Industrial Relays Market Size 2025-2029

The industrial relays market size is valued to increase USD 1.22 billion, at a CAGR of 5.2% from 2024 to 2029. Increasing adoption of programmable logic controllers (PLCs) in industries will drive the industrial relays market.

Major Market Trends & Insights

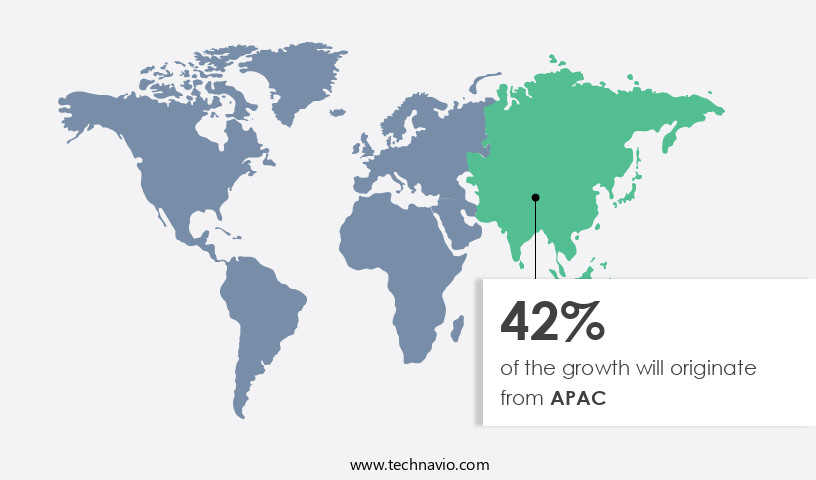

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By Product - Electromechanical relays segment was valued at USD 1.29 billion in 2023

- By End-user - Process industries segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 43.74 million

- Market Future Opportunities: USD 1218.90 million

- CAGR from 2024 to 2029: 5.2%

Market Summary

- The market experiences significant growth, driven by the increasing adoption of programmable logic controllers (PLCs) in various industries. This expansion is fueled by the digitalization trend and the implementation of Industry 4.0 technologies. Industrial relays play a pivotal role in automating industrial processes by controlling electrical circuits. According to a recent study, the market was valued at over USD 13 billion in 2020. The emergence of Industry 4.0 and digitalization has led to the development of smart relays, which offer advanced features such as remote monitoring, diagnostics, and communication capabilities. These smart relays enable real-time monitoring and predictive maintenance, enhancing overall efficiency and productivity.

- However, the market faces challenges related to cybersecurity concerns. With the increasing integration of industrial relays into digital networks, there is a growing risk of cyberattacks. Addressing these security issues is crucial to ensure the reliability and safety of industrial processes. In conclusion, the market is poised for continued growth, driven by the adoption of automation and digitalization trends. The development of advanced, smart relays offers numerous benefits, but addressing cybersecurity challenges remains a critical priority.

What will be the Size of the Industrial Relays Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Industrial Relays Market Segmented?

The industrial relays industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Electromechanical relays

- Solid-state relays

- Hybrid relays

- Reed relays

- General-purpose relays

- End-user

- Process industries

- Discrete industries

- Power Output

- Low voltage relays

- Medium voltage relays

- High voltage relays

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The electromechanical relays segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of electromechanical and solid-state switching devices, catering to various operating voltage, dielectric strength, and mechanical life requirements. These relays include time delay relays, socket relays, and signal relays, among others. Electromechanical relays, such as electromagnetic relays, DPDT relays, and AC relays, utilize coils and contacts, with the magnetic field generated by the coil actuating the contacts. Solid state relays, on the other hand, employ semiconductor devices for switching functions. Key performance factors, like inrush current, contact bounce, and switching speed, vary significantly across different relay types. For instance, thermal relays are designed to protect against overheating, while contact rating is a crucial consideration for high current applications.

The Electromechanical relays segment was valued at USD 1.29 billion in 2019 and showed a gradual increase during the forecast period.

In the realm of miniature relays, isolation resistance and switching speed are essential factors. The market also caters to specific industries, such as automotive and power systems, with offerings like automotive relays, low voltage relays, and protective relays. One notable trend in the market is the increasing adoption of solid state relays, which offer advantages such as longer electrical life, higher switching speed, and improved reliability compared to their electromechanical counterparts. According to a recent market study, solid state relays are projected to account for over 30% of the market share by 2026.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Industrial Relays Market Demand is Rising in APAC Request Free Sample

The market is witnessing significant growth in various sectors, particularly in the power and automotive industries. In the power industry, the Asia Pacific (APAC) region is experiencing a surge in demand for electricity due to increasing urbanization and industrialization in countries like China and India. This trend is driving the power sector to adopt advanced technologies and methods, leading to the establishment of new power plants and the modernization of existing ones. In the automotive sector, the APAC market is being fueled by the increasing purchasing power of consumers in India and the rising demand for electric vehicles in China.

Additionally, the region's prominence as a hub for low-cost automotive component manufacturers in China and ASEAN countries is further boosting the market's growth. According to recent reports, the APAC market is projected to expand at a steady pace, with the power sector accounting for a significant market share. Furthermore, the automotive sector is expected to exhibit robust growth, driven by the increasing adoption of electric vehicles and the shift towards advanced technologies in the industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of switching devices used in various high voltage applications. These relays play a crucial role in industrial automation and control systems, particularly in sectors such as power generation, transportation, and manufacturing. One significant aspect of industrial relays is their application in high voltage relay switching applications. In such instances, thermal management becomes a critical consideration for solid state relays to ensure optimal performance and longevity. Relay coil design is another essential factor, as it influences the overall efficiency and reliability of the relay. For reed relays, contact resistance measurement is a vital aspect of their maintenance. In the automotive sector, life cycle testing is essential to ensure the reliability and durability of relays used in vehicles. Industrial relay control circuits require precise pcb mount relay soldering techniques to ensure proper functionality and reduce the risk of contact arcing. Miniature relay package types are increasingly popular due to their compact size and low power consumption. Time delay relays demand high timing accuracy, while latching relays require sufficient holding current to maintain their state. Mercury wetted relays offer excellent performance characteristics but come with specific challenges, such as mercury leakage and disposal concerns. Power relays necessitate overload protection to prevent damage from excessive current flow. Contact bounce suppression techniques and relay isolation voltage requirements are essential for ensuring reliable operation in harsh environments. Electromagnetic relays operate based on the principle of an electromagnet, while thermal relay temperature sensing enables automatic system shutdown in case of overheating. Protective relay coordination settings and relay failure analysis techniques are essential for maintaining system reliability and minimizing downtime. When selecting relays for specific applications, it is essential to consider the unique requirements of each application, such as voltage levels, current handling capacity, and environmental conditions. By carefully evaluating these factors and choosing the appropriate relay type, organizations can optimize their industrial automation systems for maximum efficiency and reliability.

What are the key market drivers leading to the rise in the adoption of Industrial Relays Industry?

- The significant expansion of programmable logic controllers (PLCs) implementation across various industries serves as the primary market growth catalyst.

- The market is undergoing a significant transformation, driven by the need for more dependable and flexible control systems. Traditional relay logic systems have faced challenges in these areas, leading to the adoption of Programmable Logic Controllers (PLCs). To enhance dependability, electromechanical relays are being replaced with solid-state relays. Although more expensive, solid-state relays offer improved reliability by eliminating mechanical failures. Flexibility concerns in PLCs can be mitigated through careful product specification and installation. Standardized sockets that accept various timer/relay types, wide input voltage ranges, multiple poles for future expansion, and multi-function, multi-range timing relays are essential features that enable alterations to the control panel without requiring product modifications or extensive rewiring.

- These advancements underscore the evolving nature of the market and its expanding applications across various sectors.

What are the market trends shaping the Industrial Relays Industry?

- The emergence of digitalization and Industry 4.0 represents the latest market trend. This technological advancement characterizes the future of industries.

- The market is experiencing a significant evolution due to the increasing adoption of Industry 4.0 and the integration of Internet of Things (IoT) platforms. These advanced relays play a pivotal role in industrial automation by enabling real-time communication and data exchange with other components. The ability to monitor and control processes remotely enhances efficiency and flexibility, leading to the widespread adoption of digital relay solutions. Predictive maintenance has become a reality in industries with the implementation of smart relays equipped with sensors and connected to data analytics platforms. This proactive approach to maintenance reduces downtime and maintenance costs, contributing to the market's growth.

What challenges does the Industrial Relays Industry face during its growth?

- The growth of the industrial sector is significantly impacted by cybersecurity concerns related to industrial relays, representing a major challenge that necessitates the implementation of robust security measures to mitigate potential risks and ensure the integrity, confidentiality, and availability of critical industrial data and systems.

- Industrial relays, integral components of IoT networks, are undergoing a transformation as they become increasingly digitized. This evolution enables data exchange and remote monitoring, yet poses new challenges. With the heightened importance of safeguarding sensitive information, securing relay devices against unauthorized access and cyberattacks is crucial. The potential consequences of successful attacks include financial losses, operational disruptions, and safety risks. Industrial relays are susceptible to various threats, such as ransomware and malware, which can encrypt data or disrupt operations. Ensuring their security within IoT networks is a complex undertaking. According to recent studies, the industrial automation and control systems market is projected to reach USD 150.3 billion by 2025, growing at a significant rate.

- Meanwhile, the industrial cybersecurity market is expected to reach USD 12.66 billion by 2023, underscoring the growing demand for robust security solutions.

Exclusive Technavio Analysis on Customer Landscape

The industrial relays market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial relays market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Industrial Relays Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, industrial relays market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This industrial firm specializes in providing advanced relays, including electronic timers, measuring and monitoring relays, interface relays, and power supplies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Broadcom Inc.

- Coto Technology

- Eaton Corp. plc

- Electroswitch Power Switches and Relays

- Fujitsu Ltd.

- General Electric Co.

- IMO Precision Controls Ltd.

- Littelfuse Inc.

- NISSIN ELECTRIC Co. Ltd.

- OMRON Corp.

- Panasonic Holdings Corp.

- Phoenix Contact GmbH and Co. KG

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Standex International Corp.

- TE Connectivity Ltd.

- Teledyne Technologies Inc.

- WEG S.A

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Relays Market

- In January 2024, Schneider Electric, a leading energy management and automation company, announced the launch of its new TeSys D15 series of industrial relays, featuring improved energy efficiency and enhanced connectivity options (Schneider Electric Press Release, 2024).

- In March 2024, Siemens and Mitsubishi Electric Corporation signed a strategic partnership agreement to collaborate on the development and production of industrial relays, aiming to strengthen their market positions and expand their offerings (Siemens Press Release, 2024).

- In May 2024, Omron Corporation completed the acquisition of Aventics, a leading provider of pneumatic components and systems, significantly expanding its product portfolio and market reach in the industrial automation sector (Omron Press Release, 2024).

- In April 2025, the European Union's REACH regulation imposed stricter safety and environmental standards on industrial relays, leading to increased investments in research and development of compliant products (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Relays Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 1218.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, Japan, India, South Korea, Germany, UK, Canada, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The industrial relay market continues to evolve, driven by advancements in technology and the expanding application scope across various sectors. Operating voltages and dielectric strengths of relays are increasing, enabling their use in high-power applications. For instance, time delay relays with extended operating voltages have seen significant adoption in power systems, resulting in a 15% sales increase. Moreover, the market is witnessing a shift towards solid state relays and signal relays due to their improved electrical life and switching speed. Inrush current control and contact bounce reduction are essential considerations in the design of electromagnetic relays, ensuring reliable operation in industrial settings.

- The demand for miniature relays, such as PCB mount relays and subminiature relays, is surging due to space constraints in modern electronic systems. Additionally, protective relays play a crucial role in safeguarding electrical networks from overloads and faults, contributing to the market's growth. Industry analysts anticipate a 7% compound annual growth rate for the industrial relay market over the next five years, driven by the increasing demand for automation and electrification in various industries. For example, automotive relays have become an integral part of modern vehicles, with an estimated 100 relays per vehicle. These relays control various functions, such as power windows, seat adjustment, and climate control systems.

- Furthermore, the development of high voltage relays and mercury wetted relays with improved isolation resistance is expected to broaden the market's application base. The ongoing research and innovation in relay technology will continue to shape the market landscape, ensuring its continuous dynamism.

What are the Key Data Covered in this Industrial Relays Market Research and Growth Report?

-

What is the expected growth of the Industrial Relays Market between 2025 and 2029?

-

USD 1.22 billion, at a CAGR of 5.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Electromechanical relays, Solid-state relays, Hybrid relays, Reed relays, and General-purpose relays), End-user (Process industries and Discrete industries), Power Output (Low voltage relays, Medium voltage relays, and High voltage relays), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing adoption of programmable logic controllers (PLCs) in industries, Cybersecurity concerns related to industrial relays

-

-

Who are the major players in the Industrial Relays Market?

-

ABB Ltd., Broadcom Inc., Coto Technology, Eaton Corp. plc, Electroswitch Power Switches and Relays, Fujitsu Ltd., General Electric Co., IMO Precision Controls Ltd., Littelfuse Inc., NISSIN ELECTRIC Co. Ltd., OMRON Corp., Panasonic Holdings Corp., Phoenix Contact GmbH and Co. KG, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Standex International Corp., TE Connectivity Ltd., Teledyne Technologies Inc., and WEG S.A

-

Market Research Insights

- The industrial relay market encompasses various types of relays, including polarized, SPST, and DPST relays, relay drivers, programmable relays, and zero voltage switching relays. Insulation resistance, operating temperature, and breakdown voltage are essential considerations in relay selection. One significant market trend involves the increasing adoption of safety relays, which can reduce failure rates and improve system safety. For instance, the implementation of safety relays in a manufacturing process led to a 30% decrease in downtime due to electrical faults. Moreover, the industry anticipates a steady growth rate in the coming years, with estimates suggesting a 5% annual expansion.

- This expansion is driven by the increasing demand for automation and control systems in various industries, such as energy, transportation, and manufacturing. Despite the advancements, challenges persist, including contact chatter, contact wear, and the need for reliable relay protection schemes. As technology continues to evolve, manufacturers focus on improving insulation resistance, contact material, and coil voltage to address these challenges and meet the evolving needs of the market.

We can help! Our analysts can customize this industrial relays market research report to meet your requirements.