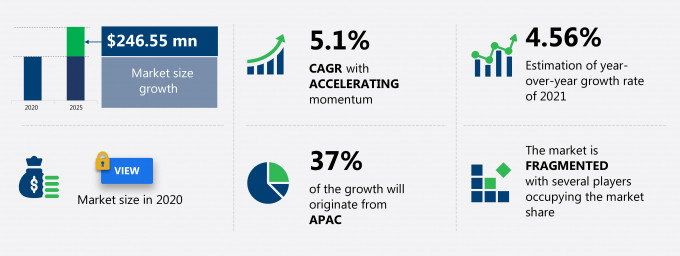

The industrial high-efficiency particulate air (HEPA) filters market share is expected to increase by USD 246.55 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 5.1%.

This industrial high-efficiency particulate air (HEPA) filters market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers industrial high-efficiency particulate air (HEPA) filters market segmentations by application (air filtration, cleanroom, and gas turbine) and geography (APAC, Europe, North America, South America, and MEA). The industrial high-efficiency particulate air (HEPA) filters market report also offers information on several market vendors, including American Air Filter Co. Inc., Blueair AB, Camfil AB, Donaldson Co. Inc., Freudenberg SE, Johnson Controls International Plc, Labconco Corp., MANN+HUMMEL, MayAir Group, and Parker Hannifin Corp. among others.

What will the Industrial High-efficiency Particulate Air (HEPA) Filters Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Industrial High-efficiency Particulate Air (HEPA) Filters Market Size for the Forecast Period and Other Important Statistics

Industrial High-efficiency Particulate Air (HEPA) Filters Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a neutral impact on the market growth during and post COVID-19 era. The growth of distributed power generation base is notably driving the industrial high-efficiency particulate air (HEPA) filters market growth, although factors such as slow growth in nuclear power generation may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the industrial high-efficiency particulate air (HEPA) filters industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Industrial High-efficiency Particulate Air (HEPA) Filters Market Driver

One of the key factors driving the industrial high-efficiency particulate air (HEPA) filters market growth is the growth of distributed power generation base. Distributed power technologies have become smaller and more widely available and more efficient and cost-effective. Gas turbines are an essential part of the distributed power technologies, along with diesel and gas reciprocating engines, solar panels, fuel cells, and small wind turbines. The growth of distributed power systems will correspond to an increase in the demand for gas turbines, thereby increasing the need for HEPA filters. Distributed power systems can overcome the constraints that typically inhibit the development of large capital projects and transmission and distribution (T&D) lines as they have lower capital requirements and are smaller. In addition, distributed power systems can be incrementally added to meet the growing energy needs. All these benefits have increased the need for distributed power generation facilities, thereby leading to a rise in the demand for gas turbines and HEPA filters in the power generation industry.

Key Industrial High-efficiency Particulate Air (HEPA) Filters Market Trend

Increasing oil and gas pipeline activity are the major trend influencing the industrial high-efficiency particulate air (HEPA) filters market growth. The oil and gas industry is a key end-user of the HEPA filters market, where they are used for providing quality air for gas turbines. Gas turbines are used to power compressors in the pumping station. The expansion of oil terminals globally has increased the need for gas turbines and efficient air handling systems across mid-stream and downstream activities in the oil and gas industry. Oil terminals are used for storing crude oil and petroleum products and serve as centers for oil and gas transportation, thereby supporting the oil and gas supply chain. Therefore, the expansion of oil terminals has a direct impact on the demand for HEPA filters. Pipelines have been the most preferred mode of oil and gas transportation. The rising global consumption of oil and gas is expected to increase new oil and gas pipeline construction activities during the forecast period, which would favor the growth of the industrial HEPA filters market.

Key Industrial High-efficiency Particulate Air (HEPA) Filters Market Challenge

Slow growth in nuclear power generation is one of the key challenges hindering the industrial high-efficiency particulate air (HEPA) filters market growth. The use of radioactive gases in nuclear power generation has increased the need for efficient air filters, such as HEPA filters, rendering them highly indispensable in nuclear plants. Nuclear power generation has been increasing in Asia with the construction of new nuclear reactors in China, South Korea, and India. However, countries such as the US, Japan, France, and Germany, which have traditionally relied on nuclear power, are moving away from nuclear power plants, mainly owing to safety concerns related to nuclear power plants. Cost delays in the construction of new nuclear power plants have added to the debt of the company. Such delays and cost overruns have questioned the viability of nuclear power plants. Therefore, while Asia may drive the future nuclear power generation demand, the phasing out of nuclear power generation capacity in the US and certain countries in Europe may not be able to compensate for the growth, resulting in a slowdown in the use of HEPA filters in nuclear power generation.

This industrial high-efficiency particulate air (HEPA) filters market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global industrial high-efficiency particulate air (HEPA) filters market as a part of the global industrial machinery market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the industrial high-efficiency particulate air (HEPA) filters market during the forecast period.

Who are the Major Industrial High-efficiency Particulate Air (HEPA) Filters Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- American Air Filter Co. Inc.

- Blueair AB

- Camfil AB

- Donaldson Co. Inc.

- Freudenberg SE

- Johnson Controls International Plc

- Labconco Corp.

- MANN+HUMMEL

- MayAir Group

- Parker Hannifin Corp.

This statistical study of the industrial high-efficiency particulate air (HEPA) filters market encompasses successful business strategies deployed by the key vendors. The industrial high-efficiency particulate air (HEPA) filters market is fragmented and the vendors are deploying growth strategies such as mergers, acquisitions, and strategic partnerships to compete in the market.

Product Insights and News

- American Air Filter Co. Inc. - The company offers HEPA-ULPA Filters such as MEGAcel I eFRM, MEGAcel II eFRM and MEGAcel II ePTFE which is used across various industries such as Pharmaceutical, Healthcare, Life Sciences and others.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The industrial high-efficiency particulate air (HEPA) filters market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Industrial High-efficiency Particulate Air (HEPA) Filters Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the industrial high-efficiency particulate air (HEPA) filters market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Industrial High-efficiency Particulate Air (HEPA) Filters Market?

For more insights on the market share of various regions Request for a FREE sample now!

37% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for industrial high-efficiency particulate air (HEPA) filters in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The high demand for commercial vehicles is expected to drive the demand for HEPA filters, thereby contributing to the growth of the regional HEPA filters market during the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In 2020, the HEPA filters market in APAC witnessed certain challenges, owing to the COVID-19 pandemic. India, Indonesia, Bangladesh, and China were some of the most affected countries by the pandemic in the region. The pandemic resulted in the cancellation of various trade exhibitions in the end-user industries in the region. For instance, in March 2020, the Japan Refrigeration and Air Conditioning Industry Association (JRAIA) announced the cancelation of the HVAC&R JAPAN 2020 due to the spread of the disease. Hence, such cancellations negatively impacted the sales of new variants of HVAC solutions, thereby hindered the growth of the HEPA filters market in the region. As the pandemic recedes in 2021, industrial activity in the region is anticipated to pick up the pace, which, in turn, is expected to drive the demand for HEPA filters in the region during the forecast period.

What are the Revenue-generating Application Segments in the Industrial High-efficiency Particulate Air (HEPA) Filters Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The industrial high-efficiency particulate air (HEPA) filters market share growth by the air filtration will be significant during the forecast period. In the air filtration segment, HEPA filters are mainly used with HVAC systems. Industrial HVAC systems are adopted in industries such as oil and gas, power, pulp and paper, chemical and petrochemical, mining and metal, and food and beverage industries. These process industries hold a dominating share in the global industrial HVAC market owing to the augmented demand for reducing the energy consumption in manufacturing processes due to government regulations and rising energy costs.

Besides the above-mentioned factors, the post COVID-19 impact has brought forth a slowdown in or fast tracked the demand for the service or product. This report provides an accurate prediction of the contribution of all the segments to the growth of the industrial high-efficiency particulate air (HEPA) filters market size and actionable market insights on post COVID-19 impact on each segment.

|

Industrial High-efficiency Particulate Air (HEPA) Filters Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2021-2025 |

$ 246.55 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.56 |

|

Regional analysis |

APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 37% |

|

Key consumer countries |

China, US, Germany, UK, and Japan |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

American Air Filter Co. Inc., Blueair AB, Camfil AB, Donaldson Co. Inc., Freudenberg SE, Johnson Controls International Plc, Labconco Corp., MANN+HUMMEL, MayAir Group, and Parker Hannifin Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Industrial High-efficiency Particulate Air (HEPA) Filters Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive industrial high-efficiency particulate air (HEPA) filters market growth during the next five years

- Precise estimation of the industrial high-efficiency particulate air (HEPA) filters market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the industrial high-efficiency particulate air (HEPA) filters industry across APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of industrial high-efficiency particulate air (HEPA) filters market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch