High Purity Alumina Market Size 2024-2028

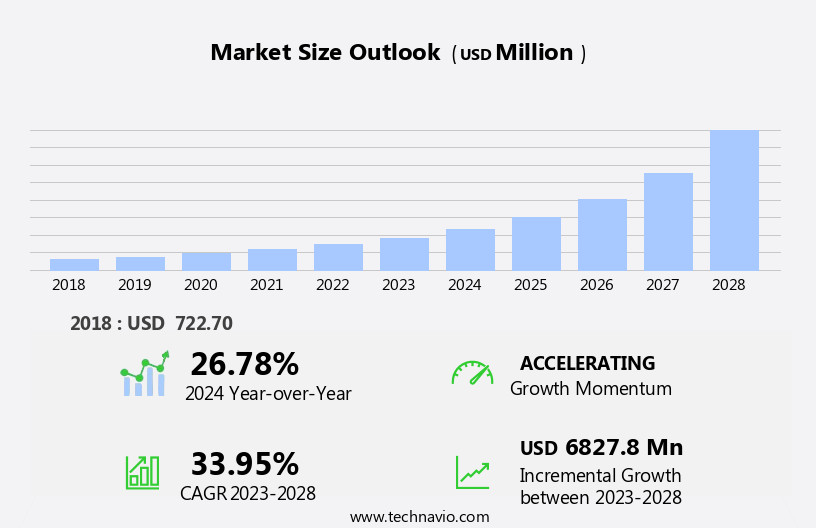

The high purity alumina market size is forecast to increase by USD 6.83 billion at a CAGR of 33.95% between 2023 and 2028.

- The high purity alumina (HPA) market is experiencing significant growth due to several key trends. The increasing adoption of LED lighting and the declining manufacturing costs of LED and lithium-ion batteries are major drivers for the market. However, the high cost of production of HPA remains a significant challenge. The rising demand for HPA in various end-use industries, such as electronics, refractories, and catalysts, is also contributing to market growth.

- Additionally, the development of new applications for HPA in emerging technologies, such as fuel cells and solar panels, is expected to further boost market demand. Despite these opportunities, the market faces challenges such as stringent regulations and the availability of alternative materials.

- To remain competitive, market participants must focus on reducing production costs and improving efficiency while maintaining high product quality. Overall, the HPA market is poised for steady growth In the coming years due to its essential role in various high-tech industries.

What will be the Size of the High Purity Alumina Market During the Forecast Period?

- The high-purity alumina (HPA) market experiences significant growth due to its increasing application in various industries, particularly In the production of batteries for electric vehicles (EVs) and lithium-ion batteries. HPA is essential in manufacturing separator sheets for these batteries, which ensure optimal battery performance and durability. Beyond batteries, HPA finds extensive use In the lighting sector, contributing to energy-efficient LED lighting technology and LCD displays.

- In microelectronics, HPA is indispensable in the production of sapphire substrates for semiconductors and LEDs. Additionally, HPA plays a crucial role in gas separation processes, including the production of boehmite, a chemical product used in wastewater treatment and ultra-filtration processes.

- The demand for HPA continues to escalate as industries prioritize energy efficiency and sustainability, with the Energy Department's lighting installation projects and advancements in LED lighting technology driving market growth.

How is this High Purity Alumina Industry segmented and which is the largest segment?

The high purity alumina industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- LEDs

- Semiconductors

- Phosphors

- Others

- Type

- 4N HPA

- 5N HPA

- 6N HPA

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Application Insights

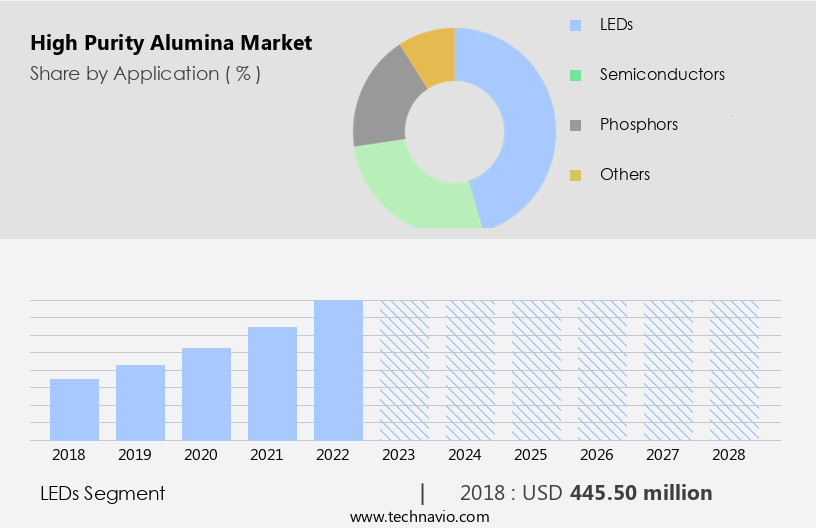

The LEDs segment is estimated to witness significant growth during the forecast period. High-Purity Alumina (HPA) plays a pivotal role In the manufacturing of sapphire crystals, which serve as substrates In the production of Light Emitting Diodes (LEDs). LEDs, with their superior brightness and energy efficiency, are extensively utilized in various applications, including automobile headlights, home illumination projects, multimedia displays, advertisement lighting, and backlights in electronic devices. The rising adoption of energy-efficient LED lighting technology over conventional lights and lamps is expected to boost the demand for HPA In the LED industry. Additionally, HPA is employed In the production of alumina-coated separators for lithium-ion batteries used in electric vehicles (EVs) and mobile phones, enhancing battery performance and durability. The increasing focus on reducing electricity consumption and the growing popularity of LED technology in various industries will further fuel the market growth for HPA.

Get a glance at the share of various segments. Request Free Sample

The LEDs segment was valued at USD 445.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

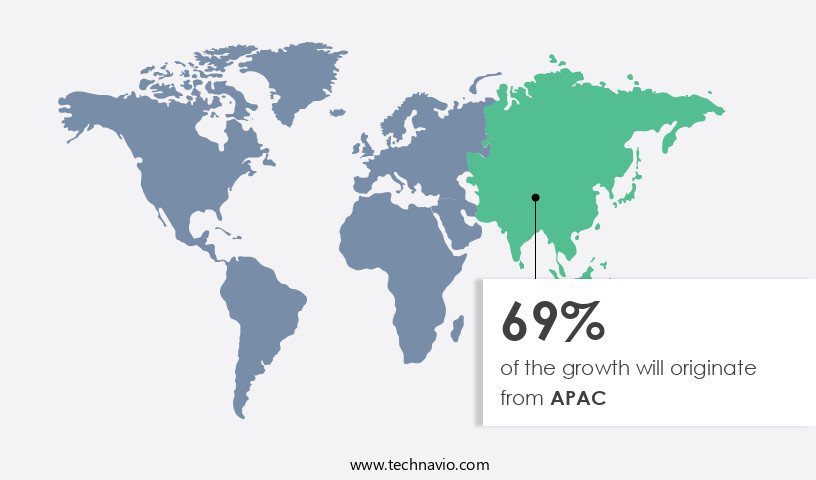

APAC is estimated to contribute 69% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

High Purity Alumina (HPA) is a critical industrial intermediate with significant applications in various sectors, including LED lighting, semiconductors, and lithium-ion batteries. The Asia Pacific (APAC) region dominates the global HPA market due to its large consumer base and robust manufacturing industry. Key APAC countries, such as China, Japan, South Korea, India, Australia, New Zealand, and Indonesia, are significant consumers of HPA. The rapid growth of the APAC HPA market can be attributed to the expanding demand for energy-efficient technologies like LED lighting and semiconductors. The semiconductor industry, which includes countries like China, Japan, Taiwan, Vietnam, South Korea, Singapore, and Malaysia, is a significant contributor to the global semiconductor market.

Additionally, the industrial LED market, which is a major consumer of HPA, is also experiencing substantial growth. The increasing demand for high-performance, durable batteries, particularly in electric vehicles (EVs) and mobile phones, is driving the demand for HPA In the lithium-ion battery sector. HPA is used In the production of alumina-coated separators, anode and cathode materials, and thermal capacity materials, ensuring optimal battery performance and durability. The HPA market's growth is also influenced by the increasing focus on energy efficiency and the reduction of electricity consumption in various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of High Purity Alumina Industry?

Rising adoption of LED lighting is the key driver of the market.

- The High Purity Alumina (HPA) market is witnessing significant growth due to its extensive applications in various industries, particularly In the production of lithium-ion batteries for electric vehicles (EVs) and batteries for LED lighting technology. The demand for HPA is driven by the increasing adoption of EVs and the growing focus on energy efficiency and eco-friendliness. HPA is used In the manufacturing of alumina-coated separators, which play a crucial role in improving battery performance and durability by preventing the anode and cathode from coming into direct contact and preventing thermal capacity issues such as thermal runaway and burns. In addition to batteries, HPA is also used In the production of sapphire for LED lighting, scratch-resistant glass, optical lenses, and LED preparation.

- The LED lighting market is experiencing continued growth due to the high adoption of smart lighting systems and the need to reduce electricity consumption. The use of HPA in LED lighting technology also contributes to the production of energy-efficient and eco-friendly lights. Furthermore, HPA is used In the manufacturing of semiconductor wafers for microelectronics, including Silicon Carbide and Gallium Nitride, which are essential components in various electronic devices such as mobile phones, watches, televisions, and LCD screens. HPA is also used In the recovery of Boehmite, a chemical product used in gas separation and ultra-filtration processes. In conclusion, the HPA market is experiencing significant growth due to its extensive applications in various industries, including batteries, LED lighting, microelectronics, and chemical products.

What are the market trends shaping the High Purity Alumina Industry?

Declining manufacturing cost of LED and lithium-ion batteries is the upcoming market trend.

- The High Purity Alumina (HPA) market has experienced significant growth due to the increasing demand for lithium-ion batteries, particularly In the electric vehicles (EVs) sector. HPA is a crucial component In the production of alumina-coated separators used in lithium-ion batteries, which enhance battery performance and durability. The demand for HPA is also driven by the expanding use of LED technology in lighting installation projects, as HPA is used In the production of LEDs, sapphire, and other energy-efficient products. The cost reduction in manufacturing LEDs between 2012 and 2020 has led to a surge in demand for LED-based products, including LED lighting, LCD screens, and microelectronics.

- HPA's role in producing high-quality separator sheets with nano-thickness has contributed to the improvement of battery stability and reduction of capacity losses. Furthermore, HPA is used In the production of anode and cathode materials in EV batteries, which require high thermal capacity to prevent thermal runaway and potential burns. Moreover, HPA is used In the production of scratch-resistant glass, optical lenses, and LED preparation. The demand for HPA In the semiconductor industry is also increasing due to its use In the production of Silicon Carbide, Gallium Nitride, and other semiconductor wafers. The growth in HPA demand is expected to continue as the market for energy-efficient products expands.

What challenges does the High Purity Alumina Industry face during its growth?

High cost of production of HPA is a key challenge affecting the industry growth.

- High Purity Alumina (HPA) is a crucial component in various industries, including batteries for electric vehicles (EVs) and lithium-ion batteries. The demand for HPA is driven by the growing adoption of EVs and the advancement of energy-efficient technologies such as LED lighting and LCD screens. HPA is used In the production of alumina-coated separators for lithium-ion batteries, which enhance battery performance and durability. In the battery industry, HPA is used to manufacture anode and cathode materials for EV batteries. Its thermal capacity helps prevent thermal runaway and subsequent battery burns. HPA is also used In the production of sapphire for LED technology, scratch-resistant glass for watches and televisions, and optical lenses.

- The production of HPA involves various methods, including the thermal decomposition method, water-soluble process, and alkoxide hydrolysis process. The thermal decomposition method uses ammonium aluminum sulfate or ammonium aluminum carbonate hydroxide as raw materials. The increasing cost of raw materials, energy, and labor, along with stringent government regulations, contribute to the high production cost of HPA. Furthermore, HPA is used In the production of semiconductor wafers made from Silicon Carbide and Gallium Nitride. In the energy sector, HPA is used in gas separation and ultra-filtration processes for LEDs and other energy-efficient applications. In conclusion, HPA is a high-value product with a wide range of applications in various industries.

Exclusive Customer Landscape

The high purity alumina market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high purity alumina market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, high purity alumina market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Advanced Energy Minerals - High Purity Alumina (HPA) is a critical material used in various industries, including electronics, refractories, and chemicals. The global HPA market is driven by increasing demand for advanced technologies, such as lithium-ion batteries and LED lighting. HPA is produced through the calcination of bauxite ore, followed by the precipitation of aluminum hydroxide and subsequent heating to produce alumina trihydrate (ATH) or alumina trioxide (Al2O3).

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Energy Minerals

- Alcoa Corp.

- Alpha HPA Ltd.

- Altech Advanced Materials AG

- Altech Chemicals Ltd.

- AluChem Inc.

- Baikowski SA

- CoorsTek Inc.

- Devtaar GmbH

- FYI Resources Ltd.

- HPA Sonics

- Nippon Light Metal Co. Ltd.

- Norsk Hydro ASA

- Orient Abrasives Ltd.

- Oyak

- Polar Sapphire Ltd.

- Sasol Ltd.

- Sumitomo Chemical Co. Ltd.

- United Company RUSAL

- Vizag Chemical International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

High Purity Alumina (HPA) is a critical material in various industries, including electronics, energy storage, and optoelectronics. HPA is essential In the production of alumina-coated separators for lithium-ion (Li-ion) batteries, which are a key component in powering electric vehicles (EVs) and portable electronics. The demand for HPA is driven by the increasing adoption of energy-efficient technologies, such as LED lighting and LCD displays, which require high-quality alumina for their manufacturing. HPA is also used In the production of sapphire, a material used In the manufacturing of semiconductor wafers for microelectronics and In the production of scratch-resistant glass for watches and optical lenses.

The production of HPA involves several processes, including gas separation and ultra-filtration. These processes ensure the purity of the alumina, which is crucial for the optimal performance and durability of end-use applications. HPA is also used In the production of anodes and cathodes for Li-ion batteries, which require high thermal capacity to prevent thermal runaway and associated risks of burns. The use of HPA in Li-ion batteries is a significant market driver, as the demand for EVs and portable electronics continues to grow. HPA is also used In the production of LED lighting technology, which is becoming increasingly popular due to its energy efficiency and long lifespan.

The production of HPA involves the use of raw materials such as bauxite ore, which is processed through a series of chemical reactions to produce alumina trihydrate (ATH) and then further refined to produce HPA. The production process requires high temperatures and precise control of reaction conditions to ensure the purity of the final product. HPA is also used In the production of nano-thickness separator sheets for Li-ion batteries, which are essential for improving battery performance and reducing capacity losses. The use of HPA In these applications is expected to drive the growth of the HPA market In the coming years.

The HPA market is highly competitive, with several players producing and supplying the material to various industries. The market is also subject to fluctuations in raw material prices and production costs, which can impact the profitability of HPA producers. In conclusion, the HPA market is driven by the increasing demand for energy-efficient technologies and the need for high-purity alumina in various industries, including electronics, energy storage, and optoelectronics. The production of HPA involves several processes to ensure its purity and quality, making it a critical material for various end-use applications. The market is highly competitive, and producers must navigate fluctuations in raw material prices and production costs to remain profitable.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 33.95% |

|

Market growth 2024-2028 |

USD 6.83 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

26.78 |

|

Key countries |

China, Taiwan, US, South Korea, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this High Purity Alumina Market Research and Growth Report?

- CAGR of the High Purity Alumina industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the high purity alumina market growth of industry companies

We can help! Our analysts can customize this high purity alumina market research report to meet your requirements.