Halal Cosmetics and Personal Care Market Size 2025-2029

The halal cosmetics and personal care market size is forecast to increase by USD 20.48 billion, at a CAGR of 4.9% between 2024 and 2029. Growing interest in personal grooming will drive the halal cosmetics and personal care market.

Major Market Trends & Insights

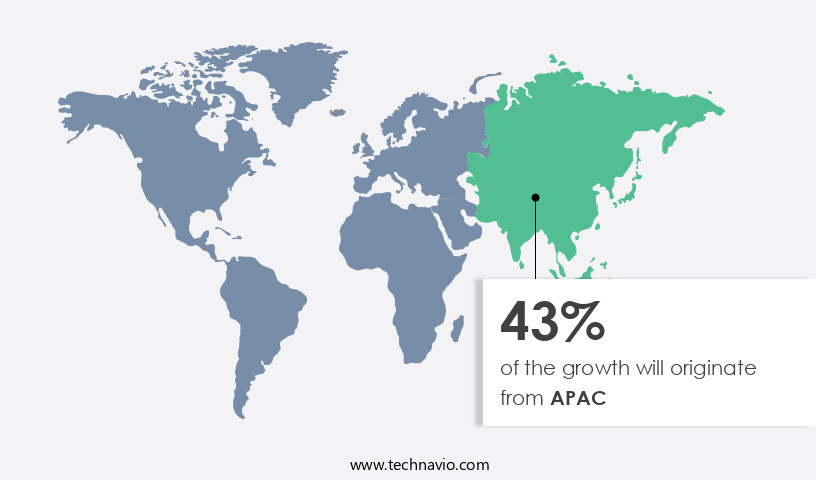

- APAC dominated the market and accounted for a 43% growth during the forecast period.

- By Type - Skin care segment was valued at USD 22.46 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 55.94 billion

- Market Future Opportunities: USD USD 20.48 billion

- CAGR : 4.9%

- APAC: Largest market in 2023

Market Summary

- The market is a continually evolving industry, fueled by growing consumer interest in personal grooming and the increasing online retailing of halal-certified cosmetics and personal care products. According to recent market research, the global halal cosmetics market is projected to reach a value of 30.1% by 2026, reflecting a significant growth trajectory. This expansion is driven by various factors, including the rising awareness of health and wellness, increasing consumer preference for ethically produced and certified products, and the entry of major cosmetics companies into the halal market.

- However, the industry faces challenges such as the increase in production costs due to the stringent requirements for halal certification. Related markets such as the organic cosmetics and personal care industry are also experiencing similar growth trends. Stay tuned for more insights into the key technologies, applications, service types, product categories, and regulations shaping the market in the coming years.

What will be the Size of the Halal Cosmetics and Personal Care Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Halal Cosmetics and Personal Care Market Segmented and what are the key trends of market segmentation?

The halal cosmetics and personal care industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Skin care

- Hair care

- Makeup

- Others

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- Germany

- UK

- Middle East and Africa

- Iran

- Turkey

- APAC

- China

- India

- Indonesia

- Japan

- Malaysia

- Rest of World (ROW)

- Europe

By Type Insights

The skin care segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving world of cosmetics and personal care, the Halal market segment has emerged as a significant player, with the skin care sector leading the charge in 2024. This dominance is driven by the increasing consumer preference for ethical, natural, and religiously permissible products. Halal skin care formulations exclude ingredients considered impure or unlawful under Islamic law, such as alcohol and certain animal-derived substances, making them appealing to a broader audience. The market experienced a substantial revenue growth of 21.7% in 2024. Looking forward, industry experts anticipate a continued expansion, with expectations of a 25.3% increase in market size by 2028.

This growth is fueled by various factors, including the rising consumer perception of halal certification as a mark of product purity and ethical manufacturing. Manufacturers are adopting green chemistry principles, such as product lifecycle assessment and ingredient transparency, to cater to the evolving consumer demands. Vegan cosmetic formulations and product shelf life studies are also becoming essential aspects of the industry. Consumer perception studies play a crucial role in understanding the preferences and needs of the target demographic, shaping the development of new product offerings. Packaging sustainability is another key trend, with biodegradable packaging and renewable energy sources becoming increasingly popular.

Kosher certification standards, palm oil alternatives, and supply chain traceability are also essential considerations for companies looking to establish a strong market presence. Sensory evaluation methods and water purification methods are essential in ensuring product efficacy and consumer safety. Sustainable packaging design, carbon footprint reduction, and sustainable sourcing practices are other critical aspects of the industry, as companies strive to minimize their environmental impact. The halal certification process involves rigorous evaluation of product ingredients, manufacturing processes, and supply chains to ensure compliance with Islamic dietary laws. Product efficacy studies, compostable materials, and microbial fermentation are some of the methods used in the certification process.

The circular economy model, recycled content packaging, and plant-based preservatives are emerging trends that reflect the industry's commitment to reducing waste and promoting eco-friendly practices. Ethical sourcing guidelines and renewable energy sources are also becoming increasingly important, as companies seek to align their operations with consumer values and expectations. In conclusion, the market is experiencing significant growth and innovation, driven by consumer preferences for ethical, natural, and religiously permissible products. The industry's focus on sustainability, transparency, and ethical manufacturing practices is shaping the future of cosmetics and personal care, making it an exciting and dynamic space to watch.

The Skin care segment was valued at USD 22.46 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Halal Cosmetics And Personal Care Market Demand is Rising in APAC Request Free Sample

The Asia-Pacific (APAC) region is experiencing significant growth in the market. This expansion is fueled by a large Muslim population and increasing consumer awareness of ethical and religiously compliant products. Key countries driving this growth include Indonesia, Malaysia, and India. Economic development, a better understanding of halal cosmetics, rising disposable income, an increase in working women, and growing interest in beauty and fashion among women are additional factors contributing to market expansion. Improved standardizations and certifications for halal products further boost market growth. With a population of over 1.8 billion people, the APAC region represents a substantial opportunity for local and international brands seeking to expand their halal-certified product lines.

Market Dynamics

The halal cosmetics and personal care market is being reshaped by a growing emphasis on sustainable sourcing of cosmetic ingredients and ethical manufacturing practices in cosmetics. This is driven by changing consumer preferences for halal cosmetics, which now align with broader ethical and clean-label trends. For instance, the demand for natural and organic ingredients has increased, with some reports showing that over 40% of consumers prioritize natural components in their beauty products.

The market's dynamic is also heavily influenced by the environmental impact of cosmetic packaging; a study found that over 95% of cosmetic packaging is discarded, and only 9% is recycled, highlighting the urgent need for biodegradable and compostable packaging for cosmetics.

This is a key feature of the market's evolution, with the global sustainable packaging market projected to grow at a rate that reflects this consumer and regulatory pressure. Brands are also focused on reducing carbon footprint in cosmetic manufacturing, with some companies publicly committing to a 50% reduction in greenhouse gases per product by 2030, which showcases the industry's shift toward a circular economy approach in halal cosmetics

What are the key market drivers leading to the rise in the adoption of Halal Cosmetics and Personal Care Industry?

- The increasing fascination with personal grooming serves as the primary catalyst for market growth.

- In the realm of personal care, halal cosmetics have emerged as a significant market trend, capturing the attention of consumers in Muslim-majority countries such as the UAE, Indonesia, Malaysia, Saudi Arabia, and Turkey. This growing demand stems from the increasing consciousness towards personal grooming and the desire for products that align with ethical and religious values. The halal cosmetics market's continuous expansion is a reflection of this evolving consumer behavior. Younger generations, in particular, are driving the market's growth, as they prioritize appearance and seek beauty products that adhere to specific standards. Halal cosmetics offer a solution, ensuring that all ingredients meet Islamic law requirements.

- This demand is not limited to Muslim consumers alone, as non-Muslim consumers also recognize the benefits of using these products. The market's dynamics are shaped by various factors, including consumer preferences, regulatory frameworks, and the increasing availability of halal-certified products. As the demand for halal cosmetics continues to grow, businesses are responding by expanding their offerings and investing in research and development to cater to this diverse and expanding market.

What are the market trends shaping the Halal Cosmetics and Personal Care Industry?

- The growing trend in the market involves the increasing online retailing of halal cosmetics and personal care products. This sector is set to expand significantly.

- Online retailing has experienced substantial growth due to the increasing penetration of the Internet and smart gadgets. This shift offers significant opportunities for businesses to expand their sales, enhance brand visibility, and boost profitability. Consumers, particularly those in the cosmetics and personal care sector, appreciate the convenience of shopping online, avoiding lengthy trips and queues. They can pay using various methods, such as credit cards, debit cards, or e-wallets. Online shopping provides additional advantages, including cash-on-delivery (COD) services, a diverse product range, free home delivery, and discounts.

- As a result, companies are increasingly targeting the tech-savvy customer demographic and expanding their online presence. This trend underscores the importance of adapting to evolving consumer preferences and leveraging the Internet for business growth.

What challenges does the Halal Cosmetics and Personal Care Industry face during its growth?

- The escalating production costs pose a significant challenge to the industry's growth trajectory.

- The global halal cosmetics and personal care products market witnesses significant investment from manufacturers due to the unique production requirements and expensive certifications. Halal cosmetics are priced higher than regular cosmetics due to the use of natural farm-raised ingredients and the costly certification process. For instance, in the production of halal-certified skin care products, manufacturers must ensure all ingredients, including preservatives and fragrances, adhere to halal guidelines. This results in increased production costs for the companies. The International Monetary Fund (IMF) reports that the global halal market, including cosmetics and personal care, was valued at approximately USD2.1 trillion in 2019, indicating a substantial market size and potential for growth.

- Despite these challenges, the market's potential is substantial, as the consumer base for halal cosmetics and personal care products continues to expand, particularly in regions with large Muslim populations.

Exclusive Customer Landscape

The halal cosmetics and personal care market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the halal cosmetics and personal care market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Halal Cosmetics And Personal Care Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, halal cosmetics and personal care market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amara Beauty - This company specializes in the production and sale of halal-certified cosmetics and personal care items, including face serums, toners, and face masks. Their commitment to providing authentic, high-quality products aligns with the growing demand for ethical and inclusive beauty solutions in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amara Beauty

- Clara International Beauty Group

- Claudia Nour Cosmetics

- Ecotrail Personal Care Pvt. Ltd.

- Halal Beauty Inc.

- INGLOT Cosmetics

- INIKA Organic

- Ivy Beauty Corp. Sdn Bhd

- LENA BEAUTY Ltd.

- Martha Tilaar group

- Nurraysa Global Sdn Bhd

- OnePure LLC

- PHB Ethical Beauty Ltd.

- PT Martina Berto Tbk

- PT Paragon Technology and Innovation

- Saaf Beauty

- SAFI

- Sampure Minerals

- SO.LEK Cosmetics

- Talent Cosmetics Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Halal Cosmetics and Personal Care Market

- In January 2024, L'Oréal, the world's largest cosmetics company, announced the launch of its new halal-certified skincare line, "L'Oréal Paris Harmony," in collaboration with the International Islamic Cosmetics and Perfumes Association (IICPA). This move marked a significant strategic partnership in the halal cosmetics market (BusinessWire).

- In March 2024, Unilever's subsidiary, Dollar Shave Club, acquired the halal-certified grooming brand, Murad, expanding its personal care offerings catering to the Muslim consumer base (Reuters).

- In May 2024, Shiseido Company Limited, a leading Japanese cosmetics manufacturer, received halal certification for its prestige brand, Shiseido, from the Malaysian Islamic Development Department (JAKIM). This approval enabled Shiseido to expand its reach in the growing halal cosmetics market (Shiseido press release).

- In February 2025, The Estée Lauder Companies, a global leader in prestige beauty, announced a strategic partnership with the Halal Cosmetics Association of Indonesia (HCAI) to launch halal-certified products under its iconic brands, including Estée Lauder, MAC, and La Mer (Estée Lauder press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Halal Cosmetics And Personal Care Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2025-2029 |

USD 20477.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

Indonesia, Turkey, India, Malaysia, Saudi Arabia, Germany, UK, China, Iran, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of cosmetics and personal care, the halal market stands out for its commitment to ethical production and consumer well-being. This sector prioritizes skin irritation testing to ensure product safety, aligning with cruelty-free manufacturing principles. Product lifecycle assessments and green chemistry principles guide the creation of vegan cosmetic formulations, contributing to a more sustainable industry. Consumer perception studies reveal a growing preference for ingredient transparency and packaging sustainability. Biodegradable packaging and compostable materials are increasingly adopted, reducing the environmental impact. Kosher certification standards further enhance consumer trust, while palm oil alternatives and sustainable sourcing practices address ethical concerns.

- Sensory evaluation methods and water purification techniques ensure product efficacy and consumer safety. Wastewater treatment and renewable energy sources contribute to carbon footprint reduction, reflecting a circular economy model. The halal certification process, which includes strict adherence to Islamic dietary laws, adds another layer of trust and transparency. Manufacturers are also focusing on sustainable packaging design and ethical sourcing guidelines. Microbial fermentation and plant-based preservatives are replacing synthetic alternatives, contributing to the sector's ongoing evolution. As the market continues to unfold, it demonstrates a strong commitment to environmental impact analysis and continuous improvement.

What are the Key Data Covered in this Halal Cosmetics And Personal Care Market Research and Growth Report?

-

What is the expected growth of the Halal Cosmetics And Personal Care Market between 2025 and 2029?

-

USD 20.48 billion, at a CAGR of 4.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Skin care, Hair care, Makeup, and Others), Distribution Channel (Offline and Online), and Geography (APAC, Middle East and Africa, Europe, North America, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Middle East and Africa, Europe, North America, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing interest in personal grooming, Increase in production cost

-

-

Who are the major players in the Halal Cosmetics And Personal Care Market?

-

Key Companies Amara Beauty, Clara International Beauty Group, Claudia Nour Cosmetics, Ecotrail Personal Care Pvt. Ltd., Halal Beauty Inc., INGLOT Cosmetics, INIKA Organic, Ivy Beauty Corp. Sdn Bhd, LENA BEAUTY Ltd., Martha Tilaar group, Nurraysa Global Sdn Bhd, OnePure LLC, PHB Ethical Beauty Ltd., PT Martina Berto Tbk, PT Paragon Technology and Innovation, Saaf Beauty, SAFI, Sampure Minerals, SO.LEK Cosmetics, and Talent Cosmetics Co. Ltd.

-

Market Research Insights

- The market encompasses a significant and growing segment of the global beauty industry. According to industry estimates, this market is projected to reach USD35 billion by 2026, representing a compound annual growth rate of 11.2% from 2021. This expansion is driven by increasing consumer awareness and demand for products that adhere to Islamic jurisprudence and ethical business practices. In contrast, the conventional cosmetics industry relies heavily on synthetic fragrances, sulfates, parabens, and animal-derived ingredients, which are not permissible in Halal cosmetics. In response, Halal cosmetics companies are investing in research and development to create alternatives, such as natural fragrances, plant-derived sulfates, and paraben-free preservatives.

- Additionally, these companies prioritize quality control measures, allergen identification, and product stability testing to ensure consumer safety and satisfaction. Moreover, Halal cosmetics companies are committed to reducing carbon emissions through green logistics and eco-friendly manufacturing processes. They also prioritize sustainable agriculture, renewable resource utilization, and waste reduction strategies. These initiatives not only align with consumer values but also contribute to a more sustainable and responsible beauty industry.

We can help! Our analysts can customize this halal cosmetics and personal care market research report to meet your requirements.