Grid-Scale Battery Market Size 2025-2029

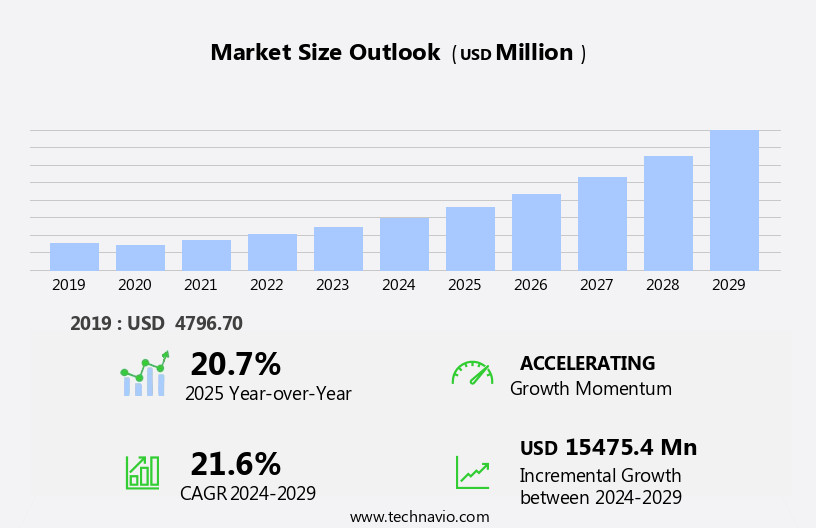

The grid-scale battery market size is forecast to increase by USD 15.48 billion at a CAGR of 21.6% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing demand for Energy Storage Systems (ESSs) from utilities to address the variability of renewable energy sources and improve power grid reliability. Another key factor fueling market expansion is the declining costs of battery storage systems, making them more economically viable for large-scale energy storage applications. However, regulatory barriers for grid-scale ESS installations pose a challenge to market growth. These regulations vary from country to country and can include complex permitting processes, interconnection requirements, and safety standards. Companies seeking to capitalize on market opportunities should closely monitor regulatory developments and collaborate with regulatory bodies to ensure compliance.

- Additionally, strategic partnerships and collaborations with utilities and renewable energy companies can help companies navigate the complex regulatory landscape and gain a competitive edge in the market. Overall, the market presents significant opportunities for growth, with the potential to revolutionize the power grid and accelerate the transition to renewable energy sources. Companies that can effectively address regulatory challenges and collaborate with key industry players will be best positioned to succeed in this dynamic market.

What will be the Size of the Grid-Scale Battery Market during the forecast period?

- The market is experiencing significant expansion as technological advancements in energy storage continue to drive growth. Batteries, including lead acid, nickel metal-hydride, and nickel-iron varieties, are increasingly being adopted to enhance grid stability and support the integration of renewable energy sources. According to industry reports, the market is forecasted to grow at a rate during the forecast period, driven by the need for energy efficiency and the reduction of standby losses. Utility-owned and third-party-owned models are both gaining traction, with the latter experiencing the highest rate of growth due to its ability to provide flexible and cost-effective solutions. The largest share of the market is currently held by lead-acid batteries, but other advanced battery technologies are expected to challenge their dominance in the coming years.

- Overall, the market is a dynamic and evolving landscape, poised to play a crucial role in the global transition towards a more sustainable and efficient energy system.

How is this Grid-Scale Battery Industry segmented?

The grid-scale battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Ancillary services

- Renewable integration

- Others

- Battery Type

- Lithium-based

- Lead-acid

- Others

- Ownership

- Utility

- Third-party

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- APAC

By Application Insights

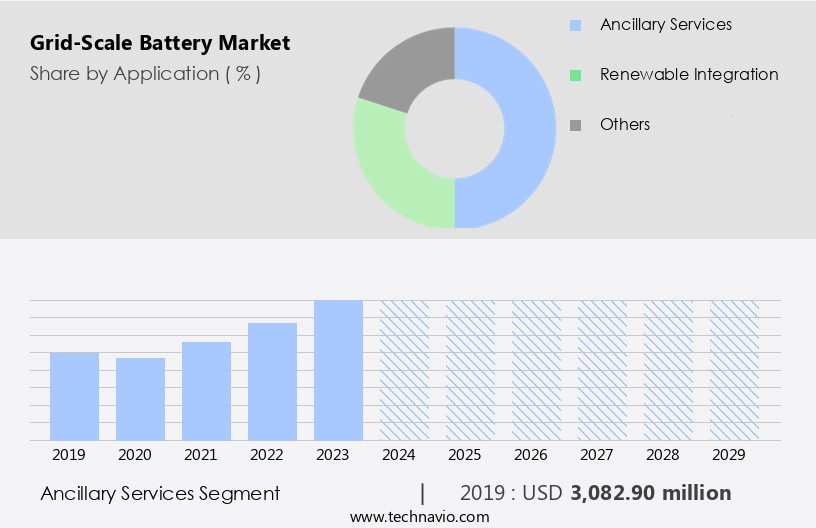

The ancillary services segment is estimated to witness significant growth during the forecast period.

Grid-scale batteries have become essential components of the electric power system, providing ancillary services to ensure grid stability and reliability. These services include managing electricity supply-demand imbalances, maintaining frequency and voltage stability, and enhancing grid resilience. Frequency regulation is a critical ancillary service provided by grid-scale batteries. They can respond quickly to grid demand fluctuations by either absorbing excess electricity or supplying additional power as needed. Technological advancements in battery storage, such as lithium-ion, flow, zinc-hybrid, sodium-based, nickel metal-hydride, and nickel-iron batteries, have expanded their deployment. Government subsidies and energy efficiency incentives have further boosted their adoption.

With a forecast period extending to 2027, grid-scale batteries offer energy capacity and power capacity rating advantages, enabling peak shaving, load shifting, renewable sources integration, backup power, and effective load control. Their integration contributes to overall grid stability, power system flexibility, energy storage resources, renewable energy, and electricity prices optimization through energy arbitrage and renewable energy curtailment.

Get a glance at the market report of share of various segments Request Free Sample

The Ancillary services segment was valued at USD 3.08 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

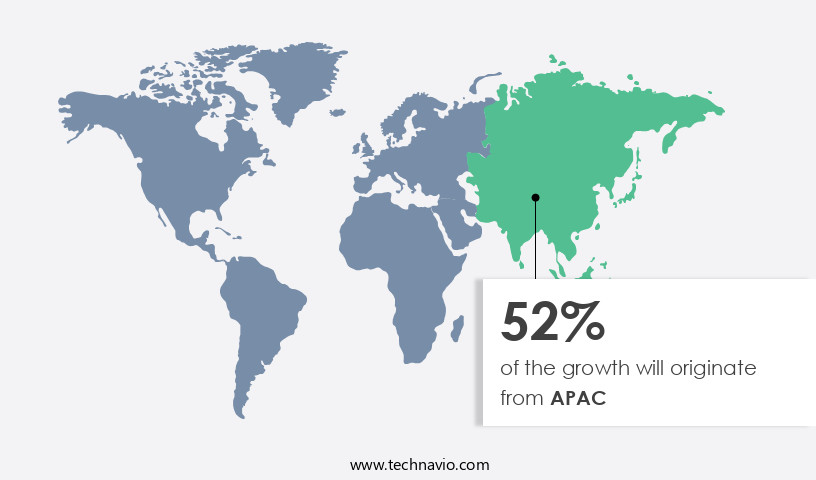

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is projected to expand significantly during the forecast period due to increasing energy demand driven by population growth and the depletion of conventional energy sources. Renewable energy, particularly solar photovolvoltaic and wind power, is increasingly being adopted in APAC to address energy security concerns and reduce carbon emissions. Grid-scale batteries, including lithium-ion, flow, zinc-hybrid, sodium-based, nickel metal-hydride, and nickel-iron batteries, play a crucial role in grid stability and reliability by providing energy storage resources for renewable energy integration and peak shaving. Government subsidies and energy efficiency incentives are also driving the market growth. Battery storage enables effective load control, energy arbitrage, and backup power, enhancing overall grid stability and power system flexibility.

Molten salt batteries are an emerging technology for large-scale energy storage. With expanding deployment and diverse resources integration, grid-scale batteries are expected to reduce electricity prices, minimize standby losses, and optimize renewable energy curtailment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Grid-Scale Battery Industry?

Growing demand for ESSs from utilities is the key driver of the market.

- The energy storage system (ESS) market is witnessing significant growth as utilities shift towards diversifying their power generation portfolios with renewable energy sources. Energy storage offers utilities various economic advantages, including balancing electricity demand during peak and off-peak hours and reducing electricity costs during peak periods, resulting in savings for customers and easing grid pressure. ESS plays a crucial role in utilizing intermittent renewable energy sources like solar and wind power by storing excess energy for later use when these sources are unavailable.

- Utilities can also profit from ancillary services, frequency regulation, and grid congestion relief through energy storage. Overall, the integration of energy storage into the power grid enhances grid reliability and resilience.

What are the market trends shaping the Grid-Scale Battery Industry?

Declining costs of battery storage systems is the upcoming market trend.

- Batteries are essential components of Energy Storage Systems (ESSs) that are increasingly being adopted worldwide due to the declining prices of battery systems. Since 2010, the costs of battery systems, including lead-acid and lithium-ion, have decreased significantly. This price reduction is attributed to advancements in hardware, economies of scale, and standardization of system design and engineering. During the forecast period, the prices of battery systems are projected to decrease further, with lead-acid and lithium-ion batteries expected to be half their current prices, and flow batteries one-third.

- The growing adoption of ESSs is driving the sales of battery systems, making them a vital investment for businesses and industries seeking energy storage solutions.

What challenges does the Grid-Scale Battery Industry face during its growth?

Regulatory barriers for grid-scale ESS installations is a key challenge affecting the industry growth.

- Energy Storage Systems (ESSs) have emerged as significant innovations in the global energy sector. Yet, the deployment of these technologies encounters numerous regulatory hurdles. Regulatory challenges include procedural issues, inconsistencies in regulations across markets, functional classification restrictions, and cost allocation concerns. A primary procedural issue is the lengthy process of implementing new regulations that favor energy storage and resolving barriers to its deployment.

- For instance, the slow adoption of performance-based compensation and the limited recognition of energy storage as an alternative in the utility commission's planning and procurement process for new power plants contribute to these delays. As a , I understand the importance of addressing these regulatory obstacles to facilitate the widespread adoption of ESSs.

Exclusive Customer Landscape

The grid-scale battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the grid-scale battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, grid-scale battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - Universal Power Solutions Inc. Provides grid-scale battery energy storage systems to facilitate the integration of renewable energy sources. This solution enhances the efficiency and reliability of power grids by compensating for the intermittency of renewable energy. By storing excess energy during off-peak hours and releasing it during peak demand periods, the system ensures a stable power supply while reducing carbon emissions. The company's commitment to innovation and sustainability drives the development of advanced energy storage technologies, enabling the transition to a more sustainable energy future.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- BYD Co. Ltd.

- Contemporary Amperex Technology Co. Ltd.

- General Electric Co.

- GS Yuasa International Ltd.

- Hitachi Ltd.

- Innolith Science and Technology GmbH

- Leclanche SA

- LG Corp.

- NEC Corp.

- NGK Insulators Ltd

- Panasonic Holdings Corp.

- Powin Inc.

- Samsung SDI Co. Ltd.

- Siemens AG

- SolarEdge Technologies Inc.

- Sumitomo Electric Industries Ltd.

- Tesla Inc.

- Toshiba Corp.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Grid-scale batteries have emerged as a critical component in the transition towards a more sustainable and resilient power grid. The expansion of renewable energy sources, such as solar photovoltaic and wind power, necessitates the integration of energy storage solutions to ensure grid stability, reliability, and resiliency. This shift is driven by several factors, including technological advancements and government subsidies. Technological advancements have led to the development of various battery types, each with unique advantages. Lead acid, nickel metal-hydride, nickel-iron batteries, and other batteries have been in use for decades but are being surpassed by more advanced technologies like lithium-ion, flow, zinc-hybrid, sodium-based batteries, and molten salt batteries.

These new battery technologies offer higher energy efficiency, longer life expectancy, and improved power capacity rating. The market is witnessing significant growth, with utility-owned and third-party-owned models gaining traction. Utility-owned models are typically used for peak shaving, load shifting, and renewable sources integration, while third-party-owned models are often used for backup power and energy arbitrage. The highest rate of growth is observed in the third-party-owned model segment due to its ability to provide effective load control and energy storage advantages. Grid stability is a primary concern for electricity grids, as renewable energy sources can introduce timing discrepancies and renewable energy curtailment.

Battery storage systems play a crucial role in addressing these challenges by providing power capacity rating and energy capacity to compensate for the intermittency of renewable energy sources. Additionally, battery technology enables power system flexibility, clean energy integration, and diverse resources integration. Energy storage resources have become increasingly important for overall grid stability, as electricity prices continue to rise and the need for clean energy becomes more pressing. The forecast period for the market is expected to see continued expansion, driven by the growing demand for energy storage solutions and the need to mitigate standby losses. In , grid-scale batteries are a critical component in the transition towards a more sustainable and resilient power grid.

Technological advancements, government subsidies, and the need for grid stability, reliability, and resiliency are driving the growth of the market. The various battery types offer unique advantages, and the utility-owned and third-party-owned models cater to different applications. The future of the power grid relies on the effective integration of energy storage solutions, and grid-scale batteries are poised to play a significant role in this transition.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.6% |

|

Market growth 2025-2029 |

USD 15475.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

20.7 |

|

Key countries |

US, China, Japan, South Korea, India, Canada, Australia, Germany, UK, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Grid-Scale Battery Market Research and Growth Report?

- CAGR of the Grid-Scale Battery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the grid-scale battery market growth of industry companies

We can help! Our analysts can customize this grid-scale battery market research report to meet your requirements.