Industrial Machine Vision Market Size 2024-2028

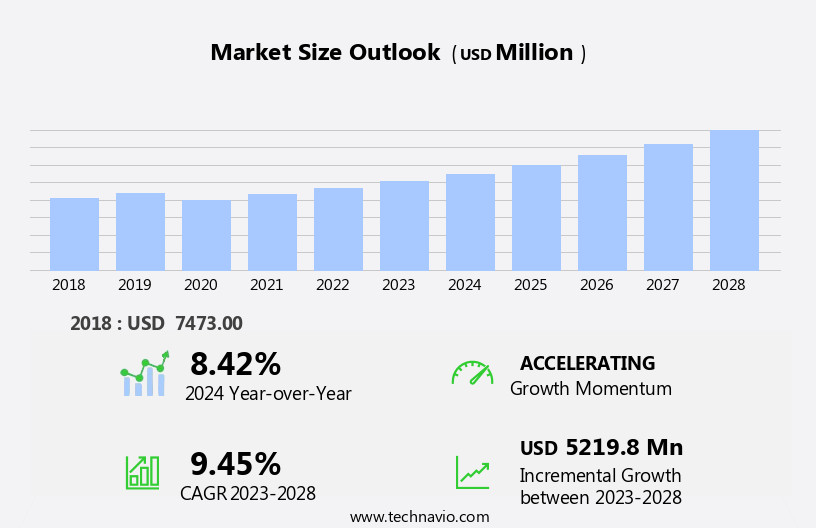

The industrial machine vision market size is forecast to increase by USD 5.22 billion at a CAGR of 9.45% between 2023 and 2028.

- The industrial machine vision market is driven by significant cost savings in operation due to process control, as automated vision systems improve production efficiency, reduce errors, and lower labor costs. An upcoming trend in the market is the rise in demand for industrial IoT (IIoT).

- As industries increasingly connect machines and devices through IoT, machine vision systems are integrated to provide real-time data, enhance decision-making, and further streamline operations, driving the growth of smart manufacturing and automation.

- However, the deployment of machine vision presents certain technical challenges, such as ensuring compatibility with various industrial environments and addressing data processing requirements.

What will be the Size of the Industrial Machine Vision Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for automation and productivity enhancements in various industries. Machine vision systems enable automated quality inspection, process control, and measurement applications, replacing manual processes and reducing labor costs.

- The market is particularly relevant to sectors such as automotive, pharmaceutical, and chemical, where high-precision inspection and real-time decision-making are crucial. Integration challenges and cybersecurity concerns, including potential cyber-attacks, are key considerations for market participants.

- The adoption of smart factories, AI vision processors, and robotics, including vision-guided robotic systems, is driving market expansion. These technologies enable advanced image processing capabilities, enabling real-time decision-making and ensuring product quality and safety standards in production processes.

- Overall, the market is poised for continued growth, offering significant opportunities for innovation and improvement in manufacturing and industrial automation.

How is this Industrial Machine Vision Industry segmented and which is the largest segment?

The industrial machine vision industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- PC-based

- Smart camera

- Component

- Hardware

- Software

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Product Type Insights

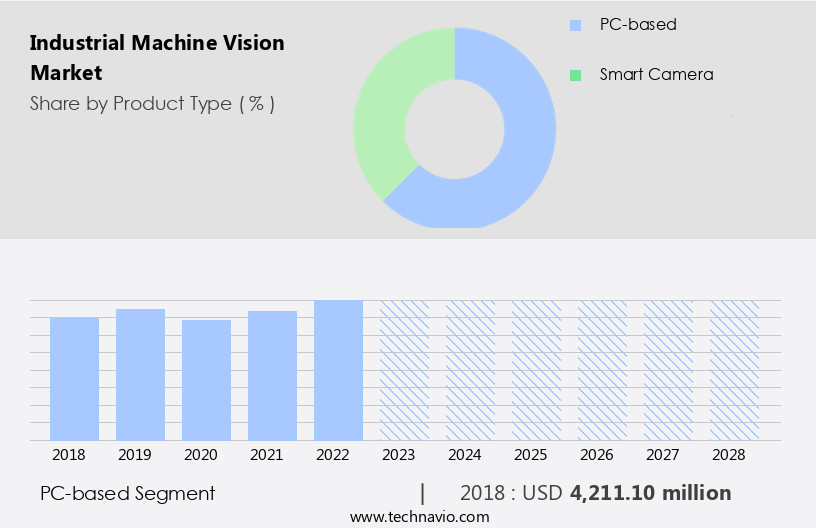

- The pc-based segment is estimated to witness significant growth during the forecast period.

Industrial machine vision systems, a critical component of smart factories and automation, enable real-time decision-making through image processing and analysis. These systems consist of hardware, such as cameras, sensors, processors, and frame grabbers, and software, including machine vision algorithms and deep learning capabilities. PC-based systems offer high processing power, multi-camera support, and integration with IoT and collaborative robotics. They are used extensively in sectors like automotive, pharmaceuticals, and consumer electronics for quality control, robot guidance, and defect detection. Challenges include integration issues, cyber-attacks, and training requirements. Vision-guided robots, a growing application area, offer increased operational efficiency and safety standards. Embedded vision applications in areas like healthcare, agriculture, and security surveillance are also on the rise. Vision processors, AI, and deep learning software play a crucial role in enhancing the functionality of these systems.

Get a glance at the Industrial Machine Vision Industry report of share of various segments Request Free Sample

The PC-based segment was valued at USD 4.21 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to the availability of innovative and cost-effective cameras from companies In the region. Key drivers for market expansion include the increasing adoption of industrial machine vision systems in sectors such as automotive and electronics in countries like China, Japan, India, Indonesia, Malaysia, and South Korea. These countries are emerging as major players In the industrial machine vision industry, with the majority of sales coming from the automotive and electronics sectors. The ongoing expansion projects In these industries, particularly in China and Japan, are further fueling market growth. Industrial machine vision systems are integral to various applications, including quality control, process control, safety standards, and robot guidance.

They enable real-time decision-making, product inspection, object detection, and defect detection. The market encompasses hardware, software, and services, including cameras, sensors, processors, frame grabbers, LED lighting, optics, barcode reading, deep learning software, integration, solution management, and PC-based and smart camera-based systems. Key sectors for machine vision applications include automotive, pharmaceuticals and chemicals, consumer goods, and agriculture. Challenges include cyber-attacks, integration complexities, and training requirements. The market also offers opportunities in emerging areas such as autonomous vehicles, healthcare, and security and surveillance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Machine Vision Industry?

Significant cost savings in operation due to process control is the key driver of the market.

- Industrial machine vision systems play a pivotal role in automating manufacturing processes, ensuring product quality, and increasing operational efficiency. By implementing machine vision systems, manufacturers can perform real-time inspection, measurement, and defect detection, enabling them to remove defective components early In the production process. This not only saves materials but also reduces labor costs and corrective action expenses. The integration of machine vision systems is particularly crucial in industries with high labor costs, such as the US and China. Machine vision systems are used in various sectors, including automotive, pharmaceutical, consumer electronics, and agriculture. In the automotive sector, vision-guided robots are employed for quality control, robot guidance, and automatic inspection.

- In the pharmaceutical sector, machine vision systems are utilized for dimensional gauging, testing automation, and identification of counterfeit products. In the consumer electronics industry, machine vision systems are used for process control, robot guidance, and quality assurance. The use of machine vision systems is not limited to manufacturing processes. They are also used in security and surveillance, traffic monitoring, and camera surveillance. Machine vision systems are available in various forms, including PC-based systems, smart camera-based systems, and hybrid systems. These systems offer high processing power, multi-camera support, integrated processing, and deep learning capabilities. However, the integration of machine vision systems poses challenges such as cyber-attacks and training requirements.

What are the market trends shaping the Industrial Machine Vision Industry?

Rise in demand for Industrial IoT is the upcoming market trend.

- The market is experiencing significant growth due to the integration of the Industrial Internet of Things (IIoT). This technology enables the automation of industrial processes, increasing productivity and reducing labor costs. Industrial Machine Vision systems can be used for inspection and measurements, replacing manual processes in sectors such as automotive, pharmaceuticals, and consumer electronics. Smart Factories, powered by AI vision processors, robotics, and vision-guided robots, are transforming quality control and process control solutions. However, challenges such as cyber-attacks and integration complexities persist. Training and software components with deep learning capabilities are essential for effective implementation. The market encompasses various applications, including hybrid vehicles, agricultural machinery, and healthcare, among others.

- Machine Vision solutions offer real-time decision-making capabilities for product inspection, object detection, and defect detection, enhancing operational efficiency. Hardware components like cameras, sensors, processors, frame grabbers, LED lighting, and optics, along with software solutions and services, form the backbone of the Machine Vision Market. These systems facilitate automatic and manual inspection, ensuring product quality and adherence to safety standards. The market caters to various industrial verticals, including automotive, pharmaceutical, chemical, and consumer goods, among others. Vision-guided robotic systems, video cameras, digital signal processing, and analog-to-digital conversion are integral components of this dynamic and evolving market.

What challenges does the Industrial Machine Vision Industry face during its growth?

Technical issues in deploying machine vision cameras is a key challenge affecting the industry growth.

- Industrial Machine Vision plays a pivotal role in automation and productivity enhancement in various industries. Machine vision systems enable automatic inspection, measurements, and quality control in manufacturing processes, reducing labor costs and improving operational efficiency. Smart factories leverage AI vision processors, robotics, and vision-guided robots to ensure product quality and process control. However, challenges such as image clarity, integration with cyber-security systems, and training staff to operate these advanced technologies persist. Embedded vision applications span sectors like automotive, pharmaceuticals, consumer electronics, and more. Machine vision systems facilitate automated quality inspection, process control solutions, and real-time decision-making for product inspection, object detection, and defect detection.

- Robot guidance, PC-based systems, and smart camera-based systems offer high processing power, multi-camera support, and integrated processing. The Internet of Things (IoT) and collaborative robotics further enhance machine vision capabilities, offering plug-and-play solutions and software components with deep learning capabilities. Safety and security are essential considerations, with solutions addressing cyber-attacks and ensuring compliance with safety standards. Machine vision applications extend to autonomous vehicles, healthcare, agriculture, and more, demonstrating its versatility and importance in various industries.

Exclusive Customer Landscape

The industrial machine vision market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial machine vision market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial machine vision market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adimec Advanced Image Systems bv - The market encompasses advanced imaging technologies designed for manufacturing automation. Solutions include the Quartz Series, Sapphire Series, and Diamond Series, which deliver high-performance inspection and measurement capabilities. These systems enable manufacturers to enhance product quality, increase efficiency, and reduce costs by automating inspection processes. Industrial machine vision integrates seamlessly with production lines, ensuring real-time defect detection and process optimization. With growing demand for smart manufacturing and Industry 4.0, the market is poised for significant growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adimec Advanced Image Systems bv

- ADLINK Technology Inc.

- Advantech Co. Ltd.

- Allied Vision Technologies GmbH

- AOS Technologies AG

- Basler AG

- Baumer Holding AG

- Cognex Corp.

- Datalogic SpA

- Edmund Optics Inc.

- ifm electronic gmbh

- iX Cameras Ltd

- JAI AS

- Keyence Corp.

- Nippon Electro Sensory Devices Co. Ltd.

- OMRON Corp.

- Optronis GmbH

- Sony Group Corp.

- Teledyne Technologies Inc.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial machine vision, a critical component of automation and productivity enhancement in various industries, continues to gain momentum as labor costs rise and smart factories become increasingly prevalent. This technology enables real-time decision-making, quality control, and process optimization in various sectors, including automotive, pharmaceutical, consumer electronics, and more. Machine vision systems employ image processing techniques to extract valuable information from visual data, facilitating applications such as inspection, measurements, object detection, and defect detection. These systems are integral to the functionality of vision-guided robots, which have revolutionized manufacturing processes by enabling precise robot guidance and automated quality inspection. The integration of machine vision technology into robotics has led to the development of collaborative robotics, allowing for a safer and more efficient working environment.

In the automotive sector, machine vision is used extensively for quality control, ensuring the production of high-quality vehicles. In the pharmaceutical industry, machine vision plays a crucial role in ensuring product quality and compliance with safety standards. The increasing adoption of machine vision technology in various industries is driven by the need for operational efficiency, improved product quality, and the ability to handle complex inspection tasks. The market for machine vision systems is vast and diverse, encompassing a range of industrial verticals and application-oriented systems. One of the key challenges in implementing machine vision systems is the integration of various hardware and software components, including cameras, sensors, processors, frame grabbers, and LED lighting.

Additionally, ensuring the safety and security of these systems is paramount, as cyber-attacks and data breaches can lead to significant consequences. Machine vision systems come in various forms, including PC-based systems and smart camera-based systems. PC-based systems offer high processing power and multi-camera support, making them suitable for complex applications. Smart camera-based systems, on the other hand, offer a more plug-and-play solution, with integrated processing and software components. Deep learning capabilities are increasingly being integrated into machine vision systems, enabling advanced object detection and defect detection. This technology is particularly useful in industries such as agriculture, where it can be used for dimensional gauging and testing automation.

The market for machine vision systems is expected to continue growing, driven by the increasing adoption of smart factories and the need for real-time decision-making and quality control in various industries. As the technology continues to evolve, it is expected to find applications in new industries and verticals, further expanding the market's scope and potential.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 5219.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, Canada, China, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Machine Vision Market Research and Growth Report?

- CAGR of the Industrial Machine Vision industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial machine vision market growth of industry companies

We can help! Our analysts can customize this industrial machine vision market research report to meet your requirements.