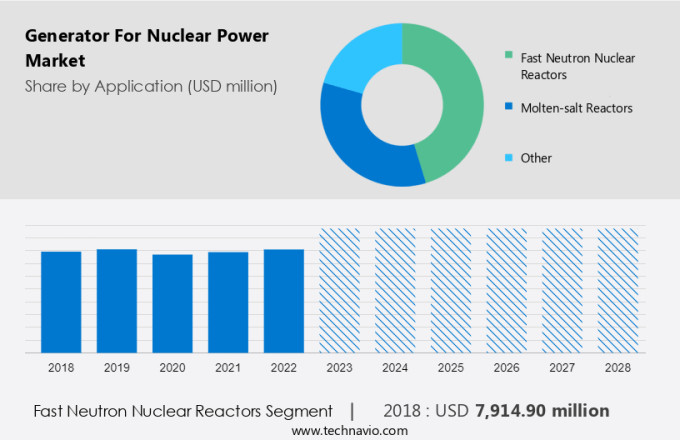

By Application

The fast neutron nuclear reactors segment will account for a major share of the market's growth during the forecast period. Fast neutron nuclear reactors have high power densities and are typically cooled by liquid metal, which has no moderating effect. They operate at or near atmospheric pressure and around 500 to 550 degrees Celsius. The growing global interest in fast neutron reactors has driven the demand for generators in this sector of the global nuclear power plant market as these reactors provide efficient, safe, and sustainable energy supply adoption.

Get a Customised Report as per your requirements for FREE!

The fast neutron nuclear reactors segment was valued at USD 7.91 billion in 2018. Moreover, in addition to current fast neutron nuclear reactor construction projects, several countries around the world are conducting intensive research and development (R&D) programs to develop innovative fast neutron reactor concepts or fourth-generation fast reactor concepts. Therefore, given the growing interest in fast neutron reactor research and development and construction of new nuclear power plants, the focused fast neutron nuclear reactor market segment is expected to grow significantly during the forecast period.

Technology Segment Analysis:

Based on technology, the market has been segmented into PWR, PHWR, WWER, and others. The PWR segment will account for the largest share of this segment. Pressurized water reactors (PWR) have two separate circulation systems, one for the turbine and the other for the nuclear reactor, which are also known as the primary and secondary coolant circuits, respectively. The PWR segment is anticipated to see continued growth as many countries have plans to, or are building, new PWR reactors. According to the World Nuclear Association, about 30 countries are thinking, planning, or beginning nuclear power programs in the next five years. For instance, Taipingling 1 and Zhangzhou 2 in China. similarly, Kursk II-1 and 2 in Russia will go onstream. Thus, such developments are anticipated to propel the PWR segment growth, which will drive the growth of the market during the forecast period.

Regional Analysis

For more insights on the market share of various regions View PDF Sample now!

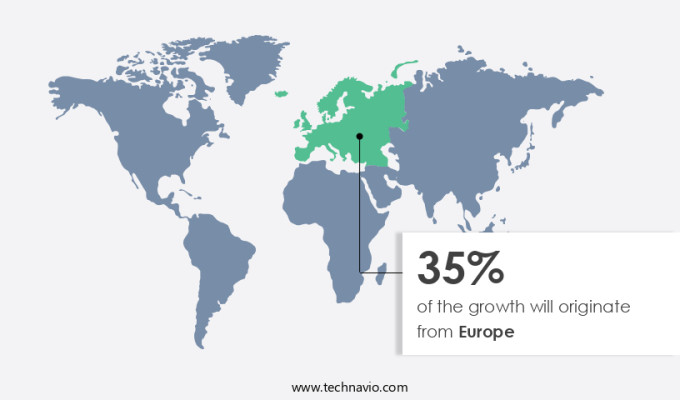

Europe is estimated to contribute 35% to the growth by 2028. Technavio's analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period. Western Europe will account for the largest market share in Europe due to the strong presence of established suppliers, increasing investment in nuclear energy, and support from governments to declare investments in nuclear power plants as environmentally friendly. Additionally, the region is working to expand the production and use of nuclear energy to meet growing electricity demands. Also, treaties such as the Euratom Treaty encourage countries in the region to invest in nuclear reactors to meet the EU's 2050 carbon neutrality plan. Therefore, such factors are expected to boost the demand for nuclear reactor generators, which in turn is expected to lead to an increase in the demand for nuclear reactor generators and drive the growth of the regional market during the forecast period.

Who are the Major Generator Market Companies?

Companies are implementing strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ALSTOM SA: The company offers generators for nuclear power such as generators with conventional islands or turbine islands used for nuclear power plants.

We also have detailed analyses of the market's competitive landscape and offer information on 20 market companies, including Ansaldo Energia Spa, AREVA SA, Babcock and Wilcox Enterprises Inc., Bharat Heavy Electricals Ltd., Bilfinger SE, BWX Technologies Inc., Cameco Corp., China National Nuclear Corp., Doosan Corp., General Electric Co., HD Hyundai Co. Ltd., Larsen and Toubro Ltd., Mitsubishi Heavy Industries Ltd., Rolls Royce Holdings Plc, Sandvik AB, State Atomic Energy Corp. Rosatom, The Japan Steel Works Ltd., Toshiba Corp., and Westinghouse Electric Co. LLC.

Technavio's market growth and forecasting report provides an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Segment Overview

The market research and growth report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Fast neutron nuclear reactors

- Molten-salt reactors

- Others

- Technology Outlook

- PWR

- PHWR

- WWER

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Portable Generator Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Germany, Japan, UK - Size and Forecast

- Generator Market in Data Centers Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Australia, UK, Japan - Size and Forecast

- Portable Generator Market Analysis China - Size and Forecast

Market Analyst Overview

The market is witnessing significant growth due to the increasing demand for electrical energy from various sectors like IT, telecommunication centers, banking, insurance, real estate, professional services, business services, healthcare services, and data centers. With the rising public health spending and the need for backup power supply, the market is expected to expand further. However, the market faces challenges such as high capital costs, safety concerns, and the growing trend towards renewable power generation. Renewable installed capacity is witnessing power capacity additions at a rapid pace, with renewable projects becoming increasingly popular due to their lower greenhouse gas emissions.

Technological advancements in the nuclear power sector, such as the development of iGreen gensets with improved fuel efficiency and high power quality, are expected to boost the market. The magnetic field, rotor, stator, and output terminals of nuclear power generators play a crucial role in energy production. The generator market also caters to the needs of sectors like hospitals, hotels, and restaurants, where reliable power supply is essential. Air quality panels and Air Quality Management systems are being integrated into nuclear power plants to ensure compliance with environmental regulations. In conclusion, the nuclear power generator market is poised for growth, driven by the increasing demand for electrical energy from various sectors and technological advancements.

However, the market faces challenges such as safety concerns and the growing trend towards renewable power generation. The market is witnessing growth due to advancements in diesel generator technology and strategic thermal projects. Renewable energy capacity expansion and the introduction of iGreen genset solutions enhance market offerings. An air quality panel ensures environmental compliance, while the E-Marketplace facilitates procurement through tender processes. Effective strategy planning and identification of investment pockets drive market development, and considerations of voltage rating are crucial for performance. As businesses explore these opportunities, the business services market evolves to support and integrate these advancements efficiently.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.13% |

|

Market Growth 2024-2028 |

USD 1.51 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.0 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 35% |

|

Key countries |

US, China, France, Russia, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALSTOM SA, Ansaldo Energia Spa, AREVA SA, Babcock and Wilcox Enterprises Inc., Bharat Heavy Electricals Ltd., Bilfinger SE, BWX TECHNOLOGIES INC., Cameco Corp., China National Nuclear Corp., Doosan Corp., General Electric Co., HD Hyundai Co. Ltd., Larsen and Toubro Ltd., Mitsubishi Heavy Industries Ltd., Rolls Royce Holdings Plc, Sandvik AB, State Atomic Energy Corp. Rosatom, The Japan Steel Works Ltd., Toshiba Corp., and Westinghouse Electric Co. LLC |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch