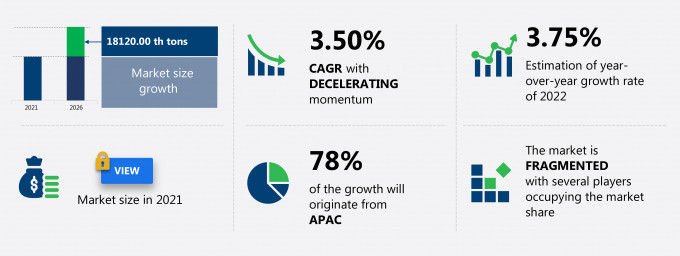

The heat treated steel plates market share is expected to increase by 18120.00 thousand tons from 2021 to 2026, at a CAGR of 3.50%.

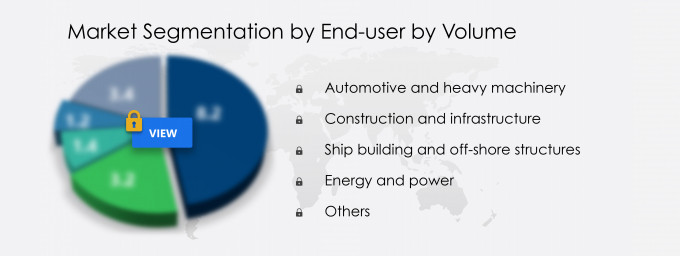

This heat treated steel plates market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers heat treated steel plates market segmentation by end-user by volume (automotive and heavy machinery, construction and infrastructure, shipbuilding and off-shore structures, energy and power, and others) and geography (APAC, Europe, North America, MEA, and South America). The heat treated steel plates market report also offers information on several market vendors, including ArcelorMittal SA, Baosteel Group Corp., Essar Global Fund Ltd., JFE Holdings Inc., Nippon Steel Corp., NLMK Group, Outokumpu Oyj, POSCO, Tata Sons Pvt. Ltd., and thyssenkrupp AG among others.

What will the Heat Treated Steel Plates Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Heat Treated Steel Plates Market Size for the Forecast Period and Other Important Statistics

Heat Treated Steel Plates Market: Key Drivers, Trends, and Challenges

The growing demand from the construction industry is notably driving the heat treated steel plates market growth, although factors such as growing preference for carbon fiber in automotive applications may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the heat treated steel plates industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Heat Treated Steel Plates Market Driver

One of the key factors driving the global heat treated steel plates market growth is the growing demand from the construction industry. Carbon steel is widely used in commercial, residential, and industrial buildings and other public infrastructures such as bridges, tunnels, and highways. Steel is strong, lightweight, and ductile, which makes it suitable for use in the construction of buildings and other infrastructures. Many new global infrastructural developments, such as the construction of smart cities, tech parks, shopping malls, high-rise buildings, highways, and other public infrastructure contribute largely to the global construction industry. The demand for high-strength and cost-effective construction materials is increasing in the modern construction industry, which is expected to propel the demand for heat-treated steel plates during the forecast period.

Key Heat Treated Steel Plates Market Trend

Increased penetration of heat-treated steel plates in industrial applications is one of the key heat treated steel plates market trends that is expected to impact the industry positively in the forecast period. Heat-treated steel plates are used in many industrial applications for the storage and conveyance of liquid, air, and gas. Stainless steel retains and enhances the strength of heat-treated steel plates. It also enhances the appearance of the surface and prevents corrosion. Thus, it improves the safety performance of vehicles, which is a primary requirement for modern automobiles. Superior mechanical and corrosion resistance properties of heat-treated steel plates are driving their use in industrial applications. Such factors will further support the growth of the market during the forecast years.

Key Heat Treated Steel Plates Market Challenge

One of the key challenges to the global heat treated steel plates market growth is the growing preference for carbon fiber in automotive applications. The need for lightweight automobiles has increased the use of carbon fiber composites in automobiles. The use of carbon fiber composites can reduce automobile weight by 40%-50% and increase fuel efficiency by 30%-35%. Carbon-fiber-reinforced polymers are gradually being used in the large-scale production of luxury cars such as the BMW i8 and BMW 7. Regulations regarding fuel efficiency and emissions levels are compelling the automotive industry to reduce the weight of the vehicles, thereby creating challenges in the global heat-treated steel plates market. Such factors will negatively impact the growth of the market during the forecast period.

This heat treated steel plates market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global heat treated steel plates market as a part of the global steel market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the heat treated steel plates market during the forecast period.

Who are the Major Heat Treated Steel Plates Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- ArcelorMittal SA

- Baosteel Group Corp.

- Essar Global Fund Ltd.

- JFE Holdings Inc.

- Nippon Steel Corp.

- NLMK Group

- Outokumpu Oyj

- POSCO

- Tata Sons Pvt. Ltd.

- thyssenkrupp AG

This statistical study of the heat treated steel plates market encompasses successful business strategies deployed by the key vendors. The heat treated steel plates market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

-

ArcelorMittal SA - Through the ACIS segment, the company offers a combination of flat, long, and tubular products through its facilities, which are located in Africa and the Commonwealth of Independent States.

-

ArcelorMittal SA - The company offers high carbon and quenchable steel hot rolled steel plates and coil for hardening and wear resistance.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The heat treated steel plates market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Heat Treated Steel Plates Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the heat treated steel plates market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Heat Treated Steel Plates Market?

For more insights on the market share of various regions Request for a FREE sample now!

78% of the market’s growth will originate from APAC during the forecast period. China, India, Japan, and Russian Federation are the key markets for heat treated steel plates in APAC. Market growth in this region will be faster than the growth of the market in South America and Europe.

The significant increase in the demand for heat-treated steel plates, owing to rapid industrialization and infrastructural developments, will facilitate the heat treated steel plates market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In 2020, the outbreak of COVID-19 affected the growth of the market, as there was a decline in the demand for heat-treated steel plates products from end-users such as oil and gas, construction, and automotive. For instance, in Q1 2020, China witnessed a decline of more than 40% in automotive sales compared with that in Q1 2019. Owing to lockdown measures in 2020, various government-imposed restrictions on the movement of vehicles and individuals that affected the import and export of heat-treated steel plates products in the region. However, the recovery of economies from the COVID-19-induced crisis and the reopening of several manufacturing facilities are anticipated to drive the growth of the market in the region during the forecast period. The market in APAC is dominated by various players such as Essar Steel, and TATA Steel Ltd. These vendors are implementing various strategic alliances such as new product launches, construction of new plants, and collaborations to drive the growth of the market during the forecast period.

What are the Revenue-generating End-user by Volume Segments in the Heat Treated Steel Plates Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The heat treated steel plates market share growth by the automotive and heavy machinery segment will be significant during the forecast period. The rise in environmental concerns and the development of new innovative technologies, such as hot stamping, to achieve cost and weight reduction, fuel economy expectations, and safety performance will increase the demand for heat-treated steel plates in the automobile industry, which will support the market growth in the coming years.

This report provides an accurate prediction of the contribution of all the segments to the growth of the heat treated steel plates market size and actionable market insights on post COVID-19 impact on each segment.

|

Heat Treated Steel Plates Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 3.50% |

|

Market growth 2022-2026 |

18120.00 th tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.75 |

|

Regional analysis |

APAC, Europe, North America, MEA, and South America |

|

Performing market contribution |

APAC at 78% |

|

Key consumer countries |

China, India, Japan, US, and Russian Federation |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

ArcelorMittal SA, Baosteel Group Corp., Essar Global Fund Ltd., JFE Holdings Inc., Nippon Steel Corp., NLMK Group, Outokumpu Oyj, POSCO, Tata Sons Pvt. Ltd., and thyssenkrupp AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Heat Treated Steel Plates Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive heat treated steel plates market growth during the next five years

- Precise estimation of the heat treated steel plates market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the heat treated steel plates industry across APAC, Europe, North America, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of heat treated steel plates market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch