HVAC System Market Size 2024-2028

The hvac system market size is valued to increase USD 56.3 billion, at a CAGR of 6.78% from 2023 to 2028. Growing demand for inverter HVAC systems will drive the hvac system market.

Major Market Trends & Insights

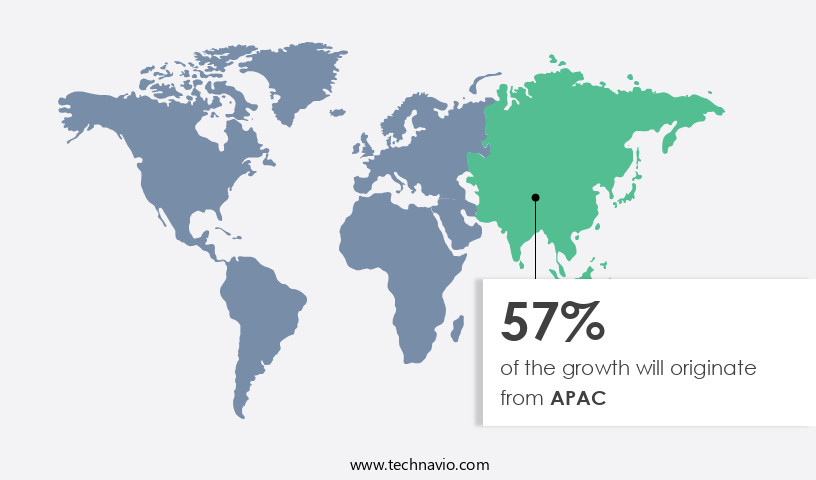

- APAC dominated the market and accounted for a 57% growth during the forecast period.

- By End-user - Non-residential segment was valued at USD 69.80 billion in 2022

- By Type - Split system segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 79.02 billion

- Market Future Opportunities: USD 56.30 billion

- CAGR : 6.78%

- APAC: Largest market in 2022

Market Summary

- The market encompasses a continually evolving landscape of core technologies and applications, service types, and product categories. One of the most significant trends driving market growth is the increasing adoption of inverter HVAC systems, which accounted for over 30% of global sales in 2020. These energy-efficient systems offer improved temperature control and energy savings, making them a popular choice for both residential and commercial applications. Another emerging trend is the growing popularity of smart HVAC systems, which allow users to remotely monitor and control their heating and cooling systems via mobile apps or voice assistants.

- However, the market faces challenges such as the lack of skilled labor, which can hinder installation and maintenance. Regulations, such as energy efficiency standards, also play a crucial role in shaping the market's direction. Stay tuned for further insights into the evolving the market.

What will be the Size of the HVAC System Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the HVAC System Market Segmented and what are the key trends of market segmentation?

The hvac system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Non-residential

- Residential

- Type

- Split system

- Ductless system

- Packaged system

- Heating Equipment

- Heat pumps

- Furnaces

- Unitary heaters

- Boilers

- Heat pumps

- Furnaces

- Unitary heaters

- Boilers

- Ventilation Equipment

- Air-handling units

- Air filters

- Dehumidifiers

- Ventilation fans

- Humidifiers

- Air purifiers

- Cooling Equipment

- Unitary air conditioners

- VRF systems

- Chillers

- Room air conditioners

- Coolers

- Cooling towers

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The non-residential segment is estimated to witness significant growth during the forecast period.

The non-residential segment of the market encompasses commercial and industrial applications. This sector holds significant market share and is projected to experience continuous expansion during the forecast period. The construction industry's growth and increasing infrastructure investments fuel the demand for HVAC systems in the non-residential sector. Rapid urbanization and favorable policies supporting commercial real estate development contribute to the increasing demand for office spaces. Consequently, the need for advanced HVAC systems to maintain thermal comfort and ensure energy efficiency becomes essential. Additionally, the emergence of start-ups and the availability of co-working spaces have further boosted the demand for HVAC systems.

Variable refrigerant flow (VRF) systems and integrated building systems are gaining popularity due to their energy efficiency and ability to provide zoned temperature control. Building energy modeling and HVAC control systems enable the optimization of energy consumption and improve overall system performance. Refrigerant management and heat exchanger design are crucial aspects of HVAC systems, with smart HVAC controllers and refrigerant leak detection systems ensuring efficient and reliable operations. Heat pump technology, air conditioning systems, and HVAC diagnostics tools are essential components of modern HVAC systems. Thermal energy storage and system performance analysis enable better energy management and cost savings.

Building automation systems, demand-controlled ventilation, and thermal comfort modeling contribute to enhanced indoor air quality and occupant comfort. HVAC maintenance schedules and air quality monitoring are critical for ensuring system longevity and optimal performance. Energy recovery ventilation and air filtration technologies improve indoor air quality and contribute to overall system efficiency. HVAC efficiency metrics and system optimization techniques help businesses reduce energy consumption and costs. Cooling tower operation and humidity control systems are vital for industrial applications, while ductwork design criteria ensure efficient air distribution. Energy efficiency upgrades and the HVAC commissioning process ensure that systems operate at their maximum potential.

Heating system design and integration with other building systems are essential for comprehensive building solutions. The HVAC market's future growth is driven by the increasing focus on energy efficiency, advanced technologies, and the growing demand for comfortable and energy-efficient indoor environments. The market is expected to witness significant growth, with a projected increase in demand for HVAC systems in various industries, including healthcare, education, and hospitality. In conclusion, the non-residential the market is expected to experience steady growth due to the increasing demand for energy-efficient and advanced HVAC systems in various industries. The market's continuous evolution is driven by technological advancements, energy efficiency concerns, and the growing need for comfortable indoor environments.

The Non-residential segment was valued at USD 69.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 57% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How HVAC System Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, the market is experiencing significant growth due to several factors. The expanding population in countries like China and India, with a combined population of over 2.83 billion in 2023, is a major driving force. Climatic conditions and increasing urbanization are also contributing factors. Moreover, demographic changes and the growing commercial construction sector are further boosting market growth.

Regulations and efficiency norms in countries such as India and China will continue to shape the market during the forecast period. For instance, India's Bureau of Energy Efficiency (BEE) Star Rating System and China's Energy Conservation Law are key initiatives promoting energy-efficient HVAC systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of technologies and applications, including variable refrigerant flow systems, energy recovery ventilation systems, air handling unit filter replacement schedules, building automation system integrations, chiller plant efficiency optimization strategies, demand controlled ventilation system commissioning, heat pump system performance evaluations, HVAC system diagnostics and troubleshooting techniques, refrigerant leak detection and repair procedures, thermal energy storage system design considerations, smart HVAC controller programming and configuration, air filtration technology selection criteria, cooling tower water treatment and maintenance, building energy modeling and simulation software, HVAC system maintenance and preventative measures, high-efficiency air conditioning system selection, energy efficient HVAC retrofit project planning, ductwork design and insulation best practices, air quality monitoring and indoor environmental control, and building code compliance for HVAC system installations.

One notable trend in the market is the increasing focus on energy efficiency and cost savings. For instance, more than 70% of new HVAC system installations prioritize energy-efficient solutions, with high-efficiency air conditioning systems accounting for a significantly larger share than traditional systems. In comparison, less than 15% of existing systems have been retrofitted with energy-efficient technologies, indicating a vast opportunity for growth in this area. Furthermore, advanced technologies such as smart HVAC controllers, demand-controlled ventilation systems, and variable refrigerant flow systems are gaining traction due to their ability to optimize energy consumption and enhance indoor environmental quality.

Building automation system integrations and air filtration technology selection criteria are also crucial factors influencing the market's growth trajectory. In terms of regional dynamics, the Asia Pacific market is expected to dominate the HVAC system landscape due to its large and rapidly growing construction sector and increasing focus on energy efficiency. Europe and North America follow closely behind, with a strong emphasis on building energy modeling and simulation software, HVAC system maintenance and preventative measures, and cooling tower water treatment and maintenance. Overall, the market is poised for robust growth, driven by a combination of factors, including technological advancements, increasing energy awareness, and regulatory compliance requirements.

What are the key market drivers leading to the rise in the adoption of HVAC System Industry?

- The increasing demand for energy-efficient and cost-effective HVAC solutions is primarily driven by the growing preference for inverter-based systems in the market.

- The market for inverter HVAC systems is experiencing significant growth due to various factors. Increasing disposable income and enhancing living standards among consumers are key drivers, as more people invest in comfort solutions for their homes and businesses. Extreme weather conditions also contribute to the demand for HVAC systems, as seen in the fifth hottest year recorded in India in 2022, with an average temperature rise of 0.51 degrees Celsius. Furthermore, government investments in infrastructure development, such as the USD2 billion allocation in India's interim budget in 2022, fuel the demand for HVAC systems in this sector.

- This trend is a continuous one, as consumers and businesses increasingly prioritize temperature control and energy efficiency. Inverter HVAC systems offer these benefits, making them a popular choice in various industries and applications.

What are the market trends shaping the HVAC System Industry?

- The rising preference for smart HVAC systems represents a notable market trend. Smart HVAC systems are experiencing growing popularity within the industry.

- The market is experiencing significant advancements, with the adoption of smart and connected HVAC systems on the rise. This shift is driven by technological innovations in portable devices and monitoring systems, enabling end-users to manage their HVAC systems more efficiently and conveniently. The demand for Internet of Things (IoT)-enabled devices is surging, particularly for data collection and analysis in addressing intricate residential and commercial HVAC maintenance tasks.

- IoT devices, such as wireless acoustic transmitters and steam trap monitors, play a crucial role in monitoring HVAC system operations. Predictive maintenance is gaining traction as it minimizes downtime and enhances operational efficiency. This trend underscores the market's continuous evolution and its applications across various sectors.

What challenges does the HVAC System Industry face during its growth?

- The scarcity of skilled labor poses a significant challenge to the expansion and growth of the industry.

- HVAC manufacturing involves producing advanced systems and offering aftermarket services, which are crucial for market success. Technical expertise is essential in installing and managing these systems. However, the industry faces a significant challenge: a persistent shortage of skilled labor. This issue is expected to persist, impacting contractors' profitability due to the importance of aftermarket services. The root cause is the preference of new graduates for careers in fields like computer programming, design, and finance over HVAC.

- This trend continues to widen the gap in the workforce, posing a significant challenge for the industry's growth. The labor shortage's consequences extend beyond contractors, affecting manufacturers' ability to meet demand and maintain profitability.

Exclusive Customer Landscape

The hvac system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hvac system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of HVAC System Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, hvac system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Carrier Global Corp. - The company specializes in HVAC systems, including Carrier Infinity, delivering advanced temperature control and energy efficiency solutions to various industries and residential markets. Their innovative technology enhances indoor comfort and sustainability, setting industry benchmarks for performance and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Carrier Global Corp.

- Daikin Industries Ltd.

- Danfoss AS

- Emerson Electric Co.

- Furukawa Electric Co. Ltd.

- GREE Comfort

- Haier Smart Home Co. Ltd.

- Hitachi Ltd.

- Honeywell International Inc.

- Ingersoll Rand Inc.

- Johnson Controls International Plc.

- Lennox International Inc.

- LG Corp.

- Midea Group Co. Ltd.

- Mitsubishi Electric Corp.

- Nortek

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Trane Technologies Plc

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in HVAC System Market

- In January 2024, Carrier Global Corporation, a leading HVAC market player, announced the launch of its new AquaEdge 19DV centrifugal chiller, featuring a digital intelligence platform that optimizes energy efficiency by up to 20% (Carrier Global Corporation Press Release).

- In March 2024, Johnson Controls and Google entered into a strategic partnership to integrate Johnson Controls' OpenBlue digital platform with Google's Building IoT platform, enabling seamless data exchange and advanced analytics for energy management in commercial buildings (Johnson Controls Press Release).

- In May 2024, United Technologies Corporation completed the acquisition of Carrier Global Corporation, creating a leading provider of HVAC and fire safety solutions with a combined revenue of USD23 billion in 2023 (United Technologies Corporation SEC Filing).

- In April 2025, the European Commission approved the Danfoss and Eaton merger, creating a leading player in the HVAC market with a combined market share of 16% (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled HVAC System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 56.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.2 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of HVAC systems, several key trends are shaping the market landscape. Chiller plant operations continue to advance, with a focus on energy efficiency and optimized performance. HVAC load calculations are increasingly sophisticated, enabling precise temperature control and reduced energy consumption. Variable refrigerant flow (VRF) systems are gaining popularity due to their adaptability and energy savings. Ventilation system types are diversifying, with integrated building systems offering improved indoor air quality and energy efficiency. Building energy modeling and HVAC control systems are essential tools for optimizing energy usage and reducing operational costs. Refrigerant management and heat exchanger design are critical aspects of HVAC systems, with smart HVAC controllers facilitating efficient operation and refrigerant leak detection.

- Heat pump technology is another area of innovation, providing both heating and cooling solutions with minimal environmental impact. Air conditioning systems are becoming more intelligent, with HVAC diagnostics tools and system performance analysis enabling proactive maintenance and repairs. Thermal energy storage and building automation systems are enhancing energy efficiency and occupant comfort. Demand-controlled ventilation and thermal comfort modeling are essential for maintaining optimal indoor air quality. HVAC maintenance schedules and air quality monitoring are crucial components of any effective building management strategy. Energy recovery ventilation and air filtration technologies are improving indoor air quality while reducing energy consumption.

- HVAC efficiency metrics and system optimization are essential for minimizing operational costs and maximizing performance. Cooling tower operation and zoned HVAC systems are addressing the unique challenges of large commercial and industrial facilities. Humidity control systems and ductwork design criteria are ensuring optimal thermal comfort and energy efficiency. Energy efficiency upgrades and the HVAC commissioning process are essential for maintaining and improving the performance of existing systems. Overall, the HVAC market is characterized by continuous innovation and a focus on energy efficiency, indoor air quality, and optimized performance.

What are the Key Data Covered in this HVAC System Market Research and Growth Report?

-

What is the expected growth of the HVAC System Market between 2024 and 2028?

-

USD 56.3 billion, at a CAGR of 6.78%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Non-residential and Residential), Type (Split system, Ductless system, and Packaged system), Geography (APAC, Europe, North America, Middle East and Africa, and South America), Heating Equipment (Heat pumps, Furnaces, Unitary heaters, Boilers, Heat pumps, Furnaces, Unitary heaters, and Boilers), Ventilation Equipment (Air-handling units, Air filters, Dehumidifiers, Ventilation fans, Humidifiers, Air purifiers, Air-handling units, Air filters, Dehumidifiers, Ventilation fans, Humidifiers, and Air purifiers), and Cooling Equipment (Unitary air conditioners, VRF systems, Chillers, Room air conditioners, Coolers, Cooling towers, Unitary air conditioners, VRF systems, Chillers, Room air conditioners, Coolers, and Cooling towers)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing demand for inverter HVAC systems, Lack of skilled labor

-

-

Who are the major players in the HVAC System Market?

-

Key Companies Carrier Global Corp., Daikin Industries Ltd., Danfoss AS, Emerson Electric Co., Furukawa Electric Co. Ltd., GREE Comfort, Haier Smart Home Co. Ltd., Hitachi Ltd., Honeywell International Inc., Ingersoll Rand Inc., Johnson Controls International Plc., Lennox International Inc., LG Corp., Midea Group Co. Ltd., Mitsubishi Electric Corp., Nortek, Panasonic Holdings Corp., Samsung Electronics Co. Ltd., Trane Technologies Plc, and Whirlpool Corp.

-

Market Research Insights

- The market encompasses a diverse range of technologies and services, including fan system performance, system control strategies, and capacity planning. HVAC design software and energy auditing services play crucial roles in optimizing system efficiency and reducing energy consumption. In contrast, HVAC retrofit projects accounted for approximately 25% of the market share in 2020, reflecting the growing importance of upgrading existing systems to meet building code compliance and improve ventilation effectiveness.

- Energy consumption data and thermal imaging analysis are essential tools for identifying areas of improvement in HVAC systems. Furthermore, system integration with building management systems, renewable energy sources, and data center cooling solutions are key trends driving market growth. Pressure drop calculations and hvac sensor technologies are essential for maintaining optimal airflow distribution patterns and ensuring thermal comfort standards.

We can help! Our analysts can customize this hvac system market research report to meet your requirements.