Industrial Vacuum Valves Market Size 2024-2028

The industrial vacuum valves market size is forecast to increase by USD 526.2 million, at a CAGR of 6.65% between 2023 and 2028. Market growth analysis aligned with the augmented production of smartphones has sparked a surge in investments aimed at modernizing industrial facilities. This trend is further fueled by the growing demand for various commodities. As smartphone usage continues to rise globally, manufacturers are ramping up their production capacities to meet consumer needs. This has led to substantial investments in upgrading and modernizing industrial facilities to enhance efficiency, output, and technological capabilities. Additionally, the growing demand for various commodities across industries has prompted businesses to expand and innovate their production processes. This includes sectors such as electronics, automotive, and consumer goods, where the need for raw materials and finished products is continuously increasing. The confluence of increased smartphone production, investments in industrial modernization, and rising demand for commodities underscores the dynamic nature of the contemporary market landscape, driving innovation and economic growth. Our report examines historic data from 2018 - 2022, besides analyzing the current and forecasts market scenario.

Market Forecasting and Size

Market Forecast 2024-2028

To learn more about this market report, Request Free Sample

Market Dynamics

The market is being propelled by the increasing adoption of automation and the continuous emphasis on improved maintenance practices. As industries such as power plants, semiconductor manufacturing, and chemicals embrace automation, there is a growing need for efficient vacuum valves to optimize processes and ensure smooth operations. Additionally, the emergence of smart valves equipped with IoT capabilities is revolutionizing maintenance strategies by enabling real-time monitoring and predictive maintenance, thereby minimizing downtime and enhancing overall productivity. Furthermore, several trends are shaping the Industrial Vacuum Valves market. Our researchers studied the market research and growth data for years, with 2023 as the base year and 2023 as the estimated year, and presented the key drivers, trends, and challenges for the market.

Key Driver- Growing demand for different commodities

The industrial vacuum valve market is experiencing a surge in demand driven by various factors. Firstly, rising consumer spending worldwide is leading to increased demand for pharmaceuticals, food products, automobiles, and household appliances. This heightened demand across diverse sectors is fostering steady economic development, propelling growth within each industry. Moreover, economic expansion positively influences consumer confidence, spurring further purchases and stimulating industrial and manufacturing activities.

Furthermore, shifts in lifestyle and dietary habits, coupled with a rise in chronic diseases, are fueling the need for pharmaceuticals across different therapeutic areas. This escalating demand necessitates heightened manufacturing activities in pharmaceuticals, food processing, chemicals, and other key industries such as automotive, electronics, and construction aggregates. As these industries are significant end users of vacuum valves, the global industrial vacuum valve market is poised for substantial growth in the forecast period.

Significant Trends- Incorporation of simulation software in valve manufacturing

Market players can use 3D simulation software to address customer needs in terms of design requirements and applications. Vacuum valve design simulation helps suppliers reduce manufacturing costs and product development time when manufacturing non-standard valves. This simulation software can also be used to analyze and test solutions during the design phase without creating multiple prototypes.

Moreover, valve manufacturing (for new valve designs) can take up to several weeks, so engineering simulation can help significantly reduce time and effort. Advanced 3D simulation software has been observed to speed up the prototype testing process and improve valve manufacturing. This simulation method also helps to improve valve design functionality and minimize physical testing and associated costs. Thus, such factors will drive the growth of the market during the forecast period.

Major Challenge- Price wars among companies and competition from local market players

If market participants incur additional implementation and maintenance costs, this will impact pricing strategies. On the other hand, customers are looking for high-quality, low-cost valves with additional features. These factors force market players to lower the price of their products to increase their market share. This requires market players to continually revise their pricing strategies to generate more revenue and invest in research and development.

Additionally, various economic factors allow domestic manufacturers in developing countries such as India, China, South Africa, and Brazil to provide end users with high-quality valves at lower costs while putting some international suppliers at a disadvantage. As a result, the threat of low-cost suppliers limits the entry of international suppliers in developing countries, especially APAC, thereby impeding the growth of the market during the forecast period.

Market Segmentation

In the market, the rapidly growing semiconductor industry, driven by the demand for memory chips and transistors in various electronic devices, is a significant driver of market growth.It plays a critical role in semiconductor manufacturing processes, such as thin-film coating and flat-panel display production, where precise vacuum control is essential for ensuring product quality. Moreover, the increasing integration of IoT, wireless communications, AI, and cloud computing technologies in industrial applications, including automotive electronics and consumer electronics like smartphones, is driving the demand for advanced equipmet capable of meeting the stringent performance requirements of modern manufacturing processes.

End-user Segment Analysis:

The semiconductor segment will account for a major share of the market's growth during the forecast period.?The semiconductor industry is anticipated to grow due to factors such as increased investment in 5G by countries such as China, expansion of server farms for cloud and streaming services, and increased adoption of AI in industries such as manufacturing. Additionally, the increasing adoption of four major programmable semiconductor technologies is driving the growth of the semiconductor industry which includes graphics processing units (GPUs), field programmable gate arrays (FPGAs), microprocessor units (MPUs), and artificial intelligence (AI).

Customized Report as per your requirements!

The semiconductor segment was valued at USD 509.40 million in 2018. Additionally, the entire semiconductor industry makes heavy use of the systems during the manufacturing process. The devices are used in processes such as etching and sputtering as well as wafer ion implantation processes in chambers. They are used to remove exhaust air from the vacuum chamber and supply atmospheric pressure to the chamber. Therefore, the growth in the semiconductor industry will drive the growth of the market during the forecast period.

Type Segment Analysis

Based on type, the market has been segmented into low vacuum valves, high valves, and ultra high valves. The low valves?segment will account for the largest share of this segment.? The high demand for this is driven by a variety of industries and applications where precise control of vacuum levels is important. These are used in equipment such as vacuum chambers, mass spectrometers, and electron microscopes. In addition, these are used in the semiconductor industry, pharmaceutical companies, biotechnology companies, and the aerospace industry. As the industry continues to evolve and demands more precise control of processes, the demand for high-quality products is expected to remain strong and is expected to drive market growth during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download Sample PDF now!

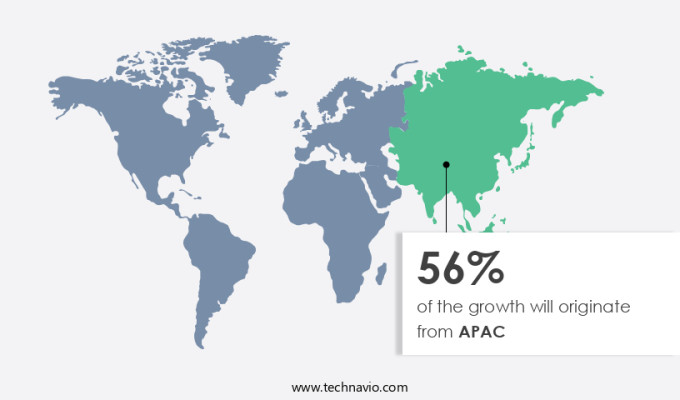

APAC is estimated to contribute 56% to the growth by 2028. Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the forecast period. APAC is the manufacturing hub for most consumer durables, electronic products, and IT equipment. Some of the world's largest electronics companies and foundries have offices and branches in countries such as Taiwan, China, Japan, South Korea, and India, contributing significantly to the market.

Furthermore, the demand for consumer electronic appliances is currently increasing in Asia, mainly due to technological advances, falling prices of home appliances, and rising per capita income. Semiconductors form the basic components of all these consumer electronic devices. Therefore, the increasing demand for semiconductors in the region will create ample opportunities for the market in the medium-term forecast period.

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Agilent Technologies Inc.: The company offers industrial vacuum valves such as Metal UHV Valves Series 54, Aluminum Block Valves Series 26, and Aluminum Gate Valves Series 12.

We also have detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including:

Agilent Technologies Inc., Atlas Copco AB, CKD Corp., Cryofab Inc., DeZURIK Inc., Elmac Technologies, Emerson Electric Co., Huntington Vacuum Products, Kurt J Lesker Co., MDC vacuum Products LLC, MKS Instruments Inc., Motherwell Tank Protection, Parker Hannifin Corp., Pfeiffer Vacuum Technology AG, Qigao Group, Ramen Valves AB, SMC Corp., Torr Marketing India Pvt. Ltd., VAG GmbH, and VAT Group AG

Technavio market forecast the an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user Outlook

- Semiconductor

- Pharmaceutical

- Food processing

- Packaging

- Type Outlook

- Low vacuum valves

- High vacuum valves

- Ultra high vacuum valves

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Rupture Disc Market: The rupture disc market is estimated to grow at a CAGR of 2.97% between 2022 and 2027. The size of the market is forecast to increase by USD 88.91 million.

- Metal Casting Market: The global metal casting market size is forecast to increase by USD 12.15 billion at a CAGR of 6.22% between 2023 and 2028.

- Brushless DC Motors Market: The brushless DC motors market is estimated to grow at a CAGR of 4.07% between 2022 and 2027. The size of the market is forecast to increase by USD 2,586.75 million.

Market Analyst Overview

The market is witnessing significant growth, driven by advancements such as IoT-integrated valves that offer enhanced functionality and control. These valves are crucial for fluid flow management techniques, ensuring precise isolation, pressure control, and gas flow direction in various applications across industries. In the semiconductor manufacturing industry, where vacuum purity is paramount, vacuum valves play a crucial role in processes such as extraction, refining, and semiconductor chip production. Moreover, in industries like flat-panel display manufacturing and analytical instruments manufacturing, vacuum valves are indispensable for processes involving indium–tin oxide (ITO) thin-film coatings, flexible displays, and high-resolution displays. The advent of IoT and machine learning further enhances valve performance and efficiency, enabling seamless integration with data storage systems and analytical instruments.

Additionally, vacuum valves are integral to critical operations in the food & beverage industry, facilitating processes like vacuum evaporation, de-aeration, and freeze-drying. As the demand for advanced displays and vacuum-based manufacturing processes continues to rise, propelled by innovations in technologies like CVD, PVD, MOCVD, and PECVD, the Industrial Vacuum Valves Market is poised for sustained growth. Despite restraints such as particle generation and outgassing, increasing adoption across R&D industries, semiconductor markets, and flat-panel display production industries underscores the market's promising trajectory. Further, the market is witnessing robust growth driven by diverse applications across industries such as paper & pulp, food & beverages, and the oil & gas sector. These valves, operating under various conditions including vacuum, argon atmospheres, and high pressure ranges, play a crucial role in critical processes like fractional distillation, vacuum filtration, and bottling. Additionally, advancements like IoT integration enable enhanced control and monitoring of vacuum systems, ensuring efficient operation. With increasing demand driven by emerging technologies like 5G cellular networks, semiconductor chips, and flat-panel display production, the Industrial Vacuum Valves Market is poised for continued expansion, catering to the evolving needs of diverse industrial sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.65% |

|

Market Growth 2024-2028 |

USD 526.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.12 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 56% |

|

Key countries |

China, US, South Korea, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Agilent Technologies Inc., Atlas Copco AB, CKD Corp., Cryofab Inc., DeZURIK Inc., Elmac Technologies, Emerson Electric Co., Huntington Vacuum Products, Kurt J Lesker Co., MDC vacuum Products LLC, MKS Instruments Inc., Motherwell Tank Protection, Parker Hannifin Corp., Pfeiffer Vacuum Technology AG, Qigao Group, Ramen Valves AB, SMC Corp., Torr Marketing India Pvt. Ltd., VAG GmbH, and VAT Group AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market growth and trends and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Market growth and forecasting across APAC, North America, Europe, South America, and Middle East and Africa

- A thorough market analysis and report of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch