Industrial Chillers Market Size 2024-2028

The industrial chillers market size is forecast to increase by USD 1.28 billion at a CAGR of 4.36% between 2023 and 2028.

What will be the Size of the Industrial Chillers Market During the Forecast Period?

How is this Industrial Chillers Industry segmented and which is the largest segment?

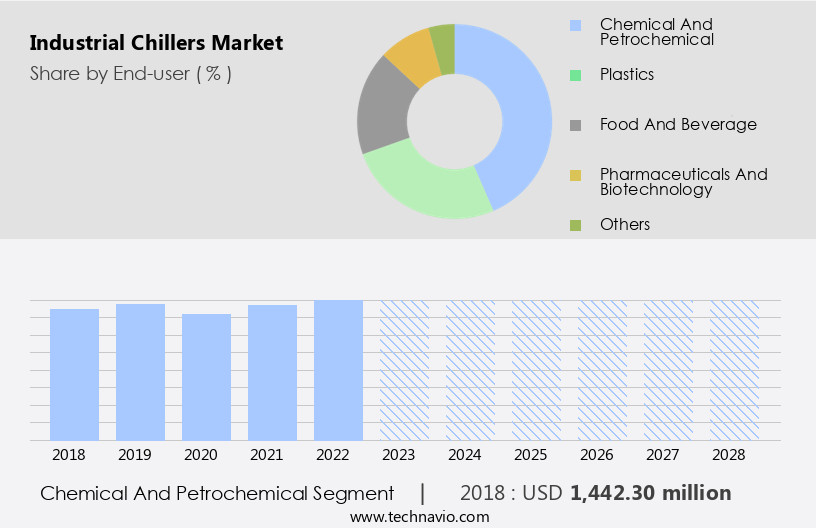

The industrial chillers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Chemical and petrochemical

- Plastics

- Food and beverage

- Pharmaceuticals and biotechnology

- Others

- Type

- Water chillers

- Air chillers

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The chemical and petrochemical segment is estimated to witness significant growth during the forecast period.

Industrial chillers play a crucial role In the industrial sector by maintaining the temperature of process equipment and refrigeration of temperature-sensitive materials. Major consumers of industrial chillers include the chemical and petrochemical industries, which require low-temperature conditions for their processes. These chillers can be integrated directly with industrial processes, utilizing waste heat generated by equipment such as flue gases, wastewater, reflux condensers, compressor interstages, and expander plants. This integration not only reduces fuel consumption but also minimizes the environmental impact by decreasing the amount of heat rejected to the environment. Advanced technologies like smart controls, temperature regulation, and energy efficiency standards enhance the performance and sustainability of industrial chillers.

The commercial sector, including data centers and food industries, also benefits from industrial chillers for occupant comfort, equipment reliability, and critical processes. Sustainable building practices and low environmental impact naturally are essential considerations In the selection of industrial chillers, with options including water-cooled chillers, air-cooled chillers, and cooling towers. Water scarcity is a concern, leading to the adoption of low GWP refrigerants, HFOs, natural refrigerants like CO2, and expandability, compact design, wireless technology, and remote monitoring features.

Get a glance at the Industrial Chillers Industry report of share of various segments Request Free Sample

The Chemical and petrochemical segment was valued at USD 1.44 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

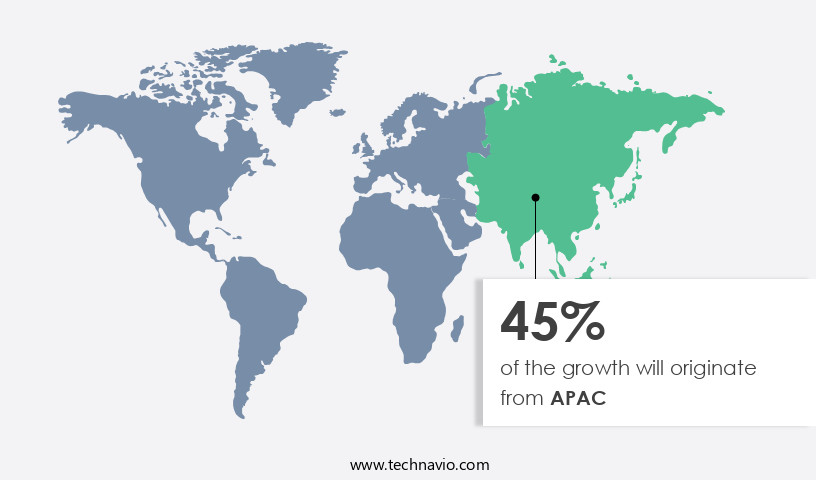

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The industrial chiller market in Asia Pacific (APAC) experiences significant growth due to increasing industrialization, urbanization, and population expansion in countries like China, Japan, India, and Southeast Asia. The surge in commercial and residential construction projects necessitates the use of medium to large-scale heating, ventilation, air conditioning, and refrigeration (HVAC and R) systems, thereby fueling the demand for industrial chillers. Additionally, the implementation of green building initiatives in countries such as China and India is another factor contributing to the market's growth. Industrial chillers are essential components in various industries, including food and beverage, pharmaceuticals, and data centers, where temperature regulation is crucial for process cooling, food baking, pasteurization, heat treatment, and critical processes.

The adoption of advanced technologies, such as smart controls, sensors, predictive maintenance features, and remote monitoring, enhances equipment reliability and energy efficiency. Moreover, the use of low GWP refrigerants, such as HFOs and natural refrigerants like CO2, contributes to the market's growth while minimizing environmental impact. The commercial sector, including data centers, demands energy-efficient industrial chillers to ensure occupant comfort and critical process continuity. The market is expected to grow further due to sustainable building practices and energy efficiency standards.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Chillers Industry?

Growing adoption of district heating and cooling infrastructure is the key driver of the market.

What are the market trends shaping the Industrial Chillers Industry?

Advent of smart connected chillers is the upcoming market trend.

What challenges does the Industrial Chillers Industry face during its growth?

High capital and maintenance costs is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The industrial chillers market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial chillers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial chillers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ait deutschland GmbH - Industrial chillers, offered by the company, are designed for maximum efficiency, enabling businesses to minimize operating costs. These chillers optimize energy usage, reducing overall energy consumption and expenses. By implementing advanced technologies and engineering solutions, the industrial chillers ensure reliable and consistent cooling performance, making them an essential investment for energy-conscious businesses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ait deutschland GmbH

- Carrier Global Corp.

- Daikin Industries Ltd.

- Drake Refrigeration Inc.

- FRIGEL FIRENZE S.p.A.

- Friulair S.r.l.

- General Air Products

- HYDAC Technology Corp.

- Johnson Controls International Plc.

- LG Corp.

- Mitsubishi Electric Corp.

- MTA S.p.A.

- Paul Mueller Co. Inc.

- PolyScience

- RTX Corp.

- Reynold India Pvt. Ltd.

- Senho Machinery Shenzhen Co. Ltd.

- Sentry Equipment Corp.

- Smardt Chiller Group Inc.

- Trane Technologies Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The industrial chiller market encompasses a broad range of applications, primarily focused on process cooling for various industries. These systems play a crucial role in maintaining optimal temperatures for various manufacturing processes, ensuring product quality and efficiency. Process cooling is a fundamental requirement in numerous industries, including but not limited to food and beverage, pharmaceuticals, and chemical manufacturing. In food processing, chilled water is utilized in baking, pasteurization, and other temperature-sensitive processes to enhance product quality and prolong shelf life. In the pharmaceutical sector, precise temperature control is essential for maintaining the stability of active ingredients during manufacturing. Industrial chillers are also indispensable In the manufacturing sector, particularly In the metal and plastics industries.

The metal industry relies on chillers for various applications, such as quenching, forming, and heat treatment processes. In the plastics industry, chillers are used to cool down molten plastic during the injection molding process, ensuring the production of high-quality end products. The data center industry is another significant consumer of industrial chillers. These facilities require large amounts of cooling to maintain optimal operating temperatures for their servers and other IT equipment. Chillers play a vital role in ensuring energy efficiency and reliability in data centers, which is crucial for their continuous operation. Advanced technologies, such as smart controls and sensors, have become increasingly prevalent in industrial chillers.

These features enable predictive maintenance, remote monitoring, and energy efficiency, making them a popular choice for businesses seeking to optimize their operations and reduce costs. Energy efficiency is a critical consideration In the industrial chiller market. With increasing awareness of environmental impact and energy costs, there is a growing demand for chillers that consume less energy and have a lower carbon footprint. Low Global Warming Potential (GWP) refrigerants and natural refrigerants, such as CO2, are gaining popularity due to their environmental benefits. The commercial sector, including offices and retail spaces, also utilizes industrial chillers for temperature regulation and occupant comfort.

Sustainable building practices and energy efficiency standards have become increasingly important in this sector, making chillers with expandability, compact design, and wireless technology attractive options. Water scarcity is another factor driving innovation In the industrial chiller market. Cooling towers, a common component of traditional chillers, consume large amounts of water. However, new technologies, such as air-cooled chillers and water-cooled chillers with closed-loop systems, offer more water-efficient alternatives. In conclusion, the industrial chiller market is a dynamic and evolving sector that plays a crucial role in various industries, from food and beverage to data centers. With a focus on energy efficiency, sustainability, and advanced technologies, industrial chillers continue to adapt to the changing needs of businesses and consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 1282.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Chillers Market Research and Growth Report?

- CAGR of the Industrial Chillers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial chillers market growth of industry companies

We can help! Our analysts can customize this industrial chillers market research report to meet your requirements.