Heavy-Duty Vehicle Tires Market Size 2025-2029

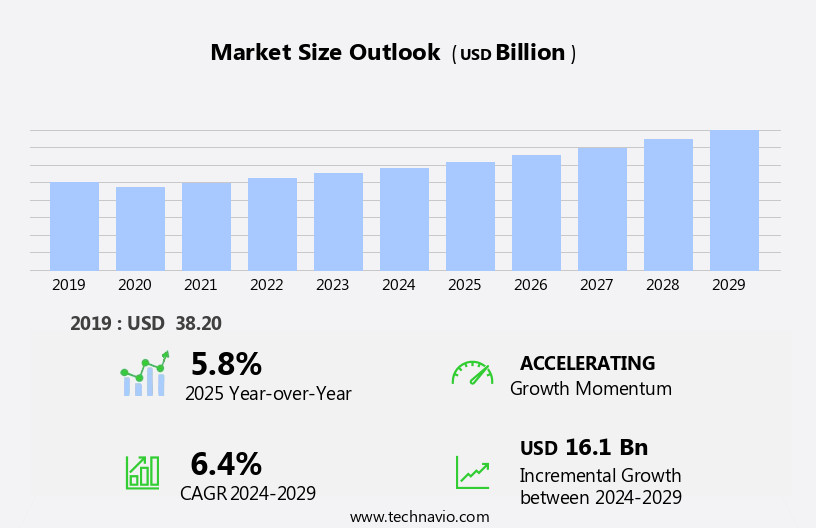

The heavy-duty vehicle tires market size is forecast to increase by USD 16.1 billion at a CAGR of 6.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for heavy-duty trucks in freight transportation. This trend is particularly noticeable in emerging economies where infrastructure development and industrialization are on the rise. Additionally, the emergence of smarter tires, which offer enhanced fuel efficiency, longer tread life, and improved safety features, is further fueling market expansion. However, regulatory hurdles impacting the adoption of new technologies and supply chain inconsistencies temper growth potential. Governments worldwide are implementing stringent regulations on tire safety and emissions, necessitating tire manufacturers to invest heavily in research and development to meet these standards. Additionally, the market sees opportunities in catering to the growing segment of hybrid electric vehicles and improving advanced automobile safety systems, such as heavy-duty vehicle engine brakes.

- Moreover, the increasing complexity of global supply chains necessitates that tire manufacturers maintain a robust and flexible supply network to cater to the diverse demands of customers. The exponential growth in demand for heavy-duty vehicles in these regions is expected to have a positive impact on the commercial vehicle braking system market and the heavy-duty trucks market as a whole. One such technology is automotive brake-by-wire systems, which utilize electrical signals to control braking functions instead of traditional hydraulic systems.

What will be the Size of the Heavy-Duty Vehicle Tires Market during the forecast period?

- The market experiences continuous evolution, driven by advancements in technology and increasing safety regulations. Tyre carcasses, an essential component of heavy-duty tires, undergo rigorous testing to ensure durability and reliability. Sipe design and tread wear indicators enhance tyre safety by improving traction and facilitating timely replacement. Tyre safety regulations mandate regular inspections and training for tyre safety guidelines. Tyre pressure sensors, sidewall height, load range, and section width are critical factors influencing tyre replacement costs. Tyre rubber, a key raw material, is subjected to stringent quality checks to ensure optimal tyre performance. Tyre monitoring systems, tyre inflation stations, and tyre management software facilitate proactive tyre maintenance and reduce the risk of tyre blowouts and punctures.

- Tyre disposal and recycling are gaining importance due to environmental concerns. Tyre liner, ply rating, rim diameter, and tyre repair techniques contribute to tyre damage mitigation. Tyre performance optimization and adherence to maintenance schedules are crucial for fleet operators to minimize downtime and ensure efficient operations. Tyre tread pattern design and reinforcement are continually evolving to meet the demands of diverse applications.

How is this Heavy-Duty Vehicle Tires Industry segmented?

The heavy-duty vehicle tires industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Trucks

- Buses

- End-user

- Aftermarket

- OEM

- Product Type

- 29 to 39 inch rim diameter

- 39 to 49 inch rim diameter

- Above 49 inch rim diameter

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

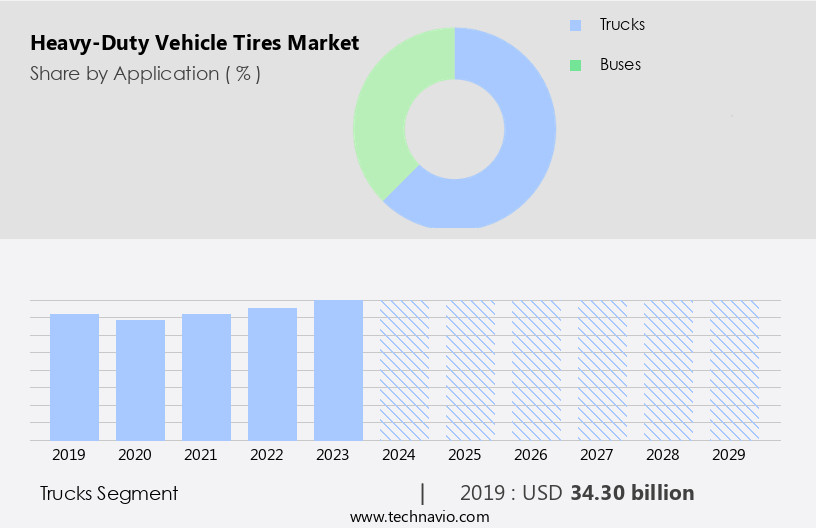

The trucks segment is estimated to witness significant growth during the forecast period. The market experiences significant growth due to the expanding freight and logistics sector, driven by globalization and e-commerce. The global trade and efficient transportation of goods across borders fuel the demand for heavy-duty trucks and their tires. Urbanization trends and the increasing focus on last-mile delivery services further contribute to the market's growth. Innovations in tire design, materials, and manufacturing processes lead to the development of heavy-duty truck tires with enhanced performance, durability, and safety features. Long haul and regional haul applications require tires with superior load capacity, fuel efficiency, and tread depth. Radial tires and on-highway tires are popular choices due to their extended tread life and improved rolling resistance. The market caters to both luxury cars and commercial vehicles, with applications extending to mobile marketing and out-of-home advertising.

The Trucks segment was valued at USD 34.30 billion in 2019 and showed a gradual increase during the forecast period. Tire inflation systems and tire pressure monitoring are essential for optimizing tire performance and reducing emissions. Electric vehicles are gaining popularity in the transportation sector, leading to the development of specialized tires for electric trucks. Advanced tire technology, such as bead technology, compound technology, and predictive maintenance, plays a crucial role in enhancing tire safety and reducing tire wear. Run-flat tires and all-position tires offer added convenience and flexibility to fleet management. Fleet management companies prioritize tire maintenance to ensure the optimal performance of their vehicles. Sidewall construction, tread patterns, and tire maintenance practices all impact tire safety and longevity. Drive tires and trailer tires require different specifications, with load capacity and tread depth being key considerations. Off-road tires and tires for autonomous driving applications present unique challenges and opportunities for tire manufacturers. Regenerative braking systems and other advanced technologies are influencing tire design and performance requirements. Overall, the market is dynamic and evolving, driven by the changing needs of the transportation sector. Unlike traditional static signs and billboards, these mobile marketing tools offer flexibility and mobility

Regional Analysis

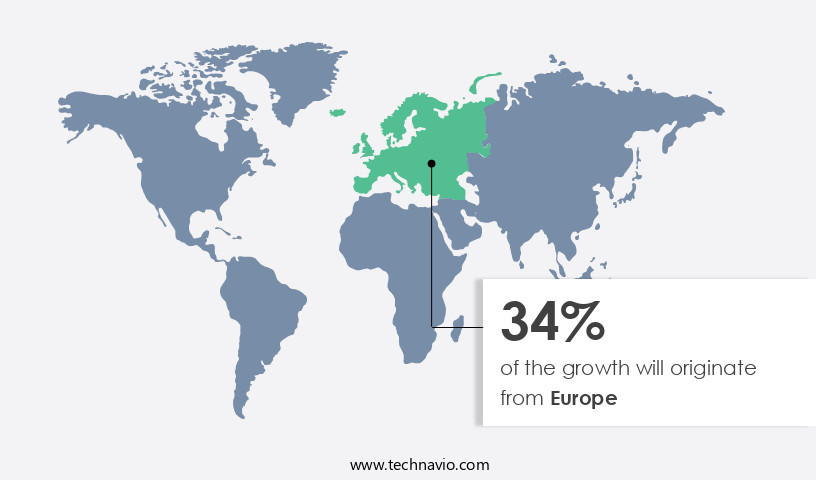

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing substantial growth due to the region's economic development and increasing industrialization. Countries like India and China are at the forefront of this growth, leading to a surge in construction, logistics, and transportation activities. These sectors heavily rely on heavy-duty vehicles, which necessitates the frequent replacement of tires. In addition, urbanization and infrastructure development projects continue to fuel demand for heavy-duty vehicles in construction and public transportation. The agricultural industry in APAC also contributes significantly to the market, as heavy-duty vehicles are essential for tasks such as plowing, harvesting, and transportation. Advanced tire technologies, including radial tires, on-highway tires, compound technology, bead technology, and sidewall construction, cater to the unique requirements of heavy-duty vehicles.

Electric vehicles and regional haul trucks are emerging trends in the market, with electric vehicles offering emissions reduction and predictive maintenance benefits, while regional haul trucks require tires with high load capacity and fuel efficiency. Data analytics, tire inflation systems, tire pressure monitoring, and tire maintenance are crucial aspects of tire management for heavy-duty vehicles. Run-flat tires, all-position tires, steer tires, trailer tires, and off-road tires cater to various applications. Rolling resistance, tire safety, and tire inflation are critical factors influencing tire selection. The market also encompasses retread tires and tread patterns, which offer cost savings and improved performance.

Autonomous driving and regenerative braking are emerging trends in the market, with the potential to revolutionize the industry. Fleet management and tire maintenance are essential for optimizing tire usage and ensuring vehicle uptime.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Heavy-Duty Vehicle Tires market drivers leading to the rise in the adoption of Industry?

- The significant increase in demand for heavy-duty trucks, driven by the freight transportation sector, serves as the primary market growth catalyst. The market experiences growth due to escalating sales of commercial vehicles, particularly in developing countries where manufacturing operations are expanding. This trend is driven by the increasing freight volumes. The tire life cycle is a crucial factor in the market, with heavy-duty truck tires featuring denser compounds and more sidewall padding to handle heavy loads at optimal air pressure. Radial tires, which are widely used in long-haul applications, are a significant contributor to the market's growth. Data analytics and tire inflation systems are essential technologies advancing tire performance and longevity.

- Bead technology and compound technology continue to evolve, enhancing tire durability and efficiency. The market's future growth is expected to be driven by the continuous development of these technologies and the increasing demand for on-highway tires.

What are the Heavy-Duty Vehicle Tires market trends shaping the Industry?

- The emergence of smarter tires, characterized by advanced technologies such as self-inflation and real-time pressure monitoring, represents a significant market trend in the automotive industry. These innovations aim to enhance vehicle performance, safety, and fuel efficiency. Heavy-duty vehicle tires are evolving to become smarter and more efficient, integrating advanced technologies to enhance safety and operational performance. Real-time tire monitoring systems, utilizing sensors for tire pressure, temperature, and tread wear, contribute significantly to improved safety and productivity. Connectivity features enable data transfer from tires to vehicle systems or cloud platforms, allowing data analytics to provide insights into tire performance, predict maintenance needs, and optimize fleet operations. This proactive approach to tire management can prevent breakdowns, reduce downtime, and extend tire lifespan. Predictive maintenance models are made possible through the integration of smart tire technologies, ensuring fleet operators can remotely monitor tire conditions and address potential issues before they escalate.

- Electric vehicles' integration into heavy-duty transportation is driving the demand for advanced tire technologies, focusing on emissions reduction and energy efficiency. Fleet management companies are increasingly adopting run-flat tires to minimize downtime and enhance operational efficiency. Overall, the integration of advanced tire technologies and connectivity features is revolutionizing heavy-duty vehicle tire markets, offering significant benefits to fleet operators and the transportation industry as a whole.

How does Heavy-Duty Vehicle Tires market faces challenges during its growth?

- The increasing demand for 6x2 axles poses a significant challenge to the industry's growth trajectory. This trend, driven by factors such as improved fuel efficiency and enhanced load capacity, necessitates continuous innovation and adaptation within the manufacturing sector. The market is witnessing significant changes due to the increasing focus on fuel efficiency and tire safety. With the growing preference for commercial trucks with improved fuel efficiency, there is a trend towards 6x2 axle driveline configurations in heavy-duty vehicles. This reduction in the number of axles used results in fewer tires being required. However, this shift poses a challenge to the market during the forecast period. Tire safety and tire inflation remain critical factors in the market. Proper tire maintenance, including regular inspection and timely inflation, is essential to ensure optimal tire performance and longevity.

- Tread patterns and rolling resistance are other important considerations for heavy-duty tire buyers. Retread tires have gained popularity due to their cost-effectiveness and reduced environmental impact. Proper tire maintenance and timely replacement are crucial to ensure the longevity of retread tires. The market is also witnessing advancements in tire technology, including sidewall construction and innovative tread patterns, to address the unique requirements of heavy-duty vehicles. Rolling resistance, tire wear, and tire safety are key factors influencing the market dynamics. Proper tire maintenance, including regular inspection and timely inflation, is essential to ensure optimal tire performance and longevity. The market is expected to face challenges due to the growing preference for fuel-efficient trucks with 6x2 axle drivelines, which require fewer tires. Despite these challenges, the market is expected to grow due to the increasing demand for heavy-duty tires that offer improved fuel efficiency, durability, and safety.

Exclusive Customer Landscape

The heavy-duty vehicle tires market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the heavy-duty vehicle tires market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, heavy-duty vehicle tires market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apollo Tyres Ltd. - The company specializes in providing a diverse range of heavy-duty vehicle tires, including the Amazer XL, Duramile, EnduraComfort CA, ALT 118, and ALT 188 models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apollo Tyres Ltd.

- Balkrishna Industries Ltd.

- Bridgestone Corp.

- Continental AG

- Giti Tire Pte. Ltd.

- Hankook Tire and Technology Co. Ltd.

- Hawk Tires

- JK Tyre and Industries Ltd.

- Michelin Group

- MRF Ltd.

- Nokian Tyres Plc

- Shandong Linglong Tyre Co. Ltd.

- Sumitomo Rubber Industries Ltd.

- The Goodyear Tire and Rubber Co.

- TITAN INTERNATIONAL INC.

- Toyo Tire Corp.

- Trelleborg AB

- Yokohama Rubber Co. Ltd.

- Zhongce Rubber Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Heavy-Duty Vehicle Tires Market

- In February 2023, Bridgestone Corporation, a leading tire manufacturer, introduced the Bandag BFGoodrich T/TREND set of heavy-duty tires. These new tires feature advanced tread designs and compounds that enhance fuel efficiency and durability, addressing the growing demand for sustainable and cost-effective solutions in the transportation sector (Bridgestone Corporation Press Release).

- In August 2024, Michelin and Volvo Group announced a strategic partnership to develop and produce next-generation tires for electric and autonomous heavy-duty vehicles. This collaboration aims to optimize tire performance and reduce environmental impact, as electric vehicles require specific tire designs to accommodate their unique power delivery systems (Michelin Press Release).

- In March 2025, Continental AG completed the acquisition of Veyance Technologies, a leading global manufacturer of rubber components for heavy-duty vehicles. This acquisition strengthens Continental's position in the tire industry and provides access to Veyance's advanced rubber compound technologies, enhancing the company's product portfolio and market presence (Continental AG Press Release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and shifting industry trends. Radial tires, once a revolutionary innovation, now face competition from on-highway tires engineered for enhanced fuel efficiency and longer tread life. Data analytics plays a crucial role in optimizing tire performance, with tire pressure monitoring systems and emissions reduction technologies becoming increasingly prevalent. Electric vehicles' emergence in the transportation sector brings new demands, necessitating specialized tires for their unique powertrains. Regional haul applications require tires with superior load capacity and durability. Predictive maintenance and run-flat tires are gaining traction, offering fleet managers improved safety and operational efficiency. Electric vehicles and compact family cars are also significant markets for automotive wrap films.

Advanced tire technology, including sidewall construction, compound technology, and bead technology, is pushing the boundaries of tire performance. Tire safety remains a top priority, with tire inflation and inflation systems, tire wear, and tire inflation being key considerations. Trailers and off-road applications also require specialized tires, with rolling resistance, tread depth, and tread patterns being essential factors. The increasing popularity of luxury vehicles and sports vehicles further boosts market growth. Fleet management and drive tires are essential components of modern logistics, with tire maintenance and all-position tires ensuring optimal vehicle uptime. Steer tires and load capacity are critical for maintaining vehicle stability and performance. Tire safety and fuel efficiency are ongoing concerns, with tire pressure and tread depth being essential factors.

Bias ply tires and retread tires still have their place in the market, offering cost savings and environmental benefits. Tread patterns and tire maintenance are essential for maximizing tire life and minimizing downtime. The ongoing evolution of the market is shaped by a multitude of factors, including technological advancements, industry trends, and regulatory requirements.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Heavy-Duty Vehicle Tires Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 16.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, China, India, Japan, Canada, Germany, Mexico, South Korea, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Heavy-Duty Vehicle Tires Market Research and Growth Report?

- CAGR of the Heavy-Duty Vehicle Tires industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the heavy-duty vehicle tires market growth of industry companies

We can help! Our analysts can customize this heavy-duty vehicle tires market research report to meet your requirements.