Europe Home Textile Market Size 2024-2028

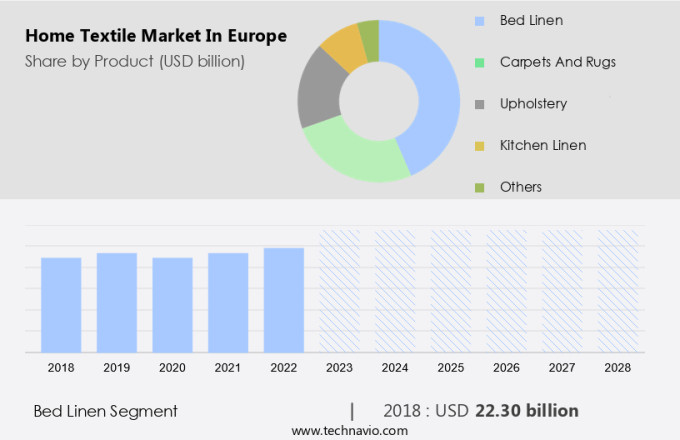

The Europe home textile market size is forecast to increase by USD 11.7 billion, at a CAGR of 4.7% between 2023 and 2028.

- The European Home Textile Market is experiencing significant growth, driven by increased consumer spending on home renovation and household furnishing. This trend is fueled by the desire for creating comfortable and aesthetically pleasing living spaces. companies are capitalizing on this trend by expanding their distribution channels, making home textiles more accessible to consumers. However, the market faces challenges in the form of stringent regulatory compliance. The European Union's REACH regulations, for instance, impose strict requirements on the production, labeling, and disposal of textiles. Navigating these regulations requires substantial resources and expertise, posing a challenge for smaller players in the market.

- To succeed, companies must invest in research and development to ensure compliance while maintaining product quality and affordability. Additionally, they must adopt effective supply chain strategies to mitigate risks and maintain a steady flow of goods to meet consumer demand. In summary, the European Home Textile Market presents opportunities for growth, driven by consumer spending trends, but also challenges in the form of regulatory compliance. Companies must navigate these dynamics effectively to capitalize on market opportunities and maintain a competitive edge.

What will be the size of the Europe Home Textile Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The European home textile market is characterized by a strong focus on sustainability and innovation. Oeko-Tex certification, a leading textile standard ensuring eco-friendly production, gains prominence. Textile recycling technologies and compostable textiles are driving the circular economy, reducing waste and minimizing environmental impact. Textile design incorporates smart elements, such as thread count, fiber blends, and fabric finishes, to create innovative, high-quality home textiles. Sustainability in textiles extends to safety regulations, with certifications like GOTS and textile research driving improvements in industrial textiles, hospital textiles, and commercial textiles. Innovation in textile engineering leads to the development of wearable technology, decorative trims, and safety features, catering to the evolving needs of consumers.

- Home textile retailers prioritize these trends, offering a wide range of textile options that meet both functional and aesthetic demands. Fabric weight, yarn quality, and textile certifications remain essential factors in the purchasing decision-making process. Textile waste management and biodegradable textiles are increasingly important, as sustainability becomes a key consideration for interior design services and home staging. The market is further enriched by the integration of textile innovation, textile standards, and textile certifications, creating a dynamic and diverse landscape for business opportunities.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Bed linen

- Carpets and rugs

- Upholstery

- Kitchen linen

- Others

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- France

- Germany

- UK

- Europe

By Product Insights

The bed linen segment is estimated to witness significant growth during the forecast period.

In Europe's home textile market, smart textiles and textile technology continue to shape innovation, with a focus on labor standards and sustainability. Digital printing and fashion trends influence design, while waterproof textiles and interior design trends prioritize functionality and aesthetic appeal. The carbon footprint and quality control are essential considerations, driving water usage and dyeing techniques to minimize environmental impact. Upholstery fabrics, bath textiles, and kitchen textiles incorporate circular economy principles, with 3D printing and printing techniques enhancing product offerings.

Consumer preferences prioritize price sensitivity, brand loyalty, and eco-friendly textiles made from organic cotton and recycled materials. Functional textiles, such as flame retardant and antimicrobial, cater to specific needs. Online marketplaces and e-commerce platforms streamline retail distribution, while fair trade and ethical sourcing ensure supply chain transparency. Energy consumption in textile manufacturing and textile recycling remain key concerns, with product innovation and sustainable practices shaping the industry's future.

The Bed linen segment was valued at USD 22.30 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Europe Home Textile Market drivers leading to the rise in adoption of the Industry?

- Consumer spending on home renovation and household furnishing has significantly driven the market's growth, with increased demand for high-quality products and services in this sector.

- The market has experienced significant growth due to increasing consumer interest in sustainable textiles and recycled materials. This trend is driven by rising consumer awareness and preferences for eco-friendly products. Energy consumption in textile manufacturing has become a major concern, leading to the adoption of energy-efficient technologies and practices. Textile recycling is another area of focus, with many companies investing in this sector to reduce waste and minimize environmental impact. Retail distribution channels have evolved, with a shift towards online sales and omnichannel strategies.

- Home textiles, such as shower curtains, continue to prioritize aesthetic appeal, offering unique designs, styles, and colors to cater to modern consumer preferences. The market dynamics are influenced by factors such as consumer spending levels, lifestyle trends, and technological advancements. Consumers are increasingly knowledgeable about interior design trends and seek out unique, high-quality home textile products to enhance their living spaces.

What are the Europe Home Textile Market trends shaping the Industry?

- company distribution channel expansion is a current market trend. This strategy involves expanding the reach of products through various channels to meet increasing consumer demands.

- The market is witnessing significant growth due to the adoption of advanced textile technologies. Smart textiles, which include textiles with embedded sensors and electronic components, are gaining popularity for their functionality and comfort. companies are investing in research and development to create innovative textile solutions, such as waterproof textiles and textiles with improved carbon footprint. Digital printing technology is another trend in the home textile industry, enabling companies to produce high-quality designs with minimal water usage and reduced dyeing techniques. Fashion trends and interior design preferences also influence the market, with an increasing demand for harmonious and immersive textile patterns.

- Labor standards and quality control are essential considerations for companies, ensuring ethical manufacturing practices and producing textiles of the highest quality. As consumers become more environmentally conscious, there is a growing demand for eco-friendly textile production methods and sustainable business practices. In conclusion, the European home textile market is dynamic and evolving, with companies adopting various strategies to meet consumer demands and stay competitive. Distribution channel expansion, particularly through omni-channel retailing, is a popular strategy for gaining market share and improving brand recognition. E-commerce retailers, such as Amazon, are significant players in the home textile market, offering customers a convenient and accessible shopping experience.

How does Europe Home Textile Market face challenges during its growth?

- The stringent regulatory compliance requirements pose a significant challenge to the industry's growth trajectory. In order to maintain business operations and expand, companies must adhere to rigorous regulatory standards, which can be costly and time-consuming. Ensuring compliance with various regulations, including those related to data privacy, safety, and environmental standards, is essential but adds complexity to business operations. This challenge is not unique to any specific industry, and all businesses must navigate these regulatory hurdles to achieve sustainable growth.

- The European home textile market is subject to stringent regulatory compliance under Textile Regulation No 1007/2011. This regulation mandates companies to label and mark fiber compositions used in home textile products to protect consumer interests and facilitate market functioning. Key inclusions of this regulation are minimum technical requirements for new fiber names, indications of non-textile animal origin parts, exemptions for self-employed tailors, and European Commission's power to adopt delegated acts amending the technical Annexes. These regulatory requirements may pose challenges to the growth of the European home textile market, encompassing upholstery fabrics, bath textiles, kitchen textiles, and more.

- Additionally, consumers are increasingly focusing on price sensitivity, environmental impact, color palettes, stain resistance, and eco-friendly textiles. Innovations like 3D printing and advanced printing techniques are also shaping the market dynamics.

Exclusive Europe Home Textile Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AW Hainsworth and Sons Ltd.

- Beyond textiles GmbH

- Dierig Holding AG

- Frette North America Inc.

- Freudenberg Performance Materials

- Hennes and Mauritz AB

- Interogo Holding AG

- Lameirinho Industria Textil SA

- Lantex Manufacturing Co. Ltd.

- Limaso

- Loftex

- Marvic Textiles Ltd.

- Mezroze and Co. Ltd.

- New Sega Textile Nantong Co. Ltd.

- Ralph Lauren Corp.

- Tirotex Textile Co.

- Tisseray and cie

- Trident Ltd.

- Vantry World SL

- Welspun Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Home Textile Market In Europe

- In February 2023, IKEA, the renowned Swedish home furnishings retailer, announced the launch of its new line of sustainable home textiles, called 'Målmö' (Malmö). This collection includes bed linens, towels, and table textiles made from 100% recycled materials, further strengthening their commitment to reducing textile waste and promoting eco-friendly practices (IKEA Press Release, 2023).

- In March 2024, Turkish textile manufacturer, Ipek Textiles, entered into a strategic partnership with the German home textile retailer, Möbel House. This collaboration aimed to expand Ipek Textiles' European market presence and enhance Möbel House's product offerings, providing customers with a wider range of high-quality home textiles (Möbel House Press Release, 2024).

- In May 2024, the European Union (EU) introduced new regulations on textile labeling, ensuring clear and accurate product information for consumers. These regulations included mandatory labeling of textile fiber composition, origin, and environmental impact (EU Press Release, 2024).

- In October 2025, Heinz-Jürgen Bertram Textilien GmbH, a leading German home textile manufacturer, completed the acquisition of French textile company, Tissage de Châteaudun. This acquisition enabled Heinz-Jürgen Bertram Textilien to expand its production capacity and market reach, making it a significant player in the European home textile industry (Heinz-Jürgen Bertram Textilien GmbH Press Release, 2025).

Research Analyst Overview

The European home textile market continues to evolve, driven by advancements in textile technology and consumer preferences. Smart textiles, incorporating functionalities such as temperature regulation and moisture management, are gaining traction in various sectors, from fashion to healthcare. Digital printing enables intricate designs and customization, while labor standards ensure ethical sourcing and fair trade practices. Waterproof textiles and stain-resistant fabrics cater to the growing demand for durability and ease of maintenance. Sustainability remains a key focus, with eco-friendly textiles, recycled materials, and reduced water usage becoming increasingly important. Circular economy initiatives, such as textile recycling and 3D printing, are revolutionizing the industry.

Interior design trends influence the market, with color palettes and aesthetic appeal shaping consumer choices. Price sensitivity and environmental impact are critical factors, driving innovation in energy-efficient manufacturing and sustainable production methods. Upholstery fabrics, bath textiles, kitchen textiles, and shower curtains all benefit from these trends. Quality control and carbon footprint are essential considerations, with brands prioritizing transparency and accountability. Dyeing techniques, such as natural dyes and low-impact processes, minimize environmental impact. Online marketplaces and e-commerce platforms facilitate consumer access to a wide range of products, while supply chain management ensures efficient distribution. Functional textiles, including flame retardant, antimicrobial, and sustainable textiles, cater to diverse needs and preferences.

Product innovation, organic cotton, and brand loyalty continue to shape the competitive landscape. The European home textile market remains dynamic, with ongoing developments in technology, sustainability, and consumer trends.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Home Textile Market in Europe insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2024-2028 |

USD 11.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch