Horse And Sports Betting Market Size 2025-2029

The horse and sports betting market size is forecast to increase by USD 252 million at a CAGR of 11.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by several key trends. One of the primary factors fueling market expansion is the increasing digital connectivity, enabling more consumers to place bets online. Another trend is the rising adoption of advanced technologies such as artificial intelligence (AI) and machine learning, which enhance the betting experience and improve accuracy. However, stringent government regulations pose a challenge to market growth, requiring operators to comply with complex rules and restrictions. Despite these challenges, the market is expected to continue its upward trajectory, offering ample opportunities for stakeholders.

What will be the Size of the Horse And Sports Betting Market During the Forecast Period?

- The market In the US continues to experience significant growth, driven by the increasing number of internet users and smartphone users. Digital infrastructure and wireless connectivity have enabled online betting to become a convenient and accessible option for individuals seeking to place wagers on athletic events.

- Horse racing and horse racing wagering remain popular categories within this market, with past performance and track conditions being key factors in bettors' decision-making processes. The trend towards digitalization is further evidenced by the rise of casino organizations offering fixed odds wagering on horse races, as well as the emergence of esports betting. According to Datareportal, there are currently over 300 million monthly active internet users In the US, and the implementation of 5G networks is expected to further enhance the user experience for mobile device users.

How is this Horse And Sports Betting Industry segmented and which is the largest segment?

The horse and sports betting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- Offline betting

- Online betting

- Type

- Fixed odds wagering

- Exchange betting

- Live betting

- esports betting

- Others

- Geography

- Europe

- Germany

- UK

- Italy

- APAC

- China

- India

- Japan

- North America

- Canada

- US

- South America

- Brazil

- Middle East and Africa

- Europe

By Platform Insights

- The offline betting segment is estimated to witness significant growth during the forecast period.

The market encompasses both online and offline platforms. While online betting is growing in popularity, offline betting remains the largest segment due to various factors. Some individuals prefer the traditional betting experience and are not comfortable with technology. Additionally, government regulations in certain regions limit sports betting to offline channels. Offline betting, including horse racing, is accessible through local bookies and betting shops, allowing customers to bet on credit. The convenience and flexibility of paying later contribute to the continued popularity of offline betting. Despite advancements in technology and the rise of online platforms, offline betting maintains a significant presence In the market.

Get a glance at the Horse And Sports Betting Industry report of share of various segments Request Free Sample

The offline betting segment was valued at USD 219.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

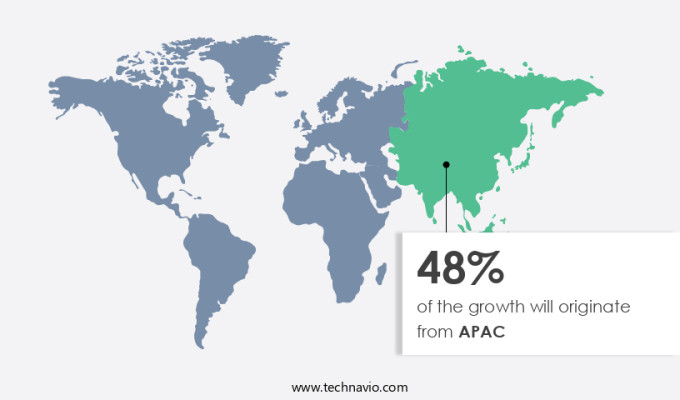

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In Europe, the market has experienced significant growth due to the increasing popularity of online betting and the widespread use of smartphones. With Internet connectivity rates averaging between 50% and 60% among European internet users, online betting platforms have gained traction. Regulatory frameworks have become more permissive towards both online and offline betting, creating a secure environment for sports enthusiasts. The presence of numerous bookmakers in major European countries such as Germany, the UK, France, Italy, and Poland, along with the popularity of various sports activities, has further fueled market expansion. Overall, the digital infrastructure and wireless connectivity have enabled easy access to athletic events, making horse and sports betting an increasingly popular pastime in Europe.

Market Dynamics

Our horse and sports betting market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Horse And Sports Betting Industry?

Increasing digital connectivity is the key driver of the market.

- The digitalization trend has significantly impacted the market, particularly among internet users and smartphone consumers. According to DataReportal, approximately 60% of the global population used the internet in 2020. This increasing internet connectivity has led to a rise in online betting activities, including horse racing and sports betting. With the advent of 5G networks and advanced mobile applications, users can now place bets on their mobile devices with ease and convenience. The football, basketball, and cricket segments dominate the sports betting market, while horse racing remains a popular choice for horse betting and wagering. Safety legislation and regulations vary among emerging nations, with some offering off-track betting sites and physical betting windows at racetracks, while others rely solely on digital platforms.

- The horse racing market offers betting choices based on predicted results, past performance, track conditions, and betting volume. The low-volume segment caters to individuals placing occasional bets, while the high-volume segment targets professional bettors and gambling sites like Pure Win. Fixed odds wagering and eSports betting are also gaining popularity In the market. The casino organization's digital infrastructure plays a crucial role in enabling wireless connectivity and facilitating online betting. The betting volume In the horse racing and sports betting market is expected to grow significantly In the coming years, making it an attractive investment opportunity for businesses.

What are the market trends shaping the Horse And Sports Betting Industry?

Increasing adoption of AI and machine learning is the upcoming market trend.

- The online market is experiencing significant growth as a result of the increasing number of smartphone users and digitalization trends. With the expansion of digital infrastructure and wireless connectivity, individuals can now place bets on their preferred athletic events, such as horse racing, football, basketball, cricket, and eSports, from anywhere using mobile devices. The betting volume In the high-volume segment, including football, basketball, and horse racing, is predicted to increase substantially. Casino organizations are leveraging advanced technologies like artificial intelligence (AI) and machine learning to offer accurate predictive analysis in fixed odds wagering. These algorithms and machine learning models use real-time data, including weather conditions, past performance, and track conditions, to provide betting choices and wagers based on the most likely outcomes.

- The emerging nations are expected to contribute significantly to the market growth due to the increasing popularity of betting and the availability of internet connectivity. Safety legislation and regulations are being put in place to ensure fair and secure betting practices. Off-track betting sites and physical betting windows at racetracks continue to coexist with online platforms like Uplatform, Pure Win, and others. The betting industry is investing heavily in digital infrastructure and 5G networks to enhance the user experience and provide faster and more reliable services. The football segment, in particular, is expected to dominate the market due to its massive fan base and global popularity.

What challenges does the Horse And Sports Betting Industry face during its growth?

Stringent government regulations is a key challenge affecting the industry growth.

- Horse and sports betting is a global industry that caters to the growing number of Internet users and smartphone users seeking convenient access to athletic events wagering. Digital infrastructure and wireless connectivity have enabled online betting platforms, such as Pure Win, Uplatform, and others, to offer various betting choices on horse racing, football, basketball, cricket, and eSports. In the US, the football, basketball, and baseball segments dominate the betting volume, while emerging nations exhibit a low volume but growing interest. Safety legislation and digitalization trends influence the market dynamics. For instance, the Indian gambling site, DataReportal, reports that 5G networks are expected to significantly impact the horse racing and horse betting markets by providing real-time data on past performance, track conditions, and predicted results.

- Betting volumes In the high-volume segment are predicted to increase as more individuals gain access to mobile devices and betting sites. Government regulations vary significantly across countries. In some, such as the US, betting is legalized and managed by football clubs and off-track betting sites. In others, like the UAE and Canada, betting is restricted or only allowed through physical betting windows at racetracks. As the market evolves, it is essential to stay informed about the latest regulatory changes and digital trends.

Exclusive Customer Landscape

The horse and sports betting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the horse and sports betting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, horse and sports betting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Bet365 Group Ltd.: The company offers horse and sports betting, such as UK racing and US horse racing. Also, the company provides a range of betting opportunities for various sports, including football, horse racing, tennis, cricket, and basketball, as well as casino, games, poker, and bingo rooms online.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 888 Holdings Plc

- Abudantia BV

- Bet365 Group Ltd.

- BetOnline

- Betsson AB

- Caesars Entertainment Inc.

- Chancier BV

- Churchill Downs Inc.

- DraftKings Inc.

- Entain Plc

- Flutter Entertainment Plc

- Kindred Group Plc

- MGM Resorts International

- Parimatch

- PENN Entertainment Inc.

- Sportech Plc

- SportsBetting.ag

- The Betway Group

- The Hong Kong Jockey Club

- Webis Holdings Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant shifts in recent years, with the advent of digital technology transforming the way individuals engage in this age-old pastime. This dynamic industry caters to a growing demographic of tech-savvy consumers, particularly those utilizing smartphones and other mobile devices. Digital infrastructure plays a crucial role in facilitating horse betting, with wireless connectivity enabling users to place wagers from anywhere at any time. The proliferation of 5G networks further enhances the user experience by ensuring faster data transfer rates and more reliable connections.

Moreover, athletic events, such as horse racing, have long been a staple of sports betting. Horse racing wagering, in particular, has seen a rise in popularity due to its accessibility and the thrill it offers to participants. The market encompasses a diverse range of segments, including football, basketball, cricket, and more. Safety legislation is a critical aspect of the horse betting market, ensuring fair play and maintaining the integrity of the industry. Football clubs and casino organizations have increasingly embraced digitalization trends, offering their customers various betting platforms, including uPlatform and others. The use of mobile devices for horse betting is on the rise, with internet users increasingly turning to off-track betting sites and physical betting windows at racetracks becoming less popular.

Furthermore, the low volume segment of the market is characterized by occasional bettors, while the high-volume segment comprises more dedicated horse racing enthusiasts and professional gamblers. Top-tier horses and their past performances are closely monitored by bettors, who use various data sources to inform their betting choices. Track conditions and other factors also play a significant role in predicting results. The horse betting market is not limited to developed nations; emerging economies are also embracing digitalization and the convenience it offers. Report coverage on this topic will delve into the details of these trends, providing valuable insights for industry stakeholders and interested parties.

|

Horse And Sports Betting Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.4% |

|

Market Growth 2025-2029 |

USD 252 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

UK, China, Germany, US, Italy, Japan, India, Brazil, Canada, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Horse And Sports Betting Market Research and Growth Report?

- CAGR of the Horse And Sports Betting industry during the forecast period

- Detailed information on factors that will drive the Horse And Sports Betting growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the horse and sports betting market growth of industry companies

We can help! Our analysts can customize this horse and sports betting market research report to meet your requirements.